iFast Corporation is a wealth management fintech platform headquartered in Singapore, providing a comprehensive range of investment products and services to financial advisory firms, financial institutions, multinational companies and high net worth individuals in Asia.

Due to the pandemic, iFast has been able to benefit from the accelerated pace of digitalisation undergoing in the wealth management industry. In view of their FY2020 and 1Q2021 results, I attended their AGM to learn more about the management and the company. Here are the seven things I learned from the 2021 iFast Corporation AGM.

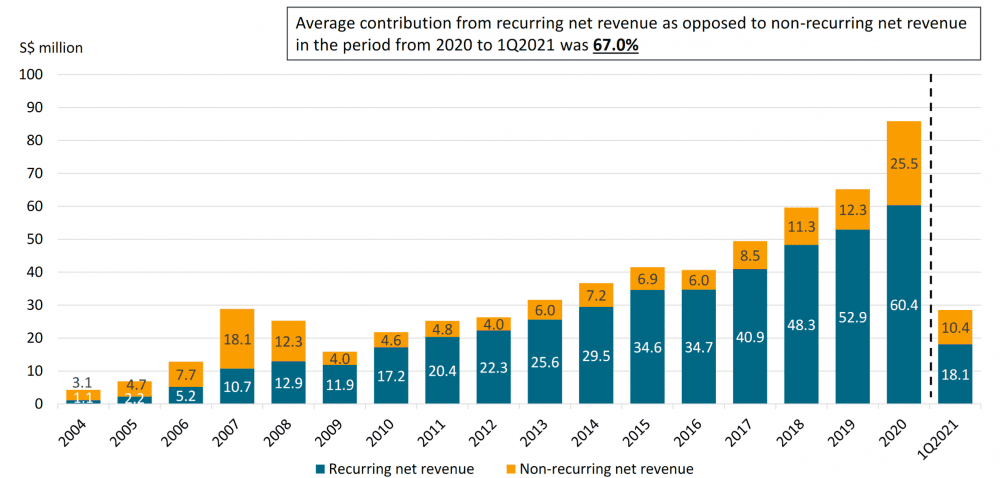

1. FY2020 net revenue increased 31.7% to S$85.7 million, from S$65.2 million the year before. iFast also started 2021 on a strong note – 1Q2021 net revenue grew 51.4% year-on-year to S$28.5 million from S$18.8 million the year before. Sixty-seven percent of iFast’s net revenue is recurring which gives the company high earnings visibility favoured among investors.

2. Net profit increased 142.5% year-on-year to S$8.82 million in 1Q2021 from S$3.64 million in 1Q2020. According to iFast: ‘Growth in profit was substantially higher than the growth in revenue, showing the positive operating leverage and scalability of the group’s business model.’

iFast’s strong growth is a result of their past investments in building an integrated digital wealth management platform which is now benefiting from the increased digital adoption in the wealth management industry.

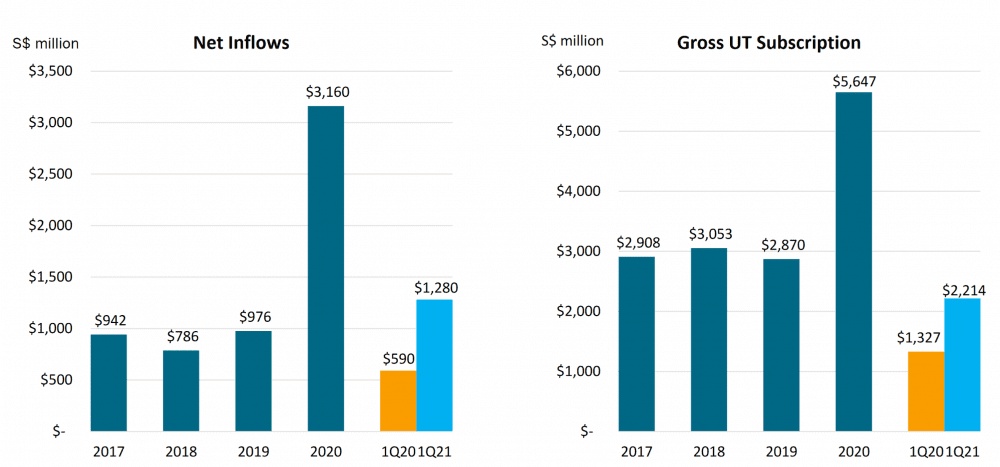

3. iFast saw a record-breaking year of net inflows at S$3.16 billion in FY2020. The company looks on track to beating that this year with net inflows of S$1.28 billion in 1Q2021 alone, a 117.0% increase compared to the previous quarter. Similarly, Gross Unit Trusts subscription reached a record high in FY2020 at S$5.6 billion. In 1Q2021, iFast posted a record-high quarter of S$2.22 billion in Gross Unit Trusts subscription, a year-on-year increase of 66.9%.

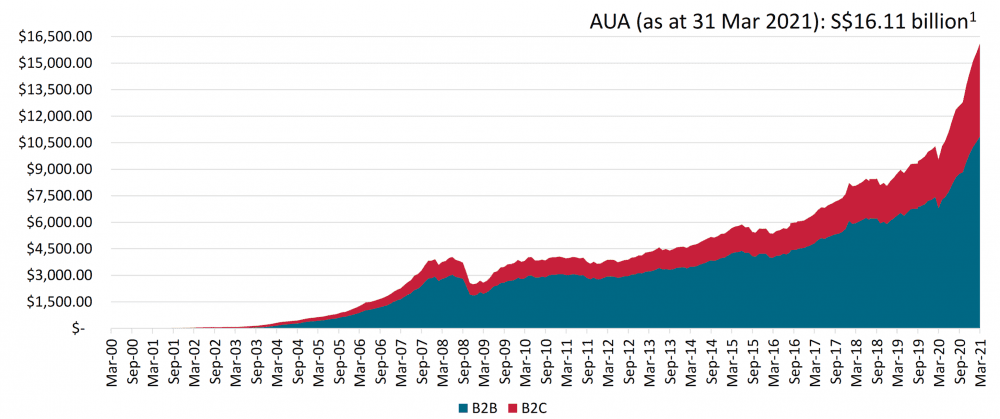

4. iFast’s assets under administration (AUA) grew by 68.9% over the past year to S$16.11 billion as of 31 March 2021. iFast’s AUA comprises two segments: Business-to-Business (B2B) and Business-to-Consumer (B2C) which made up 67.5% and 32.5% of AUA respectively.

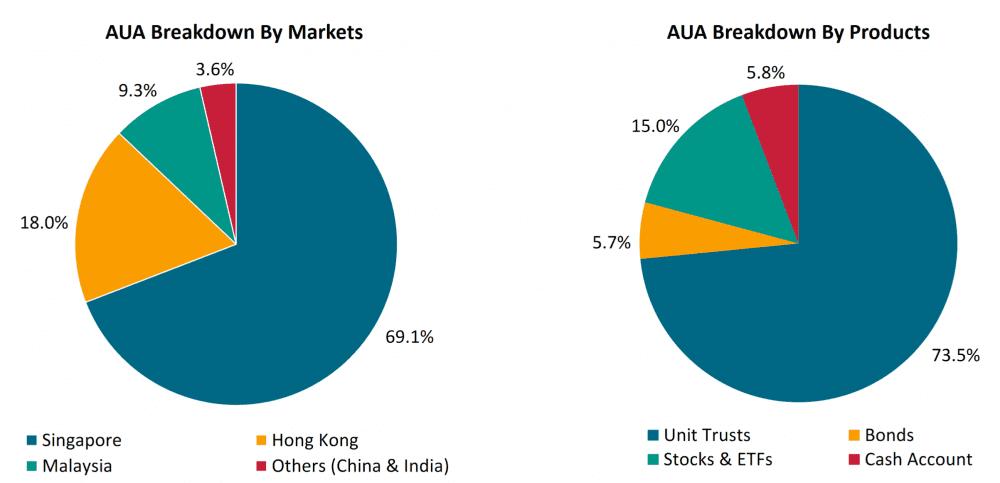

5. Singapore is still the largest contributor of AUA at 69.1%, followed by Hong Kong (18%), Malaysia (8%), and Others (3.6%). As iFast started off as a unit trust platform in 2000, unit trusts remain iFast’s key product contribution at 73.5%, followed by stocks & ETFs (15%), cash accounts (5.8%), and bonds (5.7%).

6. iFast’s core geographical markets in Singapore, Hong Kong and Malaysia remain robust and have posted growing profits since FY2017. iFast believes its B2B business in Singapore will continue to grow as it onboards more institutional partners and strengthens its suite of services and fintech solutions. Sales from the Singapore B2B division grew 127% year-on-year in 1Q2021.

CEO Lim Chung Chun said that iFast is working with potential partners to obtain a digital bank license in Malaysia. The outcome of the results will only be known early next year. The capital required for the digital bank license will be around RM100 million for the first three years,.

In Hong Kong, iFast expects that the demand for fintech solutions from its existing and prospective clients will continue to remain strong in 2021. This is driven by stronger demand for IT solutions. The revenue from the Fintech Solutions division hit a record high in 1Q2021.

7. iFast’s China net revenue grew 186% year-on-year to S$0.7 million in 1Q2021. However, the company’s China segment remains unprofitable and recorded a loss of S$1.4 million for 1Q2021. The CEO explained that the most important thing for iFast to do is to grow its market presence in China first. He revealed that iFast China is likely to record higher losses in FY2021. As the loss to growth profitability is still manageable, the management intends to build a good foundation in China for the long term.

Currently iFast China only offers unit trusts, unlike Singapore, Hong Kong, and Malaysia where there are a range of products available (unit trusts, stocks, bonds, and ETFs). The CEO said that when opportunities arise, iFast will move forward with other products. However, he’s unable to give an exact timeline. He reminded that Singapore, Hong Kong, and Malaysia also started off solely with unit trusts at the beginning.

The fifth perspective

iFast posted stellar results in FY2020 and Q12021 where it recorded record highs in revenue, profit, and assets under administration. Given the record numbers in FY2020 and Q12021, the expectations for FY2021 will be high as well. Some shareholders may expect continuous growth from iFast which may be difficult to maintain at a high rate. China remains a huge growth opportunity for iFast but the company’s China segment will remain unprofitable for some time as it seeks to gain market share there.

iFast’s share price is trading at a price of S$6.32 (as of 10 May 2021). This works out to a P/E ratio of 81.0 based on FY2020 EPS of 7.80 cents. Investors have to decide whether the company’s projected growth is worth its current premium in share price.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »