In my previous article, I addressed a critical challenge among Malaysians: income disparity and the looming retirement crisis. I emphasised that improving one’s income stands as the initial step towards achieving financial stability and growth. If you haven’t had the chance to read our initial discussion, you can catch up by reading this article: The Malaysian income and retirement crisis

Moving along this financial journey, once you’ve successfully increased your income, the next step involves saving and investing. This duo act as the cornerstone for growing your asset wealth — a crucial aspect of achieving long-term financial security and independence.

Recent data brings a concerning trend to light — a substantial portion of Malaysian youths do not invest. This article addresses this concern, offering insights into Malaysians’ lack of investment activities and proposing actionable solutions to bridge this gap. Our ultimate goal is to pave the way for a more financially secure future for young Malaysians.

The Malaysian saving-investment conundrum

According to an article from BusinessToday, Malaysians display commendable discipline when managing their budgets. Remarkably, approximately 90% of Malaysians adhere to set monthly budgets, and an impressive 70% diligently follow these budget plans. This statistic suggests that Malaysians generally are proficient at saving money.

However, the alarming reality emerges when we examine investment habits among Malaysian millennials. Astonishingly a staggering 43% of millennials openly admit to not participating in any form of investment. Furthermore, a mere 16% engage in investment activities sporadically, typically investing once every one or two years. This reluctance or infrequency in investment activities casts a shadow over these individuals’ long-term financial future.

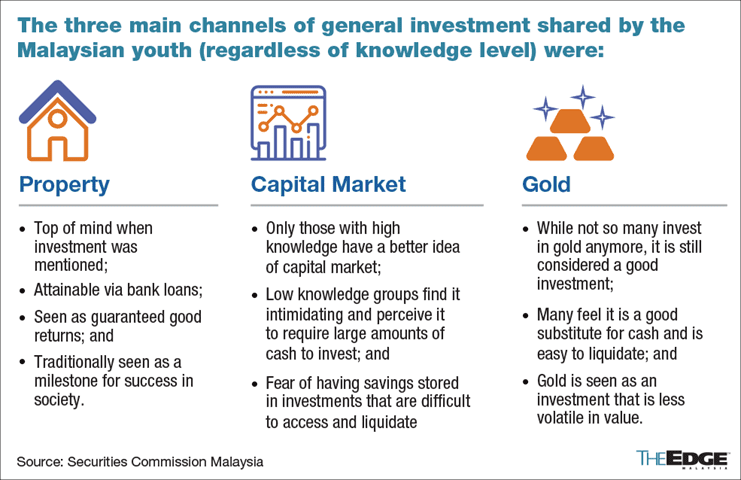

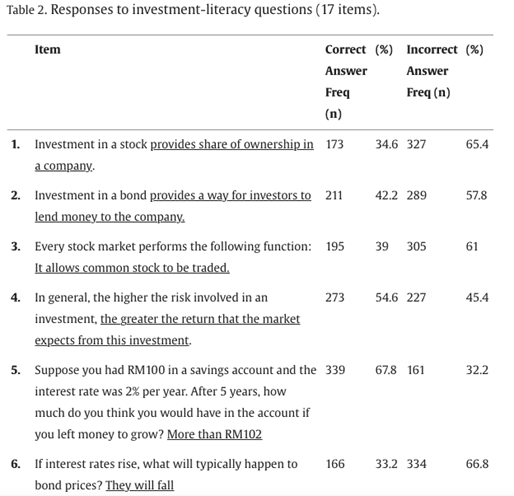

The root of this issue can be traced to a critical gap in financial literacy and an understanding of investment strategies. Many Malaysians lack the necessary knowledge and confidence to navigate the intricacies of the financial markets effectively. A study conducted by ScienceDirect corroborates these concerns, revealing that a significant number of Malaysian undergraduates lack practical knowledge about the functioning of the stock market. Moreover, their comprehension of the impact of interest rate movements on financial instruments is notably weak.

To compound this challenge, Malaysians tend to show a preference for investing within their home market. According to The Star, a substantial 63% of retail investors favour Malaysia as their primary investment market. While this loyalty is admirable, it also means that many miss out on potentially stronger stocks and currencies in overseas markets.

When we consider these factors collectively, it becomes evident that Malaysians are not harnessing the full potential of investment opportunities. This hesitancy to invest, combined with the lack of diversification in investment choices, contributes to a situation where Malaysians are not maximising their wealth-building potential.

Strategies to boost financial literacy

Empowering Malaysians to enhance their investment literacy is crucial for financial growth and stability. Here are five actionable strategies to bridge the knowledge gap and instill confidence in navigating the investment landscape:

1. Follow the markets. Begin your journey by consuming a variety of financial materials. Engage with sources like The Edge, tune into the BFM radio channel, and subscribe to investment blogs like The Fifth Person. These platforms provide a wealth of information on financial markets, investment insights, and economic trends, serving as a great starting point for your financial education.

2. Tune in to financial channels. On platforms like YouTube, you can gain access to a multitude of videos and channels that cover financial management, stock investing, and asset planning. These resources offer flexibility and accessibility, allowing you to learn at your own pace and from the comfort of your home. Investing time watching educational videos can significantly expand your knowledge base.

3. Read books. Start delving into books that offer valuable insights into investment principles, personal finance management, and economic trends. For beginners, One Up on Wall Street by Peter Lynch and Rich Dad Poor Dad by Robert Kiyosaki are highly recommended. These books provide a foundational understanding of investing and financial literacy.

4. Consider robo-advisors. Embrace a robo-advisor platform like StashAway or Wahed Invest, which automates investment decisions based on your risk tolerance and financial goals. Robo-advisors tend to simplify the investment process, making it accessible for beginners who might find traditional investing daunting. You can begin with a small investment amount and observe how automated platforms work to enhance your comprehension.

5. Consult financial advisors. Seek guidance from financial advisors or experts specialising in investments. Their expertise can provide personalised advice tailored to your unique financial situation and goals. Engaging with professionals in the field will deepen your understanding and aid in making informed investment choices.

By integrating these strategies into your financial journey, you can gradually develop the confidence and knowledge necessary to navigate the investment landscape effectively. Remember, the journey to financial literacy is ongoing, and each step you take brings you closer to a secure and prosperous financial future.

The fifth perspective

While improving one’s income starts as the first step towards achieving financial stability, the journey doesn’t end there. It’s only half the battle. Saving and investing play an equally vital role in your financial journey. While Malaysians have showcased commendable financial discipline, many fall short of embracing the investment opportunities available to them.

Nevertheless, with dedication and effort, one can gradually enhance their understanding of investments and embark on a path toward financial growth and independence. The key lies in continuous financial education and a willingness to embrace the financial markets.