SATS is a food solutions and gateway services provider, and controls about 80% of Changi Airport’s ground handling and catering business. SATS is known among local investors for paying a steady dividend over the years.

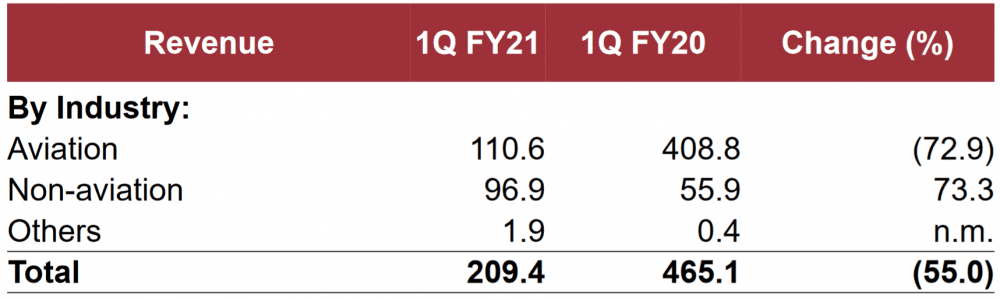

However, the COVID-19 pandemic has practically grounded global aviation and presented SATS with perhaps its greatest challenge in its history. In its most recent Q1 2021 quarter, SATS reported a 55% drop in revenue and net loss of S$43.7 million. And its latest annual dividend fell 68% from 19.0 cents to 6.0 cents per share.

Aviation is not expected to recover to pre-pandemic levels until 2024 and international travel remains on lockdown. Can SATS survive COVID-19 and the next four years? Here are five things I learned from the 2020 SATS annual general meeting.

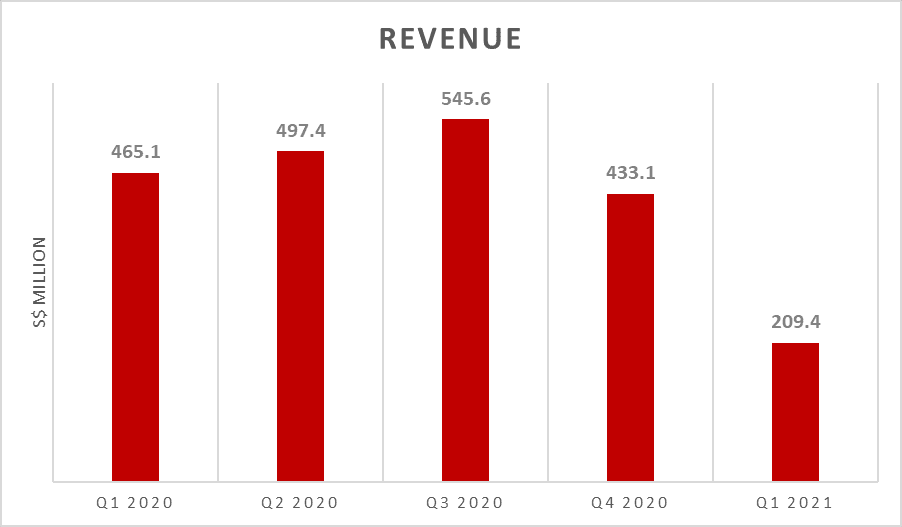

1. As SATS’ financial year ends on 31 March, the onset of the pandemic affected the company’s performance from Q4 2020 onward. Quarterly revenue fell consecutively n Q4 2020 and Q1 2021 due to a steep decline in aviation volume.

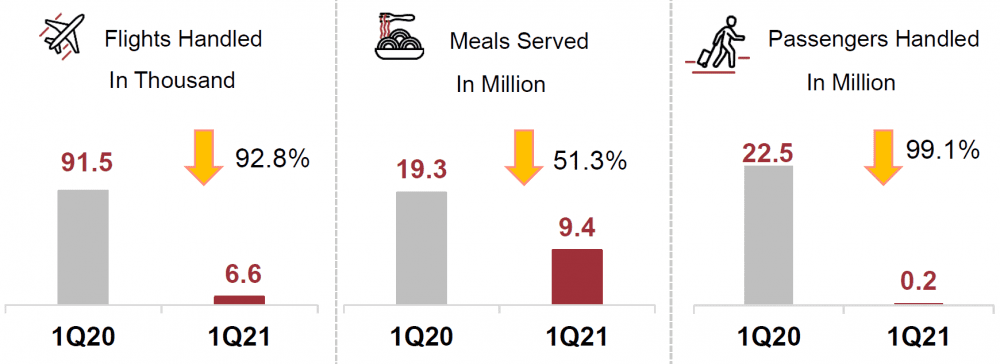

The peak months of the pandemic (April to June) was acutely felt in Q1 2021 when passenger and flight volumes all but evaporated for SATS.

2. As of 30 June 2020, SATS has cash reserves of S$723.5 million. Although free cash flow for Q1 2021 was negative S$71.5 million, the company should have enough cash reserves to tide through this difficult period as passenger volumes have gradually improved since April. However, SATS CEO Alex Hungate said that the situation remains uncertain and the priority for SATS in the meantime is to achieve profitability and positive cash flow without government support.

3. SATS’ share price has fallen 46% year-to date to S$2.77 (as of 30 September 2020). To converse cash, SATS decided not to pay a final dividend for FY19/20 and only declared an interim dividend of 6.0 cents. Based on this, its current dividend yield is only 2.2%. At the AGM, the CEO said that he wasn’t able to give an exact timeline to when full dividend payments would resume.

4. While air passenger volume has been decimated, air cargo was more resilient. Global air cargo demand fell 13.5% year-on-year in July, compared to 80% for air passenger demand. In the past quarter, SATS inked air freight contracts with Qatar Airways, Malaysian Airlines, and Spring GDS (the e-commerce arm of the Dutch national post office). COVID-19 has accelerated the growth of e-commerce, and SATS aims to broaden its operations to include e-commerce and perishable cargo handling.

5. One bright spot for SATS is its non-aviation segment. The segment’s Q1 2021 revenue grew 73.3% year-on-year to S$96.9 million. This growth was mainly due to the acquisition of the remaining 49% stake of SATS BRF Food (now renamed as Country Foods).

Country Foods is the largest meat protein importer and distributor in Singapore with over 800 branded and white-label retail products including its own retail brand, Farmpride.

SATS is also targeting the growth opportunity in running central kitchens for fast-casual restaurant chains in China and India. The CEO shared that the market segment in China is estimated to be worth more than $16 billion. The company’s central kitchen in Kunshan, China serves customers like Yum China – one of the country’s largest restaurant companies – in the Shanghai region. SATS is building an additional kitchen in Tianjin, China, and also plans to construct more kitchens in both China and India.

The fifth perspective

COVID-19 has severely impacted SATS revenue and it will take a few years for the company to recover to pre-pandemic levels. The company’s diversification into non-aviation segments has helped to cushion the blow somewhat, but its dividend is likely to remain depressed until the outlook becomes a lot clearer.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Hi Adam

I am a retired Merdeka senior, Have lost a considerable amount in some stocks, would like to seek your advice and guidance. will you be able to assist. I am willing to pay you some fees.

Best rdgs

Susan Tong

Hi Susan,

I’m sorry to hear that. We don’t manage investments for clients. However, we strongly suggest taking your time to learn more about fundamental analysis and how to identify high-quality companies. You can check out the free resources we have here: https://fifthperson.com/how-to-start-investing-in-singapore-a-practical-guide-for-beginners/

We also suggest reading these great investment books: https://fifthperson.com/top-5-books-investing-for-beginners/

At the end of the day, you can decide if long-term stock investing is something that you’re comfortable with and suitable for your risk profile. Hope this helps!

Did I fall asleep and wake up in 2021? Or does your analysis have the wrong year?

SATS’ financial year ends on 31 March. So its FY2020 runs from 1 April 2019 to 31 March 2020. Its current financial year is FY2021 which ends 31 March 2021.