Ascendas India Trust (a-iTrust) is an SGX-listed property trust that owns a portfolio of Indian IT and logistics parks with a total floor area of 13.1 million square feet spread across Bangalore, Chennai, Hyderabad, Pune and Mumbai. As of 31 March 2019, its portfolio was valued at S$1.72 billion. In this article, I’ll cover the Trust’s latest annual results, upcoming growth plans, and stock valuation.

Here are eight things to know about Ascendas India Trust before you invest:

1. a-iTrust currently owns seven IT parks and one logistics park in India:

| IT/Logistics Park | Valuation (S$ million) | Percentage of Total Portolio |

|---|---|---|

| International Tech Park Bangalore | 640.9 | 33.4% |

| International Tech Park Chennai | 363.9 | 19.0% |

| CyberVale | 72.4 | 3.8% |

| CyberPearl | 63.7 | 3.3% |

| The V | 320.3 | 16.7% |

| aVance Business Hub | 198.9 | 10.4% |

| Blueridge 2 | 160.7 | 8.4% |

| Arshiya Warehouses | 97.7 | 5.0% |

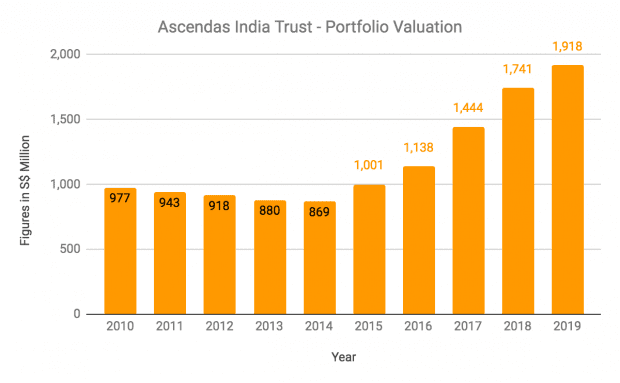

Portfolio valuation grew sharply post-2014 when the Trust acquired and developed a higher number of properties within their IT/logistics parks:

| Property | Activity | IT/Logistics Park | Period | Floor area (million sq. ft.) |

|---|---|---|---|---|

| Cybervalue 1 & 2 | Acquired | CyberVale (CV) | Mar 2015 | 0.6 |

| aVance 3 | Acquired | aVance Business Hub (aVance) | Jul 2015 | 0.7 |

| Cybervale 3 | Acquired | CyberVale (CV) | Mar 2016 | 0.3 |

| Victor | Developed | International Tech Park Bangalore (ITPB) | Jun 2016 | 0.6 |

| BlueRidge 2 | Acquired | BlueRidge 2 | Feb 2017 | 1.5 |

| aVance 4 | Acquired | aVance Business Hub (aVance) | Apr 2017 | 0.4 |

| Atria | Developed | The V | Sep 2017 | 0.4 |

| Arshiya | Acquired | Arshiya Warehouses | Feb 2018 | 0.8 |

Along with a stronger Indian rupee, portfolio valuation more than doubled from S$869.0 million in 2014 to S$1.92 billion in 2019.

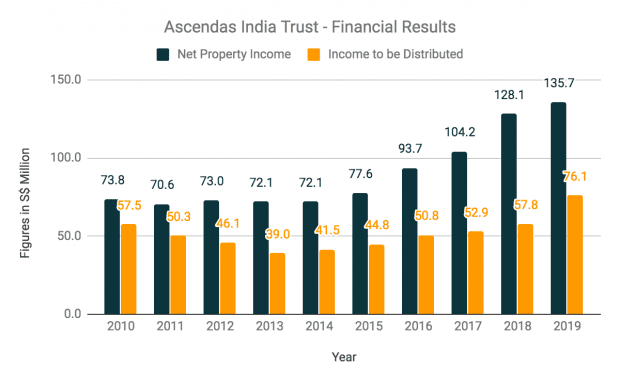

2. Distributable income has increased by a compound annual growth rate (CAGR) of 12.9% over the last five years, from S$41.5 million in 2014 to S$76.1 million in 2019. This growth mirrors the rise in portfolio valuation over the same period due to acquisitions and new developments.

3. As of 30 June 2019, a-iTrust has a gearing ratio of 33.1%. Its effective weighted average cost of debt is 6.2% and 84% of its debts are at fixed interest rates. Presently, 67% of debt is denominated in Indian rupees with the rest in Singapore dollars. Moving on, a-iTrust has a total debt headroom of S$510 million to invest in new properties or undertake development activities.

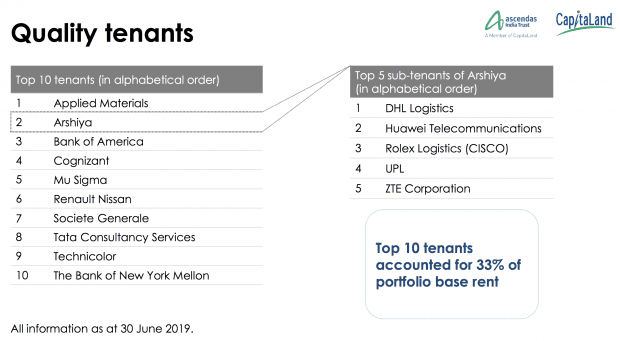

4. As of 30 June 2019, a-iTrust has a committed occupancy rate of 99.9% from a base of 343 tenants. It has a tenant retention rate of 73%. Its weighted average lease expiry is 4.3 years and 62% of its leases will start to expire only in FY2022 and beyond. Its top ten tenants currently contribute 33% of portfolio base rent:

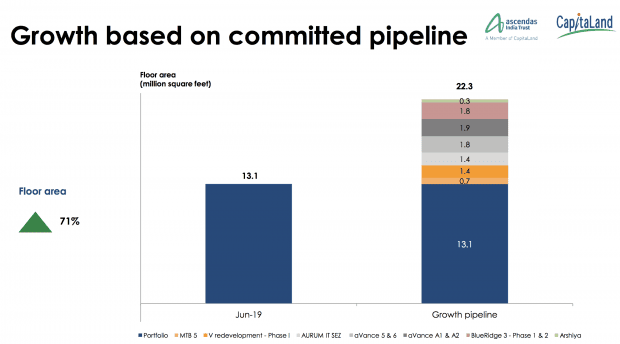

5. a-iTrust has land banks in Bangalore, Hyderabad, and Chennai with a total development potential of 6.6 million square feet (excluding the recent completion of Anchor Building at ITPB in May 2019). Moving forward, the Trust has plans for the following acquisitions/developments:

- a-iTrust has begun construction of MTB5 at International Tech Park Bangalore. Once completed, it will have 700,000 square feet of floor area and leased to an IT company. This project is expected to be completed by 2H 2020.

- a-iTrust intends to redevelop The V in Hyderabad and expand its leasable area from 1.5 million square feet to 5.0 million square feet over the next seven to ten years. Phase 1 of this redevelopment involves the demolishment of its Auriga and auditorium buildings to construct a new building sizing 1.4 million square feet. The construction of this building is scheduled for completion by 2H 2021.

- To date, a-iTrust has acquired four out of six buildings at aVance Business Hub and is looking forward to acquiring aVance buildings 5 and 6 once their construction has been completed. aVance 5 will be completed by Q1 2020, while aVance 6 has already been completed with Amazon secured as its tenant.

- In May 2018, a-iTrust entered an agreement to acquire five buildings at aVance Business Hub 2. The Trust has currently committed S$158 million in construction funds to build the first two buildings at aVance BH2 and construction is expected to be completed by 2H 2021.

- a-iTrust has also agreed to purchase two buildings at AURUM IT SEZ with a combined floor area of 1.4 million square feet for S$186 million. Building 1 has already obtained its occupancy certificate and construction of Building 2 is expected to be completed by 1H 2020.

