Founded in 1984 and listed on Bursa since 2014, 7-Eleven Malaysia Holdings Berhad owns and operates approximately 2,500 7-Eleven stores in Malaysia. In June of 2020, the company ventured into the retail pharmacy segment by acquiring a 75% stake in Caring Pharmacy Group Berhad. 7-Eleven and CARiNG are both household names in Malaysia, and especially in the Klang Valley.

Most of 7-Eleven Malaysia’s stores are typically located at or near petrol stations, train stations, shopping malls, and office towers across city centres and neighbourhood areas. CARiNG’s pharmacies on the other hand are usually found in shopping malls and shop lots. They provide full-time pharmacist services 12 hours a days and seven days a week.

Here are seven things I learned from the 2021 7-Eleven AGM.

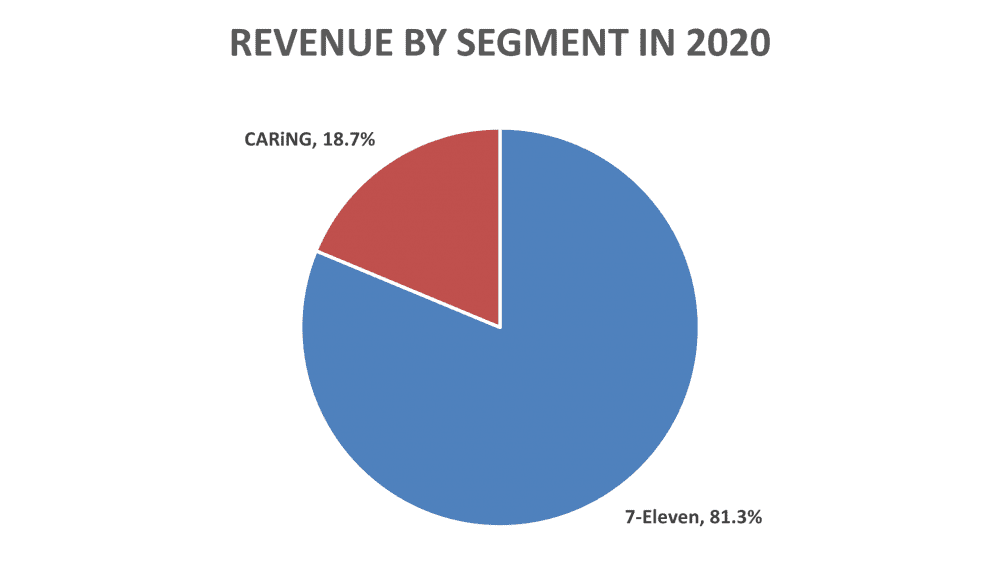

1. Overall revenue grew 7.5% year-on-year to RM2.5 billion in 2020 while net profit plummeted 44.9% year-on-year to RM29.8 million over the same period. Weaker results were due to underperforming 7-Eleven stores. Although both 7-Eleven stores and CARiNG pharmacies were regarded as providing essential services and products, and allowed by the government to operate, they were negatively impacted by shorter operating hours, lower customer traffic, lowered tourist footfalls, and repeated movement control orders due to COVID-19.

Corporate expenses amounting to RM33.7 million also led to the decline in its net profit in 2020. The weaker performance in 2020 was slightly offset by better cost control and rental support offered by landlords.

2. 7-Eleven Malaysia is the leading convenience store operator in the country with a market share of 68% in 2020. Ninety percent of the total 2,413 stores were self-operated while the remaining 10% were franchised. More than one million customers visit Malaysia 7-Eleven stores each day. The stores recorded -14% same-store-sales growth year-on-year in 2020, compared to 2.5% in 2019.

3. The average basket size per customer at 7-Eleven Malaysia was around RM7.20 in 2020. According to executive director Wong Wai Keong, tobacco contributed 40% of the company’s revenue in 2020 followed by fresh food at 10%, services at 5%, and other general merchandises at 45%. Executive director Tan U-Ming responded to a shareholder that 7-Eleven branches will continue to sell Chinese newspapers despite their shrinking sales; a lot of readers have gone digital. The company will try to work with these newspaper dailies to boost its in-store circulations. The Sun is still distributed there for free.

4. As a result of the pandemic, consumers’ consumption patterns are skewed towards preventative healthcare and take-home items such as masks, sanitisers, and medications. More fresh food products will be launched by 7-Eleven Malaysia in order to expand the gross profit margin of the company. There were no layoffs throughout the pandemic and the headcount was kept lean.

5. At 7-Eleven Malaysia, delivery cost per piece decreased by almost 30% year-on-year in 2020 while maintaining a high fulfilment to stores. The Johor Bahru distribution centre helped reduce delivery times to stores in the south and mitigate stock holding and inventory shrinkages, improving higher sales productivity. The management aims to open at least 50 to 100 stores each year and continue eliminating underperforming ones. It also targets to refine and expand its My7E loyalty app to extend Foodpanda home delivery services from the existing 750 stores to 1,000 in 2021.

6. The management will work with their suppliers to ensure both chain stores are adequately stocked with essential and popular items. The management will continue to position CARiNG as the leader in terms of offering competitively priced health products to customers while 7-Eleven Malaysia will continue to improve its convenience propositions for customers.

7. CARiNG continued to expand its presence in second- and third-tier cities across the country. In 2020, it had more than 700,000 members; approximately 50% of its sales were contributed by these members. During the year, CARiNG also launched an online licensed portal to address customers’ health-related queries and product-related questions based on their medical records.

The fifth perspective

7-Eleven Malaysia will continue to operate despite the pandemic. Its 2020 performance was impacted by hefty corporate expenses incurred on business acquisitions. The company will survive the pandemic but the business landscape is getting more competitive each day. From a customer’s standpoint, 7-Eleven Malaysia started becoming more innovative once FamilyMart (under QL Resources) and CU (under myNEWS) entered the arena. A unique selling proposition is needed to separate themselves from these players as well as Watsons and Guardian pharmacies.

VERY GOOD TQ GBU