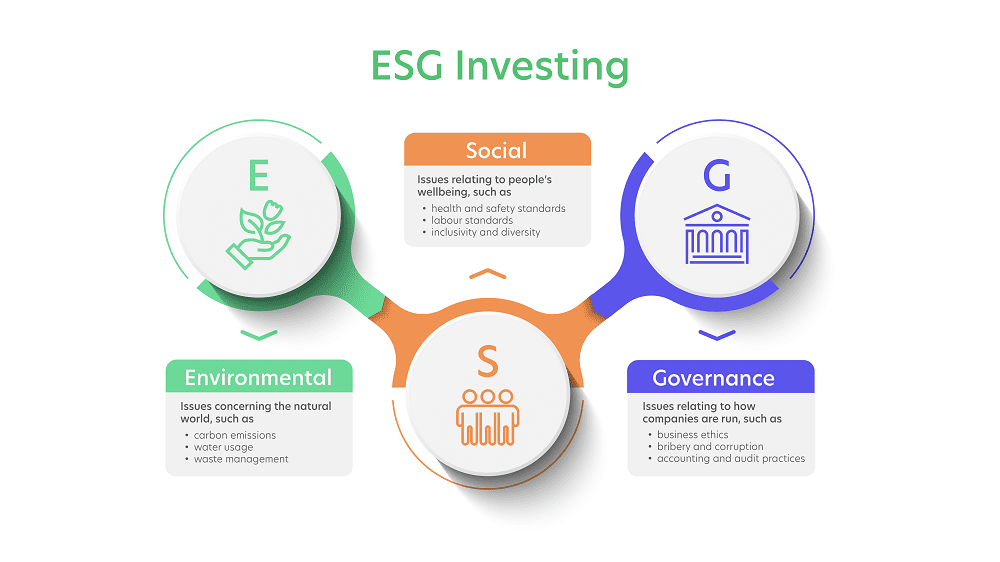

Environmental, Social, and Governance (ESG) investing or sustainable investing is a form of investing that prioritises a company’s impact on the environment, its society, and stakeholders, alongside its financial performance. Although environmental issues like climate change and renewables have taken the headlines in recent times, ESG – like its name suggests – also considers social and governance issues.

Here is an overview of ESG:

How ESG impacts a company’s future

You could be wondering how ESG or sustainable practices impacts a company’s future growth and, thereby, your investment portfolio.

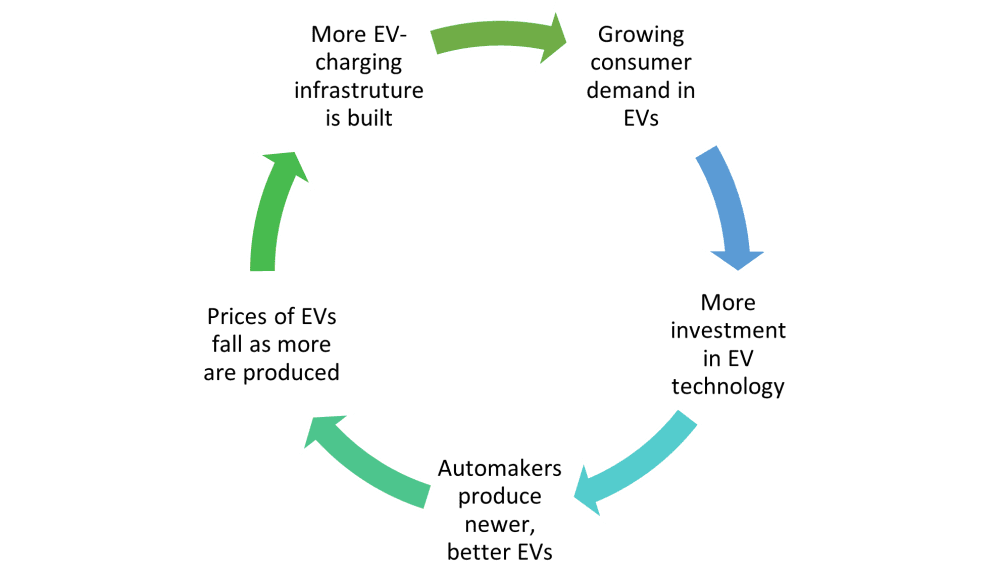

Well, consider the electric vehicle (EV) industry. Just a decade ago, EVs were considered a novelty item, reserved for wealthy tech bros and hobbyists. Today, it is widely expected that EV technology will replace the internal combustion engine and EVs will become the future of mobility.

Around the world, the revolution is taking shape. California has moved to end sales of gasoline-powered vehicles by 2035; all new vehicles sold in the state will have to be electric or electric hybrids. The European Union is aiming to have at least 30 million EVs on its roads by 2030. And China wants EVs to comprise 40% of new cars sold in the country by 2030.

In the process, a massive amount of capital has flowed — and continues to flow — toward the growing EV industry. Established automakers are releasing more EV models every year, new entrants are sprouting up looking to disrupt the usually traditional automotive industry, portable battery technology is progressively improving, and EV-charging infrastructure is steadily being built around the world.

As a result, more consumers have gradually shifted toward buying an EV over a gasoline-powered vehicle. And as consumer demand continues to grow, so will the amount of capital and investment in the EV industry.

Besides growth, ESG practices can also help ‘futureproof’ companies as rules and regulations progressively lean toward sustainability. Most prominently, climate change and the related climate action needed to reduce global carbon emissions is causing industries and companies to pivot their business strategies to adopt low carbon practices, for example, investing in renewable energy infrastructure and adopting energy efficient technology solutions.

Managing exposure to environmental and social risk has also come to the forefront. Increased stakeholder pressure from governments, regulators, customers, clients and financial institutions means that companies need to ensure that they have policies in place to manage physical and transition risk emerging from climate change as well as potential social risks in their operating environment.

On a governance level, well-managed companies also tend to be favoured by investors for their transparency, reasonable management compensation, and being aligned with shareholder interests.

Does ESG investing earn a higher return?

As investors, the question of performance naturally comes to mind. So for all their effort, do companies that implement sustainable practices actually see a higher return? To answer that question, a broad-based stock index may give some indication.

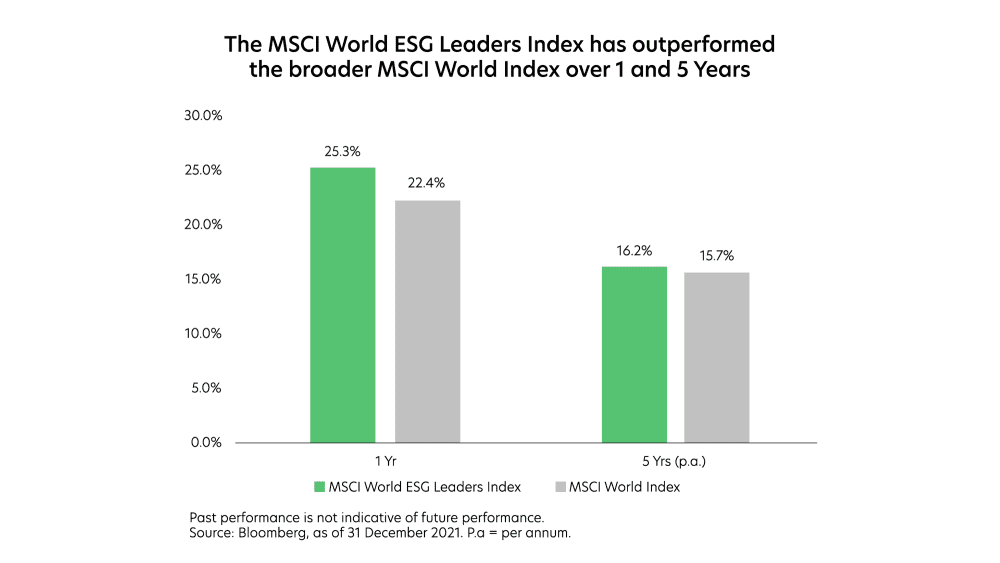

The MSCI World Index is a stock market index of 1,517 companies from 23 countries. The MSCI World Index is commonly used to represent a broad cross-section of global markets. On the other hand, the MSCI World ESG Leaders Index comprises 713 companies with high ESG performance relative to their sector peers.

As of 31 December 2021, the MSCI World ESG Leaders Index has beaten the MSCI World Index over the past one and five years respectively.

The MSCI World ESG Leaders Index is just one example which shows a positive correlation between high ESG scores and price performance. (However, correlation does not equal causation. An argument could be made that well-performing companies are more likely to end up implementing ESG policies in the first place, instead of ESG practices driving share price performance.)

Building on from the examples above, we’ve seen how certain EV companies have seen tremendous growth over the past few years. Moving forward, the EV market is expected to grow by a compound annual growth rate of 21.7% from 2022 to 2030. Similarly, research has shown that sustainable palm oil companies have also done better than bad actors in the industry.

As structural and consumer trends shift toward a more sustainable economy, companies able to ride on those trends could stand to benefit the most in terms of drawing in investor capital, while those that ignore them face the risk of being left by the wayside.

How to avoid greenwashing

Greenwashing is about misleading on environmental claims. The term was first coined by New York environmentalist Jay Westerveld in 1986 when he noticed that the hotel industry encouraged customers to reuse towels to ‘save the environment’, but the hotels did little else in environmental or conversation efforts. Westerveld concluded that the hotels’ main motive was to increase profit and not to save the environment like they claimed.

Some would argue that it is unrealistic for any company to be fully sustainable or non-pollutive (unless we all head back to the Stone Age). At the same time, investors who are seeking sustainable investment options need to discern between greenwashing (deceptive/false claims) and companies that are taking meaningful action toward sustainability.

Just like any investment, investors need to take the time to read a company or fund’s prospectus and sustainability reports to make an informed decision about its sustainability efforts. Additionally, investors can rely on reputable institutions for research and data on whether a company or fund takes sustainability seriously and is out there to truly make a difference.

The fifth perspective

Ultimately, ESG and sustainable investing are about managing risks over the long term, channeling our capital into companies attempting to improve our world, and aligning our investments with our values. For example, do you care about the environment and sustainable efforts? Do you wish for companies to create a positive social impact for the communities and people they serve? Do honesty, transparency, and respecting minority shareholder rights matter to you?

If so, then ESG investing is something that you may want to genuinely consider for your portfolio. And that your money and investment go to companies that are truly seeking to make the world a better place for all of us.

Invest where it matters. Discover how you can make a positive impact and build a sustainable investment portfolio with UOB. Developed in consultation with ESG and industry specialists, UOB’s sustainable investing framework is a methodology that enables UOB to screen, score and monitor each investment to bring you sustainable investment solutions suited to your risk profile, needs, and values.

Find out more about UOB’s sustainable investments here. To watch the full discussions between The Fifth Person and UOB on sustainable investing, visit The Fifth Person’s YouTube channel.

This article was written in collaboration with United Overseas Bank Limited (“UOB”).

All views expressed in this article are the independent opinions of The Fifth Person. The information in this article is meant purely for informational purposes and should not be relied upon as financial advice.

This article should not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this article constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this article, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the articles, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. The views expressed in the articles within this publication are solely those of the authors’, reflect the authors’ judgment as at the date of the articles and are subject to change at any time without notice. As such, UOB and its employees accepts no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this article.

This advertisement has not been reviewed by the Monetary Authority of Singapore.