Suntec REIT owns a portfolio of properties which include retail malls and office buildings located in Singapore, Australia, and the United Kingdom. As of 30 December 2019, its portfolio was valued at S$10.4 billion.

Suntec REIT gross revenue and net property income (NPI) have generally been on an uptrend since 2014. However, the REIT’s distribution per unit (DPU) has dropped from 10.005 cents in 2017 to 9.507 cents in 2019. As a result, Suntec REIT’s unit price has been trending sideways over the last few years.

As a long-time unitholder myself, I attended Suntec REIT’s recent AGM to learn more about the management’s plans to reboot the REIT’s performance and navigate the tough times ahead.

Here are eight things I learned from the 2021 Suntec REIT AGM:

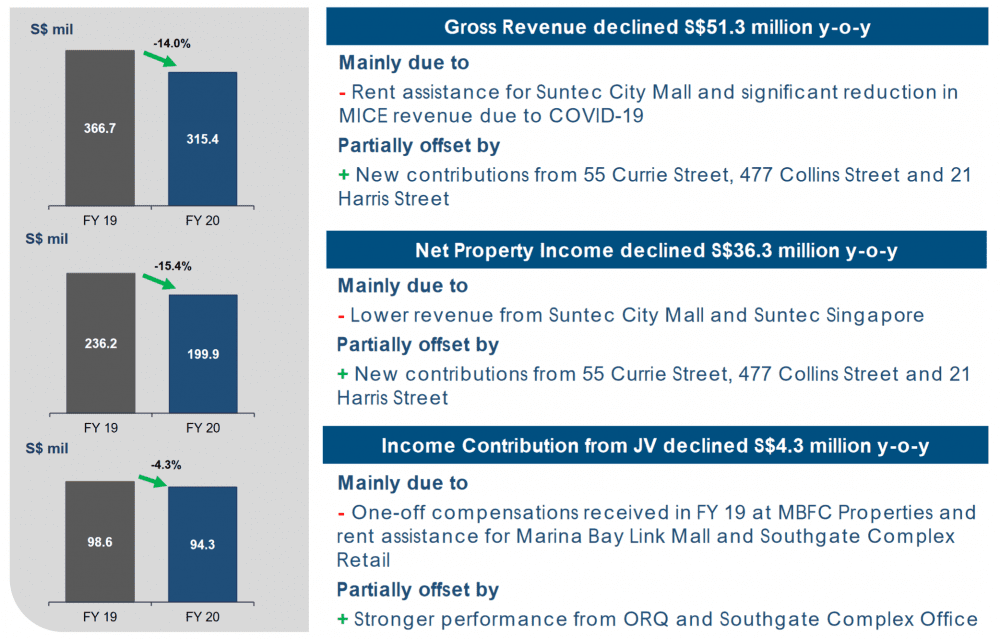

1. Gross revenue fell 14% year-on-year to S$315.4 million in FY2020 from S$366.7 million in FY2019. Likewise, NPI fell 15.4% y-o-y to S$199.9 million in FY2020 from S$236.2 million in FY2019. This was mainly due to the pandemic-induced ‘Circuit Breaker’ which caused a huge dip in footfall in retail outlets including Suntec City Mall. As part of the government rental relief framework, qualifying property owners who receive support via a government cash grant must in turn provide rental reliefs to tenants which resulted in declines in both gross revenue and NPI.

2. Distributable income fell 11.6% y-o-y to S$209.2 million in FY2020 from S$236.7 million in FY2019, while DPU fell 22.1% y-o-y to 7.402 cents in FY2020 from 9.507 cents in FY2019. Based on Suntec REIT’s DPU and closing share price of S$1.56 (as of 22 April 2021), its distribution yield in 2020 is 4.7%, which is lower than the average of other comparable retail/office REITs in Singapore (5.49% at the time of writing).

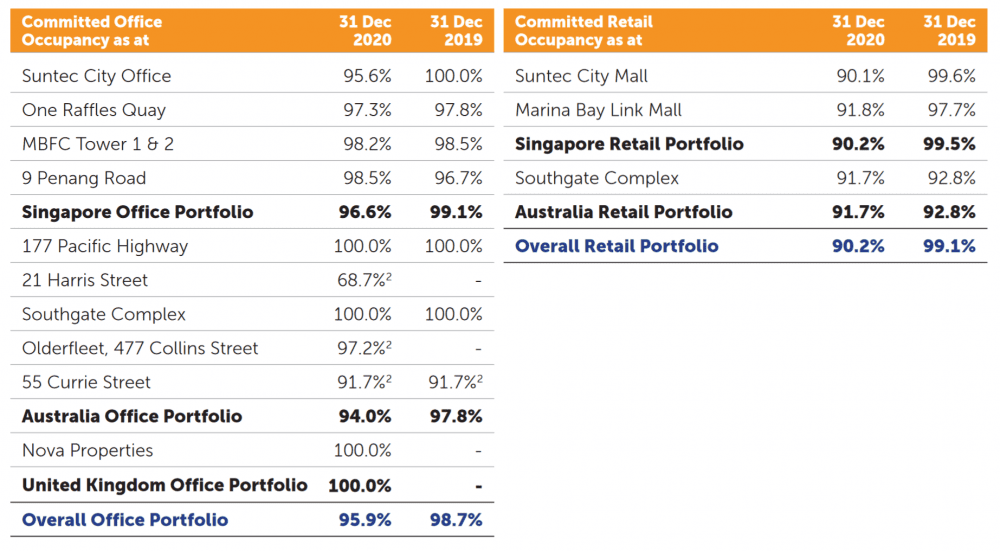

3. Office occupancy fell to 96.6% in FY2020 from 99.1% in FY2019, and retail occupancy fell to 90.2% in FY2020 from 99.1% in FY2019. The occupancy rate for Suntec REIT’s offices remained strong, 3.4% higher than the overall CBD Grade A occupancy of 93.2%. However, its malls like Suntec City and Marina Bay Link Mall saw its occupancy rates affected mainly due to COVID-19, falling 9.5% and 5.9% respectively.

4. Suntec REIT’s leverage ratio increased to 44.3% from 37.7%. CEO Chong Kee Hiong said that Suntec REIT is financially healthy for FY2021 as there are undrawn facilities of S$750 million for refinancing in FY2021. Suntec REIT also monitors its gearing ratio and maintains it within the approved limits.

5. Expansion plans: Currently, the REIT’s Singapore, Australia, and United Kingdom properties constitute approximately 76%, 17%, and 7% of Suntec’s REIT’s assets under management (AUM) respectively. The manager says Suntec REIT will remain Singapore-centric and will expect 30% to 40% of its AUM to be overseas assets in the next few years as they continue to source for accretive opportunities in these countries.

6. The CEO’s outlook on the Singapore properties remains positive as workers increasingly return to the office from Q2 2021. This is from the current levels of 30% in Suntec City Office and 45% in Marina Bay Offices (One Raffles Quay and MBFC Towers 1 and 2). The CEO said that although hybrid working arrangements may continue, the physical office remains relevant as companies see the need to build corporate culture and foster employee collaboration and socialisation. The CEO also said that the mall traffic and occupancy will not reach 2019 levels but close to it.

7. The CEO’s outlook on the Australia properties is positive as approximately 50% of workers have returned to the office in Sydney and Melbourne, while in Adelaide the figure is over 70%. The CEO said a strong income stream from office tenants constitutes more than 90% of Australia’s total rental income and the office portfolio will remain resilient due to strong occupancy rates, long WALEs with minimal lease expiry in 2021, and annual rental escalations. Furthermore, vacant spaces at 55 Currie Street, 21 Harris Street, and 477 Collins Street are protected by rent guarantees. The CEO looks to enhance tenant experience through improving physical amenities and curating community activities.

8. The CEO is also positive about the UK properties as retail and F&B outlets have reopened since 12 April 2021. Although flexible working arrangements are likely to remain due to the pandemic, high-quality office buildings located near London’s key transport hubs remain sought after. The office revenue in London will remain resilient and underpinned by full occupancy rates, long WALEs, and no lease expiries until 2027. The CEO said that the management is actively looking for retail and F&B operators with concepts that will enhance trade mix to create a social hub for office tenants and attract leisure customers. These include augmented reality gaming and thematic bars.

The fifth perspective

Suntec REIT’s properties remain as attractive assets due to the prime location of their office buildings and malls. However, the situation surrounding the pandemic remains uncertain in some countries, and travel is not expected to recover to pre-pandemic levels soon as there is an increase in daily cases recently. Therefore, Suntec’s prime malls will continue to see low tourist footfall which may dampen performance in the short term. At the same time, Suntec REIT’s master and anchor leases provide a level of income visibility and will help stabilise results until the recovery.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »