CapitaLand has deep roots in Asia which began more than two decades ago. After a restructuring of CapitaLand’s business, CapitaLand Investment (CLI) was listed on the Singapore Exchange in September 2021, creating one of Asia’s leading listed real estate investment managers (REIM) and one of the largest REIMs in the world.

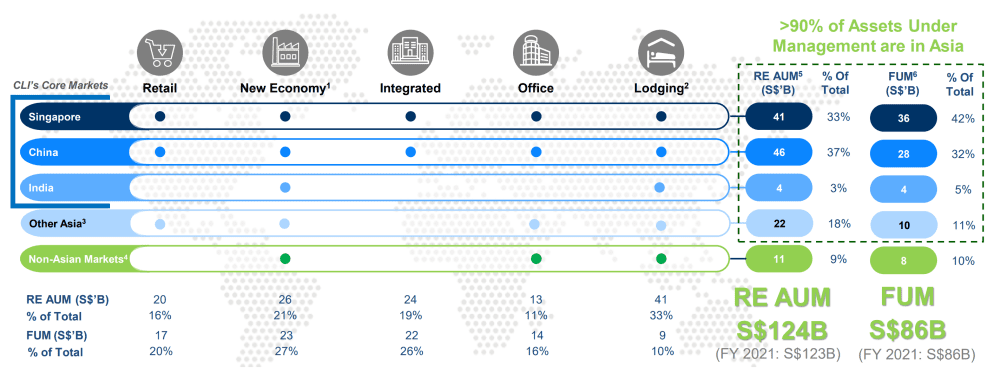

As of today, CLI has a presence in more than 30 countries and 200 cities with its core markets in Singapore, China, and India. CLI has six listed funds across Singapore and Malaysia, and 29 private funds. The total assets held by CLI amount to S$124 billion in real estate assets under management (RE AUM) and S$86 billion in funds under management (FUM).

Since CapitaLand’s restructuring, CLI’s share price has risen over 30% which made me curious about its performance thus far. How will CLI navigate itself amid the challenging macroeconomic factors we are experiencing today? To learn more, I attended its recent 2022 annual general meeting, which was also its first ever AGM as the newly restructured CLI.

Here are eight things I learned from the 2022 CapitaLand Investment AGM and its latest 1Q 2022 results.

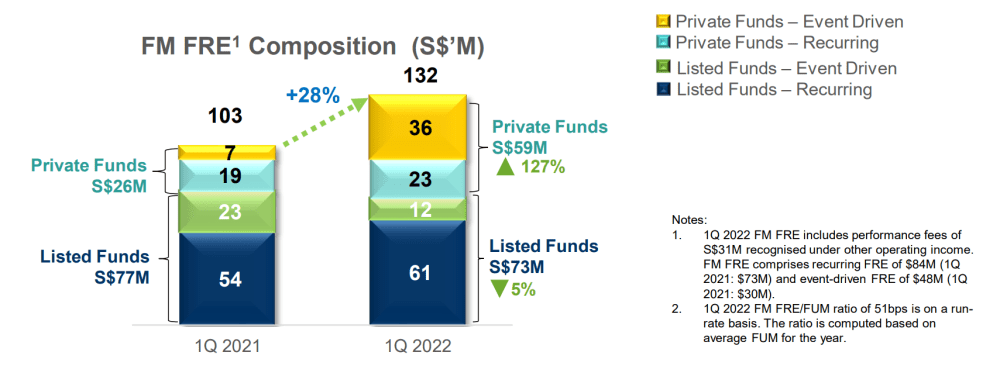

1. Fee Income-related business (FRB) gained 17% in revenue year-on-year in 1Q 2022. The overall increase in FRB was due to the growth of fund management (FM) which improved by 28% from S$103 million to S$132 million, and lodging management (LM) which gained 31% from S$42 million to S$55 million. FM comprises two components: listed and private funds. Despite the decrease in revenue of 5% from listed funds (attributed to a fall in event-driven revenue), it was offset by the 127% year-on-year growth for private funds.

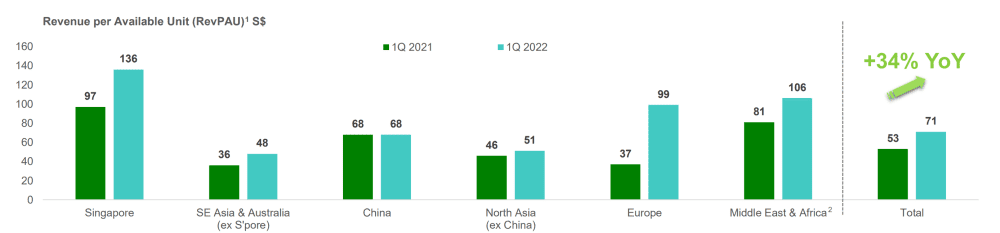

LM growth was due to a 34% year-on-year increase in revenue per available unit (RevPAU) which was attributed to stronger occupancies and average daily rates. All countries except for China saw an improvement in RevPAU. This was fuelled by the pent-up demand for travel as more countries adopt an endemic mindset and welcome vaccinated travellers.

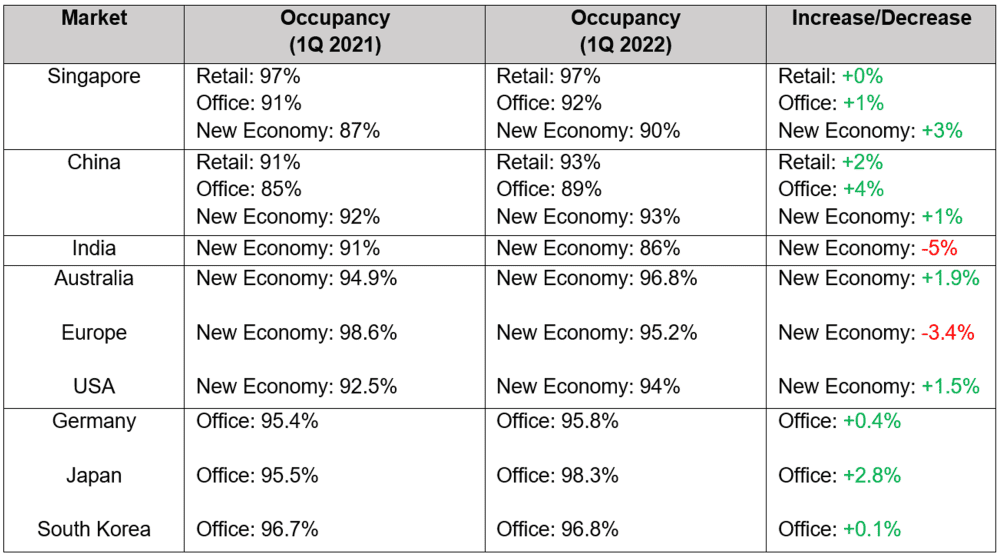

2. The real estate investment business (REIB) gained 28% in revenue year-on-year in 1Q 2022 from S$316 million to S$403 million. The growth in REIB was contributed by the increase in occupancy rates across various markets, less a few minor exceptions.

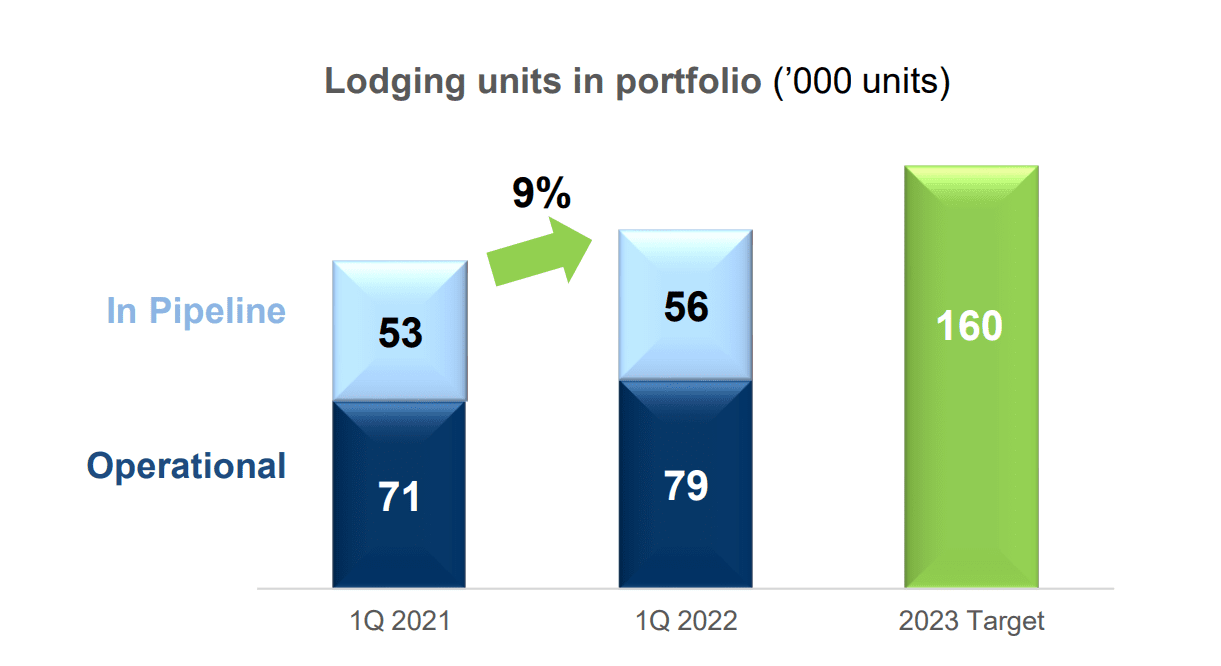

3. CLI increased its lodging portfolio by 9% on a year-on-year basis. In 1Q 2022, the company has over 3,700 lodging units signed and more than 2,200 units opened. CLI is growing its FUM with acquisitions through Ascott’s investment vehicles, Ascott Serviced Residence Global Fund and Ascott Residence Trust. The company is on track to meet its target of 160,000 units under management by 2023.

4. For FY 2021, CLI issued a total dividend of S$0.15 per share, comprising S$0.12 and S$0.03 per share in core and special dividends respectively. According to Group CFO Andrew Lim, the S$0.12 in core dividends — representing a 56% of profit after taxation and minority interest (PATMI) — is set to be maintained provided CLI is able to drive high-quality recurring cash earnings. The S$0.03 in special dividend was given as CLI generated a healthy increase in cash PATMI of over 100%. In terms of dividend frequency, the management feels that the current annual dividend is sufficient for a REIM like CLI. That said, they will not rule out paying interim dividends in the future.

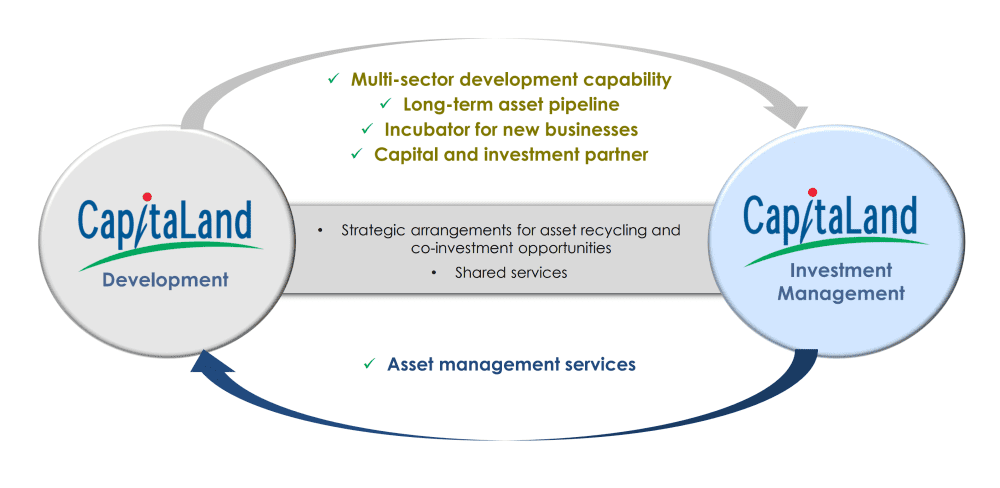

5. A shareholder asked about CLI’s competitive advantage and its growth strategy to become a leading REIM. Group CEO Lee Chee Koon said that CLI’s competitive advantage lies within its fully integrated platform (giving it the ability to invest, operate, and securitise) as well as its long track record and strong brand name in Asia Pacific. In addition, CLI’s symbiotic relationship with CapitaLand Development Pte Ltd (CLD) within CapitaLand’s ecosystem provides the company with development expertise, potential partnerships opportunities, and a pipeline of future assets to grow its FUM.

Based on responses by CLI, the company’s growth strategy is to expand fee-related earnings (FRE) for its fund management by growing its listed trusts and improving capabilities in the private funds space, allowing it to launch new private estate and private alternative asset funds to grow FUM. The company also wants to scale units for its lodging management and aims to recycle at least S$3 billion of assets across CLI and its subsidiaries annually.

6. While the rapidly growing ageing market serves as a key trend, the CEO admitted that it is not an area that seems commercially viable today. There is a growing demand for nursing homes and retirement villages. However, it doesn’t seem like a sustainable asset class as it requires a detailed plan on how it can be affordable for retirees in a sustainable manner. That said, CapitaLand’s lodging team is not ignoring this opportunity and has started to work with partners in Europe to sign management contracts in Asia, allowing them to manage these facilities to learn more about this asset class.

7. With the relaxation of pandemic restrictions in many markets, CLI’s lodging business looks poised for growth. CLI’s CEO for Lodging, Kevin Goh, said that the company is riding the tailwinds of recovery and regions that have recovered from the pandemic have shown good results and occupancy rates.

CLI aims to build the lodging business on two fronts. The first is to grow unit count to the target of 160,000 by 2023 which CLI is confident of achieving. The second is to grow Ascott Residence Trust and CLI’s private equity funds. For example, CLI has raised a purpose-built student accommodation fund this year to invest in U.S. student accommodation assets.

8. A shareholder asked about any uncertainties that CLI faces in China. With over 20 years of operating experience in China, the CEO said that they see both challenges and opportunities in the country. China may have to go through its own wave of COVID as it seeks to reopen. While this might be an issue, CLI owns income-producing assets in good locations, thereby not presenting major challenges for its portfolio.

Over the last few years, China has undergone many developments in terms of its policies such as the introduction of the ‘three red lines’ and the financing restrictions placed by the government. The CEO believes that this presents better opportunities for CLI as it levels the playing field for foreign companies like theirs, allowing CLI access to foreign capital while raising domestic capital in China.

The fifth perspective

In a relative short span of less than a year, the newly restructured CLI has gained positive public sentiment as many recognise the value of the asset-light business.

It is clear that CLI’s transformation to a REIM provides it with a more sustainable, stable, and recurring business model that’s backed by its strong branding and experience. CLI stands to benefit as we move towards a post-pandemic environment in many markets, especially for its lodging business. While the current macroeconomic landscape appears challenging, CLI will emerge stronger as it continues to stay resilient and diversified.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »