SATS (formerly known as Singapore Airport Terminal Services) is a leading provider of cargo handling and food solutions services in Singapore and various other countries. Most Singaporeans recognise the company as the nation’s main source of food catering for the armed forces and our national airline, Singapore Airlines (SIA). However, SATS is also a major international player in the air cargo industry, providing both ground handling and air cargo services. The company also plays a vital role in the operations of Singapore Changi Airport.

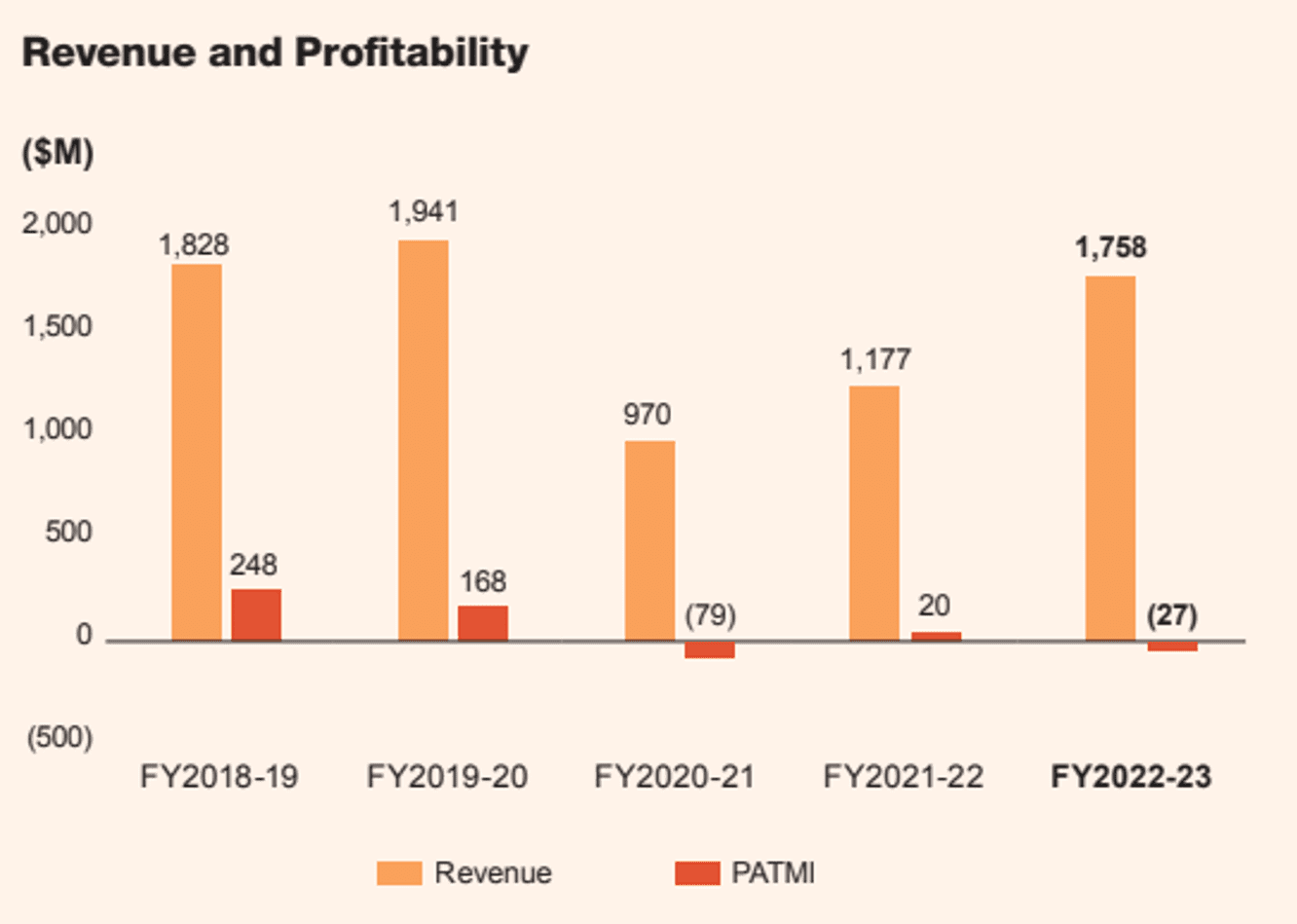

The effects of the pandemic were brutal on SATS. The company’s revenue dropped from S$1,941.2 million in FY2019-20 to S$970.0 million in FY2020-21. Consequently, SATS was forced to stop paying dividends to shareholders. Despite the initial gloomy outlook, the company decided to view the pandemic as a wakeup call and revamped its business model. SATS remains optimistic that it will be able to restore dividend payments in the near future.

Here are seven things I learned from the 2023 SATS annual general meeting.

1. SATS posted an increase in consolidated revenue from S$1,176.8M in FY2021-22 to S$1758.3M in FY2022-23. The rise in revenue can be mostly attributed to the reopening of several major economies, which have resumed their pre-pandemic activities. This, in turn, has led to the relaxation of travel constraints, enabling SATS to gradually expand its operations.

SATS hired an additional 4,346 personnel in the past financial year, bringing their total number of employees to 15,691 by the end of FY2022-2023. The company sees this as a necessary measure to ensure minimal disruption in the process of upscaling its operations. Although current employee numbers are still lower than pre-pandemic levels (17,155 employees in FY2019-2020), statistics surrounding business operational volume in FY2022-2023 have already surpassed that of FY2019-2020. This past financial year, SATS handled 508.6 thousand flights and 108.6 million passengers (compared to 351.4 thousand flights and 84.6 million passengers handled in FY2019-2020). Similarly, the company’s food solutions business is on a similar upward trajectory, producing 134.3 million gross meals in FY2022-2023 from 82.5 million in FY2019-2020.

Although revenue has been on an upward trajectory since FY2020-2021, the company’s profit after tax and minority interests (PATMI) reveal that the company is still loss making in the absence of government reliefs.

Despite this, there is hope for the future as further growth of SATS is expected in FY2024-2025. The International Air Transport Association (IATA) expects global traffic to return to 100% of pre-pandemic levels in 2024, up from 88% in 2023. The company believes that this is the push required to reattain profitability. President and CEO of SATS, Kerry Mok, attributes this future recovery to the reopening of the Chinese market saying that it is ‘another source of growth that we can all look forward to.’

2. Worldwide Flight Services (WFS) is an air cargo handling company and industry leader in the European and American markets. SATS announced its acquisition of WFS for €1.3 billion from an affiliate of Cerberus Capital Management on 3rd April 2023. Thus far, SATS is ‘very happy’ with the acquisition, claiming that ‘WFS has transformed SATS from a Singapore-centric company to a global gateway services provider, serving customers in more than 210 locations in 27 countries.’

According to Mok, the company had decided to acquire WFS as it primarily operates in handling air cargo (80% of its business) compared to its competitors, such as Swissport and dnata, which are heavily focused on ground handling. The CEO said that air cargo handling has higher margins than ground handling, and that businesses focused on air cargo handling, such as WFS, are less susceptible to the effects of manpower constraints when scaling. This facilitates quicker, more efficient scaling as they are less exposed to labour force related challenges such as time lags in growth caused by having to find, hire and train employees.

During the AGM, a shareholder posed the question as to whether SATS had reaped any negative impacts consequent of the acquisition. Mok responded by reassuring shareholders that WFS’s operations have been in line with SATS’s expectations. The CEO added that SATS is learning from WFS exemplifying the new acquisition’s attention to detail in its practice of weekly productivity tracking and reviews.

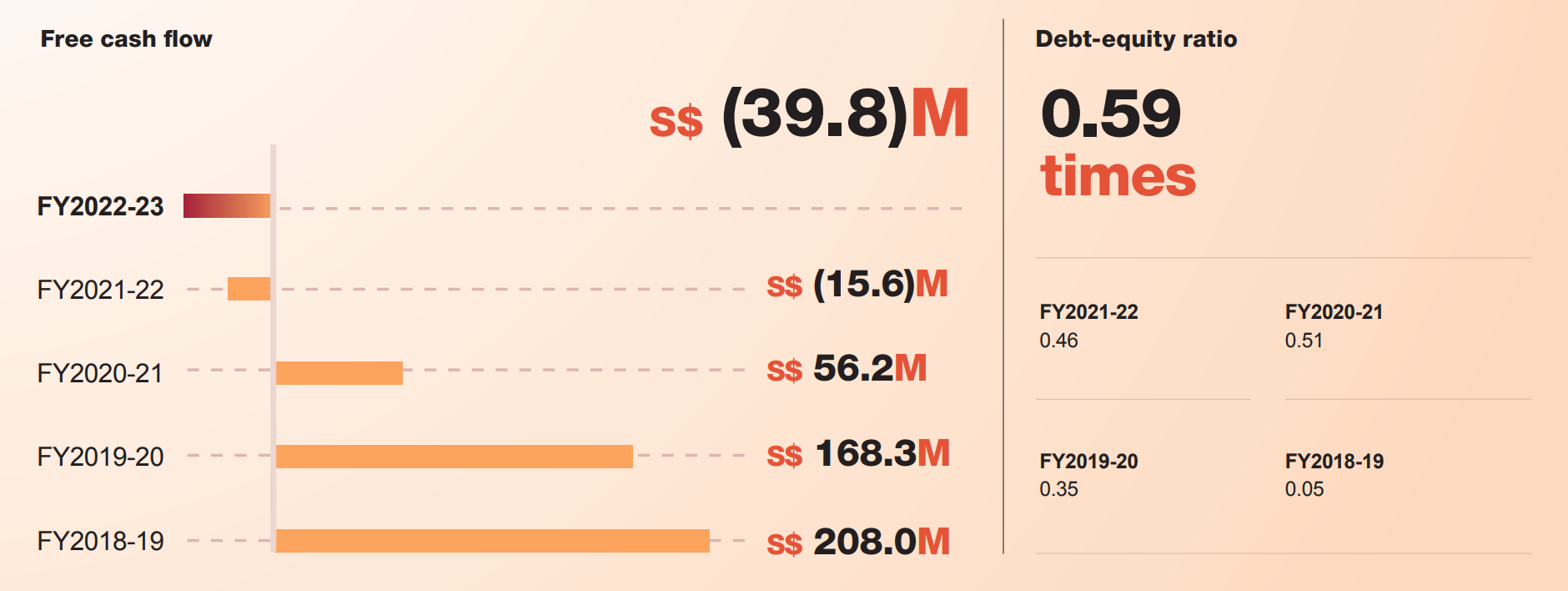

3. Due to the acquisition of WFS, SATS free cash flow has dropped further into the negative from -S$15.6M in FY2021-2022 to -S$39.8M in FY2022-2023. In light of this, SATS has implemented ongoing treasury management initiatives to reduce its costs of borrowings. This has resulted in annual savings of S$40 million in interest fees through refinancing WFS’s three series of senior secured notes. Additionally, SATS is proactively monitoring investments to maximise returns and, hence, increase the company’s free cash flow.

SATS’s debt-equity ratio increased from 0.48 in FY2021-2022 to 0.59 this past financial year. Alongside this, cash reserves have declined from S$786M in FY2021-2022 to $S374M in FY2022-2023. SATS recognises that this is an area for improvement and states that optimisation of debt levels will be of key focus to them in the years to come. Optimistically, Mok mentioned that the company believes the addition of WFS will allow for the reduction of debt levels at a faster than expected rate.

4. SATS has set several sustainability to be met by 2030 which are aimed at reducing its carbon footprint and to curb the effects of climate change. These goals include the reduction of Singapore-based Scope 1 and 2 emissions by 50% and the conversion of 100% of ground support equipment in Singapore hub to sustainable energy resources. This past financial year, SATS has shown steady progression towards meeting these goals. In FY2022-2023, 38% of its Singapore Hub Ground Support Equipment (GSE) had been made electric and the company’s carbon emissions are 8.8% lower than FY2020-2021 baseline levels, in spite of recent growth.

5. SATS is focused on continually improving its business efficiency through the utilisation of various systems. Mok explained how SATS had introduced a new streamlined digital ground operating system (G-Ops) in 2021. The system allows for the accurate tracking of ground handling cargo operations. Performance metrics recorded by the system allow for continual improvement of operations, facilitating higher levels of performance and productivity.

During the pandemic, SATS realised that a new, refreshed business model was necessary to drive growth and profitability in a new, post-pandemic world. Hence, the company invested in the SATS Global Innovation Hub and partnered with various market leaders such as Hilton Foods and SingPost to discover new sources of profitability and uncover more efficient and cost-effective modes of carrying out operations.

6. SATS believes that it must be equipped to manage the influx of new customers in order to fully reap the benefits of innovation. Hence, the company has invested in the scaling of operations through initiatives such as the construction of the Noida Cargo Hub in India and a new central kitchen in Tianjin, China. Furthermore, SATS has hired and trained staff early on, in anticipation of future growth. This is to ensure that the company is unconstrained by manpower limitations for future growth.

7. During the AGM, many shareholders questioned the board as to why SATS has been unsuccessful in achieving post-pandemic profitability, unlike its sister company, SIA. Mok had provided 3 main reasons for this:

- SATS focuses on building lasting customer relationships on long-term contracts. Due to inflationary pressures, the net income of SATS’s catering business has experienced diminishing returns as the company is unable to quickly update prices due to the longevity of contracts. Mok proclaimed that the company will be taking a long-term approach in remedying this, adjusting prices in a fair and transparent manner to ensure acceptable margins yet still bring value to their customers.

- Aviation is the largest sector in SATS’s food business. The company’s inflight catering business operations have not returned to pre-pandemic levels. Mok explained that ‘not every airline has restored the SATS food offerings that they used to offer on board.’ Furthermore, there has been an increasing occurrence of ‘double-catering’; certain airlines have begun to employ the services of inflight caterers from their home markets alongside that of SATS. These two factors equate to a reduction in demand for SATS’s inflight catering, hence lowering the business’s profitability.

- The aviation industry has not fully returned pre-pandemic levels. However, as mentioned earlier, aviation passenger traffic is expected to reach 100% of pre-pandemic levels in FY2024. Mok shared that a large sum of air cargo is stored and flown on the belly of passenger aircrafts. Hence with more flights come higher capacity for air cargo and the eventual recovery of SATS’s air cargo business.

The fifth perspective

The 2023 SATS annual general meeting provided insights into the company’s performance and strategic direction. Despite pandemic challenges, SATS rebounded with commendable revenue growth. However, Mok reminds shareholders that ‘it will not be a walk in the park’ and that the SATS team is diligently working to return the company to profitability.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »