Last December, Frasers Logistics and Industrial Trust (FLT) and Frasers Commercial Trust (FCOT) proposed a merger between the two into one enlarged REIT. FLT will acquire all units of FCOT for about S$1.54 billion via a combination of cash and new units. FCOT unitholders will receive S$0.151 in cash and 1.233 new units in FLT at an issue price of S$1.24 per unit. This means that for every 1,000 FCOT shares, FCOT unitholders receive $151 in cash and 1,233 of FLT units.

Post-merger, FLT also plans to acquire a 50% interest in Farnborough Business Park in the UK. Farnborough Business Park is a business park which offers a diversified tenant mix focused mainly in engineering, pharmaceuticals and banking. The property has a 99% occupancy rate with more than 80% of its tenant leases expiring in four years or more.

After the successful merger and acquisition, FLT’s DPU and NAV are expected to increase by 2.2% and 9.5% respectively. The enlarged REIT is expected to become among the top 10 largest S-REITs, giving it higher liquidity and a greater chance for index inclusion.

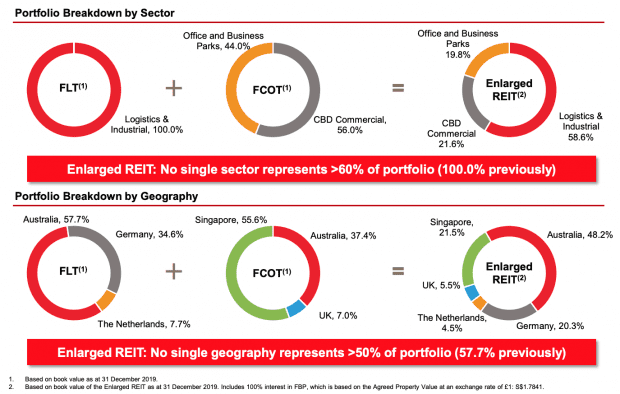

For better or worse, FLT’s portfolio breakdown is now more diversified by sector, geography and tenant mix.

Source: FLT EGM presentation slides

However, FLT’s WALE is expected to decrease from 6.23 years to 5.7 years following the merger.

The resolutions for the merger and acquisition were passed at FLT’s and FCOT’s respective EGMs which we attended, but unitholders posed some interesting questions that I would like to share with you. So here are seven things I learned from the FLT and FCOT EGMs:

1. An FLT unitholder asked the management for the rationale behind the merger, given that the enlarged REIT is now exposed to different asset classes. He added if management had considered growing the FLT and FCOT portfolio separately as pure play stocks, giving investors the flexibility to decide which asset class they would like to invest in. FLT CEO Robert Wallace replied that the potential synergies reaped from the FLT-FCOT merger will outweigh the dilution in logistics and industrial assets in the FLT portfolio. He added that logistics and industrial assets will continue to be FLT’s focus, pointing to how 63.0% of FLT’s rights of first refusal pipeline will be logistics and industrials assets (by lettable area).

2. Another FLT unitholder asked if the enlarged REIT will be restructured to reap better economies of scale and to take up larger debt amounts. FLT chairman Ho Hon Cheong replied that room for restructuring is limited, although some common activities in the middle and back office can operate on a larger scale to improve some internal efficiencies. He sees the merger as an opportunity for FLT and FCOT to complement each other’s strengths and sharpen skill sets since they operate in different asset classes.

3. At the FCOT EGM, a unitholder questioned the different methodologies used to value FCOT units and Farnborough Business Park. While Farnborough Business Park is valued at its net asset value (NAV), FCOT units were being swapped at a much lower price-to-book value than FLT units. FCOT CEO Jack Lam explained that unlike the sale of Farnborough Business Park — which was a transaction in the property market — the sale of FCOT units took place in the capital market. Hence, different valuation methods were used to value Farnborough Business Park and FCOT. Apart from NAV, FCOT’s market pricing and DPU were also considered to value FCOT.

4. The unitholder also highlighted recent asset enhancement initiatives at FCOT’s China Square Central and Alexandra Technopark properties, which improved occupancy and rental rates at these two properties. Together with capital gains made from the sale of 55 Market Street, FCOT is poised for an increase in its market share price. The CEO begged to differ saying that markets do react efficiently to FCOT’s developments. He cited an example of how FCOT’s market price increased and started to trade higher after Google decided to sign a rental lease with Alexandra Technopark in June 2019. This is despite the fact that Google would only start paying rent in the first quarter of 2020. So the market does take into consideration future developments in its current pricing. He added that FCOT has been active in sharing publicly its recent asset enhancements and latest tenant sign ups. Hence, FCOT’s current trading price is already a reflection of the market’s perception of FCOT’s brighter future with increased occupancy and rental rates.

5. A unitholder pointed out how FCOT still has a debt headroom worth S$660 million to grow. The CEO responded saying that FCOT’s potential to grow is limited. Even if FCOT’s debt headroom was used up to acquire more properties, its market capitalisation is still below S$3 billion, way off the market capitalisation of the biggest S-REITs. He added that the enlarged REIT would give unitholders better growth prospects and diversification in asset class and geography.

6. The same unitholder said that FCOT contributes disproportionately ($660 million) to the debt headroom of the enlarged REIT (S$980 million) — about two-thirds of the debt headroom. The CEO clarified that FCOT and FLT’s contribution to the debt headroom of the enlarged REIT was in fact equal. As FLT took up additional debt for the merger, the enlarged REIT was now left with S$ 980 million in debt headroom.

7. Another FCOT unitholder questioned the rationale of the merger — If FLT isn’t doing very well (since it’s saddled with Australian properties and we face a weakening AUD) and FCOT is on the path to recovery, the merger is not favourable to FCOT unitholders. FCOT chairman Bobby Chin replied that a long-term approach needs to be taken. The enlarged REIT would enable existing FCOT unitholders to achieve better scale, diversification and the status of a unitholder of an index stock. He also pointed out like FLT, FCOT also has its fair share of Australian properties.

Liked our analysis of this EGM? Click here to view a complete list of EGMs and AGMs we’ve attended »