The appeal of handpicking individual stocks is often hard to resist, but it usually demands a significant investment of time. For those stepping into the vast world of investment, researching, analysing, and managing a portfolio can seem overwhelmingly complex.

Enter exchange-traded funds (ETFs) – the perfect solution to this conundrum. Over the years, ETFs have become a preferred choice for newcomers and seasoned investors. They promise diversification across various assets, strategies, and regions. Their liquidity and relatively lower costs make them a favoured route for capital growth while sidestepping hefty fund management fees.

But how exactly do you pick the best from a sea of available options? This article highlights four standout ETFs recognised for their growth, diversification, and alignment with global economic trends. Additionally, for those keen on tax efficiency, I’ll point you towards the equivalent ETFs domiciled in Ireland and listed on the London Stock Exchange (LSE) – offering potentially lower withholding tax rates and a way around U.S. estate tax.

So whether you are building a fresh portfolio or tweaking an old one, here are four ETFs worth your consideration.

1. S&P 500 ETF (NYSE: SPY; LSE: CSPX)

The S&P 500 index stands tall as a benchmark of the U.S. stock market, and its reputation is well-earned. Investors frequently use it as a yardstick to gauge market performance, and it has become synonymous with reliability. The S&P 500 ETF has long become a staple in many portfolios, both for novices and seasoned investors.

Historically, the S&P 500 has demonstrated an impressive annualised return. While past performance isn’t an indicator of future results, the S&P 500 has historically recovered from all major downturns, making this ETF a potentially resilient choice for long-term investors. As an investment tool, this ETF offers a dynamic snapshot of the U.S. economy. Boasting holdings across a spectrum of sectors simplifies the process for those aiming to invest in American equities without the complexity of selecting individual stocks.

Central to the allure of the S&P 500 is its unique market capitalisation weighting mechanism. This method assigns greater influence on companies with larger market values, which inherently translates to stability. Larger companies, often industry leaders with established business models, exhibit lower volatility. This configuration has resulted in considerable gains over the past decade, driven notably by tech giants such as Apple, Amazon, Microsoft, and Alphabet, Google’s parent company.

2. S&P 500 Equal Weight ETF (NYSE: RSP; LSE: EWSP)

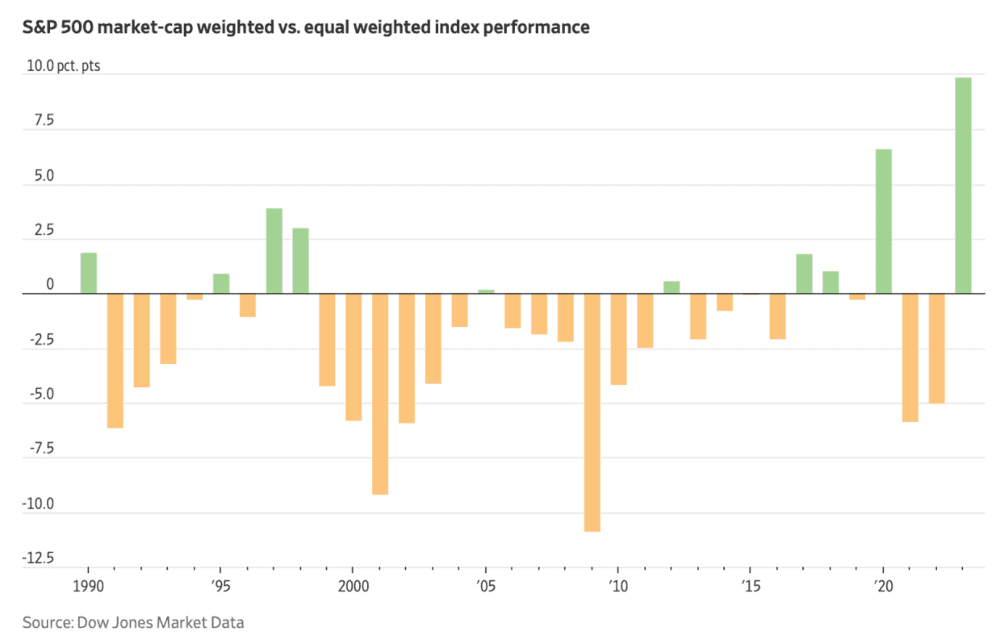

While the S&P 500 remains the lodestar for investors seeking reliable market returns, the S&P 500 Equal Weight index offers an intriguing alternative viewpoint. This index challenges the conventional paradigm of market capitalisation weighting, opting instead for an equal allocation across every company in the index. This subtle yet significant shift carries substantial implications for investors, providing them a distinctive avenue for navigating the market.

Simply put, the S&P 500 Equal Weight ETF allocates the same weight to every stock within the index, regardless of a company’s size. This approach facilitates smaller companies with higher growth potential to influence the index’s performance. In essence, this ETF offers investors broader exposure to the dynamism of smaller, emerging companies alongside established industry leaders.

While the allure of traditional S&P 500 ETFs remains, the equal-weighted approach serves as a compelling counterbalance, presenting a potentially more diversified perspective on the U.S. market.

3. Nasdaq-100 ETF (NASDAQ; QQQ; LSE: CNDX)

The Nasdaq-100 index has garnered particular appeal among investors due to its strong focus on technology enterprises. This unique characteristic exposes investors to some of the globe’s most cutting-edge and high-growth technology firms.

Over recent years, the Nasdaq-100 has exhibited superior performance compared to many broader market indices. This commendable performance owes much to its substantial allocation to technology behemoths such as Apple, Amazon, Microsoft, Alphabet (Google), and META.

One factor contributing to this exceptional performance lies in its prioritisation of disruptive technologies reshaping industries across various sectors. Companies within the index are at the forefront of advancements in artificial intelligence, cloud computing, and biotechnology. Notably, even amid periods characterised by market fluctuations or economic ambiguity, such as the case during the COVID-19 pandemic in 2020, this ETF demonstrated a rapid recovery, outclassing numerous conventional benchmarks. This resilience can be attributed to technology’s integral role in our daily lives, constantly revolutionising diverse sectors.

By investing in the Nasdaq-100, individuals open themselves up to the possibility of reaping the rewards from pioneering technology companies while mitigating the risks tied to single, high-volatility tech stocks. Thus, for those on the lookout for avenues to gain exposure to the technology sector, which boast a considerable potential for future growth, investing in the Nasdaq-100 is worth considering.

4. MSCI All Country World ETF (Nasdaq: ACWI; LSE: ISAC)

In today’s interconnected world, an investment that reflects global market performance is vital for any investor looking for portfolio growth opportunities. The MSCI All Country World Index offers investors an excellent way to diversify their portfolios and reduce risk by gaining exposure to different regions and industries. The MSCI All Country World ETF comprises thousands of stocks, ranging from established multinational corporations in developed markets to emerging companies. This diverse mix allows investors to effectively captures global growth opportunities and mitigate risks associated with economic downturns in specific countries or industries.

One interesting aspect of the MSCI All Country World Index is its weighting methodology. Unlike other indexes that use market capitalisation to determine stock weightings, this index takes a comprehensive approach, incorporating free float-adjusted market capitalisation and investability weights. By assigning equal significance to investability factors encompassing elements like foreign ownership restrictions and liquidity prerequisites, the MSCI All-World Index offers a more equitable representation of the global equity landscape. This index can also effectively mirror the evolving dynamics of global economic powerhouses. Notably, as emerging markets continue their rapid ascent, countries like China and India have witnessed a substantial upswing in their weightings within the index.

Investing in the MSCI All World Index ETF bestows another advantage – simplicity. Rather than grappling with the intricacies of cherry-picking individual stocks or navigating through complex international markets, investors can simply use this ETF and gain instant exposure to a globally diversified portfolio. So whether you’re a seasoned investor or just starting, adding this globally-focused ETF to your portfolio is worth considering.

The fifth perspective

The investing landscape has significantly changed over the years, and ETFs have emerged as a powerful tool for every investor. The four ETFs offer unique opportunities to diversify portfolios and tap into different sectors and regions of the market. However, investors should carefully assess their investment goals, risk tolerance, and time horizon before investing in any ETF. It is essential to understand that while these four options can expose various market segments, they are not one-size-fits-all solutions.

Ultimately, by incorporating these selected ETFs into a well-diversified portfolio strategy tailored to individual needs, investors benefit from broad market exposure while minimising risks associated with individual stock selection.

Hi Choon Leo, what is the best platform to buy into these ETFs? Thank you.

Hi Julie,

Any reputable broker that gives low-cost access to the NYSE/Nasday or LSE will do! Interactive Brokers is one option.

I recommend that you guys also have a look at the VanEck Morningstar Wide Moat ETF (MOAT), and consider it as a core holding.

It has quietly outperformed the S&P 500. I have been averaging into it for the last 5 years and I’m a happy camper.

https://www.vaneck.com/us/en/blogs/moat-investing/moat-question-and-answer/?utm_source=google&utm_medium=cpc&utm_campaign=moat&gad=1&gclid=CjwKCAjwgZCoBhBnEiwAz35Rwr89ZdQIA4qoECP4AdnKCVyHHMo3DezjVv8aF5deY-D-moOtw0HnyRoCMMMQAvD_BwE

Nice! Thanks for sharing, Jonathan. Will definitely check this out too!