CapitaLand Integrated Commercial Trust (CICT) owns and invests in assets primarily used for retail and office purposes. CICT’s current portfolio comprises 22 properties in Singapore and two in Frankfurt, Germany, with a market capitalization of S$14.0 billion as of 31 December 2020.

Coupled with the COVID-19 pandemic, 2020 has been an unprecedented year as CICT embarked on a new chapter following the recent merger of CapitaLand Mall Trust (CMT) and CapitaLand Commercial Trust (CCT) which took place via a trust scheme of arrangement on 21 October 2020.

At its inaugural annual general meeting, CICT’s CEO Tony Tan Tee Hieong presented the Groups’ financial performance, operational highlights, key financial metrics, and developments. There were no live questions taken during the AGM. However, relevant questions posted by unitholders that were submitted and answered before the AGM have been included in this article.

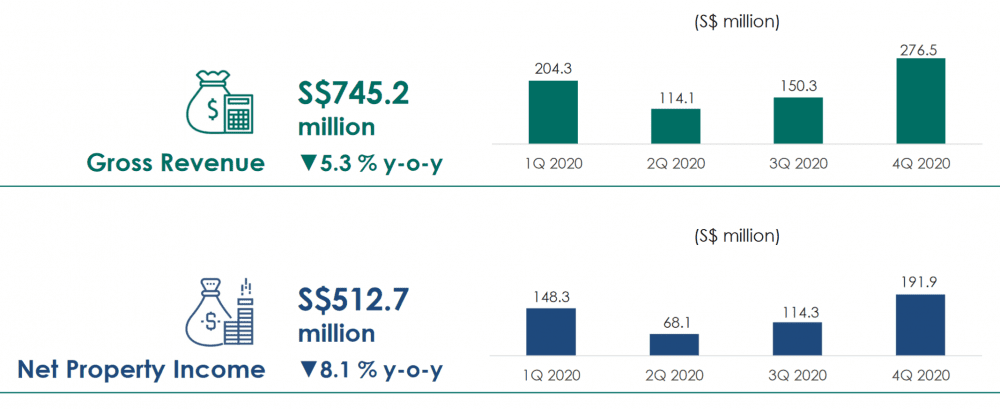

1. Gross revenue and net property income (NPI) for FY2020 was S$745.2 million and S$512.7 million respectively. Compared to a year ago, gross revenue and NPI was down 5.3% and 8.1% respectively. Distributable income for FY2020 decreased 16.4% y-o-y to S$369.4 million, while distribution per unit (DPU) fell 27.4% y-o-y to 8.69 cents.

As of 31 December 2020, net asset value (NAV) per unit decreased to S$2.00 from S$2.07 a year ago. This was due to an enlarged number of total units outstanding as a result of the merger and change in valuation of investment properties. At the AGM, the CEO attributed the lower FY2020 results to rental waivers granted to tenants affected by the pandemic.

2. However, CICT’s Q4 2020 financial performance was better, with the CEO attributing it to the merger of CMT and CCT. Gross revenue and NPI for Q4 2020 was S$276.5 million and S$191.9 million, up 36.0% and 36.4% respectively.

Distributable income for the quarter jumped 26.8% to S$145.4 million despite S$22.4 million worth of rental waivers. According to the annual report, the significant increase was attributed to the enlarged portfolio of assets and contribution from Raffles City Singapore which became a 100.0% owned property post-merger.

DPU for Q4 2020 was 2.63 cents. The CEO said that this included the clean-up distribution of 0.89 cents already paid to CMT unitholders on 19 November 2020. He added that the remaining 1.74 cents for the period from 21 October to 21 December 2020 was based on the enlarged unit base of 2.8 billion new units issued as consideration for the merger[JK(C6] on 28 October 2020.

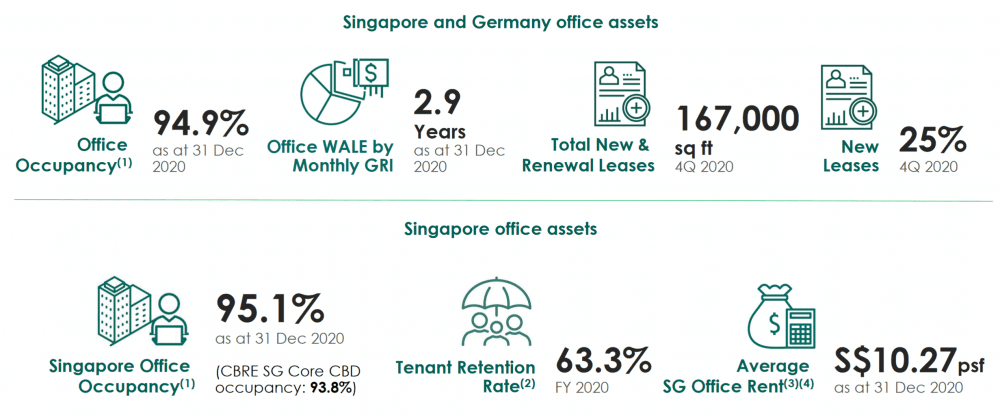

3. CICT achieved an overall portfolio occupancy of 96.4% (as of 31 December 2020). The CEO said that the REIT’s largest 10 tenants (by rental income contribution) contributed 21% of its gross rental income for the month of December 2020. He added that its enlarged tenant base ensured that no single tenant contributed more than 6% of CICT’s monthly rental income. The portfolio’s weighted average lease expiry (WALE) by monthly gross rental income is 3.0 years.

The CEO attributed the stable operational performance to proactive engagement with stakeholders and management of its properties, adding that the REIT’s operations started recovering towards the end of 2020 as Singapore geared towards its Phase 3 reopening.

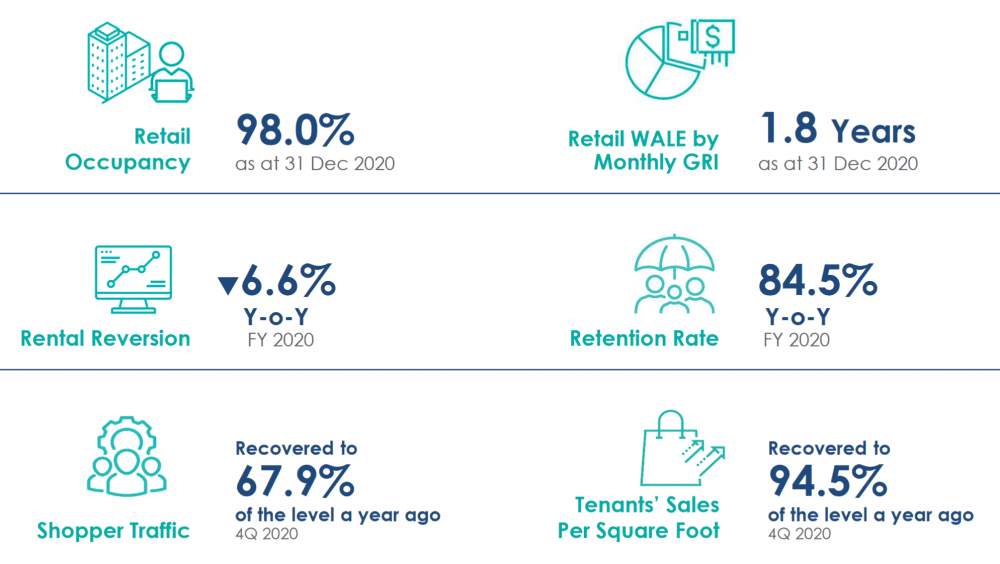

4. For its retail segment, CICT maintained a high occupancy rate of 98%, which is higher than the islandwide market occupancy rate of 91.2%. Tenant retention rate stood at 84.5%.

The CEO shared that traffic in its malls rebounded amidst safe distancing measures, while tenant sales in the fourth quarter recovered close to pre-pandemic levels owing to strong performance from its suburban malls. He added that present shopper traffic has recovered to close to 75% of pre-pandemic levels.

5. For its office segment, CICT’s Singapore office occupancy rate stands at 95.1%, slightly above the core CBD occupancy rate of 93.8%. The CEO said that office workers are gradually returning to numbers that are close to 50% of pre-pandemic levels. Total office occupancy rates for its Singapore and Germany office assets were 94.9% while office WALE by monthly GRI was 2.9 years (as at 31 December 2020).

The CEO added that striking the right balance between rents and occupancy is key for both its retail and office segments.

6. Valuation of CICT’s entire portfolio was stable, with a marginal decline of 0.4% for FY2020. The CEO attributed the decline to effects of the pandemic on market rent assumptions and provision of one-off rental rebates to qualified tenants. He added that independent valuations for its office properties and Capital Spring in 2H 2020 was largely stable with marginal declines for certain properties due to lower market rent assumptions.

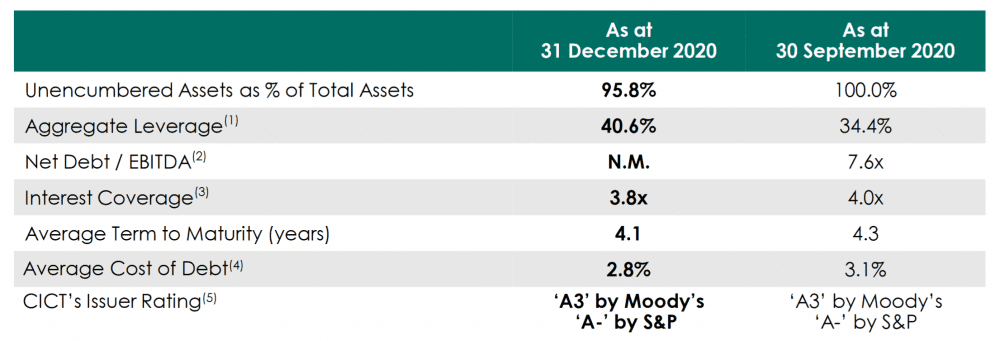

7. On the CICT’s capital management, the CEO presented the REIT’s debt maturity profile and its key financial indicators. He explained that CICT issues long-dated debt at low interest rates and that a facility to finance debt expiring in 2021 was secured. He added that its sources of funding are diversified including certainty of interest expense with 83% of borrowings at fixed rates. As at end-December 2020, leverage ratio was 40.6%, average cost of debt was 2.8%, and interest coverage was at 3.8.

8. The CEO updated that asset enhancement works for shopping mall Lot One and office properties Six Battery Road and 21 Collyer Quay are set to be completed this year. The redevelopment of Capital Spring is also targeted to be completed by the second half of 2021.

A unitholder asked about the S$45-million upgrading of 21 Collyer Quay and whether it was specifically for coworking operations as the entire building is to be leased out to WeWork.

The management responded that the recent upgrade of 21 Collyer Quay mainly includes enhancements to essential equipment, common and lettable areas and to achieve a BCA Green Mark Platinum rating. They explained that the building was not under CICT’s property management in the past as it was a net lease; the building management was under the care of the previous tenant. However, going forward, the property will be under CICT’s management. The management added that the internal fit-out is under the care of WeWork, the new tenant, whose lease is expected to commence in Q4 2021.

9. CICT strengthened its digital ecosystem with two new digital platforms, eCapitaMall and Capita3Eats, in June 2020. The platforms onboarded over 550 brands, providing direct access to CapitaStar’s 1.1 million members likewise increasing retail options for CapitaStar members.

A unitholder asked if the two digital platforms were gaining any traction, how eCapitaMall could compete with online shopping sites like Lazada and Shopee, and Capita3Eats with food delivery platforms like GrabFood and Foodpanda.

The management replied that the performances of eCapitaMall and Capita3Eats have been very encouraging, with 15 times growth in gross merchandise value since its launch in June 2020. Major campaigns such as ‘10.10’ drove an eight times uplift in daily sales while the acceptance of eCapitaVouchers on both platforms also contributed positively towards the sales of onboarded retailers.

The management clarified that eCapitaMall and Capita3Eats were not competing with online shopping sites and food delivery platforms. They explained that the primary focus of these platforms is to create an omnichannel retail experience for both CapitaLand shoppers and retailers where ‘online and offline journeys converge into a unified experience’.

10. A unitholder asked for insights on the Singapore office leasing market for the next 1-2 years, given the impact of COVID and work-from-home practices. The management stated that the challenges dealt by COVID-19 resulted in cost efficiency being the top priority for some firms in 2020. Sectors such as banking, finance, and insurance largely adopted a downsizing approach to their office needs. Activity from co-working firms was relatively muted as some co-working operators seek to postpone their new workplace openings. In CICT’s dealings with tenants, the management noted that companies are taking time to evaluate a mix of core and flexible space requirements to address their needs.

According to CBRE’s report as of 31 December 2020, the CBD core remains the preferred location for business headquarters and corporates looking to house their front offices in good-quality office buildings with access to well-connected transportation nodes and proximity to numerous well-established local firms and global multinational corporations. Apart from the typical banking and legal firms, sectors like technology, financial services, and professional services will help support demand for quality office spaces in the CBD.

The fifth perspective

Despite a tough 2020, CICT has delivered a total return of 16.51% over the last three years. It outperformed the STI, FTSE ST REIT, and FTSE ST Real Estate indexes in 2020.

Given the challenges brought about by the pandemic, CRBE projects Singapore market rentals to stay soft in the short-term, while CBD core monthly rentals are forecasted to improve marginally for 2021. Demand is also forecast to pick up in 2022 as the economy opens up and confidence returns.

When you invest in CICT you are primarily investing in Singapore and its retail-office property market. Germany only accounts for 4% of CICT’s portfolio (as at 31 December 2020). With the recent merger, CICT has positioned itself as a proxy for Singapore real estate, enabling the REIT to leverage real estate trends and opportunities in retail, office, and integrated developments locally.

A unitholder raised the concern of geographical concentration risk as the CICT’s portfolio is primarily based in Singapore. The management responded that its established track record, wide network, and reliable management team places CICT in an advantageous position to ride on the recovery of Singapore.

CICT’s higher Q4 2020 performance exhibits the potential of CICT providing greater value and return for unitholders. How well the REIT can build upon its current position to harness synergies across its properties as well as events leading to the recovery of the Singapore economy — such as employees returning to the workplace and cross-border travel resuming — will play a large factor in CICT’s performance moving ahead.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

Very helpful summary and analysis! Thank you!

Thanks Matt. You’re most welcome!