Singapore Airlines (SIA) is the flagship carrier of Singapore with its headquarters located at Changi Airport. Fortune magazine ranked SIA as the top global airline for 2022. Well known for its premium branding in the airline industry, SIA has won multiple travel-related accolades and has consistently rated among the top three airlines in the world over the years. Singapore Airlines is majority-owned by the Singapore government investment arm, Temasek Holdings, which holds 55% of voting stock as of 31 March 2020.

At its 2022 annual general meeting, I was able to observe how SIA has emerged from the COVID-19 pandemic as a more resilient, innovative, and agile airline. Here are five things I learned.

1. SIA reported an encouraging set of financial results amid a relatively volatile FY21/22. Revenue for FY21/22 jumped 99.6% to S$7,614.8 million compared to S$3,815.9 million the year before. Despite the significant improvement, revenue is still considerably lower than pre-pandemic levels.

The increase was mainly attributable to the reopening of international borders. As travel restrictions continue to be eased, SIA will continue to closely monitor the demand for air travel and increase its passenger capacity as needed. Looking forward, FY22/23 will track closer to pre-pandemic levels as suggested by early indications.

EBITDA improved remarkably from negative S$2,546.6 million in FY20/21 to S$1,301.2 million in FY21/22. This increase has been accredited to the strong demand and tight air freight capacity resulting in higher yields. Additionally, the initial reopening of the borders through Vaccinated Travel Lanes — releasing the pent-up demand for international travel — also played a vital part in lifting EBITDA to a positive value.

As a result of critical steps taken over the last two years, SIA was able to recover swiftly, achieving positive operating cash flows in the second half of FY21/22 coming off a negative base. Operating cash surplus hit a record high of S$824 million in FY21/22. Furthermore, effective cash raising exercises during the pandemic has allowed the SIA group to achieve a healthy cash balance ofS$13,762.7 million.

2. Decisive actions have built a strong financial position. SIA has raised S$22.4 billion in additional liquidity since 1 April 2020 through a series of rights issues and a small proportion from aircraft sale & leasebacks, and U.S. dollar bond issues. Additionally, SIA made a string of hard decisions that has led to effective expenditure management:

- March 2020 – There was a strict reduction on discretionary spending along with an undesirable salary reduction measure being introduced. These measures include staff pay cuts across all groups, more than 20% of SIA group staff taking varying degrees of no-pay leave, and more than 2,100 full-time employees redeployed on short-term employment contracts.

- September 2020 – Management made the painful decision to lay off 20% of staff. However, this was a last resort as SIA understands the importance of long-term employee morale in ensuring successful operations.

- February 2021 – SIA was quick to reach out to all their service providers and aircraft manufacturers to negotiate charges down and defer more than S$4 billion of near-term capex.

- February 2022 – SIA swapped passenger aircraft orders for Airbus A350F freighters to boost its cargo capabilities.

3. The experiences gained from navigating the COVID-19 crisis has made the SIA group more resilient. The airline is in a much better position to weather a similar crisis in the future. Some of the innovative solutions highlighted by CEO Goh Choon Phong include:

- Introduction of contactless initiatives such as digital health verification and menus which provided customers with ease of mind.

- Due to the limited number of passengers on each flight during the pandemic, SIA engaged customers in new and creative ways such as an A380 restaurant at Changi Airport. This gained immense popularity which several other airlines followed suit.

- SIA launched spill-free bento boxes in December 2020 for better heat retention and meal variety. Additionally, this has had ESG benefits as the new economy class dining concept reduces weight carried by 60% and almost entirely eliminates all single-use plastics. Leftover waste is sent over to an eco-digester to be converted into fuel pellets as an alternative energy source.

- SIA made a successful pivot to e-commerce with KrisShop which allowed the airline to provide more sales opportunities. KrisShop exceeded FY19/20 pre-Covid sales by 10% despite the loss of travel retail.

- SIA set up a new business venture called SIA Academy which aims to educate third-party participants on service excellence. This has been well received as SIA received more than 150 enquiries from organisations that want their staff to enter the academy. There has been early positive traction within the first year of operations as the academy has trained more than 1,500 class participants with classes confirmed into 2023. The program received a satisfaction score of more than 93%. Looking into the long-term plans for this new business model, SIA seeks to expand in Singapore and key markets overseas.

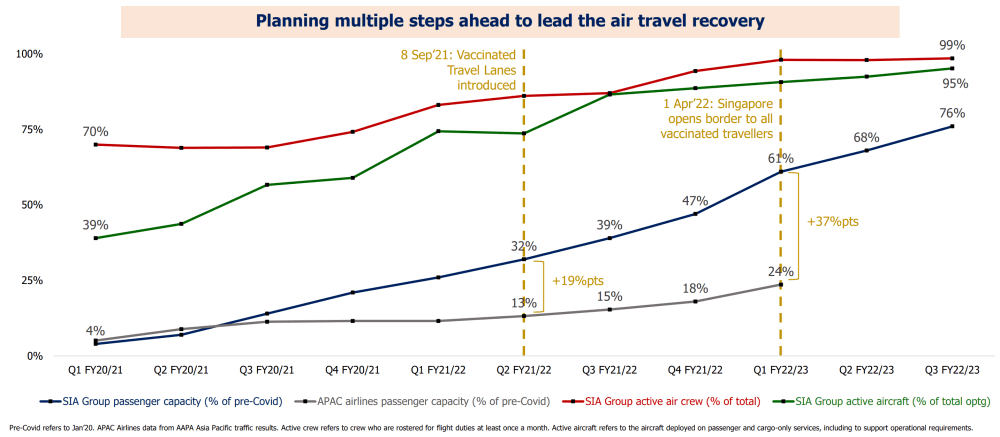

4. SIA remained primed for travel upturns. As seen in the chart below, at each stage where border restrictions were relieved, SIA was able to raise passenger capacity significantly faster and higher than its APAC peers.

This can be attributed to the fact that SIA kept operational resources (such as aircraft availability and manpower) ready for such capacity injections. Hence, passengers carried more than doubled in Q1 FY22/23.

5. Despite the hurdles that SIA had to overcome from the pandemic, it continued strengthening its core propositions. Here are a few of the examples that the CEO highlighted:

- SIA saved more than 600,000 staff hours through business process reviews and digital initiatives since FY20/21 which significantly improved productivity and organisational agility. The CEO shared that SIA staff also underwent upscaling and rescaling through a 41% increase in total training hours in FY21/22, and 70% of staff completing the new UPLIFT programme.

- Achieved benefits in terms of digital innovations for its workflow. This is seen as there was a 47% increase in speed of deployment cycle time and 100% reduction in coding defect density.

- Continued to invest in enhancing cabin products. SIA took advantage of the downtime to speed up the retrofit of all A380s with the latest cabin products which is highly welcomed by customers. Furthermore, they launched the new narrow-body product which has a full lie-flat bed on business class, and personal high-definition seatback inflight entertainment monitors on all classes.

- The SIA group seeks to provide better network connectivity for its customers through the multi-hub strategy. For example, SIA has continued to invest and support the growth of Vistara which is currently operating at 120% of pre-pandemic capacity in domestic India. Vistara has expanded to nine points including key destinations such as Paris, Frankfurt, and London. To further support the multi-hub strategy, there is continued synergy between Scoot (low cost) and SIA (full service).SIA has also deepened partnerships to access new markets which has resulted in 33 codeshare partners connecting passengers to more than 200 additional destinations making SIA the leading Southeast Asian airline group for the number of international destinations.

- The strategic transformation of KrisFlyers to SIA Group’s rewards programme has driven membership numbers to 11% higher than pre-pandemic levels. SIA also rolled out critical product features in FY21/22 such as in-app payment, partner vouchers, in-app gamification, KrisShop on Kris+, and Makan+ dining reservations feature. KrisFlyer and Kris+ also onboarded more than 420 merchants across 5 verticals in 15 countries. These initiatives have helped significantly in user acquisition in key markets as in FY21/22: there were three times more active users and four times more total downloads year-on-year.

The fifth perspective

SIA throughout its history has seen its share of turbulent skies and is no stranger to global black swan events ranging from 9-11, the SARS outbreak, and the COVID-19 pandemic. Despite these hurdles, SIA responded proactively to each crisis emerging ever stronger. Singapore is well positioned as a major hub for transpacific travel which SIA will benefit from. Looking forward, looming economic headwinds will impact SIA’s road to full recovery in FY22/23 despite the reopening of borders.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »

2 points that I am unable to clarify:

1. How much grants did it receive from the gov during the year? I assume 100% of the amounts received directly boosted the bottom line

2. It had the benefit of the fundings provided from the 2 MCBs but the cost of those fundings are nit accounted for. Instead it is deferred till the maturity of the MCBs, at which time a ‘whitewash’ will be performed, such that the shareholdets equity is not affected. Altho this is in accordance with accounting standards, I nevertheless think that the financial reports for the intervening years are not reliable. One effect could be that in the intervening years dividends are paid on profits that are lower than the profits post conversion of the MCB as the number of shares increases, such that despite higher profits dividend payment will be diluted or even skipped. This could cause its share price to fall?

Hi Eugene,

Thanks for sharing your views.

1. SIA doesn’t break down the grants in its annual reports. Instead they are ‘recognised as a deduction against expenses on a systematic basis in the same periods in which the expenses are incurred.’

2. Yes, the MCBs are massively dilutive. At the same time, SIA has the option to redeem the MCBs before maturity using cash. One would hope that the airline and the travel industry would have recovered more than substantially (and avoid another catastrophe) by the June 2030 maturity date!