Soilbuild Business Space REIT is an industrial REIT that currently owns three business park properties and ten industrial properties, located in both Singapore and Australia. As of December 2018, the REIT has a net lettable area of 4.03 million square feet, leasing its properties out to a total of 115 tenants.

Based on Soilbuild REIT’s current stock price of 62 cents and its 2018 distribution of 5.28 cents, Soilbuild REIT is rewarding unitholders with an impressive 8.6% yield — the highest among Singapore industrial REITs. At the same time, Soilbuild REIT is trading within 10% of its historical lows. In light of these facts, I attended Soilbuild REIT’s AGM to find out whether the stock is an undervalued gem, or simply a value trap.

Here are eight things I learned from the 2019 Soilbuild Business Space REIT AGM:

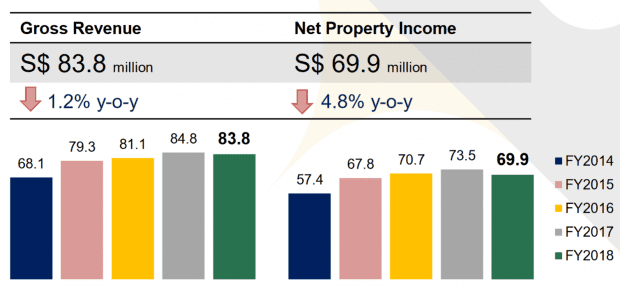

1. Soilbuild REIT’s revenues for FY2018 declined 1.2% year-on-year to S$83.8 million, while net property income (NPI) fell 4.8% to S$69.9 million. This marks the first time over the past five years that the REIT experienced a decline in these figures. This was the result of the company’s February 2018 divestment of KTL Offshore, an industrial property in Tuas that generated $4 million in gross revenues in 2017. While the company’s acquisition of two Australian properties offset a portion of that reduction, the positive financial impact of the acquisitions were limited as they were completed later in the fiscal year.

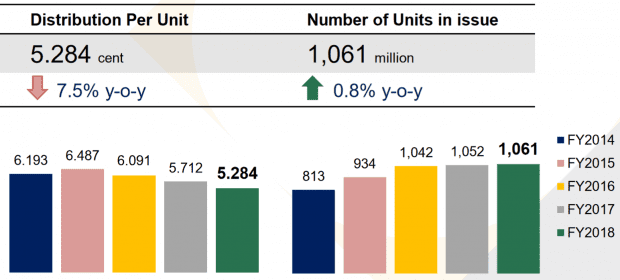

2. Soilbuild REIT’s distribution per unit (DPU) fell for a third consecutive year to 5.284 cents in FY2018, from 5.712 cents in FY2017. The drop in NPI mentioned earlier drove this 7.5% year-over-year decline in DPU. A marginal increase in the number of issued units also contributed to the decline.

3. In FY2018, Soilbuild REIT acquired two properties in Australia for a total of A$116.3 million (S$115.5 million) — their first venture out of the Singapore market. The two properties are 14 Mort Street, an office building in Canberra City; and Inghams Burton, a poultry processing industrial facility in Adelaide. In his prepared remarks, CEO Roy Teo highlighted a number of features that made these properties exceptionally compelling. 14 Mort Street is leased to the Australian government, which currently holds an S&P credit rating of AAA, attesting to its strong financial abilities. While the property has six years left on its lease, the lease contracts will most likely be renewed given that the Australian government currently owns or leases several other properties in the vicinity. To make the deal sweeter, local authorities agreed to extend the land lease of 14 Mort Street from 70 years to 99 years for a small administrative fee. The Inghams Burton poultry processing plant, which sits on freehold land, is leased to vertically-integrated poultry producer Inghams Group. Inghams is the largest poultry producer in Australia, accounting for 40% of market share in its industry. More importantly, Inghams has committed to leasing the property for the next 16 years.

4. The Australian acquisitions were funded using proceeds from an Australian dollar-denominated loan and the issuance of perpetual securities. According to its annual report, Soilbuild REIT partially funded these acquisitions with an A$43.3 million loan, which serves as a natural hedge against fluctuations in the Australian dollar. In order to fund the acquisition, Soilbuild also issued S$65 million of perpetual securities paying 6% per annum. Perpetual securities do not have a fixed maturity date and issuers are not required to redeem the principal at any point — they are only required to pay coupons to security holders indefinitely.

5. In part due to the issuance of perpetual securities, Soilbuild REIT’s gearing ratio fell from 40.6% in FY2017 to 39.1% in FY2018. While gearing remains high when compared to other Singapore REITs, gearing is now in line with the company’s long-term aggregate leverage target of between 35% to 40%. Since perpetual securities do not have a fixed repayment date, they are treated as equity (instead of debt). Thus, the $65 million of perpetuals issued by Soilbuild are not included in its gearing computation. For investors who consider perpetual securities as borrowings, Soilbuild REIT’s adjusted gearing ratio is 42.5%.

6. Several shareholders expressed concern over the default of Soilbuild REIT’s second-largest tenant, NK Ingredients, and inquired about management’s plans for the property. NK Ingredients, which accounts for 6.2% of Soilbuild’s rental income, has defaulted on its rent payments after a period of financial pressure. Soilbuild’s numbers are currently unaffected by the default thanks to a security deposit they secured from NK last year. However, the security deposit is only enough to cover rent payments up till April 2019. In response to shareholder queries, CEO Roy Teo stated the company is planning to redevelop the plot of land in question, should NK vacate the property. The current plot ratio of the land is 0.53, and a redevelopment would potentially increase plot ratio to 1.00, increasing the gross floor area available for rent. However, the redevelopment will take 18 months and will cost $60 million, a large sum when compared to the building’s current valuation of $54 million. Despite these drawbacks, management thinks that redevelopment is justified as the building still has 29 years on its land lease. The CEO also emphasized that they are open to other options, such as a sale of the building, but added it might be difficult to find a buyer.

7. Another shareholder inquired about management’s rationale for its purchase of industrial facility 72 Loyang Way for S$97 million in 2015. This comes after recent news that Soilbuild REIT divested the facility for S$34.08 million. According to the shareholder, the board was unwilling to provide reasons for the acquisition in the 2015 AGM for ‘competitive reasons’. With divestment proceedings in progress, the shareholder wanted to understand the reasoning behind the acquisition. CEO Roy Teo responded by saying that the purchase was made close to the peak in the oil and gas sector, and, at that point, waterfront properties like 72 Loyang Way were ‘very valuable’.

8. Another shareholder noticed that five of the company’s master leases currently account for over 20% of revenues, and asked management about the prospects of those leases. CEO Roy Teo remarked that two of the five master leases come from its Australian properties, which are very stable assets given their tenant profile and lease expiries. Its Singapore master leases also have over four years before lease expiry with the exception of a small building leased to Beng Kuang Marine whose lease expires in 2020. Beng Kuang Marine has ascertained that it will renew the lease for part of the building but has not committed to renewing the lease for the entire building. The CEO added that the two parties are currently in the early stages of negotiation.

The fifth perspective

Soilbuild REIT is currently offering investors an attractive 8.6% yield, a yield considerably higher than many of its peers. Its recent Australian acquisitions also look like quality assets that will provide a stable flow of rental income going forward. However, Soilbuild REIT is currently plagued by issues such as the default of its second largest tenant, which could place pressure on its future distribution levels.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »