Koufu is an established Singapore household name well-known for its chain of food courts and coffee shops. Koufu Group reports two complementary business segments — Outlet and Mall Management (comprising 50 food courts, 16 coffee shops, 1 hawker centre, 1 commercial mall); and its F&B Retail segment (comprising 76 F&B stalls, 29 kiosks, 7 quick-service restaurants and 4 full-service restaurants).

Most of Koufu’s outlets and stalls are in Singapore. It also operates marginally in Macau and Malaysia. Koufu leases out stalls at these outlets and operates some of the F&B stalls at these premises.

Koufu was originally poised to benefit from the trade tariff-induced economic slowdown as consumers scaled down on restaurant dining. However, the lockdown in Singapore due to COVID-19 means that Koufu’s business will take quite a hit as dining out is prohibited.

I tuned in to Koufu’s 2020 virtual AGM to find out how Koufu performed in FY2019 and how it intends to navigate the operational difficulties posed by COVID-19. Here are five things I learned from Koufu’s 2020 AGM.

1. Koufu’s total revenue increased by 6.1% y-o-y to S$237.5 million. This was mainly due to the opening of new outlets and retail including:

- 5 Koufu food courts (4 in Singapore, 1 in Macau)

- 1 coffee shop in Singapore

- 20 R&B tea outlets (18 of which are in Singapore)

- 2 full-service restaurants (i.e. Elemen) in Singapore

The increased revenue was also due to the reopening of the food court at Marina Bay Sands, which was closed for renovation from April to July 2018.

Geographically, Koufu’s revenue growth was driven mainly by revenue growth from its operations in Singapore, whose revenue increased by 6.4% y-o-y as most of Koufu’s retail and outlet expansions took place in Singapore. In FY2019, Koufu derived 92% of its revenue from its operations in Singapore.

Segmentally, Koufu’s revenue growth was driven mainly by its Outlet and Mall Management segment, whose revenue increased 6.9% y-o-y. The Outlet and Mall Management segment comprised slightly more than half of Koufu’s revenue in FY2019.

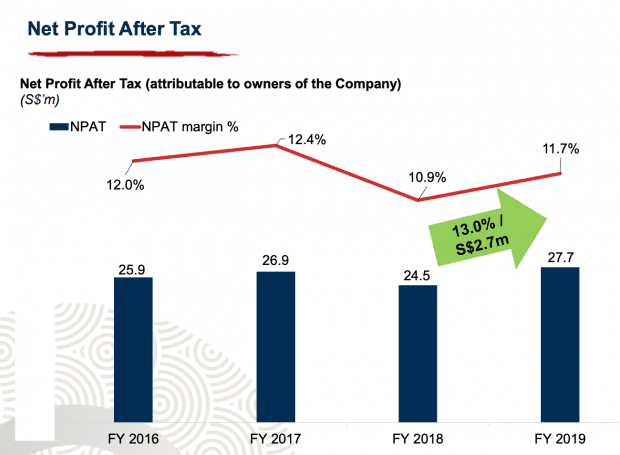

2. Koufu’s net profit margin increased by 0.8 percentage points to 11.7%. In comparison, Kimly, a similar F&B competitor, recorded a net profit margin of 9.6% in FY2019. However, note that neither Koufu’s net profit nor its net profit margin have exhibited a consistent upward trend over the past four financial years.

Source: Koufu 2020 AGM presentation slides

3. Koufu expects both its revenue and operating profits to be negatively affected due to COVID-19. Due to lockdown measures, there is significantly lower footfall at food courts across Singapore. As per government regulations, consumers cannot dine at restaurants or food courts; they can only do takeaways or deliveries for food items. Hence, Koufu has temporarily suspended operations for 10 food courts, 3 quick-service restaurants, 2 full-service restaurants and 26 tea-beverage kiosks during the circuit breaker. However, it has since reopened 4 food courts, 3 QSRs, and 1 full-service restaurant in the current Phase 1 post-circuit breaker.

Koufu’s two new food courts and two new R&B tea kiosks scheduled to open in Q2 2020 have been delayed to Q3 2020. But these plans are all subject to the COVID-19 outbreak situation stabilising or improving in Singapore.

4. Koufu has plans to cope with the negative impact COVID-19 has on its business. It has partnered with delivery platforms and launched delivery services within its own ‘Koufu Eat’ app to boost its online sales. Further, it will receive government grants and rental rebates from landlords (most of which will be in Q2 and Q3 2020).

Koufu also has a significant cash position to meet operational requirements for the time being. As of 31 December 2019, the company has S$90.4 million in cash and S$67.7 million in lease liabilities due in FY2020. Koufu also has S$4.7 million in borrowings.

5. Koufu plans to open an integrated facility that will expand Koufu’s central kitchen by five times as well as further strengthen its procurement, food preparation, processing, and distribution functions. The facility, which is expected to be ready in Q3 2020, will also house a training centre for employees, a food court, and a R&D centre for development of F&B products and recipes.

Up to 30% of total gross floor area at the facility will be rented out to Koufu’s stall holders to build their own central kitchen. The rest of the area will be for Koufu’s own business operations and joint venture businesses.

Koufu has also attempted to raise productivity levels at its food courts by recognising technology as a key enabler. For example, Koufu has 43 smart tray return robots deployed to 16 food courts and coffee shops. Its mobile ordering app ‘Koufu Eat’ is also implemented at 42 food courts and coffee shops. To encourage use, customers get to enjoy a 10% discount when they order and pay through the app.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Thanks very much, Fifthperson for always providing an indepth and very informative analysis of AGMs. Helps in our stock analysis.

You’re most welcome, Jolene! We’re glad you find the research and analysis useful! 🙂