Singapore Exchange (SGX) is the only exchange in Singapore and hosts the largest stock market in Southeast Asia. It positions itself as an international and multi-asset exchange group that offers investors access to listed securities and pan-Asian derivatives from major asset classes such as equities, currencies, and commodities. Notably, 40% of its equity market capitalisation comes non-Singapore domiciled companies. At the same time, it is a regulator.

SGX has somewhat benefited from increased trading activities during the COVID-19 pandemic. Here are eight things I learned from the 2022 SGX AGM.

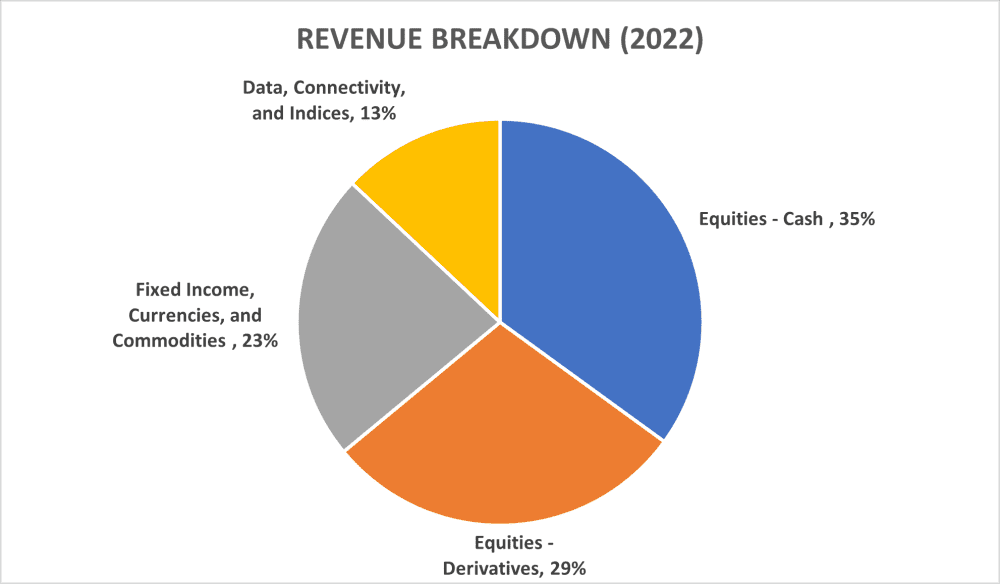

1. Revenue increased 4.1% year-on-year to S$1.1 billion in 2022 because of growth in the demand for derivatives products across different asset classes. The aggregate volume grew 6.9% year-on-year to 248 million contracts in 2022. Average fee per derivative contract increased 12.7% year-on-year to S$1.51 in 2022 because of higher fees realised from SGX FTSE China A50 and SGX Nifty 50 Index futures. Net profit grew 1.3% year-on-year to S$451.4 million in 2022. Dividend per share was maintained at 32.0 cent in the latest financial year.

| Financial year | 2018 | 2019 | 2020 | 2021 | 2022 |

| Dividend per share (cents) | 30.0 | 30.0 | 30.5 | 32.0 | 32.0 |

The company’s balance sheet remains strong as its borrowings stood at S$735.8 million compared to its cash at S$997.7 million.

2. A shareholder pointed out that the equity segment was the largest revenue contributor to the company in 2022 and was worried about the segment’s stagnant growth. The management acknowledged the challenges surrounding Singapore’s relatively small stock market but assured the shareholder that SGX as a whole has ample room for growth in other segments, most notably in derivatives. I will further expand on these points below.

3. According to Chairman Kwa Chong Seng, SGX owns more than 90% of the international iron ore trading market. The Chicago Mercantile Exchange and Hong Kong Exchange tried to compete with SGX by offering commission-free trading to trade the commodity, yet SGX still maintained the lion’s share of the market. It took SGX 10 years to grow its iron ore market to its current size. The company aims to replicate its strength and achievement in the commodity market to the forex market.

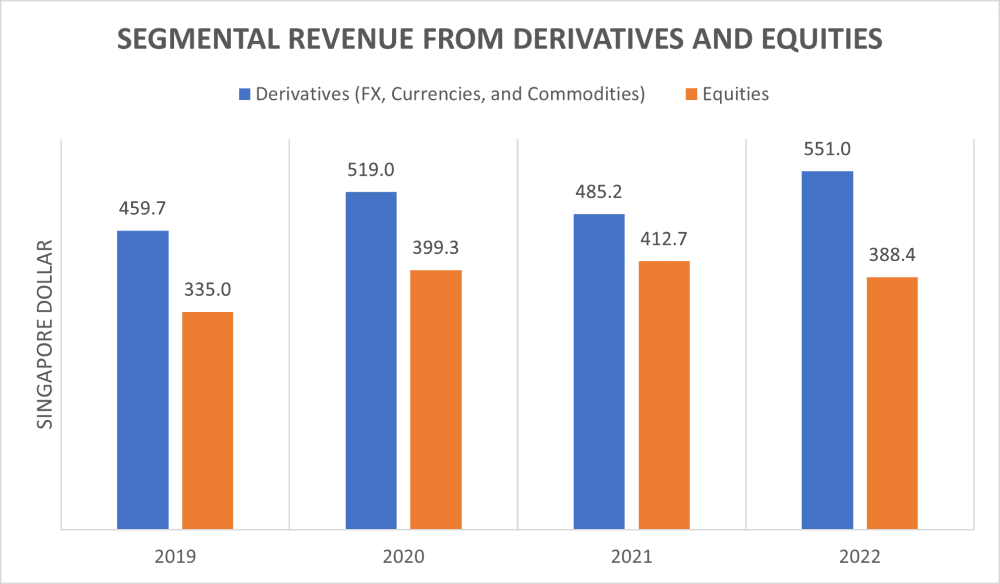

4. The exchange continues to expand its fast-growing derivative business as evident in the chart above. Kwa emphasised that the exchange must focus on its strength as the domestic market is small and the access to global exchanges is at everyone’s fingertips.

The focus on growing SGX’s derivative business is partly due to the stiff competition in the equity business with the Hong Kong Stock Exchange (HKEX) in Asia. HKEX houses many Chinese companies belonging to the new economy such as Alibaba and Tencent as well as H-shares like BYD Co. Ltd. Growth investors who want to profit from the growth of mainland China can invest in these HKEX-listed entities. Furthermore, the Shanghai-Hong Kong Stock Connect allows investors to invest in the mainland China market easily.

On the other hand, the top 30 largest companies in Singapore consists of mainly dividend stocks like banks, consumer staples, and REITs. Today, SMEs and start-ups in Singapore (and elsewhere) can raise money through private equity firms (and equity crowdfunding) instead of having to go through the traditional route of an initial public offering. Competition is rife in the equity market.

Recent prominent SGX equity listings included electric vehicle manufacturer Nio as well as spirits company Emperador. However, the stock market is not conducive for listings currently as worries of stagflation persist. The market will turn only more optimistic if the U.S. Federal Reserve pauses further interest rate hikes.

5. SGX is the largest foreign exchange (FX) trading centre in Asia and the third largest of its kind in the world after London and New York. SGX has been expanding and focusing on the electronification and automation of its FX business in the past few years. By leveraging on its acquisition of over-the-counter (OTC) FX trading platforms — namely BidFX in July 2020 and MaxxTrader in January 2022 — SGX established CurrencyNode, an FX electronic communication network (recognised by the Monetary Authority of Singapore) to connect both OTC and futures participants and enhance liquidity.

The acquisition in 2022 contributed to part of the 7.0% year-on-year increase in total expenses to S$562 million in 2021 as employee headcount increased. The average daily volume of the FX business is expected to reach US$100 billion in the medium term from US$78 billion in 2022. The margin will improve as the FX business scales.

6. CEO Loh Boon Chye responded to a shareholder that total addressable market of the overall FX market was US$6.6 trillion in 2019 (last surveyed). SGX is focused on approximately one-third of the market that include Asian currencies like renminbi and rupee FX futures. The management prides SGX as a global exchange that provides access to Asia markets and wants to bank of the growth of the continent. Kwa explained that more than 80% of the current FX products are related to G10 currencies. Of which, the yen is the only Asian currency. As Asia grows, the demand for Asian currencies will grow.

7. A shareholder was concerned about the exchange’s collaboration with its competitors in the region. Loh reassured him that competition is not at the expense of collaboration and can be a win-win situation for both parties. For instance, SGX partners with the New Zealand Exchange to list dairy futures and options contracts that have been traded exclusively on SGX since November 2021. SGX also partnered with the Stock Exchange of Thailand to launch Thailand-Singapore Depository Receipts in 2023. An ETF link will be established between SGX and the Shenzhen Stock Exchange next year.

8. SGX will continue to evaluate potential acquisitions in the cryptocurrency market (including platforms) while strictly adhering to relevant rules and regulations. Loh mentioned that the management is more interested in the underlying technologies of cryptography such as smart contracts and distributed ledger technology to issue fixed-income smart contracts and disintermediate banks through Marketnode, a joint venture with Temasek.

The fifth perspective

SGX remains a solid dividend stock in Singapore. It maintained its dividend per share despite a difficult business environment. Although there is competition for quality listings particularly in the equity segment, the exchange continues to focus on and grow its derivatives business. It is worth noting that there are short-term headwinds as retail equity trading activities dropped post-pandemic.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »