Mapletree Logistics Trust (MLT) is a REIT that owns a diversified portfolio of logistics properties located in Singapore and across the Asia-Pacific. It is also Singapore’s first Asia-focused logistics REIT.

As many e-commerce companies benefitted from pandemic-induced lockdowns in several countries, MLT enjoyed an eventful 2020 as rental income from e-commerce logistics companies continued to stream in. Will this trend keep up? I tuned in to MLT’s recent AGM to find out more.

Here are seven things I learned from the 2021 Mapletree Logistics Trust AGM.

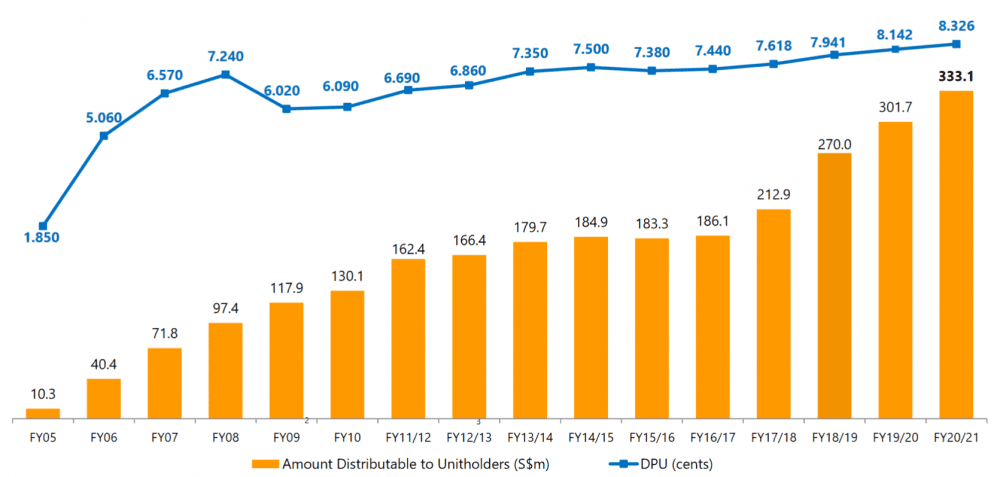

1. MLT’s distribution per unit (DPU) increased by 2.5% year-over-year to 8.326 cents. The increase was mainly due to an increase in contributions from existing properties, newly acquired properties, and the distribution of divestment gains. Since its listing in 2005, MLT has managed to steadily grow its amount distributable to unitholders and DPU.

Based on MLT’s unit price of S$2.11 (as at 6 September 2021), its distribution yield is 3.9%. In comparison, the average yield for Singapore REITs is currently 5.4%.

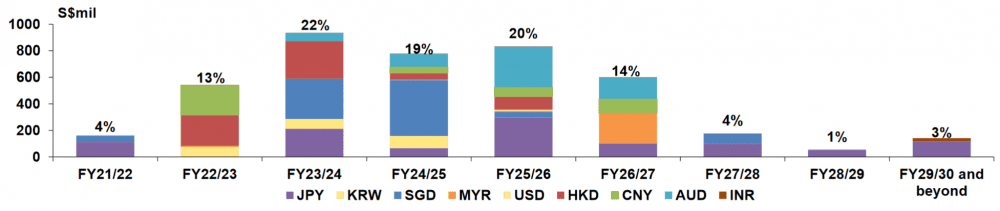

2. MLT’s aggregate leverage ratio is 38.4% as at 31 March 2021, a 0.9 percentage point decrease from the previous year. MLT’s debt maturity profile is well-staggered over the coming years with less than 22% of its debt coming due in a single financial year. MLT’s interest coverage ratio stands at 5.1.

The management has stated that they are comfortable with a gearing ratio of around 40%. At current gearing levels, MLT has a debt headroom of S$1.3 billion to fund acquisitions before the ratio reaches 45%.

3. MLT derives its revenue from a range of geographic sources. The top five sources of revenue by geography are Singapore (29.8%), China (18.9%), Hong Kong (18.5%), Japan (10.6%), and Australia (7.6%). These five countries amounted to 85.4% of MLT’s gross revenue.

MLT’s well-diversified portfolio means that the REIT is not reliant on any one country. MLT’s network of logistics properties across Asia-Pacific also provides a competitive, single-provider option for tenants who are looking to expand quickly across the region.

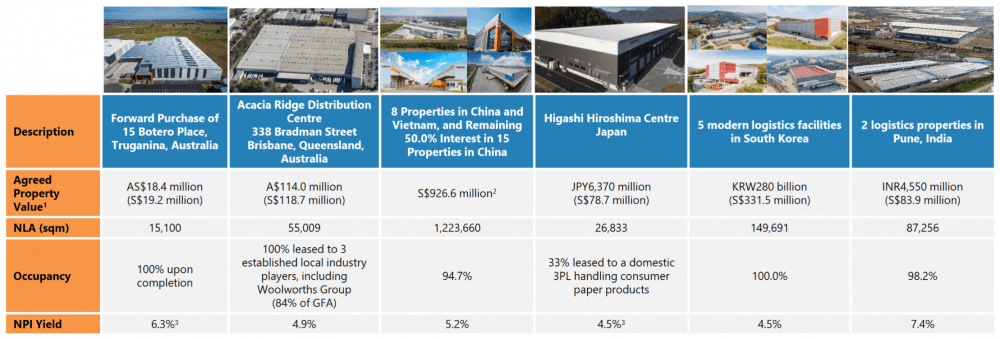

4. MLT continues to enhance its suite of logistics facilities through acquisitions, divestments, and redevelopments. In FY 20/21, MLT made acquisitions totalling S$1.6 billion. It acquired 18 modern specifications logistics facilities in Australia, China, Vietnam, Japan, South Korea, India, and the remaining 50% interest in 15 properties in China. These acquisitions deepen MLT’s footprint in the Asia-Pacific market and strengthen the portfolio’s quality.

5. MLT’s unit price achieved 183.8% in capital appreciation since its IPO in July 2005 till 31 March 2021. In comparison, the Straits Times Index and FTSE ST Real Estate Investment Trusts Index only grew 38.8% and 15.5% respectively over the same period.

MLT also generated an additional 161.3% in distribution yield since IPO, which gives a total return of 345.1%. Unitholders that invested in MLT since its listing have been handsomely rewarded. The sustained demand for e-commerce and logistics — accelerated by the pandemic – will continue to benefit MLT in the next few years.

6. MLT stated that it will continue acquiring assets that will provide long-term growth in DPU and net asset value. The management believes that it is advantageous for MLT to have exposure to both mature and developing markets. Mature markets such as Australia and Japan offer stability, while developing markets like China and Vietnam — with increasing urbanisation, e-commerce growth, and a limited supply of Grade A warehouse space — offer higher growth prospects.

MLT is also seeking acquisition opportunities in India, particularly in Tier 1 cities like Delhi NCR, Bengaluru, Chennai, Mumbai, Pune and Hyderabad. India is a fast-growing logistics market with strong demand for e-commerce and logistics space, underpinned by a large consumer market and the country’s increasing importance as a major manufacturing hub in Asia Pacific. India currently comprises 0.8% of the MLT’s assets under management.

7. MLT is not looking to expand into Europe or the U.S. The management remains focused on the Asia-Pacific region which offers more growth opportunities driven by rising urbanisation, middle-class consumption, and the relative lack of Grade A warehouse space.

The fifth perspective

MLT’s expansion into developing markets such as China and Vietnam have shown good returns since their acquisitions. Moving forward, India will be a new growth area for MLT. The pandemic has also accelerated the growth of e-commerce, increasing demand for logistics space.

With its dividend yield at 3.9%, MLT is currently overvalued in my opinion. I would prefer to wait for a better price/yield If I were looking to invest in the REIT.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

thank you .

I have been investing for umpteen years, and losing money most times

now in 70’s

Your analysis stops me from jumping into stocks without adequate research

You’re most welcome, Linda! Glad this helped!