Uchi Technologies Berhad is a middleware supplier that designs and produces electronic control modules for manufacturers of coffee machines. The company also produces bio-tech instruments, precision/industrial weighing scales, and LED displays.

Since its listing in 2000, Uchi has averaged a return on equity of 28.3% over the last 19 years, with nearly zero debt. Its gross and net profit margins have averaged 66.1% and 43.3% respectively. With such an impressive financial track record, I attended Uchi’s recent annual general meeting to find out more about the company.

Here are seven things I learned from the 2019 Uchi Technologies AGM:

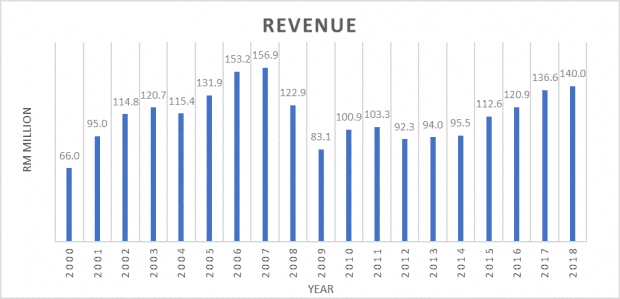

1. Revenue grew 2.5% year-on-year to RM140.0 million in 2018. Uchi’s revenue is fairly cyclical and has decreased during economic downtimes such as the Great Recession in 2008/09 and the European Debt Crisis in 2011/12. Over the long term, revenue has increased at a compound annual growth rate (CAGR) of 4.3% from 2000 to 2018.

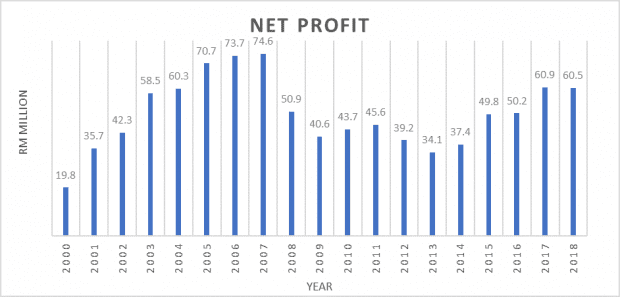

2. Net profit decreased marginally by 0.7% year-on-year to RM60.5 million in 2018. Like its revenue, Uchi’s net profit follows a similar cyclical pattern. From 2000 to 2018, net profit has increased at a CAGR of 6.4% in 2018 from 2000.

3. This cyclical pattern is mainly due to Uchi’s major client, Jura, a Swiss high-end coffee machine manufacturer. Jura is mentioned as ‘Customer A’ in Uchi’s annual reports whose identify was confirmed by Uchi directors at this AGM. Over the last 10 years, Jura has contributed on average 73% of Uchi’s annual revenue. For most people, a coffee machine is a want, and not a need. It is an expensive, big-ticket item that people will put off from buying during a recession, which explains the cyclical nature of Uchi’s revenue.

4. Executive director Ted Kao believes Uchi’s competitive strengths revolve around its research and development capabilities, as well as its track record in its fast design cycle to design good electronic control modules. Research and development can sometimes be costly and lengthy which is a barrier to entry to competitors.Managing directorChin Yau Meng did not share much detail of Uchi’s exclusive agreement with Jura. He only mentioned that Uchi treats its customers like partners to harness the strengths of both parties.Jura is good at mechanical design, marketing, assembling, and distributing coffee machines, while Uchi focuses on establishing long-term relationships with customers to co-develop custom-made products.

5. After some shareholders labelled Uchi as a boring and unsexy business, executive director Edward Kao countered by saying that Uchi is a boring but safe company that’s slowly growing. He shared that the relative size of Uchi and the geographical locations it occupies do not offer many ‘natural’ or human resources opportunities. He thinks Uchi is located away from the hub of electronic components and operates a business model that creates the best value from its location. In my opinion, I think Uchi lacks the energy and momentum to maximise its growth moving forward.

6. The directors said that Uchi is not greatly affected by the U.S.-China trade war as its products are mainly assembled in Europe and distributed to the U.S. A possible impact from the trade war could lie with the sourcing of raw materials from Chinese suppliers. As a result, Uchi implemented a safety buffer stock scheme to stock up critical material components and is actively looking for alternative sourcing places other than China. With regards to the shortage of multi-layer ceramic capacitors that make up to 30% of an electronic control module, Chin shared that the situation started in 3Q 2017. Uchi had stocked up one year of inventory but that was used up. The company is currently buying capacitors at a slightly higher cost, while looking for new sources.

7. A shareholder asked if the management planned to increase the utilisation rates of both of its plants in China and Malaysia to beyond 80%. Chin replied that both plants are not running 24/7 so they still have sufficient capacity for higher demand. Should there be excessive demand, Uchi will outsource instead as they do not want to invest heavily in equipment.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »