3 key risks when investing in REITs (and how to avoid them)

Real estate investment trusts, or REITs, have done extremely well as an asset class. Since the very first Singapore REIT, Ascendas REIT, was listed back in 2002, there has been a slew of IPOs for different REITs covering a wide variety of sectors and geographies. The 43 REITs and trusts listed on the SGX generated an average total return of 23% in 2019 and ended the year with an average distribution yield of 6%.

Investors gravitate towards REITs due to their stable nature: REITs are essentially securitised bundles of investment properties that generate a steady, consistent rental income. Regulations stipulate that REITs need to pay out at least 90% of their earnings as dividends. As most REITs pay out either a quarterly or half-yearly dividend, they are viewed as pseudo-fixed income instruments for their predictability and stability of passive income. This fact, coupled with their hard-asset backing, lends the perception that REITs are dependable and rock solid.

However, as with any investment, REITs have a number of risks that investors should duly take note of. These risks are sometimes overlooked due to the current optimism surrounding this asset class, but investors should not be complacent and let their guard down.

Here is a description of each risk and some examples of how they impacted the affected REITs. Guidance will also be offered on what to watch out for with respect to the current crop of REITs.

1. Concentration risk

Concentration risk refers to a REIT with just a few properties (usually around 4-6), where most of its gross revenue and net property income (NPI) are tied to one key asset. This concentration increases the overall risk for the unitholder as an adverse event affecting the key asset would result in a material negative impact on distribution per unit (DPU).

A recent example of this relates to Mapletree North Asia Commercial (MNACT). The REIT owns a total of nine assets, a mall in Hong Kong called Festival Walk, two properties in China (Sandhill Plaza and Gateway Plaza), as well as six Japanese properties. However, for its 1H 2020 earnings, Festival Walk’s revenue and NPI made up close to 62% of the total for the REIT.

Due to the protests in Hong Kong that broke out in June 2019, the mall was badly damaged in November due to rioters and the REIT announced that the mall would remain closed until further notice as repair and recovery work took place. As this asset alone made up the bulk of revenue and NPI, it’s natural to assume that DPU would take a significant hit as a result of this closure, and the REIT’s unit price duly tumbled from S$1.27 to S$1.15 (a 9.4% drop) when the news was released. This was significantly below the 2019 high of S$1.48 recorded in July 2019 when the protests first broke out and represents a total decline of 22.3%.

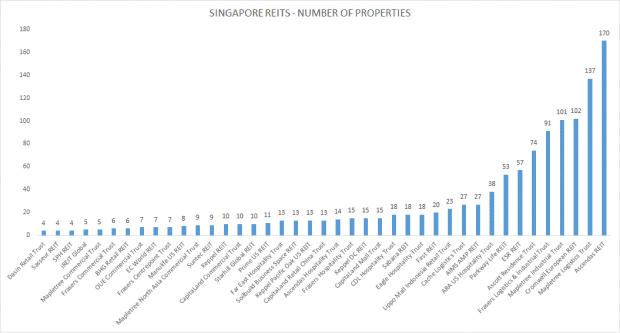

Source: REITs’ earnings reports

From the graph above, it can be seen that there are around 10 REITs with less than eight properties in their portfolios. Out of these, four of are from China: Dasin Retail Trust, Sasseur REIT, BHG Retail REIT and EC World REIT.

Aside from the low number of properties, another factor that I note is the geographic concentration of the properties within a REIT. If all the properties are clustered in one location, this increases the concentration risk for the REIT. For example, iREIT Global only has five properties all located in Germany.

2. Refinancing risk

A second big risk is that of refinancing, and this is usually tied to high levels of gearing for the REIT and a short weighted average debt maturity. A REIT’s typically short debt maturity makes it imperative for it to refinance within a short period of time, while the gearing cap of 45% imposed by the Monetary Authority of Singapore (MAS) means that a REIT must work within the limit while refinancing its debt.

During the Global Financial Crisis, CapitaLand Mall Trust (CMT) announced a rights issue of 9-for-10 shares at S$0.82 per share to raise S$1.23 billion. As a recap, CMT is a retail-focused REIT that owns 15 shopping malls, all located in Singapore. The issue price was a deep 43.4% discount to the then-closing price of S$1.45 for CMT.

The problem was that CMT had a gearing ratio of 43.2%, just slightly shy of the 45% threshold. This meant that it had little wiggle room to borrow more, and the crisis made it extremely difficult to refinance as the financial system had seized up. As a result, the REIT was forced to undertake a massively dilutive rights issue to shore up its balance sheet. Unitholders who could not afford to cough up cash for their rights entitlement were significantly diluted and suffered a big drop in DPU as a result.

In terms of leverage, most REITs right now have leverage ratios of between 30% to 37%, while a few are below 30%. As the MAS gearing cap stands at 45%, most REITs should not venture above 40% so that they can allow themselves some buffer.

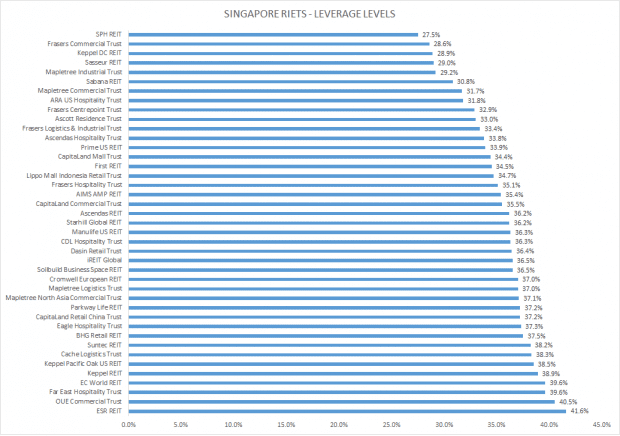

Source: REITs’ earnings reports

From the graph above, EC World REIT and Far East Hospitality Trust have gearing levels of 39.6%, while ESR REIT’s gearing stands at 41.6%, the highest among the REITs listed in Singapore.

The MAS is currently proposing to raise the gearing limit to 50% or even 55% if REITs can demonstrate good interest coverage ratios, but this a work-in-progress and there is no guarantee that it will come to pass.

3. Interest rate risk

The third big risk is that of interest rates, also known as cost of financing. In a world of low-interest rates, owning a REIT that has a high cost of financing translates to lost opportunities as the higher finance costs suck away precious cash that could have been diverted to accretive acquisitions or organic asset enhancements. Having more cash also allows a REIT to have an adequate buffer in the event of another financial crisis.

Source: REITs’ earnings reports

Investors should note that the REITs that have a higher cost of financing (4% and above) are usually the foreign ones. An exception is Sabana REIT which holds only Singapore industrial properties, with a 4.43% cost of financing. It’s important to take note of REITs with a high cost of financing in case interest rates move north, as this may put further pressure on a REIT’s cash flows.

The fifth perspective

Investing in REITs can be a very lucrative exercise, but investors need to balance the risks against the rewards. As shown above, there have been cases where such risks resulted in significant capital and DPU loss for unitholders. It is the investor’s responsibility to sift through the various REITs’ financial and operating numbers to ensure that he picks only the REITs that are the best in class. Only then can the investor enjoy steady and consistent gains from investing in REITs.

Hi,

Good day.

Nice article to digest.

Anyhow, how about the perpetual bond that issue?

Will it be 1 of the risk as well?

Thanks.

Sincerely Yours,

Sid

Good point, Sid. Perpetual securities are classified under equity. But it is better to include them as debt in your calculation of the gearing ratio.

Hi Rusmin,

Thank you.

This matter raise as more and more company issue these type of bond and yet it did not show up clearly.

Regards,

Sid