A monopoly is defined as ‘a market structure where a single seller or producer assumes a dominant position in an industry or a sector’. For example, Genting Malaysia is the only licenced casino in Malaysia and monopolises the country’s casino market. Google dominates the global search engine market with a market share of 83.8%. Many of us use Google daily and we sometimes even replace the word ‘search’ with ‘Google’. These monopolies are well-known and obvious.

However, in this article, I will explore three companies that you may not have heard of that monopolise their respective industries.

EssilorLuxottica

Listed on Euronext Paris, EssilorLuxottica designs, makes, distributes, and sells lenses, frames, and sunglasses. The company owns more than 150 prominent brands including lens brands like Essilor and Crizal, as well as eyewear brands like Ray-Ban and Oakley. (In case you don’t know yet, Captain Pete ‘Maverick’ Mitchell, played by Tom Cruise, also wears a Ray-Ban in the movie Top Gun: Maverick.)

It runs approximately 18,000 optical retail stores worldwide such as Sunglass Hut; LensCrafters in North America; Apollo in Europe, the Middle East, and Africa; as well as Spectacle Hut in Singapore. It even sells optical instruments and equipment to opticians, optometrists, and ophthalmologists. It also produces eyewear and/or sunglasses with prescription lenses for over 20 designer brands including Prada and Miu Miu. The market capitalisation of the French-Italian company is €62 billion at the time of writing.

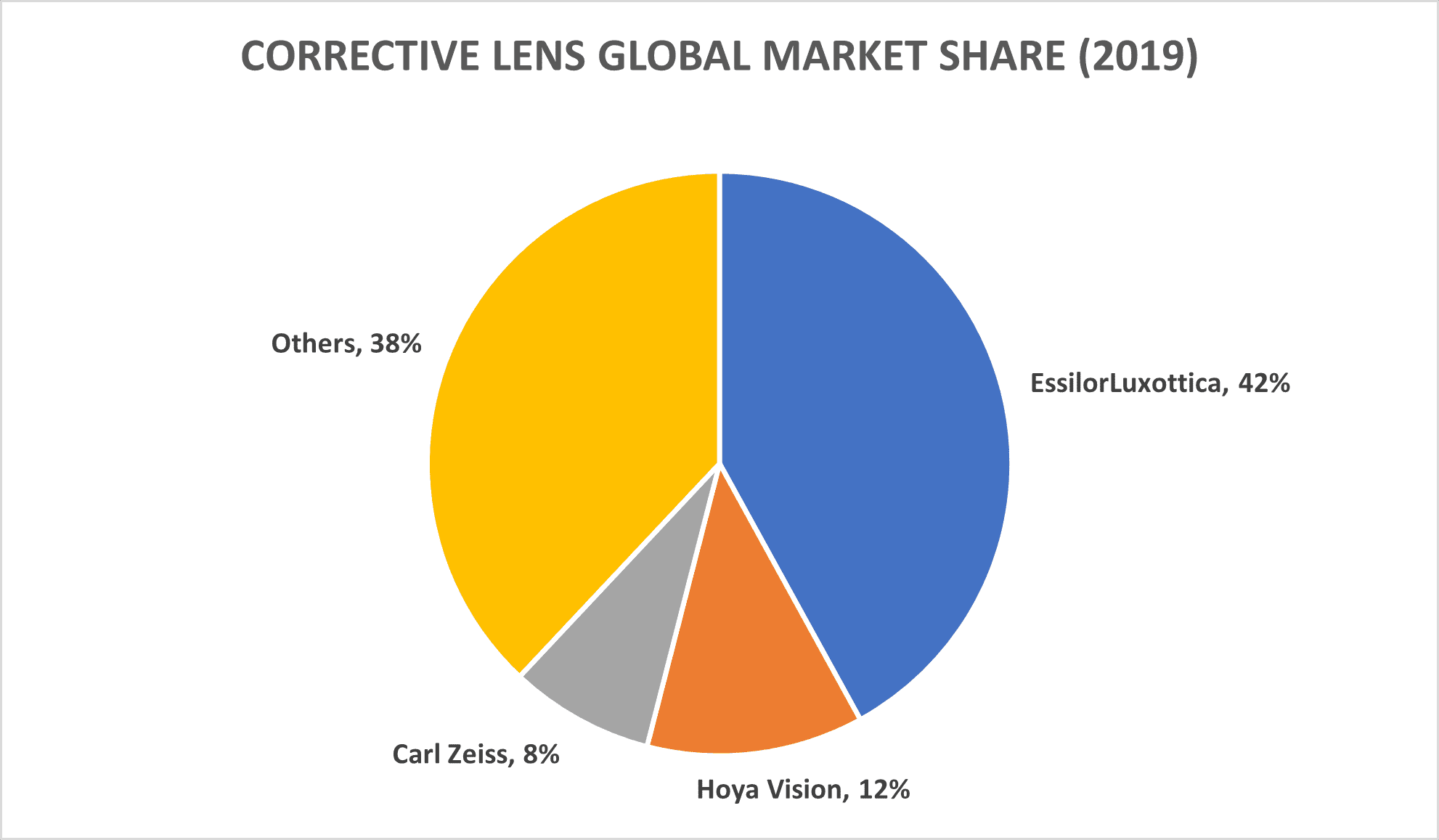

EssilorLuxottica’s brand equity, wide distribution network, and economies of scale contributed to the company’s dominant position in the global corrective lens market. In 2021 alone, it produced 565 million prescription lenses and 66 million pairs of non-prescription sun lenses. Some of us may have bought a pair of lenses or frames produced by EssilorLuxottica unknowingly!

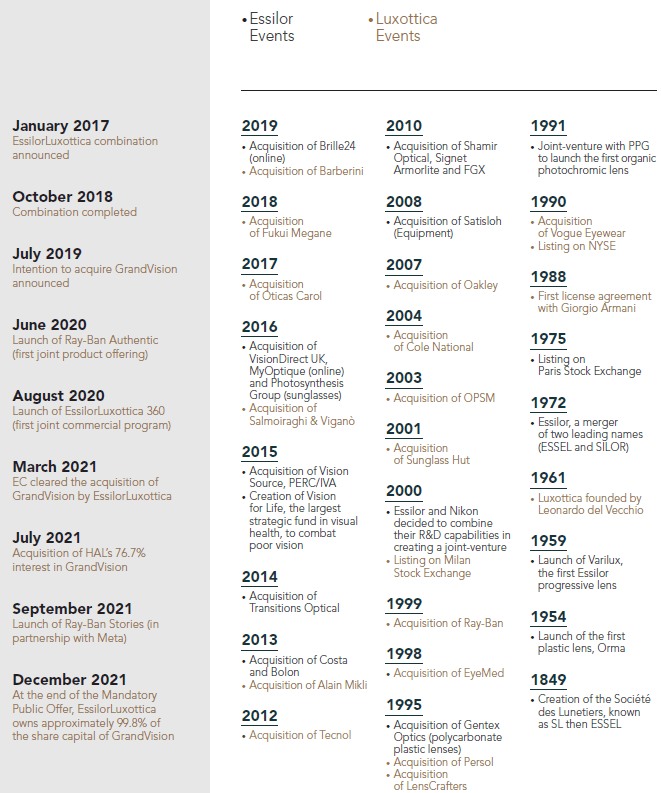

The optical giant was formed in 2018 between the merger of French lens maker Essilor and Italian eyewear company Luxottica. As shown in the table below, the company has relied on acquisitions in the past to fund its growth and bolster its dominant position in the global eyewear industry including the hostile takeover of Oakley.

Its recent major acquisition of competitor GrandVision was finalised in 2021 at a price tag of €7.2 billion and will further cement its monopolistic position. As a result of its vertically integrated operations and monopolistic presence, the company often marks up its lenses and frames by about 1,000%.

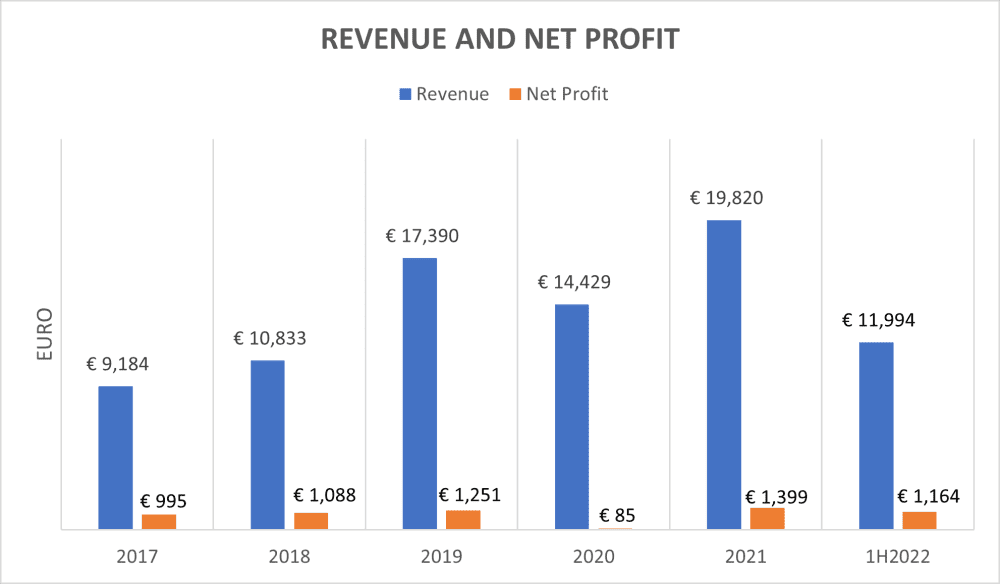

EssilorLuxottica’s revenue and net profit excluding other income reached all-time highs in 2021. In the past five years, thy recorded a compound annual growth rate of 21.2% and 8.9% respectively.

The company was hit by COVID-19 in 2020 but emerged stronger post-pandemic. As evident in its recent outstanding half-yearly results, it will mostly deliver another record year in 2022.

Taiwan Semiconductor Manufacturing Company

Founded in 1987 and listed on both the Taiwan and New York Stock Exchange, Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world’s largest dedicated semiconductor foundry. Most of TSMC’s plants are in Taiwan and it is the largest company there by market capitalisation. TSMC manufactures chips (that are widely used in smartphones, laptops, and electric cars) for fabless semiconductor companies and integrated device manufacturers like Apple, Nvidia, and Intel. However, TSMC remains relatively low-profile while its clients like Apple enjoy the limelight every time it launches newer and shinier consumer products.

The foundry business has a high entry to barrier which bodes well for TSMC. It costs billions of dollars to set up a chip manufacturing facility. In 2021, TSMC committed to spend US$100 billion over the next three years to boost its manufacturing capacity including setting up a US$12 billion Arizona plant in the U.S.

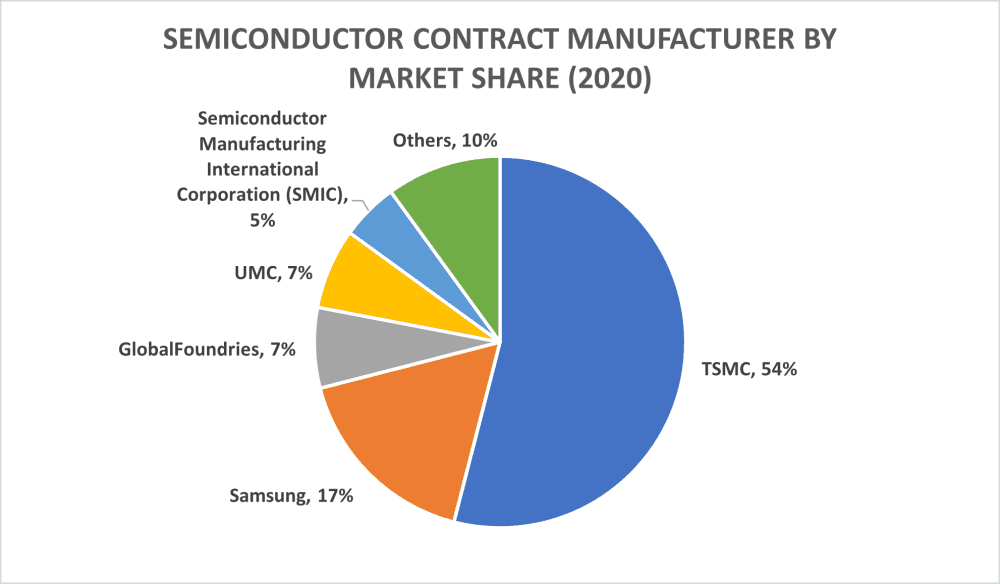

Trust matters in the semiconductor industry. Clients will not simply engage a new company to manufacture these critical components overnight. Further, foundries benefit from economies of scale that drives down the cost of production per unit. As TSMC outcompetes peers like United Microelectronics Corporation (which owned 7% of the global foundry share in 2020) and focuses on more advanced smaller chips, TSMC will stand to benefit. Further market consolidation gives advanced chipmakers like TSMC the pricing power to raise prices twice since 2021.

In addition, TSMC’s clients have a high switching cost to pay if they lose TSMC as a supplier. It takes a lot of resources and time to find a new supplier. It is also risky. Case in point: In 2020, Huawei’s revenue from its consumer business segment (consisting mostly of smartphone sales) accounted for slightly more than half of the company’s total revenue. The following year, segmental revenue dropped 49.6% from RMB482.9 million in 2020 to RMB243.4 million in 2021 after the U.S. imposed sanctions against Huawei that cut off more than 98% of Huawei’s smartphone-related chips from TSMC at that time.

In 2021, TSMC’s spending on research and development alone totalled NT$124.7 million and represented 7.9% of its annual revenue. The company is targeting to launch its 3-nanometer (nm, a nanometre is one billionth of a metre) technology commercially by the second half of this year, shortly after Samsung. The move will continue to maintain the duo’s technology lead and cement their market share in the semiconductor industry if they continue to achieve research breakthroughs.

Beyond that, patents also serve TSMC well. In December 2021, TSMC holds more than 50,000 patents globally. It filed the highest number of patents in Taiwan in 2021 and was the fourth largest patent receiver in the U.S. the same year.

ASML

Founded in 1984 in the Netherlands, ASML provides semiconductor manufacturers with chipmaking equipment and software. ASML’s business presence is spread across Europe, Asia, and the U.S. where its customers are based. The company is dual-listed on Euronext Amsterdam and NASDAQ, and boasts a market capitalisation of around US$180 billion.

ASML is a provider of lithography machines that are used by clients to print circuit patterns onto silicon wafers using lasers. It is the world’s biggest provider of lithography machines with a global market share of 62% in 2020, which has doubled since 2005.

ASML owns a monopoly in the top-end extreme ultraviolet (EUV) lithography segment as ASML’s competitors, like Nikon and Canon from Japan, can only manufacture lower-end deep ultraviolet technology machines. EUV lithography machines allows ASML’s clients like TSMC, Samsung, and Intel to manufacture smaller and more advanced 5- and 3-nanometre chips. These clients have no choice but to stick to ASML.

In 2021, ASML spent €2.5 billion on R&D. It is developing the next-generation EUV lithography system that allows its clients to manufacture chips with even smaller transistors. The smaller the transistors, the more transistors can be packed onto a chip, and the more powerful a chip can be.

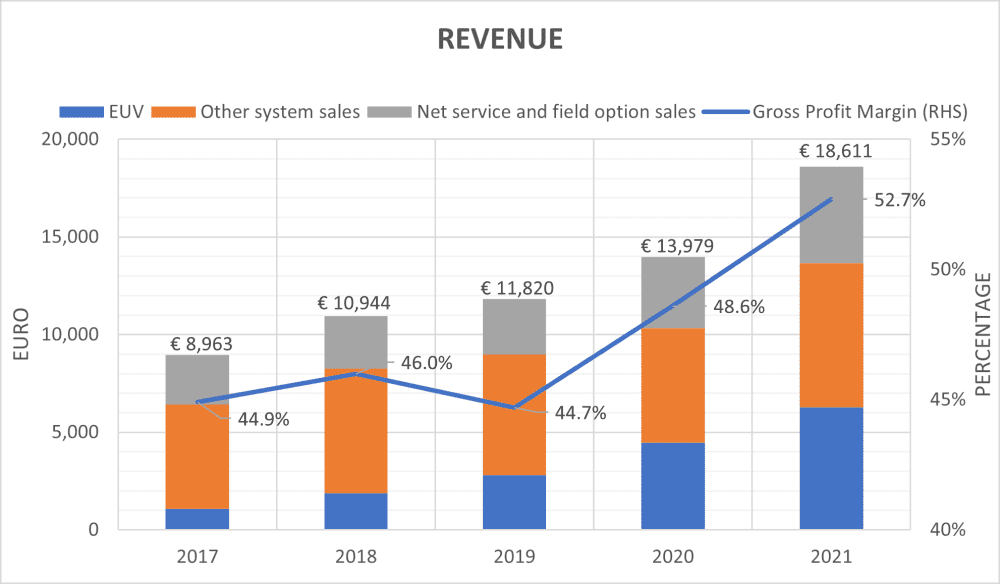

ASML’s proportion of revenue from EUV lithography segment grew from 12.1% in 2017 to 33.8% in 2021. The company expects the EUV lithography segment to account for about two-thirds of its total system sales by 2025 (currently 46.0% in 2021) as its clients upgrade from existing deep ultraviolet machines.

The EUV lithography segment delivered the fastest CAGR between 2017 and 2021 at 55.2%, enabling overall revenue to grow at a CAGR of 20.0% during the same period. At the same time, gross profit margins expanded from 44.9% to 52.7% within four years. ASML’s clients will continue to grow and so will the demand for EUV lithography equipment.

The fifth perspective

Revenue and net profit that increase year after year as well as stable (or growing) gross profit margins are often indicators that a company monopolises a market, which obviously make for great investments. However, investors may need to be aware of potential scrutiny from regulators and public as these companies risk getting split up due to antitrust regulations.

How do I receive regular up-date from you?

Hi HS, you can sign up to be notified of new articles and videos by clicking on the blue ‘Newsletter’ banner on the right sidebar 🙂