Incorporated in 1968, PPB Group Berhad has grown into one of the biggest conglomerates in Malaysia. It is also one of the 30 largest listed corporations on Bursa Malaysia and, thus, a constituent of the FBM KLCI. As at 31 July 2019, PPB is worth RM26.5 billion in market capitalisation.

I recently went through its 2018 annual report and will be covering PPB’s latest financial results, long-term performance, and valuation in this article.

Here are 12 things to know about PPB before you invest:

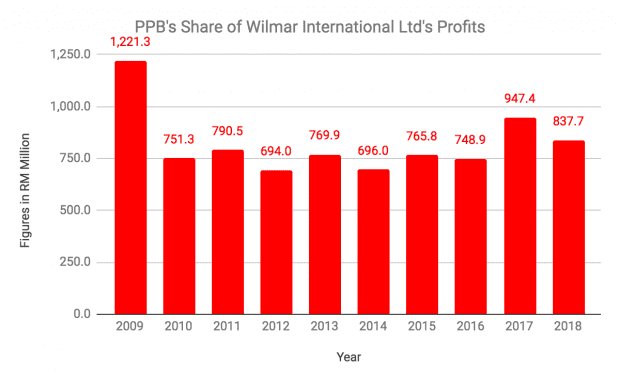

1. Wilmar International Ltd: PPB owns a 18.5% stake in Wilmar, a Singapore-listed integrated agriculture group. Wilmar is involved in the cultivation, processing, manufacturing, and merchandising of agricultural products including palm oil and sugar. It owns over 500 manufacturing plants and has an extensive distribution network across China, India, Indonesia, and 50 countries worldwide. Wilmar is PPB’s largest profit contributor – contributing RM837.7 million in profit in 2018. The market value of PPB’s stake in WIlmar was worth RM11.1 billion in 2018.

2. Besides its stake in Wilmar, PPB has six core businesses which contributed a combined RM4.5 billion in revenue in 2018. Of these, PPB derived 92% of revenue from three main segments – Grains & Agribusiness, Consumer Products, and Film Exhibition & Distribution:

| Segment | Revenue (RM millions) | Percentage of Revenue |

|---|---|---|

| Grains & Agribusiness | 2,992 | 66.0% |

| Consumer Products | 638 | 14.1% |

| Film Exhibition & Distribution | 538 | 11.9% |

| Other segments | 360 | 8.0% |

| PPB 2018 total revenue | 4,528 | 100.0% |

Source: PPB Group annual reports

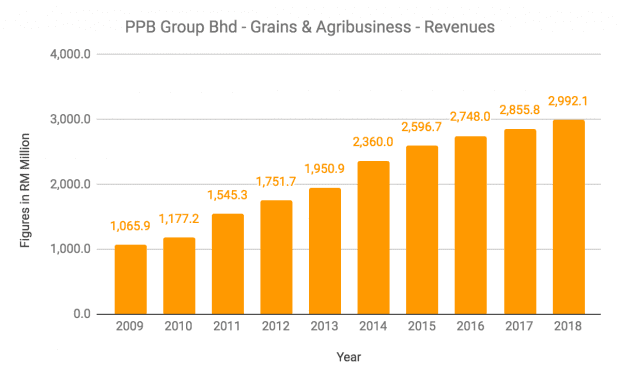

3. Grains & Agribusiness:This segment operates under FFM Group which is involved in flour milling, animal feed milling, and livestock farming activities:

- FFM Group operates nine flour mills — five are located in Malaysia, two in Vietnam, one in Indonesia, and one in Thailand. In addition, FFM has a 20% interest in nine flour-milling associate companies in China.

- FFM Group is a leading feed miller in Malaysia with five feed mills with a total production capacity of 67,000 metric tonnes a month.

- FFM Farms operates two broiler breeder farms with a total production capacity of 3.25 million broiler chicks a month and one layer farm with a monthly production capacity of 18 million eggs.

Overall, this segment has grown at a compound annual growth rate (CAGR) of 12.2% in revenue, from RM1.07 billion in 2009 to RM2.99 billion in 2018.

51%-owned subsidiary, VFM-Wilmar Flour Mills, is currently building a 500-metric-tonne-a-day wheat flour mill in Quang Ninh province, Vietnam. The project will cost US$19.7 million and is expected to be completed in Q1 2020.

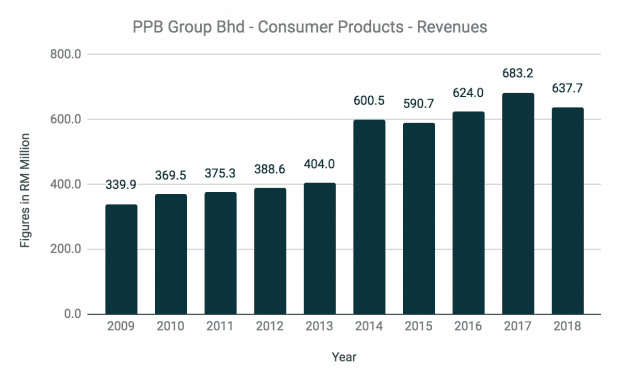

4. Consumer Products: This segment operates under two key subsidiaries:

- FFM Marketing distributes a diverse range of fast-moving consumer good through its twelve warehouses with a total warehousing capacity of 300,000 square feet.

- The Italian Baker operates a state-of-the-art baking plant in Pulau Indah. It has three fully automated production lines, consisting of a line producing 16,000 loaves per hour, a line producing 24,000 rolls per hour, and a line producing 15,000 cakes per hour.

This segment has contributed about RM600 million in revenue annually over the last five years. Revenue spiked in 2014 as the subsidiary increased its overall capacity by 60% with the launch of new bread production lines in May 2014.

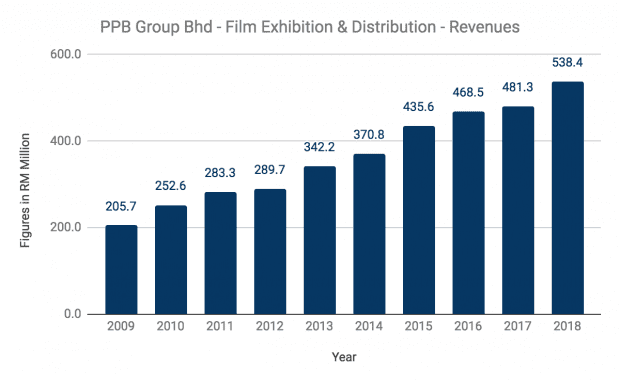

5. Film Exhibition & Distribution: This segment operates under Golden Screen Cinemas (GSC). GSC is Malaysia’s leading cinema operator with 344 screens in 36 locations. It also has a 40% interest in Galaxy Studio JSC which operates 89 screens in 14 locations. This segment also includes GSC Movies which purchases and distributes films to cinemas. It also sub-licenses movie content to pay TV, free TV, over-the-top platforms, and hotel operators.

In 2019, GSC is planning to open two new cinemas with a total of 26 screens and add another three screens at the GSC Summit USJ cinema. Meanwhile, Galaxy Studio JSC is working to open five cinemas with a total of 24 screens in Vietnam.

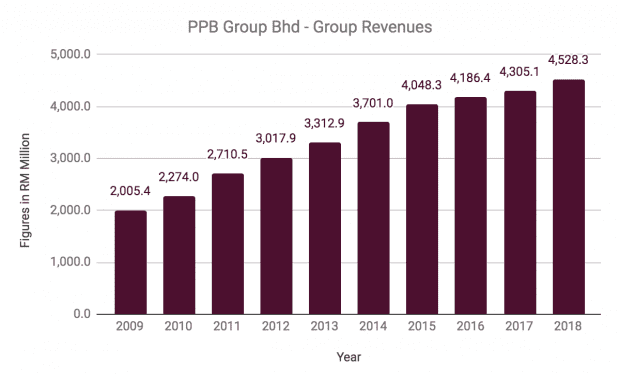

6. PPB has achieved a CAGR of 9.5% in group revenue, growing from RM2.01 billion in 2009 to RM4.53 billion in 2018. This is mainly due to growth in revenues by PPB’s core businesses.

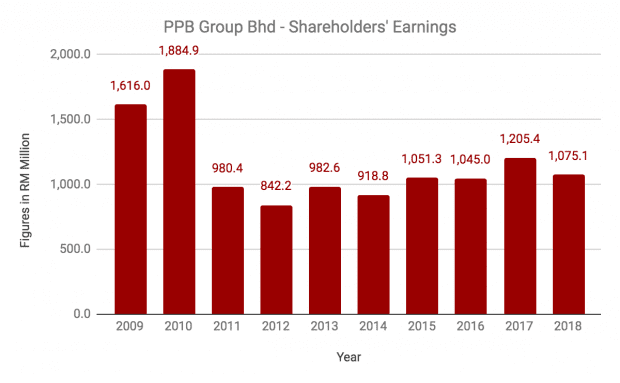

7. PPB’s profit has grown much slower, from RM980.4 million in 2012 to RM1.08 billion in 2018. Profit last spiked in 2010 as the company disposed stakes in the following companies and recorded RM841 million in disposal gains that year:

- 100% stake in Malayan Sugar Manufacturing Company Bhd

- 50% stake in Kilang Gula Felda Perlis Sdn Bhd

- 5,979 hectares of land located in Chuping, Perlis

- 9.8% stake in Tradewinds (M) Bhd

Excluding one-off gains, adjusted profit in 2010 would be RM1.04 billion. This is still a drop from the RM1.61 billion recorded in 2009 as the company received higher profits from Wilmar and included earnings derived from the disposed companies that year.

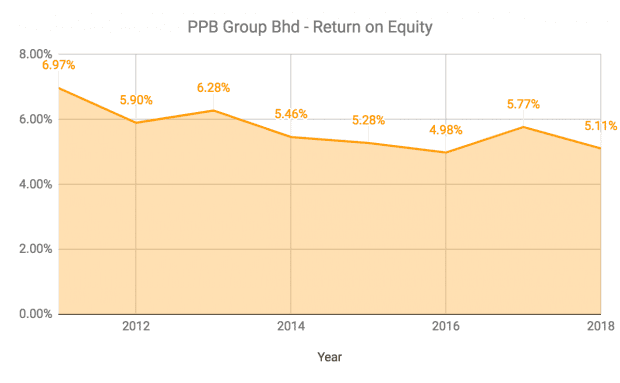

8. PPB has an eight-year return on equity average of 5.72%. Since 2011, ROE has also been on a gradual downtrend.

9. Since 2009, PPB has generated RM2.33 billion in net operating cash flow and collected RM2.57 billion in dividends from its associate companies. Out of which, it has spent:

- RM1.57 billion on capital expenditure

- RM445.5 million on net long-term debts

- RM4.28 billion on dividends

Dividends are inclusive of RM770.6 million in special dividends paid in 2010 from the disposal of companies that year. PPB has also increased its cash position from RM731.0 million in 2009 to RM1.39 billion in 2018.

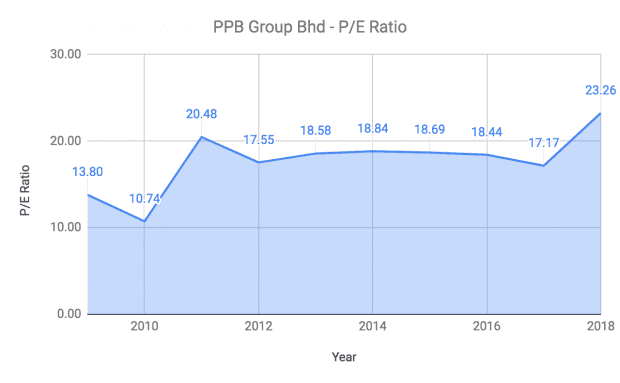

10. P/E ratio: PPB reported earnings per share of RM0.756. Based on PPB’s share price of RM18.70 (as at 31 July 2019), its current P/E ratio is 24.74 which is above its 10-year average of 17.78.

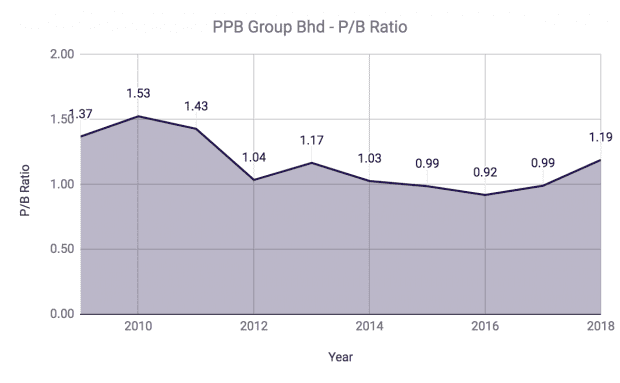

11. P/B ratio: As at 31 December 2018, PPB has net assets of RM14.79 per share. Therefore, its current P/B ratio is 1.26, above its 10-year average of 1.16.

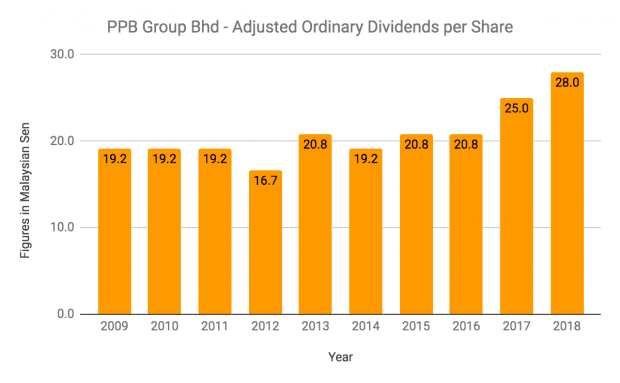

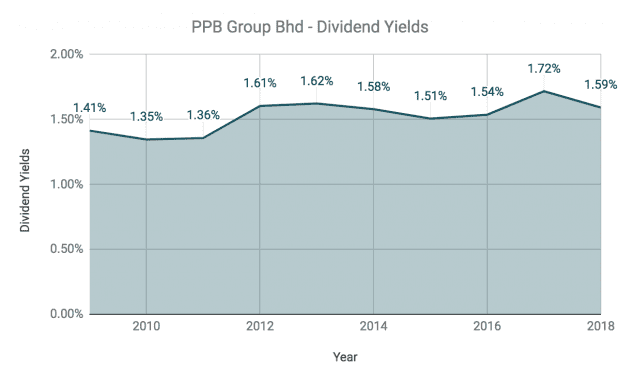

12. Dividend yield: PPB has gradually increased its dividend per share from 19.2 sen in 2009 to 28.0 sen in 2018. The chart below shows ordinary dividend per share adjusted for a 1:5 bonus issue in 2018.

If PPB maintains its dividend, its current yield is 1.49%, below its 10-year average of 1.53%.

The fifth perspective

Overall, PPB has delivered relatively stable financial results over the last 10 years, and gradually increased its dividend to shareholders. However, the stock’s recent run-up in price since the start of the year has seen its valuation rise above its long-term averages.

In this case, investors may prefer to demand a higher discount for a company that only displays relative low levels of earnings growth.