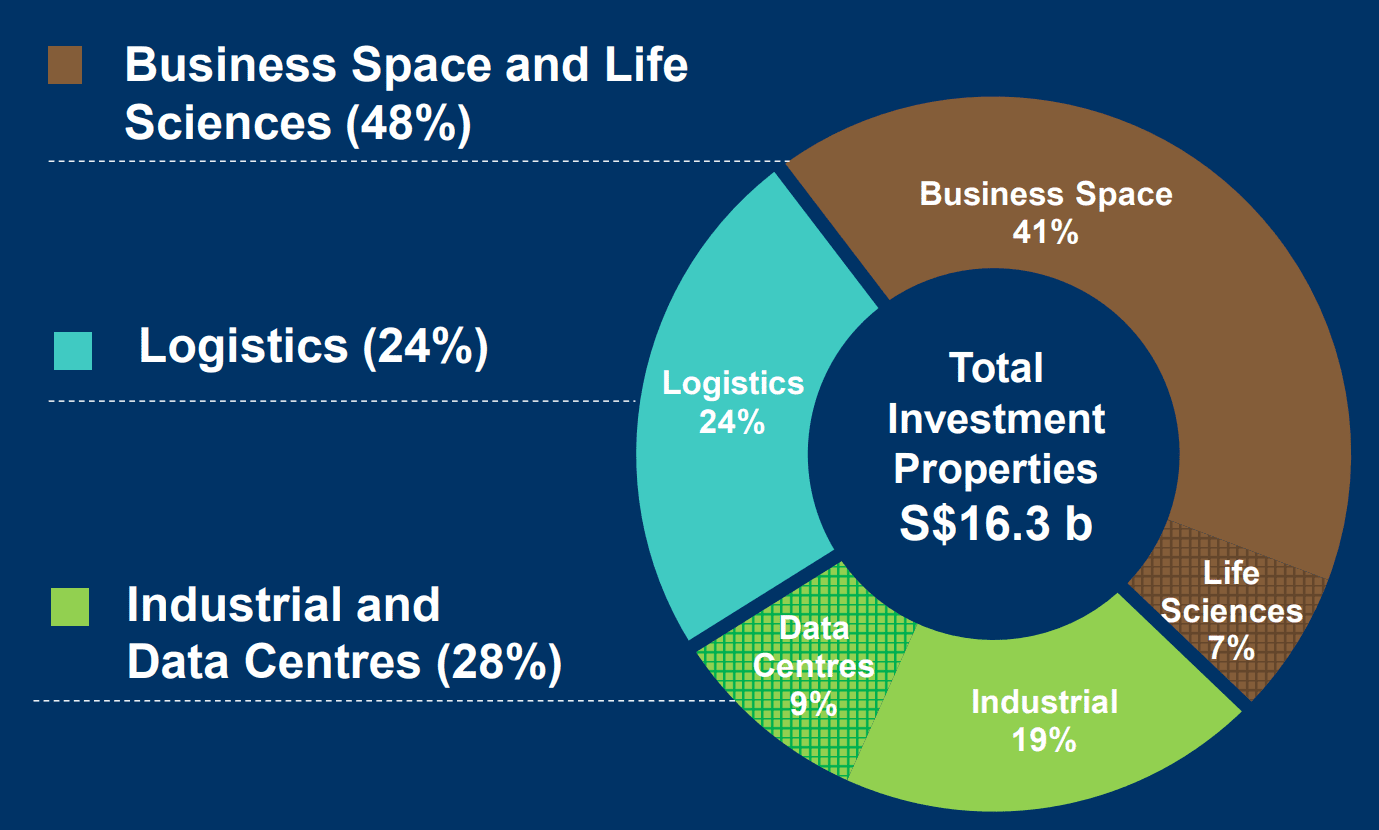

Ascendas Real Estate Investment Trust (AREIT) is Singapore’s largest listed business space and industrial REIT. AREIT owns and manages a well-diversified portfolio of industrial, logistics, business parks, and data centre properties, valued at S$16.3 billion as of 31 December 2021. The portfolio comprises 220 properties in Singapore, Australia, the United Kingdom, Europe and the United States.

Here are eight things I learned from the 2022 Ascendas REIT AGM.

1. Gross revenue grew 16.9% to S$1.2 billion, and net property income (NPI) rose 18.6% to S$920.8 million in FY2021. The increase in revenue and NPI was mainly from newly acquired properties and completed developments during FY2020 and FY2021.

2. Distributable income grew 17% to S$630.0 million, while distribution per unit (DPU) increased 3.9% to 15.258 cents in FY2021. The increase was mainly due to the rise in NPI, partially offset by performance fees (S$7.4 million) and increased non-property operating expenses and tax expenses attributable to new acquisitions.

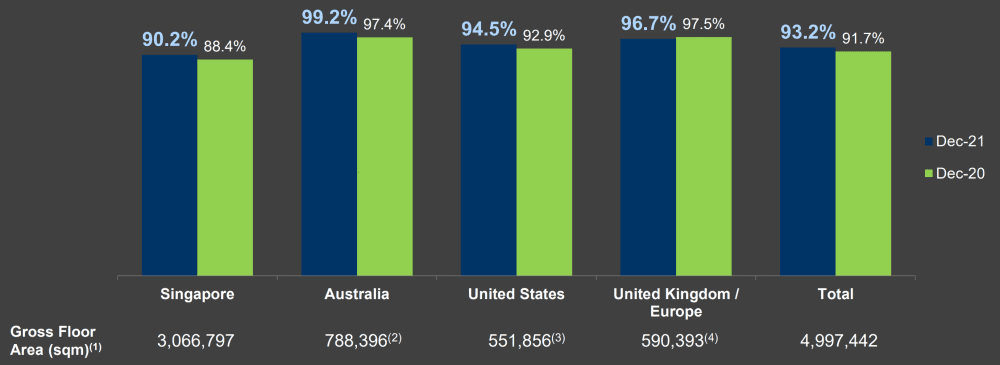

3. Portfolio occupancy rate is 93.2% as of 31 December 2021, compared to 91.7% on 31 December 2020. The occupancy rate of the Singapore portfolio climbed to 90.2% from 88.4%, mainly attributable to improved occupancy of the Business & Science Park segment.

Properties which achieved higher occupancies included Nucleos (98.4%), The Capricorn (85.7%), and The Aries, Sparkle & Gemini (92.9%). The completion of Grab Headquarters (100%), and the acquisition of Galaxis (97.0%) also contributed to the segment’s higher occupancy rate. The overseas portfolio occupancy rates remained healthy at 99.2% for Australia, 94.5% for the USA, and 96.7% for the UK/Europe.

4. Gearing ratio is 35.9% as of 31 December 2021, well below the MAS’s regulatory limit of 50%. The average cost of debt is 2.2%, and the average term to maturity is 3.5 years. For 79.4% of AREIT’s total borrowings, interest rates have been hedged, providing stability in the current rising interest rate environment for an average term of 3.6 years. The management shared that for the unhedged portion of AREIT’s interest exposure, a 1 percentage point increase in interest rates would result in a 2% decrease in distribution.

5. During FY2021, AREIT acquired 11 data centres in London, Amsterdam and Paris. This acquisition raised AREIT’s investment in data centres to S$1.5 billion, or 9% of total investment properties. AREIT now has a multi-asset portfolio that caters to the opportunities expected to originate from developing sectors like technology, life sciences, and logistics.

6. During FY2021, AREIT completed the divestment of two properties in Singapore and three properties in Australia. In Singapore, 11 Changi North Way, a logistics property, was sold for S$16.0 million, and 1 Science Park Drive, a business park property, was divested for S$103.2 million. The latter was sold to a joint venture between CapitaLand and AREIT that will redevelop the property into a life science and innovation campus.

In Australia, 1314 Ferntree Gully Road, a logistics property, was sold for S$24.2 million, and 82 Noosa Street and 62 Stradbroke Street were sold for a collective sale price of S$104.5 million.

7. On 4 May 2021, AREIT successfully raised gross proceeds of approximately S$420.0 million through a private placement. Through the private placement, 142,664,000 new units were issued at S$2.944 per unit. Proceeds raised were used to partially fund the acquisition of the remaining 75% interest in Galaxis, located in Singapore, and for debt repayment.

8. Singapore will remain a critical acquisition/development market for AREIT. AREIT’s core strategic goal is to pivot its portfolio mix to cater to the business activities of companies in the technology, life science, and logistics industries. While the Singapore portfolio has experienced a decline in net property income in recent years, mainly due to higher operating expenses such as maintenance and conservancy, utilities and security, the new acquisitions have been DPU accretive and have helped maintain DPU at a stable level.

The fifth perspective

Based on its FY2021 DPU, AREIT’s current distribution yield is 5.6% (as of 20 May 2022). You can compare the distribution yield of other Singapore REITs here. AREIT’s outlook remains positive as it continues to pivot toward technology, life science, and logistics industries. With its size and resources available, AREIT has potential to continue growing in Singapore and abroad.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »