How to build a 6-figure investment portfolio (part 2)

Previously, I talked about how patience can help build you a six-figure portfolio. I also revealed some ‘behind-the-scenes’ activity on how we built our dividend portfolio.

Today, I’ll carry on where I left off and talk about what else you should be doing while you’re waiting to invest in the stock market.

How To Zoom In On

Investment Opportunities

How do we know which are the companies to focus on?

And how do we know when is a good time to add these companies to our portfolio?

The answer is you need a watchlist.

Think about this…

Before you can even invest in a company, you must first know which companies are worth investing in.

And in order to do that, you need to build a watchlist of great companies that you’d really like and want to own.

These are companies that you should know inside out and willing to hold onto for the next 10 to 20 years.

For example, some of the companies that are on my personal watchlist include Visa, Adobe, Alphabet, McDonald’s, DBS, SATS and 18 others.

And then companies like Singapore Airlines, American Tobacco Company, Snapchat, etc. will never make it to my watchlist no matter how attractive their growth stories are or how cheap their valuations become.

With a watchlist, I am not distracted by hot stocks or the flavour of the month. I have a clear idea on the kinds of businesses I want to own and should keep my focus on.

So, here are some questions…

Do you have a watchlist of stocks?

If you don’t, it’s time to start one.

And if you do have one, how many stocks on your watchlist are great companies you know inside out?How To Win The Game of Stocks

When you’ve done your research and understand a business like the back of your hand, you’d be able to tell if a drop in share price actually represents an investment opportunity, or a sign that the long-term fundamentals of the company are affected.

On the other hand, when you’re unsure about a company and its fundamentals, you’d be hesitant to make a decision even if the opportunity presented itself.

Let me share a recent story…

Back in October 2017, we published a case study on Tencent Holdings in Alpha Lab. Tencent is a social media giant in China that owns WeChat and QQ. It is also the world’s largest video game company.

After going through Tencent’s business model and financial performance, it seemed like a great company to own with plenty of foreseeable growth years down the road.

From FY2012 to FY2016, revenue had grown at an annualised rate of 36.4% and its stock price hit HK$352 in October 2017.

Tencent price chart Jan 2012 to Oct 2017.

Its price, however, was also pretty rich at 52 times earnings. Yes, Tencent’s a growth company but its valuation was keeping me on the fence.

As a growth stock priced to perfection, any slowdown in growth that didn’t meet the market’s expectation could send the stock price tumbling down.

Should I just jump in now and ride the wave or should I wait for a better valuation?

What if the share price continued to rise higher? Would I miss out on an ‘opportunity’ to invest in a great company?

It was a hard decision to make, but it’s during times like these that I remind myself of quotes such as this:

‘Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.’ — Warren Buffett

If you are not comfortable with the valuation, then simply place that company on your watchlist and wait.

In the end, that opportunity for Tencent did come.

In 2018, the Chinese government decided to ban releases of new video games in an effort to combat gaming addiction among its youth. Because of the new regulations, Tencent was forced to shelf the launch of major games in China and posted its biggest earnings miss in 10 years. Investors started to sell down the stock due to fears that the new regulations would stall Tencent’s future growth and revenue.

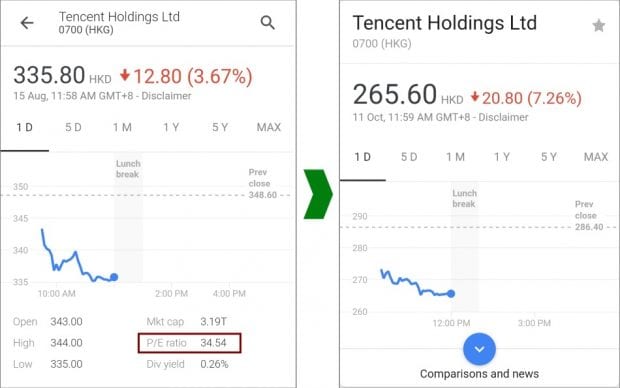

I remembered posting on our Instagram Stories about waiting for Tencent’s valuation to go drop further, from a P/E of 40 to 35 to 30…

Tencent falling below its average P/E of 43 in October 2018.

In October 2018, with Tencent trading at 31 times earnings, it finally looked like a great opportunity to buy a piece of a great company — which I did at HKD 282. (In fact, Tencent fell further to a low of HK$252 in November, which just goes to show how hard it is to time the market.)

Today, Tencent’s share price has rebounded to HK$766.5 (as at 25 January 2021).

If you bought the stock at HK$252, you’ll be sitting on a 204.2% gain…

That’s like Tripling your money plus more…

Tencent price chart Jan 2018 to Feb 2020.

I know it looks as if I writing all of this based on plain hindsight, but I always wanted to share about my personal experience ‘waiting’ for Tencent. (Thus the mobile screenshots below which I took as the situation unfolded back in August and October 2018.)

Opportunity Knocks More Than Once…

During the peak of the coronavirus epidemic back in March 2020, Tencent’s share price again, crashed from HKD416 to HKD334.

It’s P/E again, has fallen to about 32.4 times and we were once again presented with another chance to buy into Tencent even if you’ve missed the boat in October 2018 (This article was first published in Feb 2020 before the market crashed in March 2020).

And if you had bought it back in March last year, you too will be sitting on a 129.3% return today.

Again, you’ll notice the same thing happening again.

Know exactly what you want to invest…

And wait for the right valuation.

Today, Tencent’s P/E is back at 50 times… and like before, if I have not invested into Tencent, I would put them in my watchlist, and wait for the right valuation.

But what I want to say is…

I had the opportunity to invest in Tencent back in 2018 because of the Chinese government’s regulations.

If they had never intervened, I may not have had that opportunity in the first place, and Tencent’s stock price may have continued climbing ever higher.

But here’s the thing… it’s OK.

I’ve missed out on opportunities like Parkway Life REIT and Mapletree Commercial Trust before (mainly because they were not on my personal watchlist then).

And although I do feel like I missed out on those great companies, I know that another opportunity to own a great company will always come along.

*Update: I’ve since added MCT to my portfolio during the pandemic at S$1.49 and is sitting on a 20.1% gain (29 Oct 2020), excluding dividends.

The idea behind building a six or seven-figure portfolio is not about jumping from one hot stock to another, but to focus on owning a handful (or two) of great companies for the long term.Why A Watchlist Is So Important

In our journey as an investor, we may come across a number of great companies that we really like but are too expensive at that point in time.

When you do, add them to your watchlist. Every month, have a look at these companies and evaluate whether their valuations match what you’re willing to pay.

That’s it.

As long as you invest in great companies at great prices and ride their runway for growth, your portfolio should do quite well over the long term.

And if you combine this with what I shared about saving your capital in Part 1, then building a six or seven-figure portfolio is definitely attainable for anyone is patient and willing to focus on the long game.

Sounds like great advice. Much to learn but a watchlist seems like a great time and effort investment.

Can this apply to ETFs in some way? or does that make less sense?

Yes, if you prefer not to pick stocks, then index ETFs are a passive way of investing as well. Even then, you may want to keep a watchlist of ETFs for your personal reference as well.