Oversea-Chinese Banking Corporation (OCBC) is the second largest financial institution in Southeast Asia with a market capitalization of over S$53.0 billion (as of 12 May 2022). Over the years, OCBC has grown its international footprint and now comprises more than 470 branches and representative offices in 19 countries and regions. As of 31 December 2021, OCBC’s total assets comprised more than S$542.2 billion.

OCBC and its subsidiaries offer a broad array of commercial banking, specialist financial and wealth management services, ranging from consumer, corporate, investment, private and transaction banking to treasury, insurance, asset management and stockbroking services.

I attended OCBC’s 2022 AGM to understand more about the bank’s outlook and corporate strategy amid the rising interest rates and inflation. Here are eight things I learned from the 2022 OCBC Bank AGM.

1. Total income increased 5% year-on-year to S$10.6 billion in FY2021 from S$10.1 billion in FY2020. This was mainly attributed to non-interest income increasing 14% year-over-year from broad-based fee income, strong treasury customer flow income and increase in insurance income. However, net interest income decreased 2% year-on-year, mainly attributable to a 7-basis point fall in net interest margin (NIM).

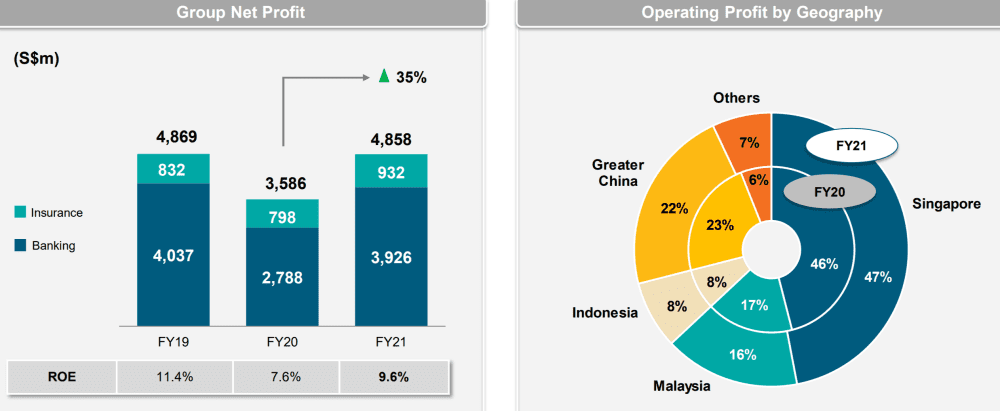

2. Net profit increased 35% year-on-year to S$4.9 billion in FY2021 from S$3.6 billion in FY2020. This was due to the robust performance of the banking, wealth management and insurance businesses. Wealth management income hit a record high of S$3.9 billion. Customer loans grew 8% year-on-year and CASA deposits were up 14%. Singapore and Greater China remain the largest geographic contributors.

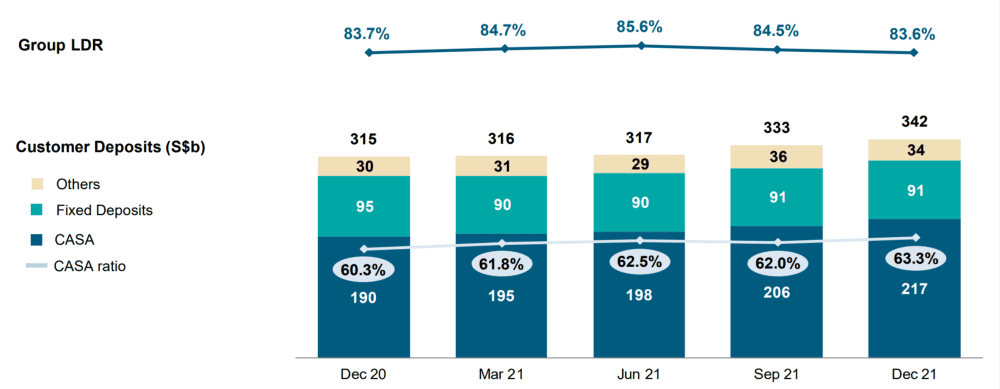

3. The CASA ratio increased to 63.3% in FY2021 from 60.3% in FY2020. The growth in total deposits to S$342 billion was driven by a 14% increase in current account and savings deposits (CASA) to S$217 billion. Loans-to-deposits ratio was 83.6% — no change from 83.7% in the preceding year.

