Parkway Life REIT (PLife REIT) is one of Asia’s largest listed healthcare REITs and owns healthcare properties located in Singapore, Japan, and Malaysia. As of 31 December 2020, the REIT owns a portfolio of 54 healthcare and aged care properties valued at approximately S$2.02 billion.

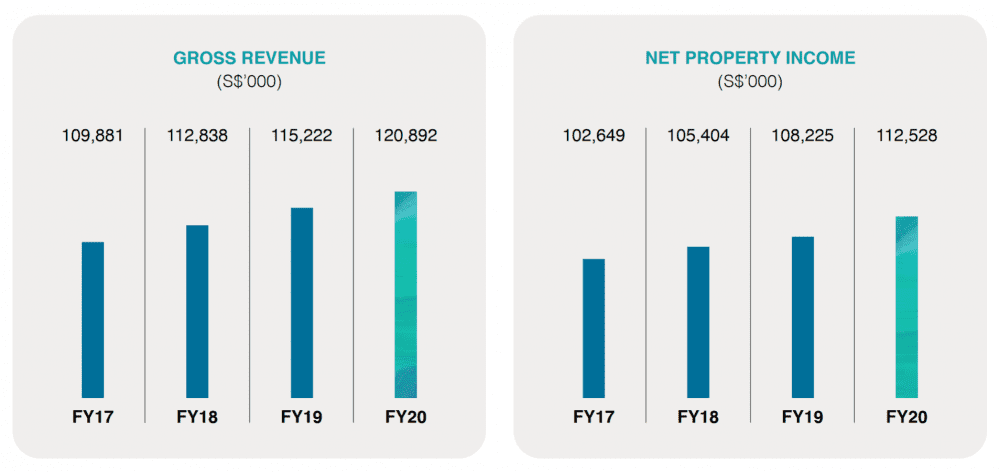

PLife REIT’s gross revenue and net property income (NPI) have been on a general uptrend since it listed in 2007. Likewise, its distribution per unit (DPU) increased from 6.32 cents in FY2007 to 13.79 cents in FY2020.

As a unitholder, I attended PLife REIT’s recent annual general meeting to learn how COVID-19 has affected the REIT’s performance and whether it has changed the landscape of the healthcare industry moving forward.

Here are eight things I learned from the 2021 Parkway Life REIT AGM.

1. Gross revenue increased 4.9% year-on-year to S$120.9 million in FY2020 from S$115.2 million in FY2019. Likewise, NPI increased 4% y-o-y to S$112.5 million in FY2020 from S$108.2 million in FY2019. Demand for healthcare surged during the pandemic which boosted the performance of PLife REIT.

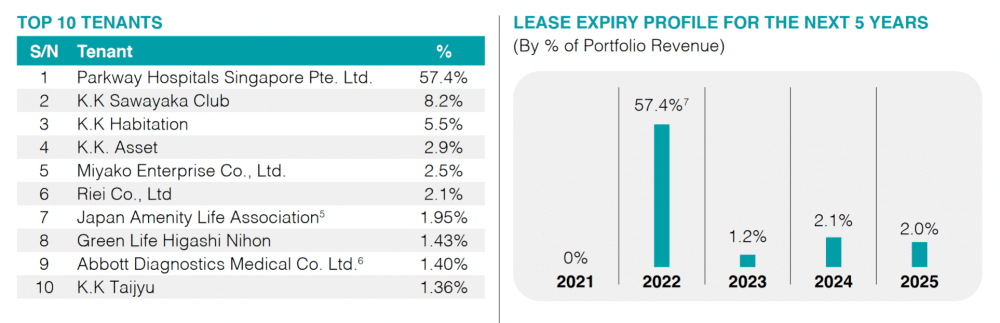

Singapore, Japan, and Malaysia constitute 57.4%, 42.5%, and 0.1% of PLife REIT’s revenue respectively.

2. Distributable income increased 4.5% y-o-y to S$83.4 million in FY2020 from S$79.8 million in FY2019, while DPU increased 4.5% y-o-y to 13.79 cents in FY2020 from 13.19 cents in FY2019. Based on PLife REIT’s DPU and closing share price of S$4.17 (as of 30 April 2021), its distribution yield is 3.3%.

3. Gearing ratio increased to 38.5% from 37.1%. CEO Yong Yean Chau said that PLife REIT is financially healthy for FY2021 as there is ample debt headroom of S$474.9 million before reaching the 50% gearing limit. Gearing increased marginally due to loans drawn to fund the acquisition of a Japanese nursing home in December 2020 and for working capital purposes.

4. As of 31 December 2020, PLife REIT had an occupancy rate of 100% for its portfolio with a weighted average lease expiry (WALE) of 5.74 years. Ninety-five percent of the portfolio has downside protection which adds to PLife REIT’s income stability in the immediate future. Parkway Hospitals Singapore — which is owned by IHH Healthcare, the sponsor of PLife REIT– remains the REIT’s largest tenant.

Parkway Hospitals Singapore is the master lessee of PLife REIT’s three Singapore hospitals: Mount Elizabeth Hospital, Gleneagles Hospital, and Parkway East Hospital. Parkway Hospitals Singapore master leases will expire in 2022 with an option to renew for another 15 years under a triple net lease arrangement.

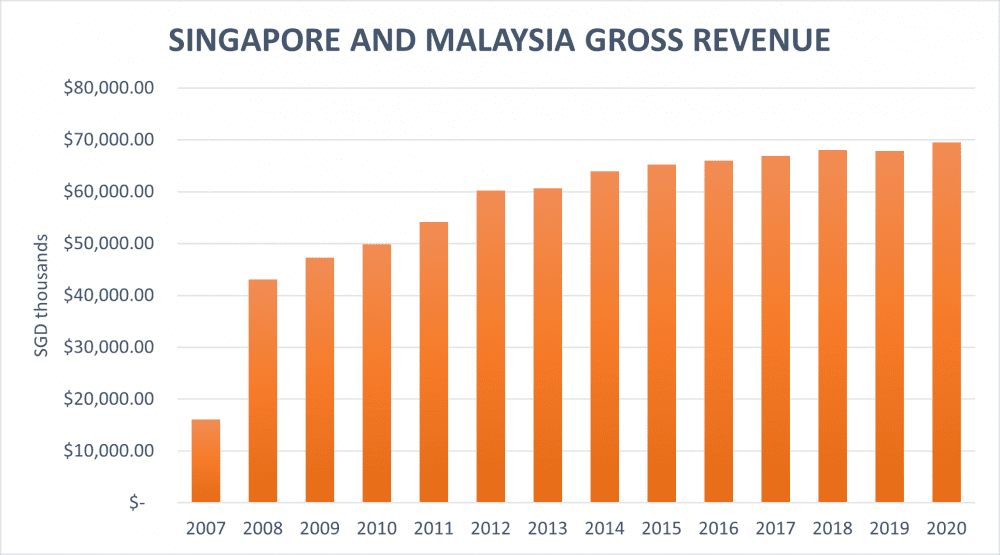

PLife REIT’s Singapore + Malaysia revenues have grown from S$48.7 million in 2008 to S$69.5 million in 2020. This is contributed by having a favourable lease structure for its Singapore hospitals.

The formula comprises a yearly rent revision based on the annual growth of the Consumer Price Index (CPI) +1 %. If CPI growth is zero or negative, PLife REIT is still guaranteed a minimum of 1% growth in rent every year.

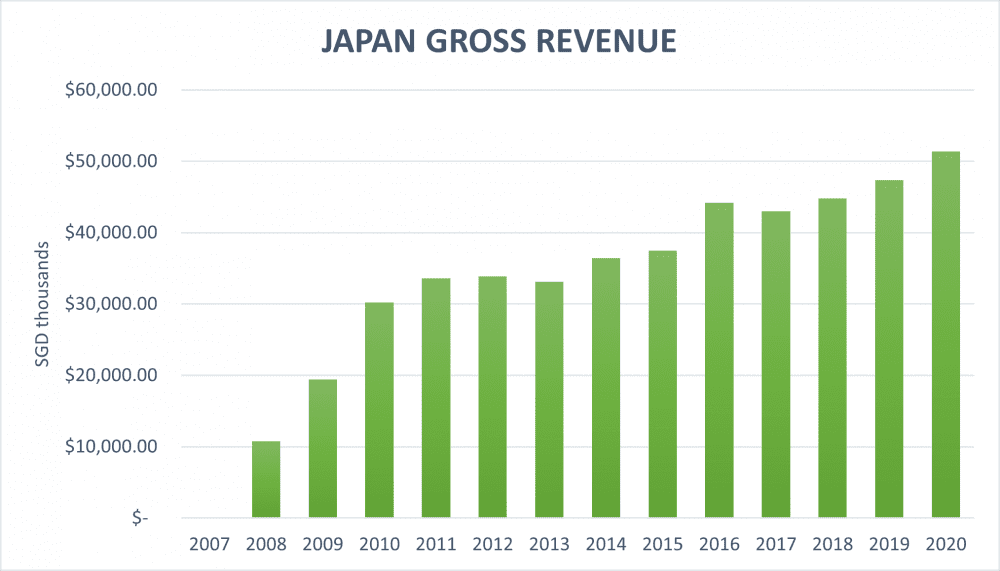

5. PLife REIT has a portfolio of 50 healthcare properties in Japan worth S$799.7 million based on the latest appraised values as of 31 December 2020. Since its entry in 2008, Japan revenue has grown from S$5.2 million in FY2008 to S$51.3 million in FY2020.

PLife REIT enjoys a favourable lease structure with a WALE of 11.29 years, an ‘up-only’ rental review provision for most of its nursing homes, and 100% committed occupancy in Japan.

6. In December 2020, PLife REIT acquired a Japan nursing home in the Greater Tokyo Region from the Habitation Group for JP¥1.65 billion (S$21.2 million). PLife REIT managed to acquire the property at 4.6% below valuation and with a NPI yield of 6.4%. The acquisition delivered immediate yield accretion to the REIT. This acquisition also deepened PLife REIT’s working relationship with the Habitation Group.

7. Strong demand for healthcare is expected to grow in Singapore and Japan. The proportion of the population aged 65 or older in Japan makes up approximately 29% of the total population and is estimated to reach 35% by 2040. While Singapore is faced with increasing life expectancy and low fertility rates, Singapore’s resident population aged 65 or older has risen to 15.2% in 2020. The life expectancy of Singaporeans has also increased over the last decade to approximately 84 years old.

8. On 18 September 2020, PLife REIT reached a significant milestone with its inclusion into the FTSE EPRA NAREIT Global Developed Index. It’s an index designed to track the performance of listed real estate companies and REITs worldwide. This enhances PLife REIT’s trading liquidity, and visibility to investors and index funds worldwide.

The fifth perspective

Without a doubt, PLife REIT has built a long-term track record of delivering steady growth in gross revenue, NPI, and DPU since its IPO. The pandemic, while debilitating for the overall economy, boosted the performance of the healthcare sector.

Moving forward, the REIT has laid a strong foundation for sustainable growth in the future as it enjoys favourable lease arrangements with long lease tenures, guaranteed increments in rent, and downside protection.

With an aging population in both Singapore and Japan, the outlook for PLife REIT remains optimistic. (For more financial ratios and details about Singapore REITs, please feel free to check out Singapore REIT Data.)

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »