Why most experts can’t beat the market, but you can

It’s common knowledge among the investment community that many actively managed funds underperform the market over the long term. For example, one study found that 95.56% of all actively managed large-cap funds in the U.S. underperformed their respective benchmarks over a 20-year period (from 2002 to 2021).

In 2007, Warren Buffett famously bet a million dollars that a low-cost S&P 500 index fund would outperform a group of high-cost hedge funds over a 10-year period. (Even though Buffett himself is a counterexample of someone who has beat the market.) In the end, Buffett won his bet and donated the million dollars to charity.

So why can’t experts beat the market?

In fact, experts can beat the market – but it’s extremely hard to do so consistently over a long period of time. The biggest challenge that successful fund managers face is the law of large numbers. When a fund does well, it naturally attracts more investment. But the larger the fund, the harder it is for the manager to achieve the same level of performance. (It’s much easier for a $100 million fund than a $10 billion fund to double in size and so on.) On the other hand, if a fund does poorly enough, it simply closes down. Too bad.

At the end of the day, picking the right fund to stick to over the long term is just as challenging as picking the right stock. At the same time, active funds offer one more significant disadvantage for investors – they charge high fees.

‘A number of smart people are involved in running hedge funds. But to a great extent their efforts are self-neutralizing, and their IQ will not overcome the costs they impose on investors.’ – Warren Buffett

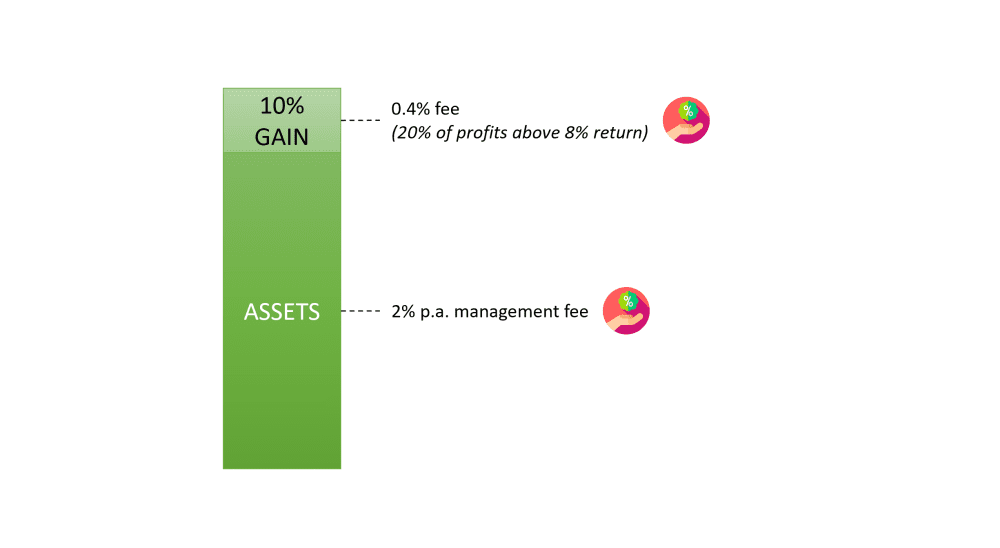

2 and 20: how to calculate fund management fees

Many active funds charge a standard ‘2 and 20’ fee: 2% annually for assets under management and 20% of profits above a minimum threshold. For example, let’s say a fund charges a 2% management fee and 20% of profits above an 8% return. So if the fund generates a total return of 10% for the year, you only take home 7.6% and the fund earns 2.4% in fees.

Many beginner investors make the mistake of thinking that 1-2% in fees is a small amount. But looking at the example above, you essentially share a quarter of those 10% returns to the fund. And if the fund only made a 4% return that year, you share half of your returns due to the management fee. Not only that, you still pay the 2% management fee even when the fund loses money. Stretch this out over long period of time and the fees really add up. In fact, an extra 1% in fees could cost an investor $590,000 in sacrificed returns over a 40-year period!

‘Performance comes, performance goes. Fees never falter.’ – Warren Buffett

Minimise your fees as much as possible

Knowing that fees can eat into a chunk of returns, it makes sense to minimise your fees as much as possible, especially when low-cost options are so easily available nowadays. Passive investors can pick from a wide range of low-cost index funds like the Vanguard S&P 500 ETF which has an expense ratio of only 0.03% per annum. That works out to just $3 in fees for every $10,000 invested!

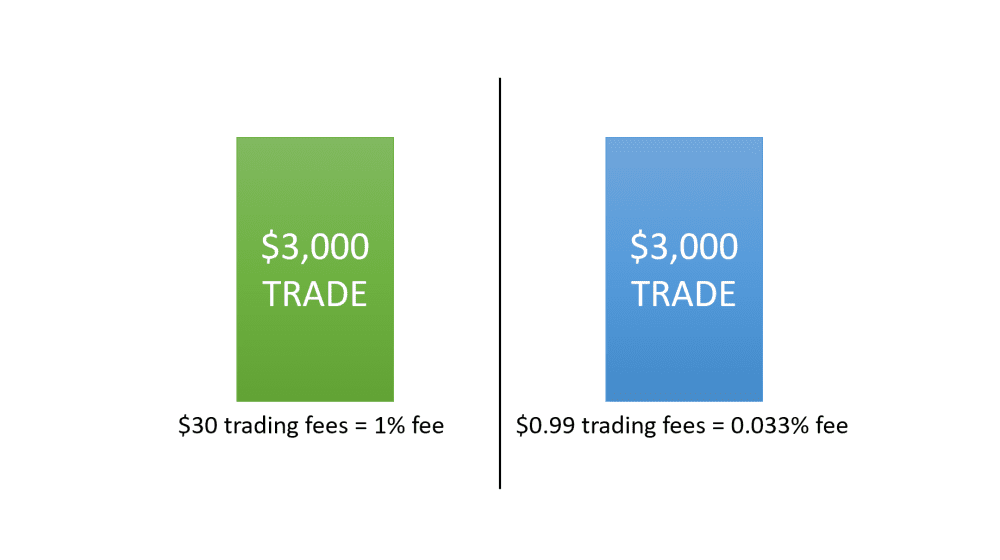

The same is true for brokerage fees. High brokerage fees can eat into your returns, especially if your starting capital is small. For example, if your broker charges $30 per trade, that’s effectively a 1% fee on a $3,000 investment in one stock. Then when you sell, you incur another 1% fee (assuming the stock didn’t move in value). If you’re a trader, the fees can really add up as you enter and exit multiple positions.

In comparison, a low-cost brokerage like Futu SG (moomoo) makes a world of difference when it comes to reducing your brokerage fees. If you are deciding on how to buy US stocks in Singapore, Futu SG (moomoo) now offers lifetime zero-commission trades*, and zero platform fees for one year* (a flat $0.99 per trade thereafter) for all U.S. stocks and ETFs.

This essentially means you eliminate your brokerage fees when you trade U.S. stocks with moomoo in the first year of opening your account. Even after the first year, the tiny $0.99 platform fee works out to just 0.033% in fees for a $3,000 investment in one stock. A world of difference.

Why you can beat the market

It’s easy to think that we can’t do as well as the expert fund managers investing in the stock market, but we have two key advantages as a retail investor: 1) we don’t typically deal with very large sums of capital, and 2) we can reduce or eliminate our fees to nearly zero. (On the other hand, running a fund incurs costs and overheads).

Think about it. Unlike an active fund manager, you’re under no pressure to invest from clients who financed large sums and oftentimes expect immediate returns. You only have yourself (and maybe your family) to answer to, and you have the space and choice to make the best investment decisions for your personal financial situation and investment goals. With low-cost ETFs and brokerages available to retail investors today, you have all the tools you need to succeed over the long term.

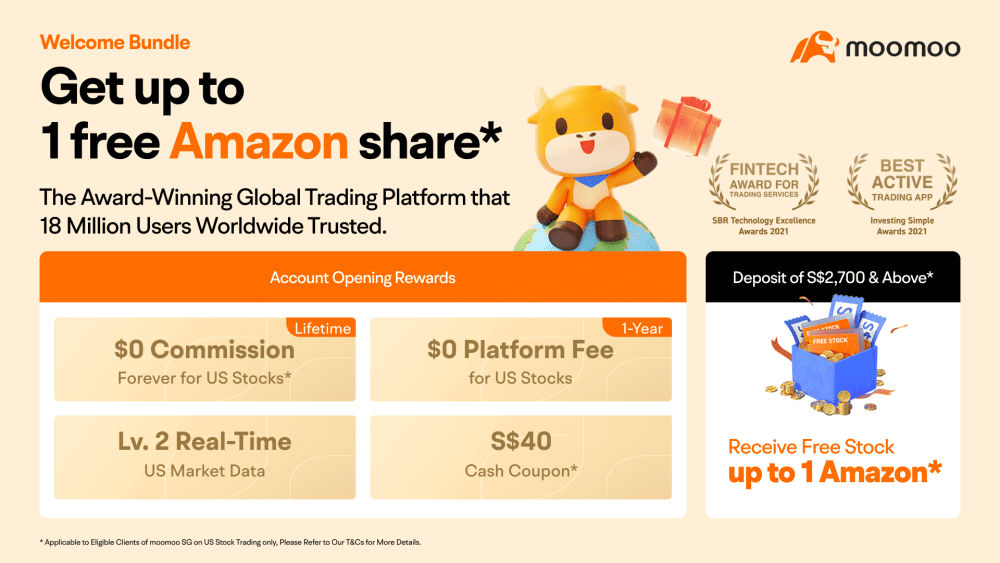

How to buy US stocks in Singapore with moomoo. FUTU SG via moomoo trading app has announced a lifetime $0 commission on US market for existing and new users. They are offering one of the most competitive trading fees across US, HK, SG & China A Shares with real-time quotes and level 2 US market data.

When you successfully register for your securities account via the moomoo app, you will get to enjoy $0 commission-free* trading for the U.S. stock markets, platform fees will be waived for the first year. You would also gain free access to Level 2 market data for the U.S. stock market; Level 1 market data for the Singapore stock market; Level 1 market data for China A Shares. From now till 23 September 2022, you also receive one FREE Amazon share* when you deposit S$2,700 in your moomoo account.

Investment products available through the moomoo app are offered by Futu Singapore Pte. Ltd., a capital markets services licence holder regulated by the Monetary Authority of Singapore. Futu Singapore’s parent company, Futu Holdings Limited, is backed by world-class investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Open your FUTU SG securities account today with moomoo here. *Terms and conditions apply.

Open an moomoo account here to get the rewards.

This article was written in collaboration with Futu Singapore Pte. Ltd. All views expressed in the article are based solely on The Fifth Person’s independent opinion.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Hello Adam Wong,

i’m so disappointed to find our that the moomoo is not a regulated broker in Singapore after checking it out in MAS regulation website hence sorry to say that this is scam.

Hi Shahamad,

Moomoo (Futu Singapore) is regulated by the MAS and holds a Capital Markets Services license: https://eservices.mas.gov.sg/fid/institution/detail/235399-FUTU-SINGAPORE-PTE-LTD

It is also the first digital brokerage in Singapore to obtain all trading approvals from SGX: https://finance.yahoo.com/news/moomoo-poised-become-first-full-054000503.html

Hi Adam,

I have to say that my experience with MooMoo is fantastic. Forget the naysayers ! I am one happy MooMoo client and I am happy to add on more $$ to MooMoo each month as I continue to dollar cost average in the current bear market. One of the rare few bear markets in our lifetime ! Very good opportunity to buy into good businesses !

Thanks James! Shahamad brought up a great point; you do want your broker to be regulated. Was correcting the fact that moomoo is indeed regulated by the MAS.

Adam, I think there’s one simple reason that most professional fund managers can’t beat the market. It’s because “they are the market”. The big traders running the biggest portfolios are the people who drive price changes, far more so than the small retail investor. Whenever these “big boys” make a big trade it ends up being noticed, whereas the small investors just get lost in the noise. So it’s hardly surprising that in a typical year only around 20% of professional fund managers outperform the typical benchmark index.

For me, a classic local example is the Straits Times Index (STI). Frankly most of the index components have gone ex-growth because they seem to struggle to expand outside Singapore. However, if we look at the index components that have generally succeeded outside the domestic market they’ve outperformed the index quite nicely. So whereas a fund manager will tend to hold a bit of everything in the index mostly with a market cap weighting, the small investor can ignore the ex-growth stocks and focus on the value-growth element. Of course if we dollar cost average into a STI index fund then we can still do OK, and overall returns are probably going to be better than some of the “professional fund managers” and very often better than most of the unit trusts etc (some of which have been caught buying index funds themselves!).

Thanks Jonathan! Good points as always! Yes, the institutions are the market. In fact, institutional investors account for more than 85% of the volume of trades on the New York Stock Exchange.