Ajinomoto (Malaysia) Berhad was one of the very first Japanese companies to start its business operations in Malaysia in 1961. Since then it has expanded from being a distributor of monosodium glutamate to a manufacturer of a wide range of food seasoning including umami seasoning, ready-mix seasoning, chicken stock, pepper, sweeteners, and industrial seasoning.

Ajinomoto Malaysia now has 10 branches in Malaysia and one sales office in Saudi Arabia, and a market capitalization of RM1.25 billion as at November 2018.

Here are seven things to know about Ajinomoto Malaysia before you invest:

1. Ajinomoto Malaysia has two main product categories: retail and industrial. Starting with a single product brand, AJI-NO-MOTO, the management has since expanded its retail product line with new brands such as TUMIX, SERI-AJI, AJI-SHIO, Pal Sweet, AJI-MIX and AJI-NO-MOTO PLUS. Ajinomoto Malaysia’s industrial products are marketed under the TECHNO brand and sold to industrial food producers for use in instant noodle, seasoning, snack food, sauce, and processed food. All products are certified Halal.

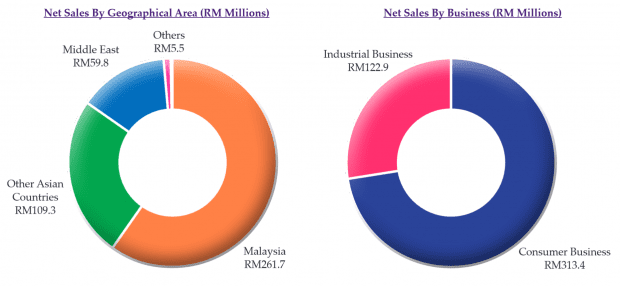

2. With more than half-century of history in Malaysia, Ajinomoto is a household name in kitchens around the country. Net sales in Malaysia generated 60% of total net sales followed by other Asian countries (25.1%) and the Middle East (13.7%). By business segment, the consumer business contributed 71.8% of total sales, with the rest contributed by the industrial business. However, the industrial business segment is growing faster – it grew 7.8% in 2018 compared to 2.6% for the consumer business. This was mainly due to higher export volume for TECHNO products.

Source: Ajinomoto 2018 annual report 2018

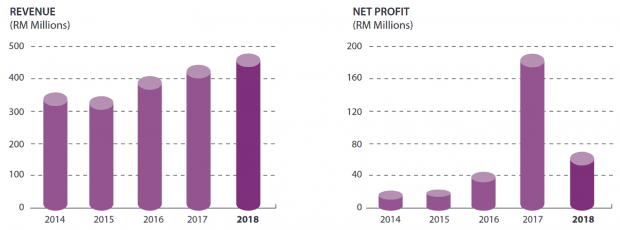

3. Revenue and net profit have increased steadily over the last five years. From 2014 to 2018, revenue and net profit grew by a CAGR of 6.0% and 15.6% respectively. The company recorded an exceptional gain in 2017 when it received RM166 million in compensation from the Malaysian government when it acquired a plot of land in Jalan Kuchai Lama for the MRT2 project from Ajinomoto Malaysia. As at 31 March 2018, Ajinomoto Malaysia had no debt and RM126.7 million in cash.

Source: Ajinomoto 2018 annual report 2018

4. Ajinomoto Malaysia increased its dividend payout ratio from 40% in 2015 to 50% in 2016 and has maintained the ratio for the past three years. Net dividend per share has increased from 18.50 sen in 2014 to 46.50 sen at 2018. Even then, its dividend yield remains unattractive as it ranges around 2-3%. In 2017, Ajinomoto Malaysia paid a special dividend of 113 sen due to the exceptional gain that year.

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Dividend Payout Ratio | 40.11% | 40.90% | 50.31% | *50.27% | 50.25% |

| Net Dividend Per Share (in sen) | 18.50 | 20.00 | 33.75 | 42.00 | 46.50 |

| Special Dividend Per Share (in sen) | - | - | - | 113.00 | - |

*Excluding special dividend. Source: Ajinomoto 2018 annual report 2018

5. On 12 February 2018, Ajinomoto entered into a sales and purchase agreement for the acquisition of a plot of freehold land measuring 2.03 million square feet located at Techpark@Enstek for RM81.2 million. The management revealed at the company’s AGM in August that the agreement has not been finalised and will announce further details in due time.

6. Ajinomoto Malaysia’s reporting currency is in Malaysian ringgit, but around 40% of the company’s sales and 31% of its costs are transacted in foreign currencies. This means a shift in foreign exchange rates can the company’s profitability. The following table demonstrates the sensitivity of the company’s profit before tax to a change in foreign currencies, with all other variables held constant.

Source: Ajinomoto 2018 annual report 2018

7. As at 31 March 2018, Ajinomoto Malaysia had trade receivables of RM44.2 million. Fort-two percent of trade receivables were from five major customers. If we extrapolate this, we can assume these five customers account for around 40% of Ajinomoto’s total revenue. A loss of any one of these major customers would make a dent on the company’s revenue and profit.

With additional article contributions by Mitra Chen.