Frasers Commercial Trust (SGX: ND8U) is a Singapore REIT that invests in a portfolio of commercial office properties. As at 30 September 2017, it has six properties located in Singapore and Australia valued at S$2.1 billion.

In this article, I’ll bring a detailed account of Frasers Commercial Trust’s developments since its listing, the individual performances of its existing properties so far, their impact on the group’s financial results and updates on Frasers Commercial Trust’s plans for the future. Therefore, here are the 14 things you need to know about Frasers Commercial Trust before you invest.

Portfolio reshuffling

1. Frasers Commercial Trust (FCOT) was originally listed as Allco Commercial REIT on 30 March 2006. In August 2008, Frasers Centrepoint Limited (FCL) acquired Allco Commercial REIT and renamed the REIT to its present name in October the same year. Since there, FCOT reshuffled its portfolio by:

- Retaining properties from the initial portfolio: China Square Central, Singapore; 55 Market Street, Singapore; Central Park, Australia; Caroline Chisholm Centre, Australia

- Acquiring properties: Alexandra Technopark, Singapore (2009); 357 Collin Street, Australia (2015)

- Divesting properties: – Cosmo Plaza, Japan (2011); Australia Wholesale Property Fund (2011); KeyPoint, Singapore (2012); Azabu Aco Building, Japan (2012); Galleria Otemae Building, Japan (2012); Ebara Techno-Serve HQ Building, Japan (2012)

Singapore properties

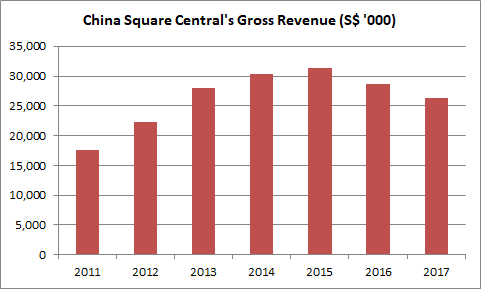

2. China Square Central is a development that comprises a 15-storey office tower and a retail podium located in the central business district of Singapore. In 2017, the property was valued at S$565.0 million, accounting for 26.9% of FCOT’s portfolio value. Since 2016, China Square Central is undergoing an asset enhancement initiative (AEI), causing its occupancy rate to decline from 96.2% in 2015 to 79.8% in 2017. As a result, gross revenue also fell from S$31.4 million in 2015 to S$26.2 million in 2017.

Source: Annual Reports of Frasers Commercial Trust

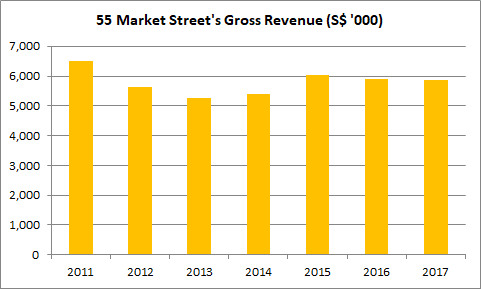

3. 55 Market Street is a development that comprises 15 floors of office space and two floors of retail space located at Raffles Place, Singapore. In 2017, the property is valued at S$139.0 million, accounting for 6.6% of FCOT’s portfolio value. It enjoys a 90% occupancy rate with a pool of 17 tenants. Corporate Serviced Offices Pte Ltd is the main tenant as it leases 16.6% of the total net lettable area (NLA) of the building. Overall, 55 Market Street has been contributing S$5-S$6 million per annum in gross revenue since 2012.

Source: Annual Reports of Frasers Commercial Trust

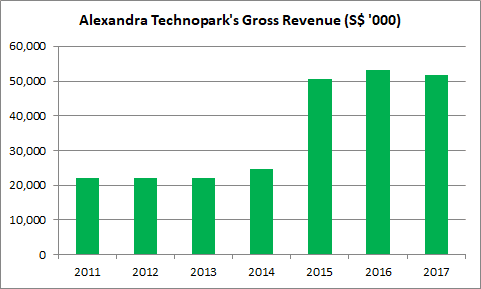

4. Alexandra Technopark is a development that comprises two high specification business space blocks located at Alexandra, Singapore. The property was acquired by FCOT on 26 August 2009 for S$342.5 million. In 2017, it was valued at S$508.0 million, accounting for 24.2% of FCOT’s portfolio value. Before 2014, the property derived a fixed master lease rent of S$22.0 million annually from Orrick Investments Pte Ltd. On 25 August 2014, the master lease was not renewed which allowed FCOT to receive rental income directly from its tenants at Alexandra Technopark. As a result, FCOT reported an increase to S$50.0 million a year in gross revenue from 2015 to 2017.

Source: Annual Reports of Frasers Commercial Trust

Australia properties

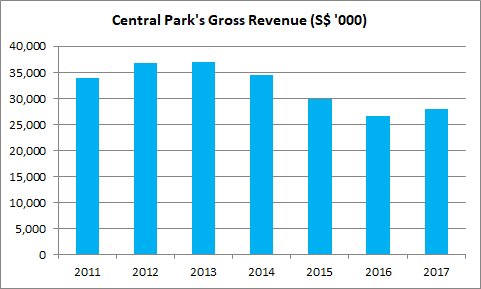

5. FCOT has a 50% interest in Central Park, a 47-storey premium grade office tower located in Perth, Australia. In 2017, FCOT’s 50% interest is valued at S$289.8 million, accounting for 13.8% of FCOT’s portfolio. Central Park has reported a continuous reduction in occupancy rate, from 99.7% in 2011 to 88.9% in 2017. CEO explained at the Fraser Commercial Trust 2017 AGM that the fall in occupancy is due to the slump in the mining industry and economy in Perth. Likewise, Central Park’s gross revenue has dropped from S$36.7 million in 2011 to S$27.9 million in 2017.

Source: Annual Reports of Frasers Commercial Trust

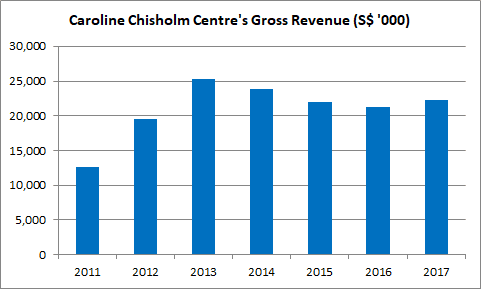

6. FCOT acquired a 50% interest in Caroline Chisholm Centre on 18 June 2007. Subsequently, it acquired the remaining 50% interest on 13 April 2012. Combined, the acquisition price for the property was S$244.4 million. In 2017, Caroline Chisholm Centre is valued at S$265.9 million, accounting for 11.6% of FCOT’s portfolio. The building is a five-storey Grade A office complex which is leased to the Commonwealth Government of Australia for a lease term of 18 years commencing on 5 July 2007, with a 3% annual rent increment. Gross revenue has dropped from S$25.3 million in 2013 to S$22.2 million in 2017 due to the weakening of the Australian dollar against the Singapore dollar.

Source: Annual Reports of Frasers Commercial Trust

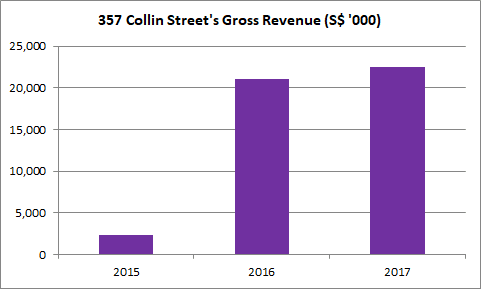

7. On 18 August 2015, FCOT acquired 357 Collin Street for S$226.6 million. It is a 25-storey Grade A prime office building located in the Melbourne central business district. In 2017, it is valued at S$303.1 million, accounting for 14.4% of the FCOT’s portfolio. It enjoys a 100% occupancy rate with 34 tenants. The Commonwealth Bank of Australia is its anchor tenant as it presently leases 42.4% of the property’s total NLA. 357 Collin Street has seen a steady increase in gross revenue from S$21.1 million in 2016 to S$22.5 million in 2017.

Source: Annual Reports of Frasers Commercial Trust

Group financials

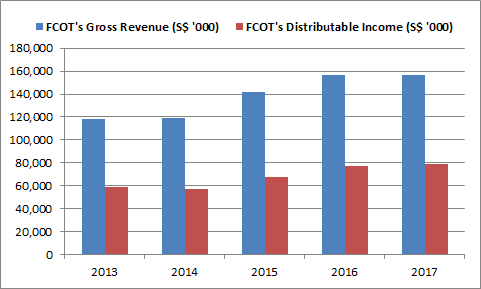

8. FCOT has achieved growth in both gross revenue and distributable income over the last five years. Gross revenue has grown from S$118.2 million in 2013 to S$156.6 million in 2017. Distributable income has increased from S$58.8 million in 2013 to S$78.6 million in 2017.

Source: Annual Reports of Frasers Commercial Trust

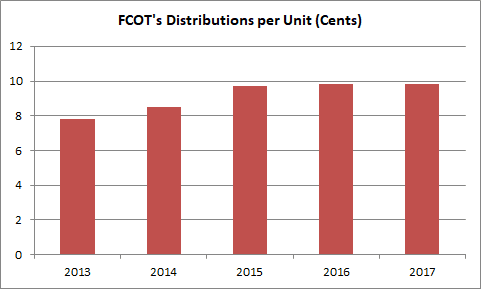

9. FCOT has steadily increased its distributions per unit (DPU) from 7.83 cents in 2013 to 9.82 cents in 2017. As at 15 January 2018, FCOT’s share price is trading at S$1.49. If FCOT is able to maintain its DPU at 9.82 cents, its expected gross dividend yields is 6.59%.

Source: Annual Reports of Frasers Commercial Trust

Income visibility and growth

10. As at 30 September 2017, the top 10 tenants accounted for 59.9% of FCOT’s gross rental income. Of which, five of these tenants have long-term leases, adding to FCOT’s income visibility for years to come:

| Tenant | Lease Expiry | % of Gross Rental Income |

|---|---|---|

| Commonwealth of Australia | Jul 2025 | 15.2% |

| Rio Tinto Ltd | Jun 2030 | 7.0% |

| Commonwealth Bank of Australia | Dec 2022 | 6.0% |

| Microsoft Operations Pte Ltd | Jan 2022 | 2.8% |

| Suntory Beverage & Food Asia Pte Ltd | May 2020 | 2.6% |

Source: Annual Reports of Frasers Commercial Trust

11. FCOT is embarking on a S$38 million AEI to rejuvenate the retail podium at China Square Central. Upon completion, it expects to increase its NLA from the current 64,000 square feet to 75,000 square feet. The project is expected to start in Q1 2018 and completed by mid-2019, which is in conjunction with the launch of the Capri by Fraser Hotel at China Square Central.

12. FCOT is progressing with a S$45 million AEI at Alexandra Technopark to create “a new campus environment that will provide a stimulating and inspiring work environment for the working community at Alexandra Technopark”. This project commenced in Q1 2017 and will be completed around mid-2018.

13. On 14 December 2017, FCOT and its sponsor, Frasers Centrepoint Limited entered a 50:50 joint venture agreement to purchase Farnborough Business Park for £174.6 million (or S$314.8 million). It is a 46.5-hectare freehold business park comprising 14 commercial buildings with a total NLA of 555,000 square feet located west of London, United Kingdom. It has a long weighted average lease expiry of 8.3 years and enjoys a 98.1% occupancy rate with a tenant base of 36 tenants. The acquisition is expected to be completed January 2018.

Risks

14. Hewlett-Packard as a collective group — Hewlett-Packard Enterprise Singapore (HPE) and Hewlett-Packard Singapore (HPS) — accounted for 18.2% of FCOT’s gross revenue in 2017, making it a significant income contributor. Unfortunately, HPE decided not to renew its lease. On 22 September 2017, HPE informed FCOT that it would vacating 178,843 square feet (out of 191,846 square feet) of its space at Alexandra Technopark upon expiry in September and November 2017. Likewise, HPS informed FCOT that it will only extend a portion of its lease by between 2-13 months from 1 December 2017.

The fifth perspective

Since 2013, Frasers Commercial Trust has delivered growth in gross revenue and distributable income to its unitholders after it reshuffled its portfolio. Moving ahead, FCOT looks ready to achieve long-term growth and deliver stable distributions to unitholders. In the short term, however, the REIT has to find a way to replace Hewlett-Packard’s vacating its lease as it accounts for substantial part of its revenue.