The platform business: One of the most powerful business models in the world

What do four of the world’s largest businesses, Amazon, Alphabet (Google), Microsoft, and Apple have in common? They are all platform businesses in some form.

As a business model, platforms are not at all new. A platform, by definition, is an organisation that assists in the facilitation of a transaction between two or more parties. Physical platform businesses such as shopping malls and railways have long existed since the 19th century. For example, shopping malls serve as a platform that provides shops with a place to sell their goods and customers with a place to purchase.

A significant difference between today’s platforms and traditional platforms is the presence of digital software, which dramatically expands platform reach with greater speed and convenience. For example, Apple’s App Store connects developers to millions of iOS users, and YouTube connects video creators to video viewers worldwide.

The Internet has enabled a more extensive network throughout the economy, resulting in a greater importance of digital platform businesses. The goal of a platform is to make it easier to connect two or more independent parties by lowering transaction costs. Platforms add value to their users by lowering search costs and information asymmetry, promoting more efficient matching and better asset utilisation, making it easier for different parties to trade value. The value of a platform is not determined by its software or assets but rather by the level of network and connectivity between its users on the platform.

Self-reinforcing moat

In a traditional economy, adding a new customer does not improve the customer experience for an existing customer. A conventional linear economy is organised around production and based on supply and demand.

In a digital platform economy, each additional user will enhance the user experience of another user. Consider Shopee; with each new seller on the Shopee platform, a potential buyer will have more options to choose from; with each new buyer on the Shopee platform, sellers gain an additional selling opportunity.

Layered on top of network effects is the concept of zero marginal cost. As the platform network expands, the cost of adding each new user becomes zero. One additional driver on the Grab platform costs almost nothing to add to the network, and one additional seller on Shopee costs nothing to add a listing.

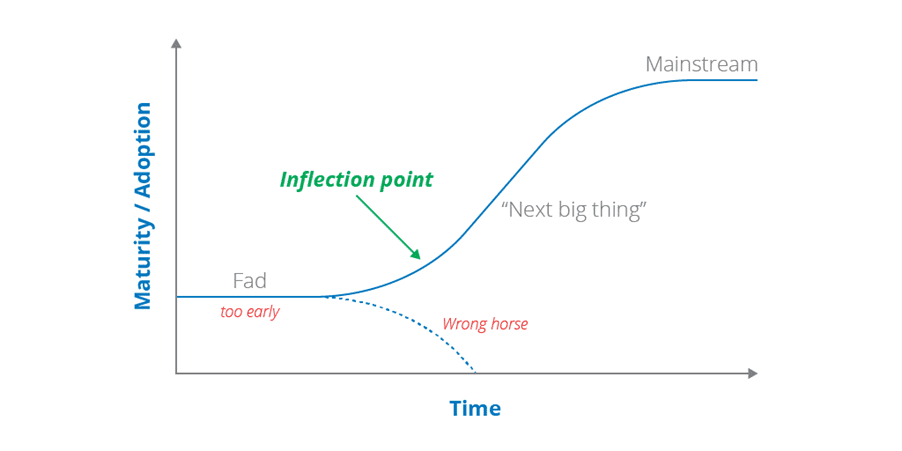

With network effects and zero marginal cost self-reinforcing each other, a platform will begin to grow exponentially once it has passed its ‘inflection point’, and a snowballing effect will begin to occur. The more users a platform acquires, the more valuable it becomes, and the easier it is to add new users who want to join the network.

Ecosystem control

A critical element of platform businesses is the requirement to implement a specific set of central architectures, rules, and standards to ensure platform users can interact efficiently. Once a platform has established itself as the dominant platform in a particular space, this frequently places the platform in a position of dominance throughout the value chain.

For instance, if a retailer wants to open a store in a shopping mall, they must adhere to the mall operator’s requirements, such as maintaining a sanitary environment. A video creator who wants to publish a video on YouTube must adhere to Google’s guidelines for their video to be available on the platform.

How to invest

From an investing perspective, the best time to invest in these companies is before they achieve market domination, and their moat is yet to be reflected in their financials. When it comes to acquiring users, early-stage platform businesses frequently face a chicken and egg problem. Before a platform can achieve market dominance and earn enticing profits, it must provide sufficient incentive to new users to kickstart their network effect. As a result, platform businesses are likely to run at a significant loss until they firmly establish themselves as the winner.

Inflection point

When the platform is in its early phases, we should be patient until the ‘inflection point’ is reached. At this point, the platform becomes self-sustaining.

For example, Sea Limited’s Shopee division has been signalling that it is approaching its inflection point by reducing subsidies such as free shipping and increasing commission rates in multiple countries, indicating that their ecosystem has achieved dominance and Shopee is beginning to extract more value from its users through higher fees.

Scaling market dominance

After a digital platform has advanced through its inflection point, the next optimal time to invest is when the platform begins to demonstrate evidence of its ability to scale its market domination further. This evidence is typically found in their financials where platform unit economics continue to improve, sales and marketing costs decrease, and gross margins increase over time.

The fifth perspective

As the platform is undoubtedly an excellent business model, investors who can earlier identify the next successful platform that will achieve market dominance should be able to generate a lucrative return over the next decade. At the same time, it is not always certain which platform will ultimately dominate its market. investors should always do their due diligence and understand the risks associated with any investment.

If we’re looking for a “platform” business model, I think cyber-security is the one currently at its inflection point. I particularly like CrowdStrike (CRWD). It has excellent financials and is starting to make real money. A lot of big companies have taken up their offering and they’ve established themselves as one of the best in the business. Definitely worth taking a closer look. My friends in the IT industry speak highly of them. Another thing I like about CRWD is that the CEO is not drawing an excessive salary (unlike another i.e. CyberArk – which has a great product, but less convincing fundamentals).

Disclosure: CRWD is currently about 1% of my own portfolio.

Hi Jonathan,

Thanks for sharing! Cybersecurity is definitely another growth area. In my opinion, Crowdstrike is a linear business even though it’s a tech company. Crowdstrike creates value by selling products/services to its customers. A platform business model creates value by facilitating transactions between multiple parties.