4 free stock screeners to find investment ideas from all over the world

“What do you usually use to screen for companies?”

This is one of the most frequent questions we get from our readers and attendees of our Dividend Machines and Investment Quadrant courses.

When Warren Buffett started out in 1951, he had to go through 20,000 pages of Moody’s Manuals page by page to look for undervalued stocks. Fortunately for us, those days of flipping through tomes of yellow pages are behind us. Today, with the power of technology and the Internet, we have access to a number of stock screeners for free. With a click of the mouse, we can generate a list of companies that meet our criteria in a matter of seconds.

Before you jump to the free stock screeners I’ve listed below, keep in mind that screeners provide the convenience for gathering data, but they are not a substitute for doing your own due diligence. Most screeners’ databases are updated and maintained by data entry specialists. They can be prone to human error, so ensure that you cross-check the data you gather from screeners with the data in the annual reports.

With that said, here are four free stock screeners you can use to shortlist companies from any part of the world:

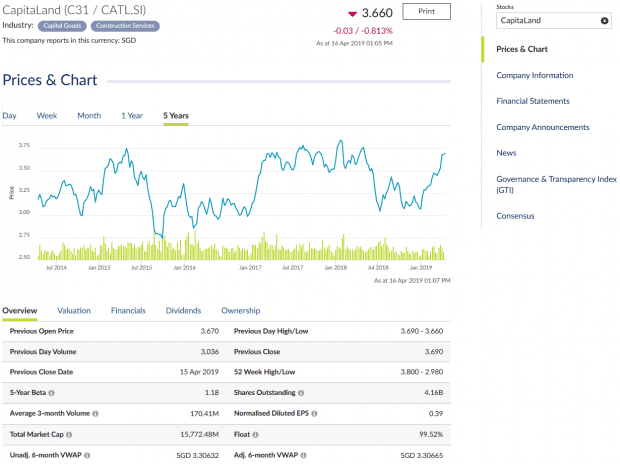

1. SGX StockFacts

Looking for companies listed on the sunny island of Singapore? SGX StockFacts is the screener for you. The screener is a collaboration between SGX and Refinitiv.

You can filter companies listed on the SGX based on 15 search criteria including P/E, yield, and ROE.

If you are lost and don’t know where to start, here are 4 financial ratios to screen for potential investment ideas fast. We show you a step-by-step example of how to use StockFacts to screen for potential investments based on revenue growth, net profit margins, return on equity, and debt-to-equity.

When you select a particular stock, you can view the company’s profile, financials, chart, dividends, latest news, and more!

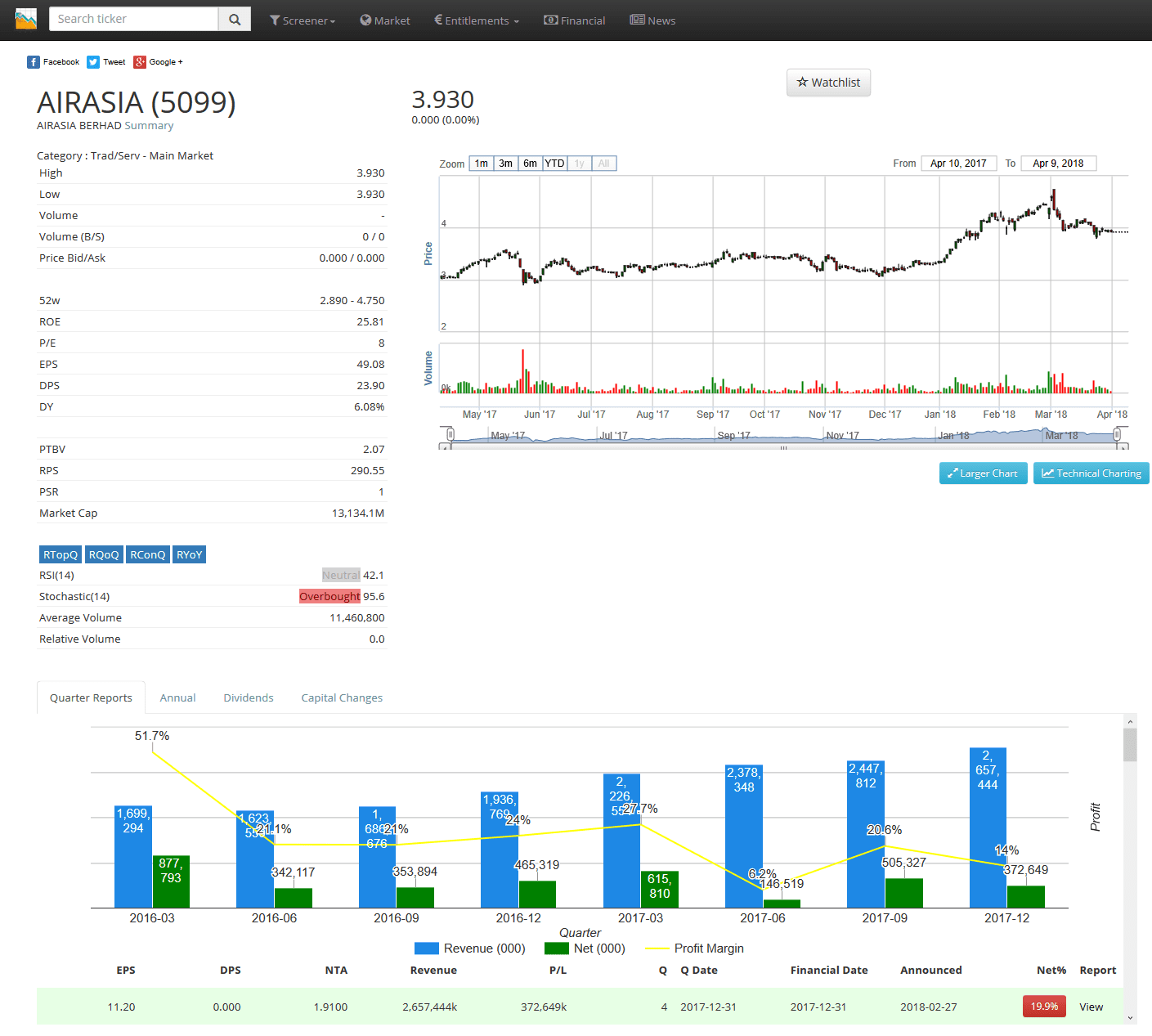

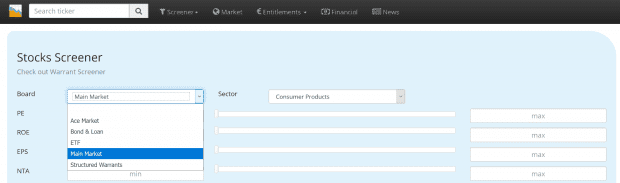

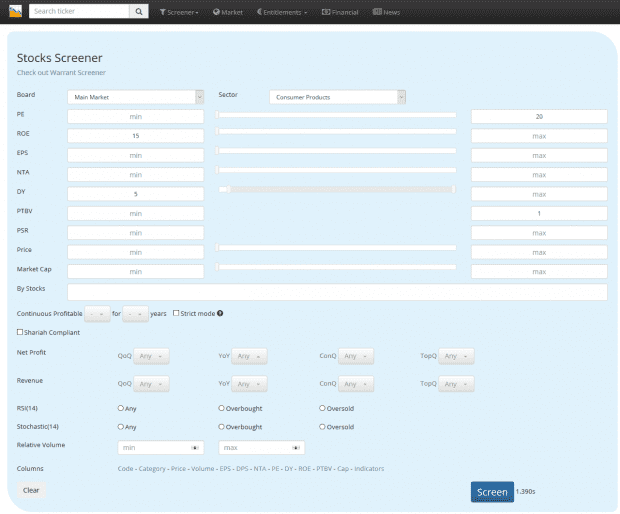

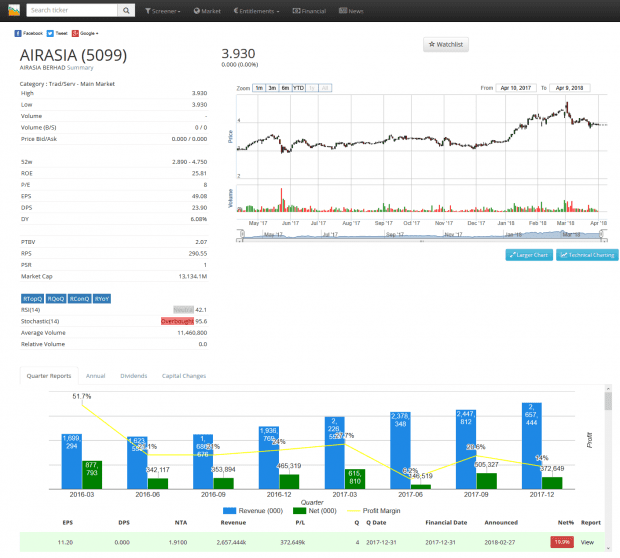

2. KLSE Screener

For companies in listed on Bursa Malaysia, KLSE Screener is a great free option. You can click on Board to sort based on the market they trade in: Ace Market, Bond & Loan, ETF, Main Market, and Structured Warrants. You can find the majority of companies on the Main Market, while the Ace Market is where smaller Malaysian companies and start-ups are listed (similar to the Catalist board in Singapore).

From there, you can narrow down your search by selecting a sector and a range of fundamental and technical criteria.

When you select a particular stock, you can view the company’s summarised financials, charts, dividends, recent news/announcements, and more.

If you prefer a paid stock screener with more comprehensive data and detailed reports Malaysian stocks, you can check out BursaKing.com.

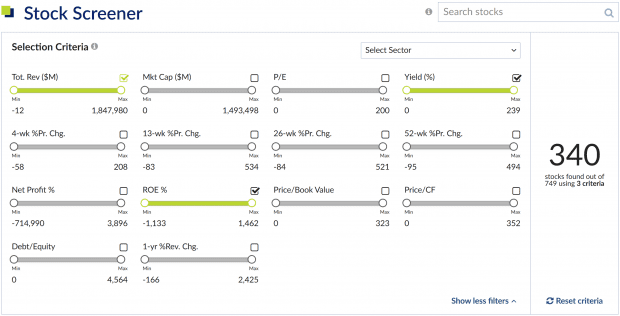

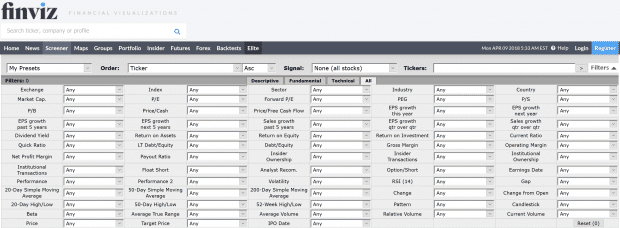

3. Finviz

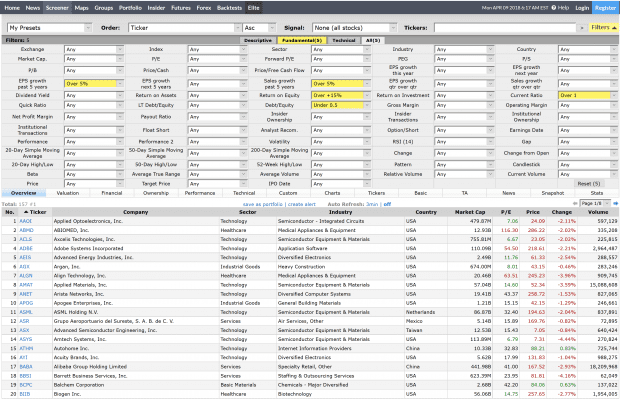

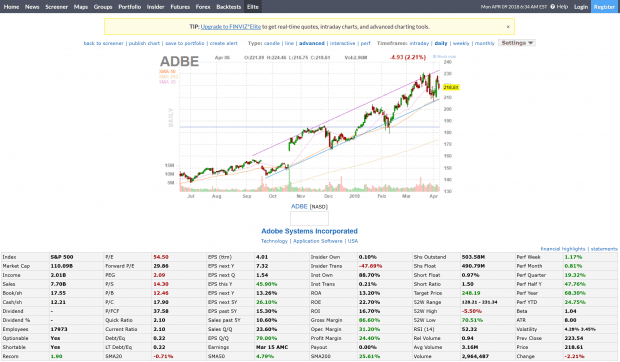

When it comes to the U.S. stock market, Finviz is one of my favorite screeners. It is very comprehensive and packed with features. You can screen stocks based on a wide range of fundamental and technical criteria.

For example, based on the five metrics I used above, I generated a list of 157 companies.

When you select a particular stock, you can view the company’s chart, financial ratios, analyst views, and insider trades.

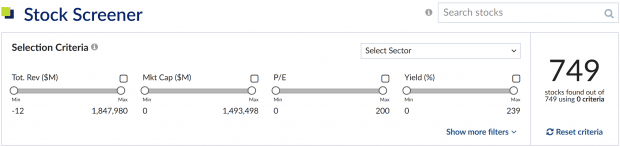

4. Yahoo Finance

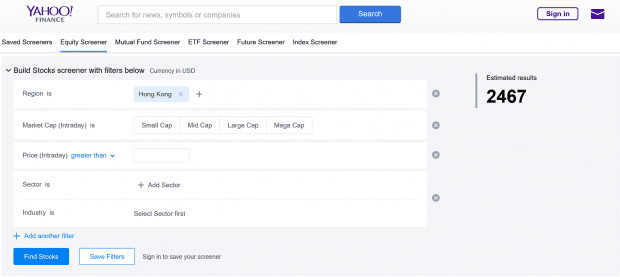

Yahoo Finance is one of the most versatile of all free stock screeners.

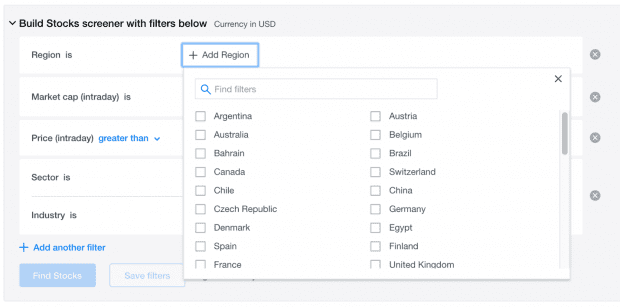

You can screen for companies from all over the world including Singapore, Malaysia, Hong Kong, Thailand, Australia, the UK and the U.S.

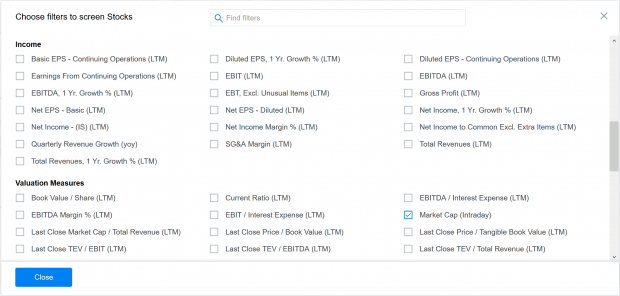

You can select from a wide range of search criteria grouped according to Share Statistics, Income, Valuation, Cash Flow, ESG Scores, and more!

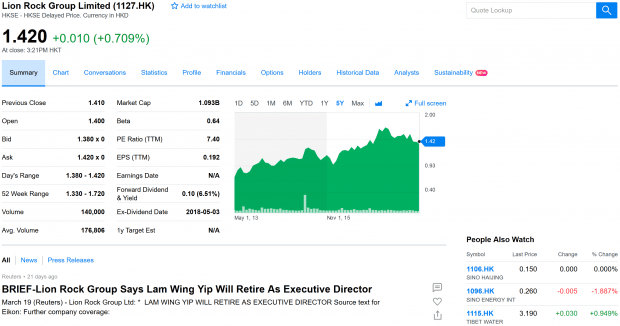

When you select a particular stock, you can view the company’s chart, key ratios, financials, analyst views, and more.

Although each of the free stock screeners mentioned above are by no means perfect, it does a pretty good job of shortlisting the potential companies of your choice. Take your time to familiarize yourself with the screeners and find one that is suitable for you needs. Happy hunting!

Any good stocks for my retirement holding (Singapore and HK or Malaysia )

Thanks

Hi Chan,

We can’t make any stock recommendations, but you may like to read more about income investing:

https://fifthperson.com/5-reasons-why-you-should-invest-in-dividend-stocks/

https://fifthperson.com/5-reasons-invest-s-reits/

https://fifthperson.com/top-10-singapore-reits-that-made-you-money-if-you-invested-from-their-ipo/

Very informative without being too long, thanks. I am not sure, how I would be able to trade without a stock screener. It helps a lot with making decisions. I found a great tool in Wallmine where I transferred my portfolio from Yahoo