When it comes to social media, Facebook is the biggest name out there. What started as a social networking service for Harvard University students is now the largest social media company in the world with over 2.8 billion users across its various platforms.

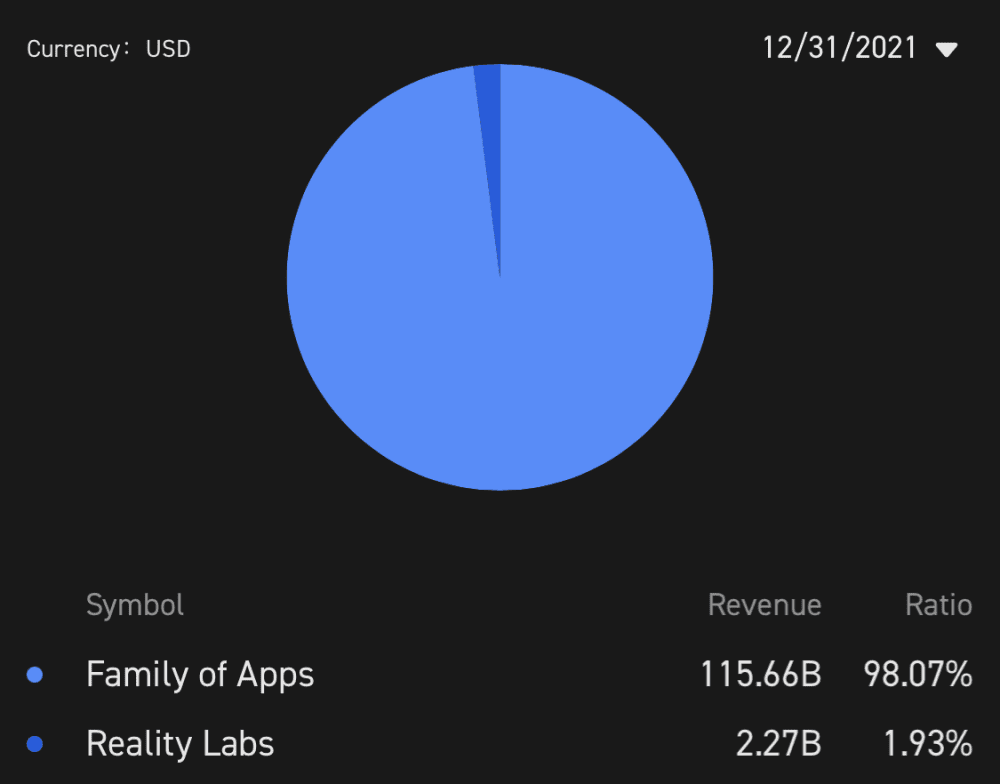

In October 2021, Facebook changed its name to Meta Platforms to emphasize its aim of building the ‘metaverse’ – a virtual world where people can socialise and connect with one another. To reflect its new focus, Meta reorganised its business into two new reportable segments: Family of Apps and Reality Labs.

The Family of Apps segment comprises Meta’s social and messaging platforms: Facebook, Instagram, Messenger, and WhatsApp. This segment generates revenue through the sale of advertising placements across its platforms.

The Reality Labs segment generates revenue through the sale of consumer hardware, software, and content. Its line of products includes Meta Quest, a virtual reality headset, and Facebook Portal, a smart video calling device.

As you can see from the chart above, Meta generates nearly all its revenue from its Family of Apps. This is understandable since the company only pivoted toward the metaverse in late 2021, and the Reality Labs business is still relatively young.

Now that we have an overview of Meta’s business segments, how do we evaluate its performance moving forward? If you’ve always found the company’s quarterly releases confusing, then this article will help you zoom in on the key information you need to know when analysing Meta.

1. Revenue growth

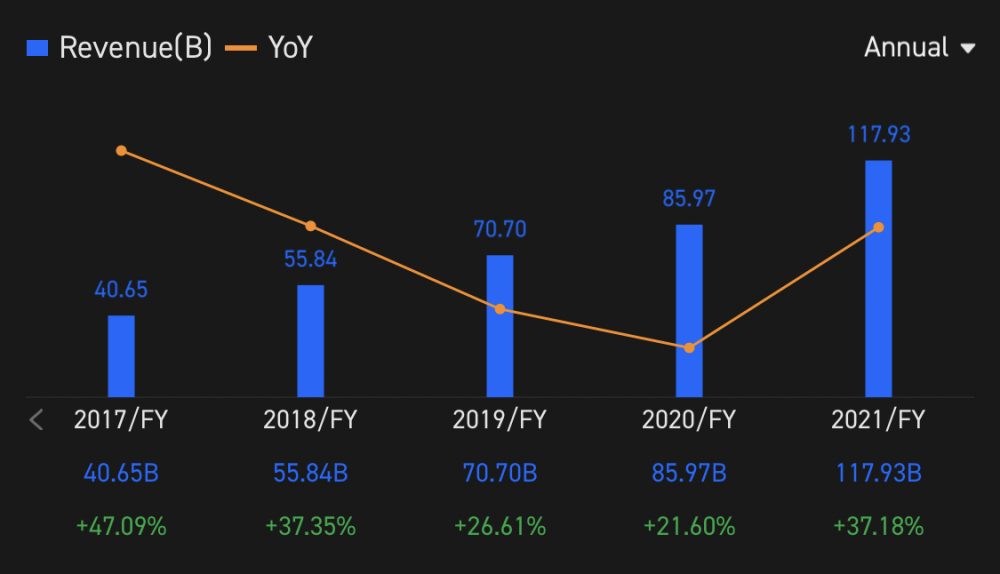

The first thing to note is the company’s revenue growth on a year-to-year basis. For example, Meta reported US$117.9 billion in revenue for FY2021, a 37.18% increase from FY2020.

As you can see from the chart, Meta’s revenue growth slowed from FY2017 to FY2020. This is primarily due to the law of large numbers: as a company grows bigger, the same growth in absolute terms represents a smaller percentage increase. The first half of 2020 was also adversely affected by the COVID-19 pandemic. Revenue growth jumped in FY2021 on the back of a post-pandemic boost which accelerated the growth of e-commerce and digital advertising.

Since advertising generates nearly all of Meta’s revenue, it’s important to monitor the growth and latest developments in the digital advertising industry and Meta’s position in the industry moving forward.

2. Family active people

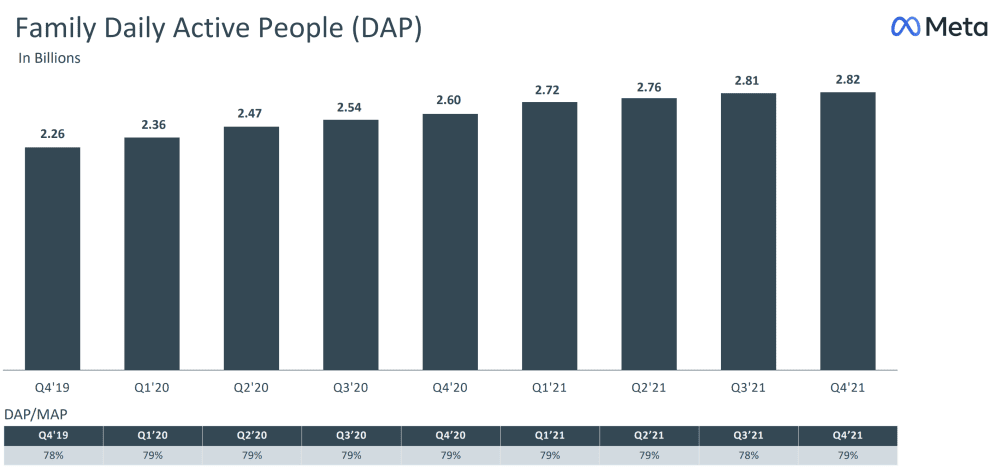

Advertising requires attention. And the more people Meta has on Facebook, Instagram, etc., the more attention it has. This is why investors love to see user growth on Meta. And the best way to track this is via Family Daily Active People (DAP) and Family Monthly Active People (MAP).

A DAP and MAP is defined as a user who logs in to Facebook, Instagram, Messenger, and/or WhatsApp (Family of Apps) on a given day and within the last 30 days respectively.

As we can see from the chart, user growth is slowing down on Meta’s Family of Apps – DAP only grew by 10 million people sequentially in Q4 2021. In fact, daily active users actually fell on Facebook for the very first time. This spooked the markets which caused Meta’s stock to plummet 26% in February 2022 when results were announced.

Although growth on Facebook is becoming more challenging as its user profile ages, Instagram’s popularity is still going strong. Moving forward, Instagram is likely to become Meta’s leading social network.

3. Average revenue per person

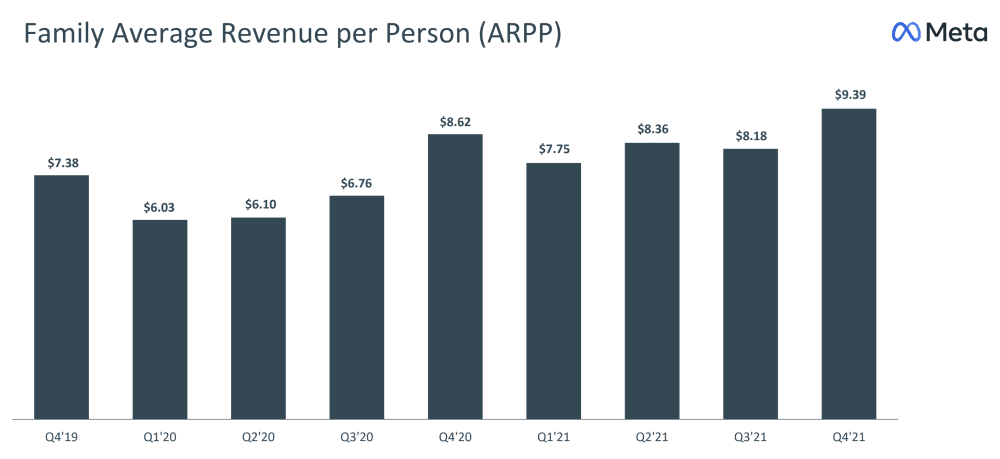

Having billions of users is one piece of the puzzle, being able to generate a higher average revenue per person (ARPP) is the other.

Over the mid to long term, we want to see Meta generate a higher ARPP. From the chart, we also notice that Meta tends to earn a higher ARPP in the fourth quarter as advertisers spend more for the holiday season.

ARPP is largely driven by two metrics: ad impressions and average price per ad. Ideally, we want both to increase over time.

| Year-on-year growth | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Ad impressions | 39% | 40% | 35% | 25% | 12% | 6% | 9% | 13% |

| Average price per ad | -16% | -21% | 9% | 5% | 30% | 47% | 22% | 6% |

Meta’s management will often explain the reasons behind the growth (or decline) in ad impressions and average price per ad. For example, you’d notice that the average price per ad declined in Q1 and Q2 2020 due to the pandemic:

‘The growth in impressions was primarily driven by Facebook Mobile News Feed, due to product changes and increased engagement compared to last year. The decline in average price per ad was largely attributable to the economic impact of the pandemic.’

Competition from Google and, more recently, TikTok will also play a role in how many eyeballs Meta can attract and, in turn, how much advertisers are willing to pay moving forward.

4. Reality Labs

I highlight Reality Labs as a key item as Meta is investing heavily in building the metaverse. While the idea of 3D virtual worlds and avatars is futuristic and exciting, the fact is no one really knows if the metaverse will actually take off. Because of this, we want to carefully watch if Meta’s investment will bear fruit.

The Reality Labs segment made a net loss of US$10.2 billion in FY2021, and we can expect the segment to continue posting multibillion-dollar losses in years to come. The management has already stated it could take 10 to 15 years for the metaverse to be fully realised. In the meantime, the company’s advertising business will essentially bankroll the project and investors have to swallow the losses with no guarantee of success.

5. Earnings transcripts

Finally, I highly encourage investors to read Meta’s earnings call transcripts that are released along with its quarterly results. Or if you are more auditory, you can listen to the earnings call itself, which is also a great option during your drive or commute.

The earnings call reveals the CEO and management’s thoughts about the company’s recent performance and outlook — straight from the horse’s mouth. Oftentimes, you will gain valuable information not found in the financial reports. Analysts from major financial institutions will also ask questions, usually around areas of concern, which will give you more insights into matters that could affect the company moving forward.

Earnings calls are a treasure trove of information. Listening to a few of the most recent earnings calls is great way to get up to speed about a company quickly!

The fifth perspective

The market has punished Meta’s stock price due to concerns about its recent slowdown and heavy investment in the metaverse. At its current P/E of 15.76, Meta is trading below its historical average. It is also trading below the sector’s average P/E.

While these concerns are certainly valid, Meta remains a highly cash-generative business and a dominant player in the digital advertising industry. It also has a fortress balance sheet with zero debt.

Meta’s foray into the metaverse may feel like a step into the unknown. However, this isn’t the first time that Meta has had to pivot its business model as the industry evolves. Facebook started life as a website before it pivoted to mobile in 2012 when it realised that the smartphone would become the cornerstone of our digital lives.

Can its next pivot to the metaverse be just as successful? We’ll just have to wait and see.

Get the latest news, analysis, and financials about Meta Platforms and other U.S. stocks on the moomoo trading app. FUTU SG via moomoo trading app has announced a lifetime $0 commission on US market for existing and new users. They are offering one of the most competitive trading fees across US, HK, SG & China A Shares with live market data.

When you successfully register for your securities account via the moomoo app, you will get to enjoy $0 commission-free* trading for the U.S. stock markets, platform fees will be waived for the first year. You would also gain free access to Level 2 market data for the U.S. stock market; Level 1 market data for the Singapore stock market; Level 1 market data for China A Shares.

Investment products available through the moomoo app are offered by Futu Singapore Pte. Ltd., a capital markets services licence holder regulated by the Monetary Authority of Singapore. Futu Singapore’s parent company, Futu Holdings Limited, is backed by world-class investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Open your FUTU SG securities account today with the moomoo app here. *Terms and conditions apply.

This article was written in collaboration with Futu Singapore Pte. Ltd. All views expressed in the article are based solely on The Fifth Person’s independent opinion.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.