Starhill Global REIT (SG REIT) is a retail/office REIT that owns 10 properties in Singapore, Malaysia, China, Japan, and Australia. Its largest assets are Wisma Atria and Ngee Ann City which are located along the prime Orchard Road shopping belt. As of 30 June 2020, SG REIT’s properties were valued at S$2.9 billion.

SG REIT has been in my portfolio for a few years now and paid me a decent dividend yield-on-cost of 6% to 7% per annum. However, the pandemic has decimated the retail and travel industries which have affected SG REIT doubly hard as its prime malls welcome a higher share of tourist traffic compared to suburban malls.

I attended SG REIT’s recent AGM to learn how it plans to navigate the challenges posed by COVID-19 and whether it can sustain its dividend. Here are seven things I learned from the 2020 Starhill Global REIT AGM.

1. Gross revenue fell 12.3% year-on-year to S$180.8 million and net property income (NPI) fell 17.1% y-o-y to S$132.0 million in FY2020. The drop was due to the pandemic and ensuing lockdowns which affected SG REIT’s performance for the second half of the financial year. The REIT’s prime shopping malls were particularly impacted by lower footfall due to fewer office workers in the city centre and the near-complete halt in tourist arrivals.

Despite the challenges, the management views that malls in prime locations remain an attractive, long-term business proposition. Prime retail locations still command some of the highest rents in the world and the current decline is due to an unprecedented global pandemic than an issue with the business model.

2. Distributable income fell 23.7% y-o-y to S$77.4 million. Out of this, SG REIT retained S$4.9 million and deferred S$7.7 million in distributable income – which must be paid out to unitholders by December 2021 as per IRAS rules – to conserve cash. Because of this distribution per unit (DPU) fell 33.9% y-o-y to 2.96 cents for FY2020. SG REIT also switched to semi-annual distributions and adopted half-yearly reporting to achieve cost savings and greater financial flexibility.

Based on SG REIT’s closing unit price of 45 cents (as of 16 November 2020) and FY2020 DPU, its distribution yield is 6.6%. You can view and compare the yields of other Singapore REITs here.

The management gave no guidance to whether DPU will deteriorate further but will continue to monitor the performance in view of the uncertainty surrounding the pandemic. (Although positive news about a vaccine has recently been announced.)

3. Gearing ratio is 39.7% as at 30 June 2020, an increase from 36.1% a year ago. However, the increase is mainly due to a devaluation of SG REIT’s property portfolio and slightly higher borrowings to build up its cash balance considering the pandemic. Weighted average debt maturity is 2.7 years and average cost of debt is 3.23%. Ninety-one percent of SG REIT’s debt is hedged at fixed interest rates.

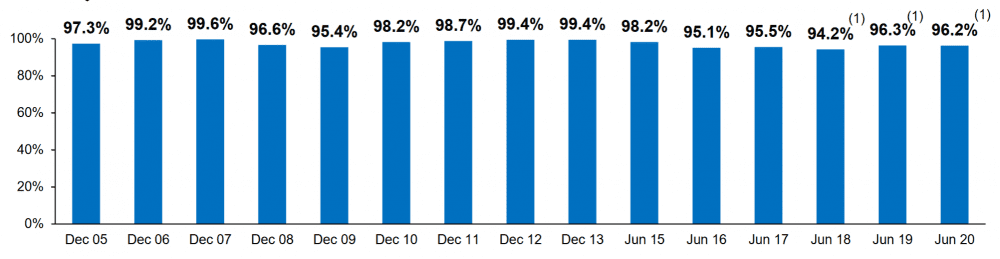

4. Portfolio occupancy rate was 96.2% as at 30 June 2020. SG REIT’s occupancy has remained largely resilient even during the 2008 crisis and now during the pandemic.

This was partly helped by stable master leases in Singapore with Toshin Development Singapore (a wholly-owned subsidiary of Takashimaya) and in Malaysia with YTL Corporation (SG REIT’s sponsor). In Australia, long-term anchor leases at Myer Centre in Adelaide and David Jones Building in Perth (both expiring 2032) cushioned the impact. The overall Australia portfolio posted a stable actual occupancy of 94.3% as at 30 June 2020.

Singapore office occupancy dropped to 87.6% from 93.2% a year ago. This was mainly due to a single large tenant at Ngee Ann City who vacated before the pandemic. Half of the vacated space has since been taken up by new tenant. The lower office occupancy at Ngee Ann City was partially offset by the improvement in office occupancy at Wisma Atria.

However, rents and occupancies for retail and office are expected to remain under pressure due to economic uncertainties which could affect tenant lease renewals.

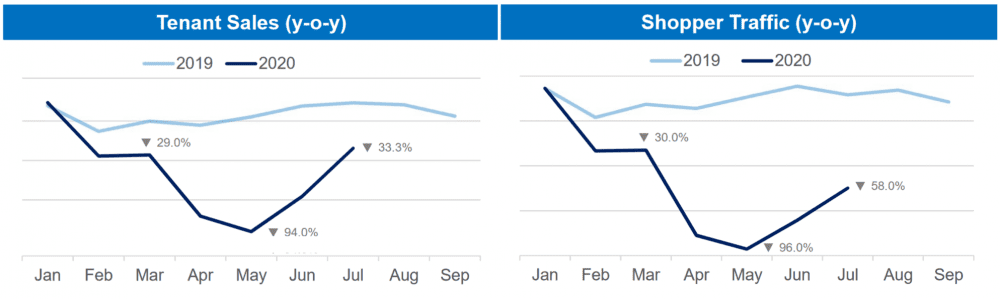

5. Wisma Atria comprised 30.9% of gross revenue in FY2020 and is SG REIT’s second largest revenue contributor. Tourist arrivals to Singapore have fallen by 99.0% since April 2020, and Wisma Atria’s tenant sales and shopper traffic declined by 94.0% and 96.0% y-o-y respectively at the peak of the pandemic. Tenant sales have since recovered to two-thirds of pre-pandemic levels.

SG REIT provided rental assistance for eligible tenants affected by the COVID-19 pandemic which helped to sustain the mall’s retail occupancy rate at 96.7%.

SG REIT has been attempting for many years to acquire the remaining 25.8% stake at Wisma Atria from Isetan Singapore. However, the management gave an update that no further progress has been made thus far.

6. The Starhill in Kuala Lumpur is still undergoing redevelopment as planned. The redevelopment will revamp the property’s interior and convert its top three floors into 160 hotel rooms operated by JW Marriot. Work was temporarily halted for two months during the lockdown in Malaysia but has since resumed and is expected to complete by end-2021.

The management did not reveal any potential acquisition targets right now. At the same time, the management is looking to divest properties where they lack scale and ability to value-add (i.e. Japan and China). For example, SG REIT has divested five properties in Japan in recent years. SG REIT’s Japan and China portfolio now only contribute 2.6% of total gross revenue.

7. For three months from April to June 2020, the board took a 20% pay cut in directors’ fees, the CEO and CFO took a 10% in salary, while other senior employees took a 5% pay cut. The savings was passed on to unitholders as part of a 10% reduction in base management fees for the same period. Although the pay cuts weren’t obligatory, this was done to show solidarity with unitholders in light of the pandemic.

The fifth perspective

SG REIT’s malls will remain attractive assets due to their prime location in key cities. However, the situation surrounding the pandemic remains uncertain and travel is not expected to recover to pre-pandemic levels until 2024 (notwithstanding the success of a vaccine). Therefore, SG REIT’s prime malls will continue to see low tourist footfall which may dampen performance in the short term. At the same time, SG REIT’s master and anchor leases provide a level of income visibility and will help stabilise results until the recovery.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Can you buy S.REIT through IBKR Canada?

You did nor provide conclusion weather it is a value buy of this reit as compare to other sin. Reit ?

Do you help to manage money ? ( invest into REIT )

Hi Christopher,

Yes, IBKR provides access to the SGX.

We don’t make any recommendations on whether a security is a buy (or sell) as every investor has different investment goals and risk profiles. While we provide a summary of our research, you’d have to make your own decisions whether an investment is suitable for your portfolio. We don’t manage money for clients. Hope this helps!

Yes. Thankyou. Have a super day