Despite being the initial epicenter of the COVID-19 outbreak, China’s resilience is shining through by being the first country to see a recovery from the economic downturn caused by the pandemic. In this article, we will look at China’s growing importance in global equity indices, the characteristics of the Chinese equity market, as well as the key trends and risks facing the dynamic transformation of China’s economy.

1. China is the youngest market regionally, with the Shanghai and Shenzhen Stock Connect schemes launched only five years ago. Shanghai Connect was launched on 17 November 2014 followed by Shenzhen Connect on 5 December 2016. This enabled the integration of Chinese equities into the global financial system, raising the profile of Chinese companies, and was the beginning of China’s equity representation in the MSCI Emerging Markets Index.

Investors can access the Chinese equity market through several share classes, the largest being A-shares. A-shares refer to companies listed on the Shanghai and Shenzhen stock exchanges and were previously only available for trading by mainland Chinese citizens. H-shares on the other hand are listed on the Hong Kong stock exchange and available for trading to all investors.

With the Stock Connect schemes, investors outside of mainland China can now use the Hong Kong Exchange to buy A-shares in Shanghai or Shenzhen (known as ‘northbound’ trades) while Mainland China residents can use the Shanghai or Shenzhen exchanges to buy H-shares or Hong Kong-listed stocks. (known as ‘southbound’ trades)

It is crucial for an investor to understanding the differences between the various share classes in China to make informed investment decisions. The table below includes key information that investors should know about the different types of China share classes.

| Share Class | Definition | Stock Exchange (Currency) |

|---|---|---|

| A | China securities incorporated in Mainland China, listed on the Shanghai or Shenzhen Stock Exchange and traded in Renminbi (RMB). | Shanghai (RMB), Shenzen (RMB) |

| B | China securities incorporated in Mainland China, listed on the Shanghai Stock Exchange (USD) and Shenzhen Stock Exchange (HKD). | Shanghai (USD), Shenzhen (HKD) |

| H | China securities incorporated in Mainland China, listed on the Hong Kong Stock Exchange (HKD). | Hong Kong (HKD) |

| Red-Chips | China securities of state-owned companies incorporated outside Mainland China, listed on the Hong Kong Stock Exchange (HKD). | Hong Kong (HKD) |

| P-Chips | China securities of non-government owned companies incorporated outside Mainland China, listed on the Hong Kong Stock Exchange (HKD). | Hong Kong (HKD) |

| Listed Overseas | China securities (including ADRs) incorporated outside Greater China (mainland China, Hong Kong, Macao and Taiwan); listed on the NYSE Euronext–New York, NASDAQ, NYSE AMEX (N-Shares) traded in USD; and Singapore (S-Shares) Exchanges traded in Singapore Dollars (SGD). | New York (USD), Singapore (SGD) |

Source: MSCI

2. Inclusion of China A-shares in the MSCI Emerging Index. MSCI began including China large-cap A-shares in the MSCI Emerging Index on 31 May 2018. Based on data from MSCI in 2018, China equities form 31.3% of the MSCI Emerging Markets Index at 5% inclusion.

Based on current market capitalizations, at a hypothetical 100% inclusion, China equities would comprise 42% of the MSCI Emerging Index in the future.

As the inclusion factor of China A-Shares into the MSCI Emerging Markets Index is expected to rise, the exposure of institutional and foreign investors to A-shares should increase and reflect China’s growing importance in global equity indices.

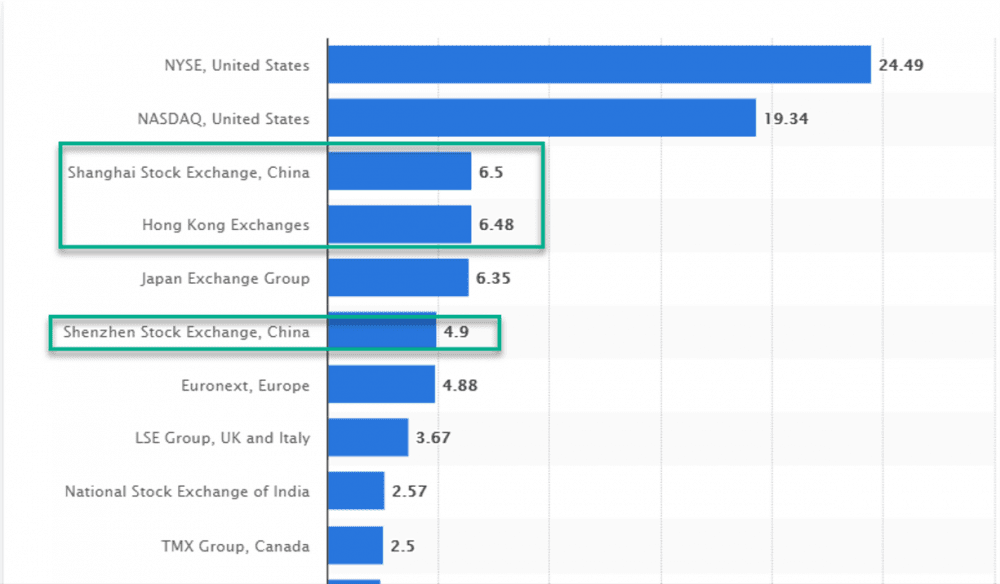

3. Significant expansion of China’s capital markets. The combined market capitalisation of the exchanges in Shanghai, Shenzhen, and Hong Kong is US$17.88 trillion (as of January 2021). China’s combined capital markets places it in third position within the top 10 largest stock exchange operators, with the New York Stock exchange and Nasdaq of the United States leading the rest of the world.

4. Chinese companies are becoming more market-oriented

Once largely out of reach to foreign investors, China’s state-owned enterprises (SOEs) held outsized influence over the country’s economy, leading many investors to question China’s corporate governance standards.

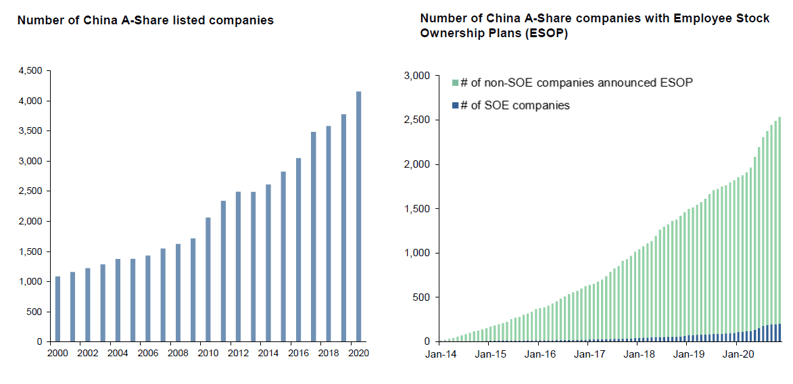

However, over the last 15 years, non-strategic SOEs such as local consumer or technology businesses are behaving more like profit-seeking entities. Much of the investment activities that previously took place in private and venture capital markets are increasingly accessible to investors in listed equity markets.

An increasing number of state-owned and privately owned enterprises offering employee stock-ownership programmes have been on the uptrend, turning employees into shareholders who have an active stake in the company’s success.

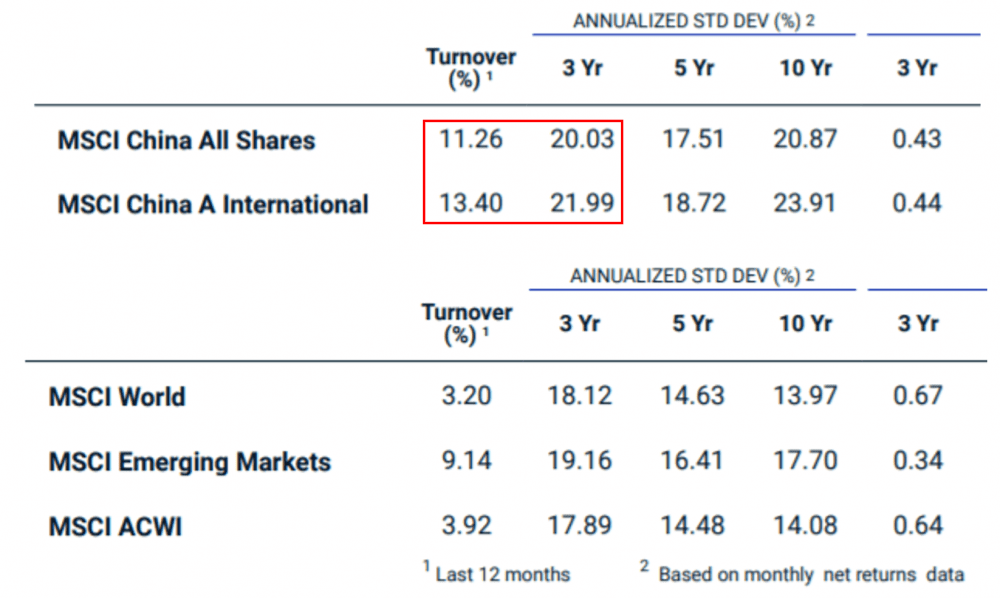

5. China markets are highly liquid. Chinese equity markets have a high level of retail investor participation. Much of the investment activity is led by a culture of short-term trading. Frequent change of investor sentiments causes significant market volatility and reflects a dominant characteristic of local domestic investors who tend to speculate rather than invest based on informed valuations.

This is evident in the MSCI indices, where Chinese equities rank the highest for turnover (buying and selling of shares) and standard deviation (volatility).

However, markets with high turnover ratios are generally easier to trade (more investors are buying and selling) and therefore favourable to skilled investors employing momentum, market timing, and sector rotation strategies.

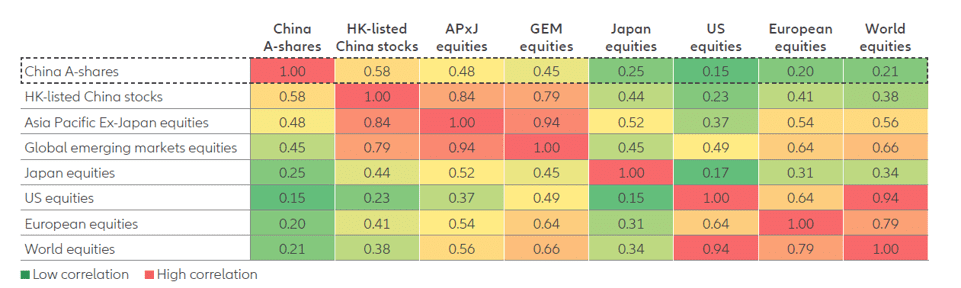

6. China equites offer portfolio diversification. The stock movements of China’s A-shares are weakly correlated to stock movements in other equity markets. Over the last 10 years, China A-shares have seen a correlation of 0.21 compared to global equities. In comparison, U.S. shares have a correlation of 0.943 compared to stocks in global equity markets.

Holding China equities can offer diversification benefits during market downturns such as the period of the COVID-19 pandemic when highly correlated asset classes fell.

7. Chinese trends that investors should pay attention to. As China transits towards self-sufficiency, increased infrastructure spending, and upgrade of domestic consumption, the sectors expected to benefit are domestic tourism, machinery, solar energy, semiconductors, industrial automation, renewable energy and electric vehicles.

China is the largest market for electric vehicles (EVs) globally. According to a McKinsey report, China’s EV market is about three to four times that of the U.S which could potentially propel Chinese EV makers into the global arena for the manufacturing of EVs, batteries and charging infrastructure.

Major fund house analysts expect Chinese equities to continue performing well in the first half of 2021, with investors revising up their earnings forecasts for the year as policy initiatives related to self-sufficiency, domestic demand and sustainability attract investor attention.

Central bank and regulators are also expected to exit from policy stimulus as China’s economic growth gradually returns to normal, triggering the recent profit-taking and sell offs in Chinese stock markets as the Chinese economy bottomed during the second quarter. Among the backdrop described above, China is still expected to achieve a mid-to-high single-digit GDP growth in 2021.

8. Risks that investors should heed. Recent executive orders forbidding all U.S. persons from investing in the securities of companies deemed to be Chinese military companies were issued by the Trump administration. According to the executive order, all U.S. persons will also have to divest their holdings of these blacklisted securities by 11 November 2021.

At an institutional level, U.S. funds and ETFs whose portfolio consists of these blacklisted constituents will have to remove such companies from their portfolios, causing performance deviation from major benchmarks and indexes these funds and ETFs measure against. Retail investors who buy into these companies, funds or ETFs could see valuation affected.

The current situation remains extremely fluid and could reverse as the Biden administration begins a thorough review of its predecessor’s policies. Capital mobility restrictions, market accessibility, and under-coverage of Chinese companies continue to be a current challenge for global asset managers and foreign investors.

The fifth perspective

China’s equity markets have increasingly liberalized and are still undergoing a transformation as we speak. As a result of these efforts, China equity has become more accessible for international investors compared to just five years ago.

However, the ongoing U.S.-China tensions continue to undermine confidence in China equity. The recent executive order blacklisting China companies is a good example. This will continue to be an ongoing dynamic as the international investing community adjusts to China’s increasing inclusion in the global financial markets. Another detractor would be the relatively inexperienced Chinese retail investor and their trading culture where frequent sector rotation and sudden swings in market sentiment affects share prices.

China’s future economic growth drivers is increasingly underpinned by self-sufficiency initiatives. As China aims to increase capital expenditures in infrastructure, technologies and domestic consumption, the number of listed companies and market capitalisations is expected to rise and provide an increasing pool of opportunities for investors.

The majority of global investors today still own an incomplete China equity portfolio. With selective stock picking, investors can increase exposure to China’s growth story, add meaningful diversification to their portfolio and potentially benefit from greater risk-returns.

Great article,

another risks for investing in China stocks

ETF based on U.S., Europe – impacted by tensions U.S. – China

I selected the Hong Kong Exchange for investments in China stocks.

Also I check if the stock is not subject to U.S. restriction.

I like China stocks for

– China strategy as country

– innovations, STAR market

– big market

Thanks Petre!

Nice to know that you have an interest in Chinese stocks. Chinese equity certainly provides portfolio diversification and a range of thematic options. A typical investor who has allocation to China usually holds stocks of globally well-known companies from technology, banking and insurance sectors. There exist other large Chinese companies from sectors such as healthcare, infrastructure, energy that are relatively under-covered.

Julian,

my portfolio of Chines stocks includes more than 45 companies:

– Energy

– metals (AL, Cu)

– Concrete

– Railroads

– logistics

– EV, tractors

– E-commerce

– Technology

– Healthcare

– Biotech

– CRO (Contract Research Organization Wuxi Bio HKEX:2269)

– Value Partners (HKEX:0806) stock as ETF (diversification to Asia stocks)

– Water

– Waste

I plans to include

-5G

– Aviation + Cosmos

br

Petre

2 big risks, not to put it all in China’s basket

1. Expect USA to continue sabotage on China’s progresses all along the way to prosperity. Nothing pleases US more than having China’s economy & its stock market tank to poverty levels.

2. Political risks from China’s govt interventions – short term pains likely, although long term could be good for the the country to balance against full-fledge capitalism as what we have seen in the US right now.

I feel, the better way to invest into China Stocks is as always via passive ETFs, particularly technology/biotechnology ETFs.

Already MCHI or PGJ are interesting. Not to mention CQQQ, KWEB, HK:3067, HK:3109, HK:3147, KURE, HK:2820.

What are the readers views on LION-OCBC SECURITIES CHINA LEADERS ETF. New to investing and looking to broaden the portfolio

Hello !

If some stock have dual listing – in HK and Mainland China – what stock prefer to buy ?

Thank in advance

Hi Acardy,

Hong Kong. The exchange is more accessible to international investors and its capital markets are more developed at the moment.