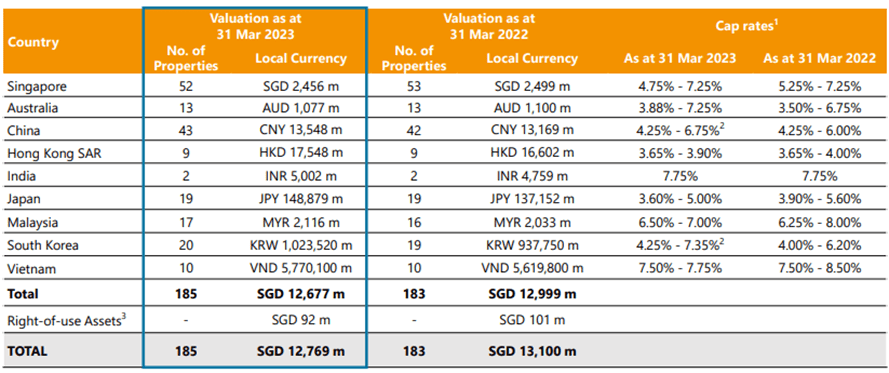

Mapletree Logistics Trust (MLT) is Singapore’s first Asia-centric logistics REIT that owns a diversified portfolio of logistics properties located in Singapore and across the Asia-Pacific. As of 31 March 2023, MLT’s asset under management was valued at S$12.8 billion with a portfolio of 185 properties.

Having reviewed MLT’s recent financial year’s performance, I was curious to learn more about the REIT’s near-term outlook, and its plans to overcome current macro challenges. As such, I attended its annual general meeting to find out more.

Here are the eight things I learned from the 2023 Mapletree Logistics Trust AGM.

1. Value of investment properties decreased from S$13.1 billion in 2022 to S$12.8 billion in 2023, representing a decline of 2.5% year-on-year (y-o-y). Portfolio valuation takes into account a S$224.2 million revaluation gain and net translation loss of S$757.9 million from weaker a CNY, JPY, KRW, and AUD against the SGD.

Gross revenue and net property income for 1Q FY23/24 declined by 2.9% and 3.1% y-o-y to S$182.2 million and S$158.1 million respectively. This decline was mainly due to currency translation loss, which was mitigated by better performance in Singapore and contribution from recent acquisitions in Japan and South Korea.

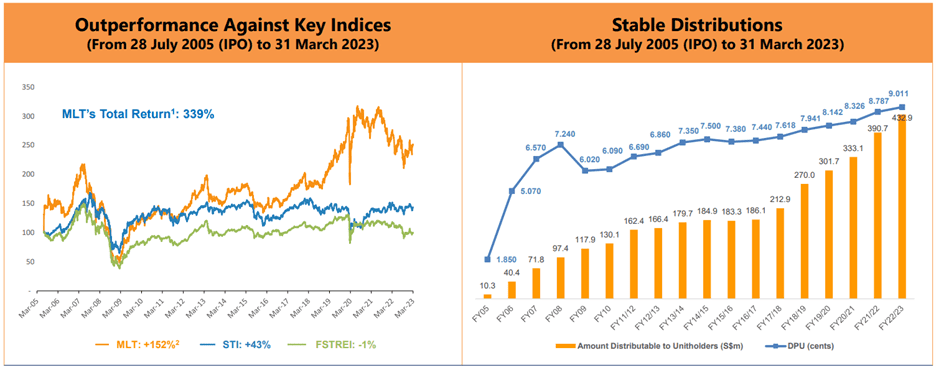

2. MLT’s amount distributable to unitholders increased 10.8% y-o-y to S$432.9m while distribution per unit (DPU) grew 2.5% y-o-y to S$9.011 cents. This increase was due to better same-store performance recorded as full-year contributions from acquisitions made in the precious financial year. Net asset value per unit reached S$1.44, representing a 2.7% y-o-y growth.

Since MLT’s listing on 28 July 2005, the REIT has provided consistent long-term returns with total returns amounting to 339%; returns of MLT has far outperformed the Straits Times Index and FSTE REIT index.

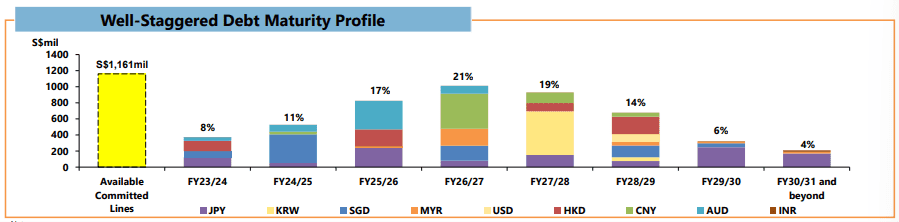

3. As of 31 March 2023, MLT’s leverage ratio is at 36.8%, with total debt amounting to S$4,877 million. Weighted average annualised interest rate is at 2.5%, a 0.3% increase y-o-y due to the higher interest rate environment. MLT’s average debt duration is 3.8 years, and interest coverage ratio is at 4.0. To further mitigate the risk derived from sharp increases in interest rates, 84% of MLT’s total debt has been hedged at fixed rates. MLT’s available committed credit facilities of S$1.2 billion on hand puts it in a strong position to meet its refinancing needs.

4. MLT has been growing and diversifying its tenant base with its top 10 tenants accounting for 23.5% of total gross revenue, and no single tenant comprising more than 4.4%. MLT’s tenant base comprises 887 local and international companies, with approximately 75% of its portfolio serving consumer-related sectors such as F&B, healthcare, and fashion. This allows MLT to benefit from growing domestic consumption and resilience in its revenue streams.

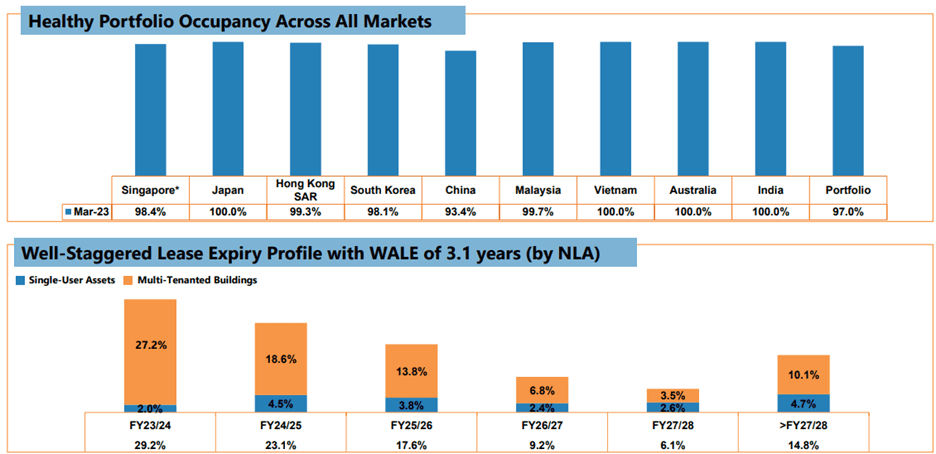

Portfolio occupancy rates remain healthy at 97% except for the China market which underperformed due to post-effects from China’s Covid-19 restrictions. Despite China’s reopening, demand has been below expectations, leading tenants to adopt a more cautious approach and opt for shorter lease commitments.

5. MLT has provided a cautious outlook for its FY23/24 outlook. In terms of leasing, MLT’s tenants are expected to be cautious about rent increases due to the uncertain economic outlook. However, management has reassured that MLT’s portfolio of modern, well-located properties is expected to remain resilient, ensuring stable occupancy rates. Regarding capital management, MLT’s distributable income will inevitably be affected by higher cost of borrowing and the weakness of regional currencies. To mitigate this, MLT will implement a proactive hedging strategy. Lastly, in terms of asset management and investment, MLT will pursue a ‘Yield + Growth’ strategy. This involves carefully planned divestments, opportunistic acquisitions, and strategic initiatives aimed at enhancing asset optimisation, increasing yield, and fostering growth.

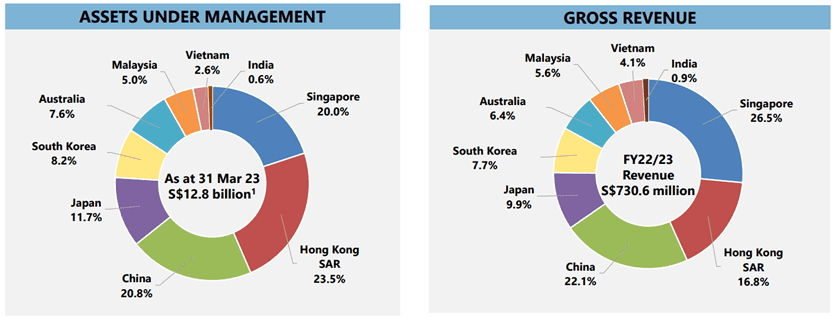

6. A unitholder expressed his concerns about the growing tensions between the U.S. and China, and its potential effects on the demand for warehouse space, given that the bulk of MLT’s properties are situated in China. In response, Lee Chong Kwee, Chairman of MLT, mentioned that as an Asia-focused player, MLT needs to establish a presence in China. Currently, 20.8% of its assets and 20.1% of total revenues is derived from China and deemed by the management to be a healthy exposure. In terms of its strategy, MLT has shifted its focus to China’s domestic consumption which will benefit from China’s long-term goal of reducing its dependence on the U.S. Moving forward, investors can expect MLT’s China allocation to remain at the 20% range and to grow in tandem with its overall portfolio.

Ng Kiat, Chief Executive Officer of MLT emphasised the importance of China and its impact of Asia-Pacific. While volatility is to be expected from its segment in China, she reassured investors that 70% of MLT’s exposure remains in developed markets and will provide overall portfolio resilience.

7. In light of the high interest rate environment, a unitholder was concerned about MLT’s growth prospects when it comes to acquisitions. To add, the unitholder was curious on whether Indonesia was a potential market for expansion. Ng admitted that the high interest rates are a potential deterrence for future acquisitions. However, investors can expect MLT to drive growth through rebalancing of its portfolio. This means that MLT will divest assets with lower cap rates and reinvest in properties with higher rates to drive an uplift in DPU for unitholders.

As for market expansion, the Chairman mentioned that Indonesia is at the top of its list for a potential entry. However, as MLT focuses on grade A facilities, it is vital that other parts of the supply chain are of the same quality. Until future developments, investors can expect MLT to hold its venture.

8. Despite the majority (23.5%) of MLT’s asset allocation coming from Hong Kong, it only contributes 16.8% of total gross revenue. As such, a unitholder was concerned if there are any underlying issues. In response, the Chairman mentioned that assets in Hong Kong are expensive regardless of its type, be it residential, commercial, etc. Despite its high cost, assets in Hong Kong are expected to benefit from faster capital appreciation compared to other markets. Therefore, unitholders will make substantial gains if MLT opts to divest these assets in the future.

The fifth perspective

MLT’s portfolio is highly diversified with exposure in multiple geographies outside of China. While China may seem ‘un-investable’ by some investors, I believe that MLT’s focus on China’s domestic demand will provide both resilience and future growth. In the current high interest rate environment, investors can expect a slowdown in M&A activities for the overall industry which will translate to slower growth in the short term. That said, such headwinds are temporary and MLT seems well-positioned to overcome it.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »