Dutch Lady Milk Industries Berhad (Dutch Lady Malaysia) manufactures and distributes dairy products. It has over 50 years of presence in Malaysia and more than 140 years of Dutch dairy heritage. It started off its business by importing sweetened condensed milk from the Netherlands. Its existing product portfolio includes milk powders, liquid milk, and yogurts. Their products are marketed under different brands including Dutch Lady, Dutch Baby, Frisolac, Friso Gold, and Dutch Lady PureFarm.

I took a closer look at this company when its share price was hammered recently by declining net profit, as a result of higher dairy raw material prices and unfavourable foreign exchange rates.

Here are 12 things to know about Dutch Lady Malaysia before you invest:

1. Dutch Lady Malaysia operates as a single legal business entity. It is 51%-owned by Royal FrieslandCampina N.V., one of the world’s largest dairy co-operatives based in the Netherlands. It principal operations are in Malaysia and it exports some of its products to Singapore and Pakistan. It is professionally managed as the existing directors do not own any of the company shares. Dutch Lady’s strong business model allows it to be chaired by different individuals. Since 1999, Dutch Lady Malaysia has had seven managing directors.

2. Dutch Lady Malaysia does not own any dairy farms, which carry more risk inherently due to its biological assets. Instead, it imports main raw ingredients such as skimmed and whole milk powder and anhydrous milk fat (using U.S. dollars) and sells the finished product in the domestic market. It also purchases other raw materials like sugar, cocoa, and paper as well as plastic packaging products. Dairy Farm reaches the mass market via e-commerce platforms like Lazada and Shopee; and indirectly via supermarkets and convenience stores. It is also present in the B2B segment by catering to the needs of hotels, cafes, and bakeries.

3. Dutch Lady Malaysia has strong brand equity in Malaysia. This was apparent in the amount of shelf space they took up on an AEON supermarket in Kuala Lumpur I visited.

It owns about 40% of the liquid milk market share with a notable presence in the UHT (ultra-high temperature) milk segment. Its products are mostly priced within the affordable range.

| Product Category | Market Share |

|---|---|

| Growing-up Milk Powder | 25% (2018) |

| Liquid Milk | 40% (2019) |

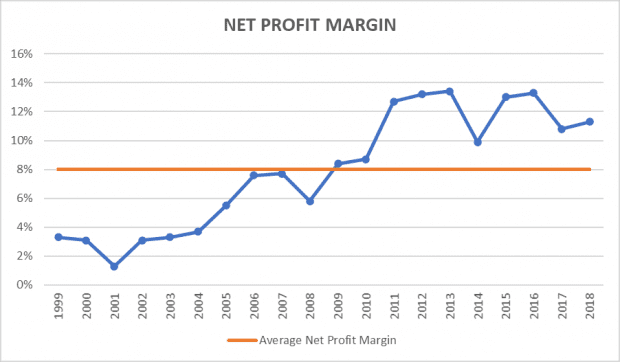

4. As part of its product reshuffling, it stopped producing its very first imported product – sweetened condensed milk in 2011 to focus on healthier dairy choices. Sweetened condensed milkmade up of 12% of Dutch Lady’s imported volume at that time. The decision was aligned with its commitment to reduce the sugar content in its products. More importantly, the profit margin of sweetened condensed milk is low and the consumer market is becoming more health-conscious. Consequently, Dutch Lady Malaysia was able to streamline its product portfolio and focus on its key products. It managed to improve its internal efficiencies and achieve economies of scale. As shown below, its net profit margins have been increasing and averaged an impressive 8.0% in the past 20 years.

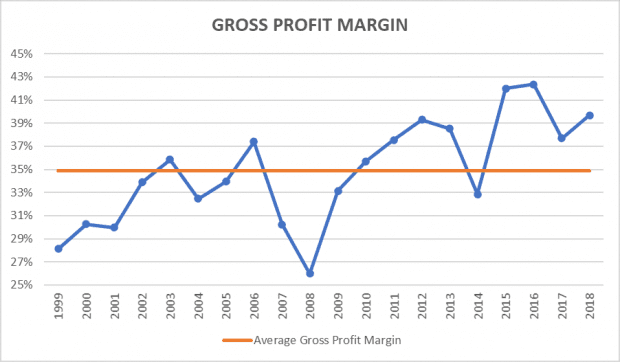

5. Dutch Lady Malaysia is impacted by fluctuations in raw material prices and foreign exchange rates. Whenever raw material prices increased sharply, for instance, in 2008, 2014, and 2017, their gross profit margin took a hit. A weakening ringgit will also affect them negatively as in 2014. The percentage point difference between the lowest and highest points of gross profit margin from 2008 to 2016 was 16.4%, a fairly large gap. Overall, the gross profit margin is still on an uptrend because of its economies of scale and bargaining power. It receives help from its holding company to procure raw materials at the right price and time to save costs. Dutch Lady Malaysia is also exposed to customer concentration risk as one single external customer contributed to 11.6% of its revenue in 2018.

6. It is worth noting that Malaysia is not a traditional milk-consuming country. Milk consumption in Malaysia decreased from 0.5 litre per person per week in 2013 to 0.3 litre in 2019. The entire dairy market experienced a decline and slowdown in sales volume in 2012 and 2014 respectively. Dutch Lady Malaysia could still grow its revenue by increasing the price of its products particularly for the growing-up milk powder segment as they have done so in the past. However, managing Director, Tarang Gupta, would like to absorb cost increases by improving internal efficiencies and not pass on any cost increases to customers. Consumers of the liquid milk segment may be slightly sensitive to price changes. Therefore, any adjustments to selling prices need to be done carefully.

7. Growing-up milk powder is usually a bit sticky and more resilient in economic downturns. In good times or bad, parents will still buy baby formula. As long as their babies respond well to a baby formula product, the parents will most likely stay with the same brand and move vertically to another Dutch Lady product as the babies grow up. In addition, its products are generally affordably priced.

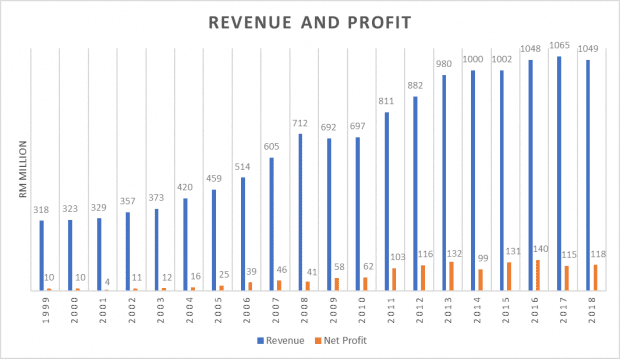

8. Over the past 20 years, revenue has grown steadily at a compound annual growth rate (CAGR) of 6.5%. Between 2014 and 2018, the CAGR of its revenue was just 1.2%. In 2o18, revenue dropped 1.5% although sales volume was up by 3% because of its pricing strategy to make milk affordable to the public in order to pursue greater market share for long-term growth. The CAGR of its net profit (excluding one-off items) in the past 20 years is 13.9%. Net profit increased 2.6% year-on-year in 2018 because of improved operational efficiencies and product innovations. A weakening ringgit and rising cost of raw materials will also put a dent on its net profit.

9. In 2014, milk powder and liquid milk contributed to 95% of its revenue. Meanwhile, growing-up powdered milk for infants and toddlers has higher margins than other products.

| Product Category | Revenue Contribution in 2014 |

|---|---|

| Milk powder | 65% |

| Liquid milk | 30% |

| Yogurt | 5% |

Source: Analyst report

10. Dutch Lady Malaysia has a good financial track record over the past 20 years:

- An average free cash flow of RM70.2 million.

- Almost zero debt except in 2007 and 2018 and the business does not need any debt to run.

- Total-debt-to-equity ratio at 0.1 in 2018.

- Average return on equity at 42.3%, which is way above the 15% we set as a general guideline for a good ROE value.

- Average cash-flow-to-net-income ratio at 1.3, which indicates earnings of good quality.

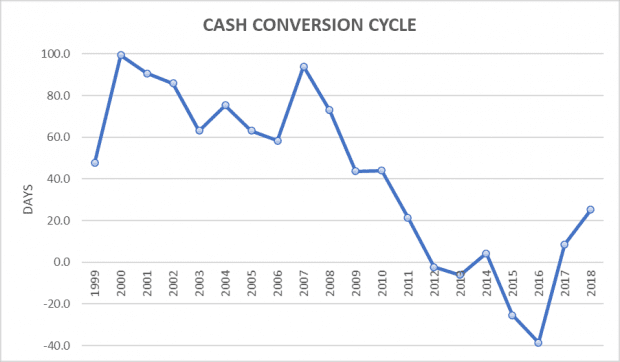

11. Cash conversion cycle has been decreasing for the past 20 years and averaged at 41.3 days. This means the company has been more effective in converting its inventory to cash. The number has even fallen into the negative territory in 2012, 2013, 2015, and 2016. In these years, Dutch Lady Malaysia collected payment from selling products to customers even before payments to its suppliers for goods and services were due.

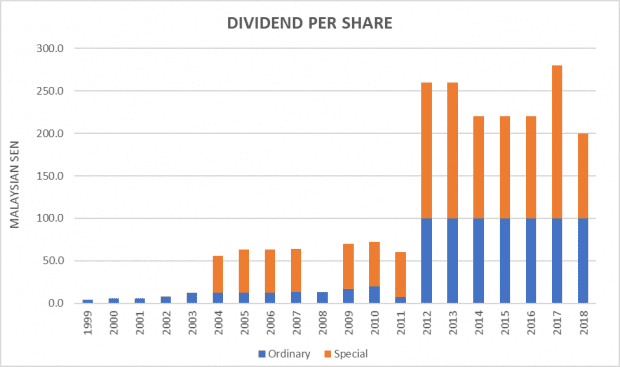

12. Dividends per share has been fairly consistent if we look only at ordinary dividends. Dutch Lady Malaysia has been distributing RM1.00 per share of ordinary dividends in each of the past seven years. However, its retained profits has been decreasing since 2011 when they started paying hefty special dividends between 2012 and 2018.

The fifth perspective

The depreciation of the ringgit and the fact that Dutch Lady Malaysia largely operates in Malaysia are two concerns for foreign investors. As Dutch Lady Malaysia continues to pay handsome dividends, it pays to be more conservative by including only ordinary dividends in the calculation of dividend yield. Overall, Dutch Lady Malaysia is a great business with limited growth potential for now.