Maximising your returns: How to invest based on the economic cycle

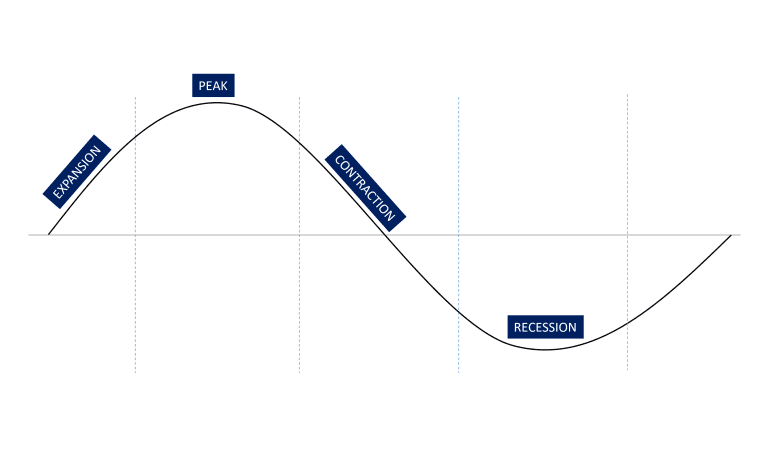

Finding the starting point to identify which equities to invest in can be challenging. One method is to determine which sector is currently favoured based on the macroeconomic backdrop. The economic (or business) cycle tracks the trajectory of an economy, and composes of four key phases: Expansion, peak, contraction, recession. While all economies undergo these four phases, their respective duration and intensity can vary. Today, we provide more details about the four phases and which sectors are preferred during each.

Expansion

Otherwise known as an economic recovery since it closely follows an economic bottom, this is a period of growth lasting anywhere between one to two years. Various indicators such as GDP and productivity show signs of improvement, coupled with easing monetary policy and falling interest rates which help support business valuation. Accordingly, the equity markets experience buoyancy as business valuation and thus stock prices rise.

As consumers and investors become more confident, the consumer discretionary sector tends to outperform as disposable income rises and spending on non-essential goods and services rise. Technology is another beneficiary as falling interest rates bolsters their valuation. Reduced borrowing costs also favour REITs as they typically borrow to acquire a pool of real estate properties and undertake asset enhancement initiatives to increase rental income. Cheaper mortgage costs also support the real estate sector as homeowners can finance their loans at more attractive rates.

Peak

GDP growth begins to slow but remains positive. The peak phase is typically the longest stage in the economic cycle. Investor sentiment is strong, economic activity gathers momentum, and credit conditions are promising. Businesses can more easily obtain capital from the debt market due to low interest rates and the equity market due to upbeat stock prices. In turn, companies spend more on capital expenditure and potentially reinvest their profits in search of higher growth. Sectors which previously shone continue to perform well, although the bullish climate also allows other sectors like information technology and industrials to deliver strong returns.

There may be some market corrections during this phase. This happens when the market index falls between 10% to 20% from recent highs and is a phenomenon for prices to return to their longer-term trend. Equity investors should consider reviewing their risk tolerance and rebalance their portfolio if deemed necessary.

Contraction

This marks the turning point of an economy as GDP and other indicators post slower growth, potentially retracing previous gains and start trending downwards. Economic contractions rarely last longer than the peak period and can be accompanied by inflation. In response, central banks may hike interest rates to stymie an ‘overheated’ economy. Nevertheless, the contraction phase presents opportunities for equity investors.

Defensive sectors such as consumer staples and healthcare are favoured. These businesses deliver goods and services that consumers purchase regardless of where the economy is headed towards. Investors can uncover companies with pricing power and capable of passing higher costs to their customers. Such a company can maintain or even grow their revenue (price times volume) as the increase in price more than proportionately compensates the fall in volume. Since these companies can pass their expenses to consumers, they ought to enjoy higher margins as well. Keeping in line with the theme of combating inflation, inflation-protected sectors like utilities and energy can also be good additions to the portfolio as demand for such amenities stays resilient. Finally, the financial sector could likewise benefit from higher interest rates, as their net income increases due to widening interest spreads.

Currently, inflation has been widely felt globally due to the confluence of many factors. The Federal Reserve reacted by hiking the fed fund rates. Given Singapore’s trade dependence and how intricately linked our open economy is to the international state of affairs, we experience similar increases in both inflation and interest rates. Taken together with other indicators, it seems to suggest that our economy currently resides is headed toward a contractionary phase.

Recession

During the trough of an economic cycle, GDP and other indicators decline. Notwithstanding the pessimistic outlook, there exists several silver linings for equity investors. Firstly, recession has historically been the shortest phase in the economic cycle, lasting no more than a year. Authorities usually respond with a slew of policies to stimulate the economy. For instance, expansionary fiscal policies like tax cuts and increased government spending are used to boost aggregate demand and spur recovery. On the other hand, central banks can tap on expansionary monetary policies by lowering interest rates, decreasing banks’ reserve requirements, or buy government securities. All these are aimed at tiding an economy through the recession phase.

Secondly, this period is a golden opportunity to identify exceptional companies. As Warren Buffett puts it, ‘Only when the tide goes out do you discover who’s been swimming naked.’ During trying times, well-managed companies reveal themselves more readily. These companies are able to sustain relatively stable profits even when their competitors struggle and post lower than expected earnings and growth. Post-recession, these businesses are well positioned to ride the uptrend of the expansion phase of a new cycle. Given the depressed stock prices during a downturn, there could be buying opportunities waiting for the savvy investor to discover.

Thirdly, even though equities perform poorly during a recession, some sectors are superior to others. These sectors are similar to those favoured in the contractionary phase of the economic cycle, such as consumer staples, healthcare, utilities, and energy. Their defensive nature allows them to possibly pay higher dividends, while other sectors such as technology cut, or even stop their dividend paying policies to maintain cash flow.

The fifth perspective

Every phase of an economic cycle presents unique opportunities. Some sectors provide higher rewards but punish overly aggressive investors during recessions, other sectors are naturally capped in terms of the returns they can generate but have a place during more prudent times. By considering how various sectors react to the economic cycle, equity investors have a higher chance to maximize their rewards while minimizing risks.