- Subsequent to the acquisition of six warehouses in Arshiya in 2018, the a-iTrust signed an agreement to acquire an additional warehouse at Arshiya for S$42.1 million. Construction will be completed by 1H 2020 and the warehouse will be leased for a period of six years upon completion.

- In June 2019, a-iTrust entered an agreement to acquire BlueRidge 3 — which comprises two IT office buildings — for S$146.7 million. The two buildings will be developed in Phases 1 and 2 and construction is expected to complete in 1H 2021 and 2H 2023 respectively.

Upon completion of the following development/acquisition activities listed above, a-iTrust’s portfolio would increase its total floor area from 13.1 million to 22.3 million square feet.

6. Ascendas-Singbridge has granted a-iTrust the first right to acquire International Tech Park Pune and any business park developments held under the Ascendas India Growth Programme. International Tech Park Pune is a business park with 1.9 million square feet of completed space and 400,000 square feet of space under development.

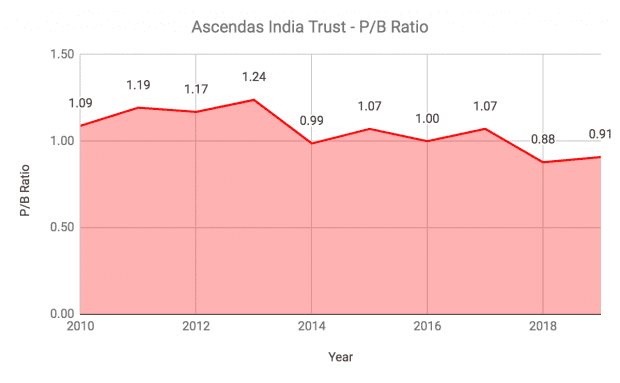

7. P/B ratio: As of 30 June 2019, a-iTrust has a net asset value per unit of S$1.27. Based on its unit price of $1.55 (as of 14 October 2019), its P/B ratio is 1.22 — above its ten-year average of 1.06.

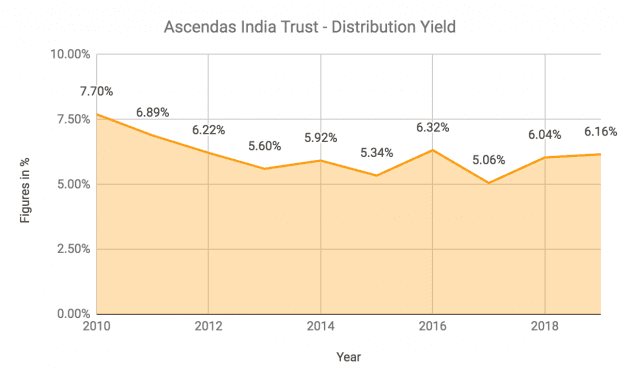

8. Distribution yield: a-iTrust paid 7.33 cents in distribution per unit in its last financial year. Thus, its gross distribution yield is 4.73% — below its ten-year average of 6.13%.

The fifth perspective

Ascendas India Trust has delivered strong growth over the last five years as it rides on a wave of continued economic development in India. For investors looking for exposure to the Indian business economy, ai-Trust might interest them. The Trust also has a pipeline of growth initiatives over the next few years which would expand the size of its portfolio considerably.

However, ai-Trust is currently trading above its historical P/B average and offering a below average yield for an investment in an emerging market. For investors seeking better value and yield, they may prefer to wait for a more opportune time to invest in the Trust.

I used to invest in quite a bit in this fund because of its high dividends but have since sold them all.

re. Ascendas India, at my Hong Kong-based broker, I can only find a “warrant” with the symbol “AIT” – do you know if this represents the same as “CY6U”?

Hi Rudi,

Ascendas India Trust is only listed on the SGX. If you wish to buy its shares, you’d need to trade with a broker that has access to the SGX.