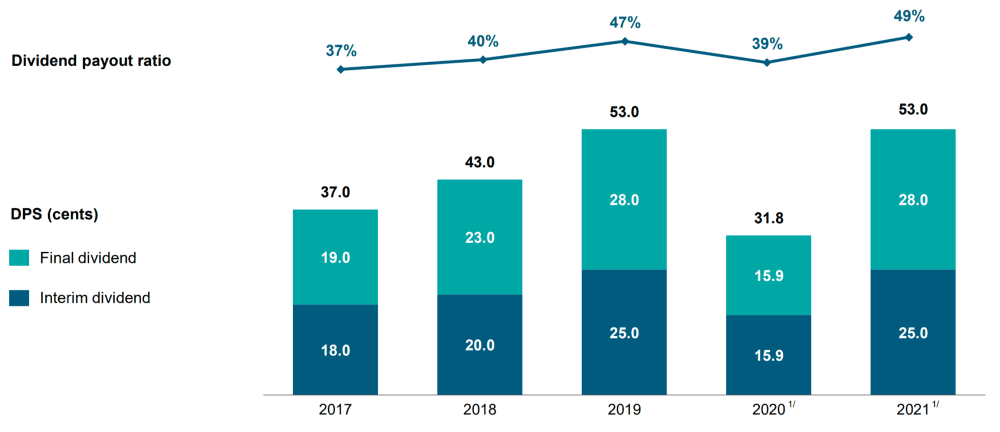

4. FY2021 total dividend was 53 cents per share, back to pre-pandemic levels. The dividend payout represented 49% of FY2021 net profit. CEO Helen Wong mentioned that OCBC does not have any plans to change OCBC’s dividend payment frequency from half-yearly to quarterly.

5. The CEO mentioned that OCBC’s outlook remained precautionary in 2022. I’ve summarised OCBC’s growth catalysts and potential headwinds below.

| Growth Catalysts | Potential Headwinds |

| OCBC is in a great position to benefit from Asia’s growth as one of the fastest growing regions. | Inflationary pressures from sharp increases of commodity and energy prices from rising geopolitical tensions may cause disruption. |

| Opening up of the economy and interest rate hikes remains positive for OCBC. | Supply chain disruptions could place further drag on global output growth. |

| The potential emergence of new COVID-19 variants that may prolong the pandemic. |

6. The CEO stated that sustainability is one of OCBC key corporate strategies. OCBC targets to achieve carbon neutrality for banking operational emissions in 2022 by increasing renewables in their energy mix, reduce energy consumption, etc. OCBC has also set a new sustainable financing target of S$50 billion by 2025, up from the previous target of S$25 billion.

7. A shareholder shared that a company buying back its shares is an indicator that its stock is undervalued. However, OCBC buys back a fixed number of shares regularly and wanted to know the rationale for doing so. OCBC chairman Ooi Sang Kuang mentioned that companies buy back shares for a variety of reasons. He said that OCBC does not buy back its shares to influence the price. Instead, OCBC buys back shares to meet its obligations under its various share delivery schemes – the share option scheme, employee share purchase plan, and deferred share plan.

8. A shareholder questioned if OCBC would be more aggressive in expanding considering DBS has been very aggressive in growing its business. The CEO explained that OCBC has been very cautious over the last two years during the pandemic. Moving forward, OCBC will embark on a three-year strategy to drive growth and reinforce core strength. She believes that OCBC will be able to position itself in Greater China and Hong Kong by capturing the rising Asian wealth with the bank’s Singapore-Hong Kong hubs and digital propositions.

The fifth perspective

OCBC has built a track record of delivering steady growth in dividends, except for 2020 due to the pandemic. Despite the challenges, the bank has remained resilient and was named the Best Retail Bank by The Digital Banker.

At its current share price of $11.70 (as of 12 May 2022), OCBC price-to-book ratio is 1.0, which is below its 10-year historical average of 1.18. With interest rates rising and the pandemic receding in the distance, there is potential upside left on the table for OCBC shareholders.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

When it comes to share buy-backs, some people may not understand that in Singapore paying out dividends to shareholders probably makes more sense. Dividends here are not taxable, whereas in some other countries (especially the USA) there are clear tax advantages for shareholders in executing buy-backs instead of paying big dividends.

Definitely. Singapore is great for dividends!