When it comes to investing for growth, the Singapore stock market may not always set the pulses racing. From January 2003 to December 2022, the Straits Times Index grew 142.3%, while the S&P 500 grew 336.4% over the same 20-year period. Investors may glance at the higher returns in the U.S. and decide that Singapore isn’t a great place to invest in.

While it is true that the Singapore stock market may not exhibit the same level of rapid expansion as some of its global counterparts like the U.S., its steady growth, coupled with a range of distinctive advantages, creates an investment landscape that is appealing for various reasons. Here are five reasons why the Singapore stock market is still a great place to invest in.

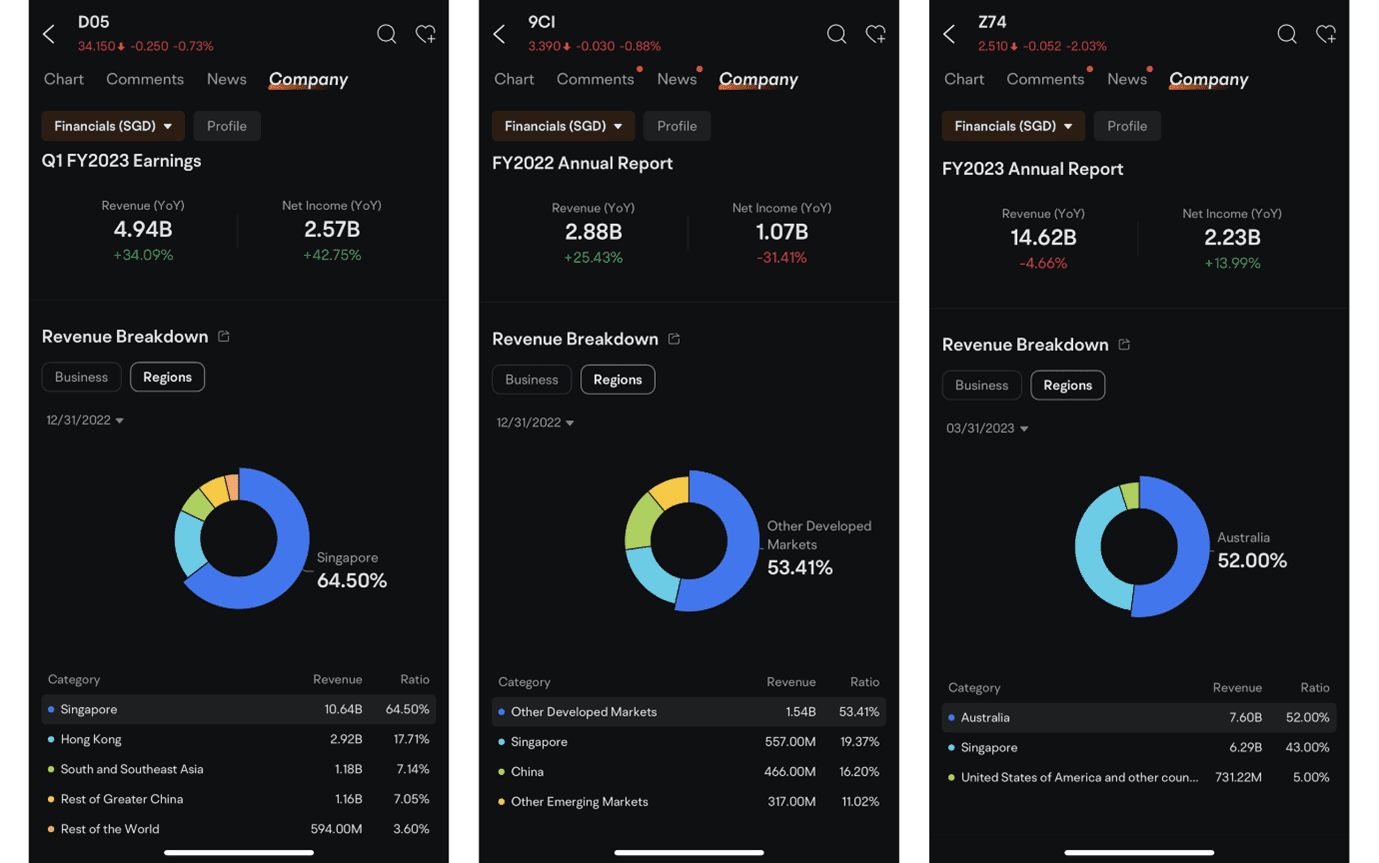

1. Access to Asian markets

While Singapore by itself is a not a very big market, Asia is a different beast altogether. Many Singapore-listed companies have significant operations and investments across the region, allowing investors to participate in Asia’s growth story. For example:

- DBS Bank is the largest bank in Singapore, but it also has a presence in 19 markets including China, Hong Kong, India, Indonesia, Japan, and South Korea

- CapitaLand Investment is headquartered in Singapore, but it manages properties in over 40 countries across Asia, Europe, and the U.S.

- Singtel is Singapore’s largest mobile network operator, but it also owns significant stakes in the top one or two mobile operators in India, Indonesia, Thailand, the Philippines, and Australia.

Investing in Singapore stocks provides exposure to Asian markets (and beyond) without investing directly in individual countries. Singapore is also renowned as a global financial centre. The country has a well-developed banking system, efficient capital markets, and a wide range of financial services. This enables Singapore-listed companies to access capital easily, facilitating their growth and expansion plans. Additionally, the presence of financial institutions and expertise in the country enhances the overall liquidity and stability of the stock market.

2. Stable dividend growth

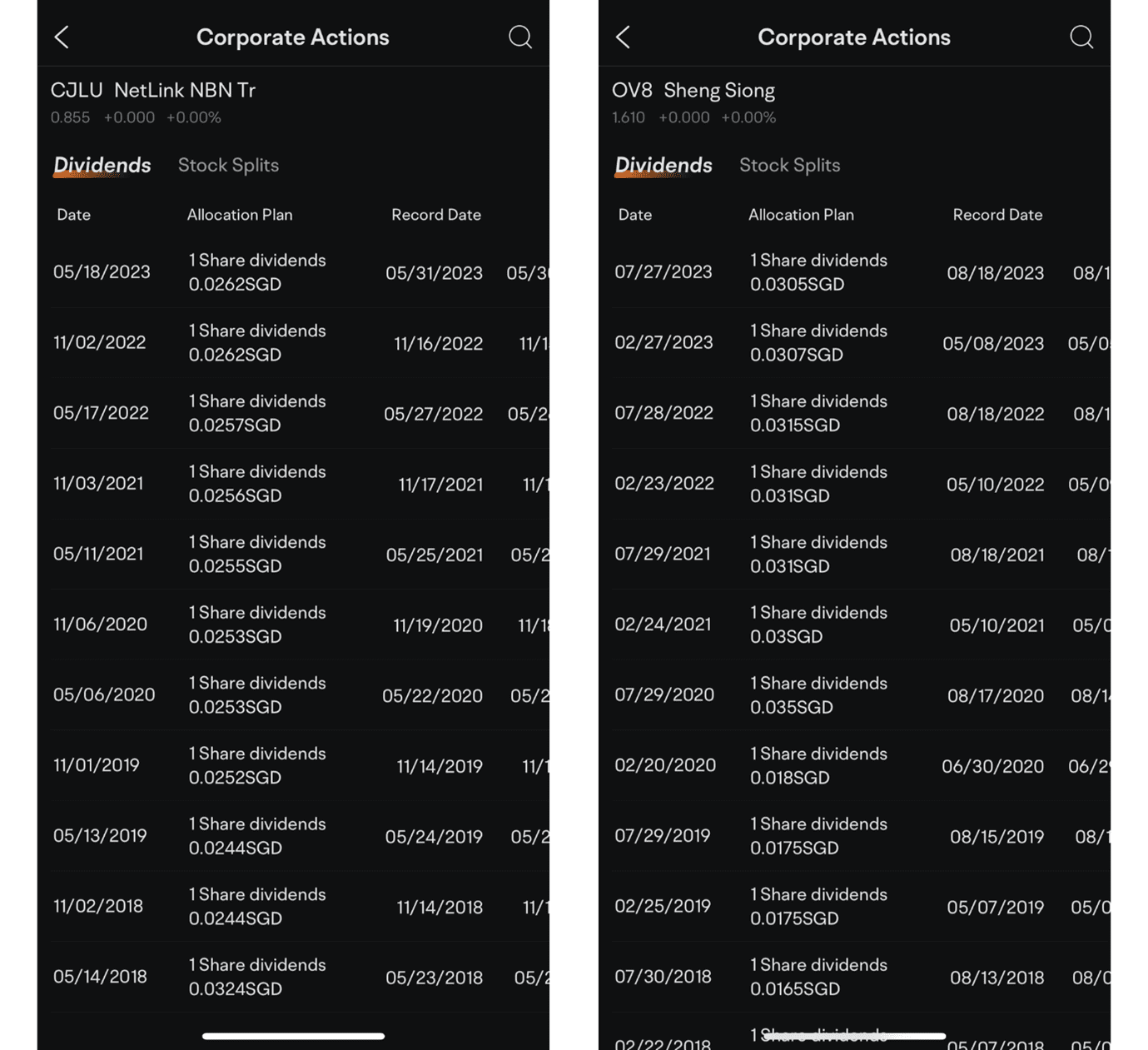

Many Singapore-listed companies have a culture of paying regular dividends to shareholders. This is particularly appealing to income-seeking investors who prioritize consistent cash flows. Dividend stocks can provide a steady income stream and potentially outperform during periods of market volatility.

- Netlink NBN Trust, Singapore’s only fibre optic cable provider, has paid a growing dividend per share since its listing – from 3.24 cents in 2018 to 5.24 cents in 2023. Based on its last closing share price of 86 cents (as at 20 July 23), its dividend yield is an attractive 6.1%.

- Sheng Siong, a supermarket retailer, has also paid a growing dividend since its listing. Its dividend per share has increased from 1.77 cents in 2011 to 6.22 cents in 2022. If you had invested in Sheng Siong at its initial public offering (IPO) price of 33 cents, your current dividend yield-on-cost stands at an impressive 18.8%.

There are successful real-life examples of Singaporeans who invest only in the Singapore market and collect a six-figure annual dividend income from their stock portfolio. So if you’re an investor interested in dividends, Singapore is a great place to invest in.

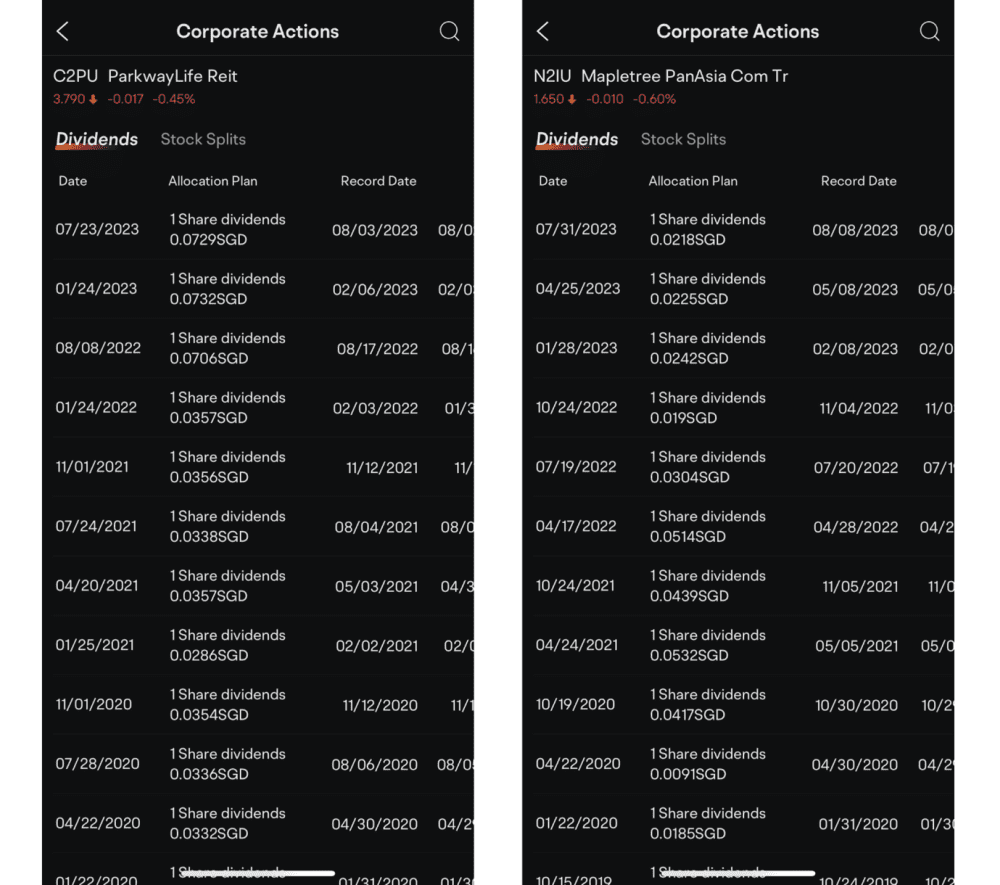

3. Well-established REIT market

Carrying on with the theme of dividends, Singapore also has a vibrant real estate investment trust (REIT) market which is now the second largest in Asia (after Japan). REITs provide investors with an opportunity to gain exposure to a diversified portfolio of income-generating properties, such as commercial buildings, retail malls, and industrial estates. REITs in Singapore often offer attractive dividend yields and can provide stability to an investment portfolio.

REITs are a great way to gain exposure to Singapore real estate which has appreciated steadily in value over the last five decades. Singapore is a small city-state with a finite land area. With a dense population and limited land, there is high demand for housing, both for residential and commercial purposes.

Besides their exposure to Singapore real estate, many Singapore REITs (S-REITs) also own properties outside Singapore. This gives S-REITs access to growing Asian and global markets, giving investors the best of both worlds.

There are currently 42 REITs and property trusts listed in Singapore. The average dividend yield of S-REITs was 7.6% as of 31 December 2022. This compares favourably with the 10-year Singapore government bond benchmark yield of 3.1%.

Here are some examples of S-REITs that have steadily grown their dividends over the years:

- Parkway Life REIT, one of Asia’s largest healthcare REITs, has grown its distribution per unit (DPU) from 2.27 cents in 2007 to 14.08 cents in 2022. If you had invested in Parkway Life REIT at its IPO price of S$1.28, your current dividend yield-on-cost stands at an impressive 11.0%.

- Mapletree Pan Asia Commercial Trust owns 18 commercial properties across Singapore, China, Hong Kong, Japan, and South Korea. It has grown its DPU from 5.27 cents in 2012 to 9.61 cents in 2022. If you had invested in MPACT at its IPO price of 88 cents, your current dividend yield-on-cost also stands at an impressive 10.9%.

Historically, there has been a positive long-term correlation between inflation and real estate. As economies grow, the demand for properties tends to increase, leading to rising rents over time. Because of this, property and REITs are often considered as an effective inflation hedge. However, given the current uncertain outlook, investors should exercise caution and choose high-quality REITs with robust balance sheets to mitigate potential risks.

4. Tax-friendly

The Singapore government has implemented various measures to attract investors and foster a conducive investment climate. Various tax incentives for individual investors include:

- Zero capital gains tax. Investors can realize gains from the sale of assets, such as stocks, real estate, and businesses, without being subject to capital gains tax.

- Zero dividend tax. Singapore operates on a one-tier corporate tax system, where the corporate income is taxed at the company level, and dividends distributed to shareholders are tax-exempt. This helps to avoid double taxation and encourages companies to distribute profits to shareholders.

- Tax transparency for REITs: REITs that distribute at least 90% of their taxable income enjoy tax transparency treatment by IRAS. Individual investors receiving these distributions also enjoy tax-exemption treatment.

- Zero estate/inheritance tax. There is no tax imposed on the transfer of assets from a deceased person to their beneficiaries, ensuring that accumulated wealth can be smoothly passed on to future generations with minimal financial burdens.

In essence, building a portfolio of assets in Singapore can be highly tax-efficient and serve as a powerful strategy to grow your wealth. The combination of tax advantages and a pro-business environment makes Singapore an attractive destination for investors.

5. Strong currency

The strength of the Singapore dollar (SGD) contributes to the country’s reputation as an attractive investment destination. A strong currency that retains its value reduces uncertainties for investors and provides a predictable environment for financial planning and decision-making.

For companies operating in Singapore, a strong SGD can lead to lower import costs for raw materials and goods. This can positively impact profit margins and improve the overall competitiveness of Singaporean businesses in international markets.

For foreign investors looking to invest in Singapore, the strong SGD serves as a hedge against currency risks. When investing in a country with a robust currency, investors are less exposed to potential losses resulting from unfavorable exchange rate movements, which can erode returns on investments denominated in weaker currencies.

In summary, the strength and resilience of the SGD enhance Singapore’s status as a preferred destination for both local and global investors looking to capitalize on stable growth prospects and opportunities in a well-regulated and investor-friendly environment.

The fifth perspective

While the Singapore stock market may not be the fastest growing, it offers a compelling investment landscape with several distinctive benefits. By capitalizing on these advantages, investors can build a resilient and diversified investment portfolio in Singapore, taking advantage of the country’s stable growth and long-term potential. With the right approach, Singapore’s investment landscape can be a valuable addition to any investor’s portfolio.

Buy Singapore stocks, REITs and ETFs on one convenient trading platform with the moomoo app. Moomoo SG has announced a lifetime zero commission for the U.S. market and 1-year zero commissions* for the Singapore market for eligible clients. Moomoo SG offers one of the most competitive trading fees across US, HK, SG & China A Shares with live market data.

| Brokerage | Min. Fees (S$) | Trading Commissions | ||

|---|---|---|---|---|

| < S$50K | > S$50K-100K | > S$100K | ||

| CGS-CIMB Securities | 25 | 0.275% | 0.22% | 0.18% |

| DBS Vickers | 25 | 0.28% | 0.22% | 0.18% |

| FSMOne | 8.80 | 0.00% | 0.00% | 0.00% |

| Interactive Brokers | 2.50 | 0.08% | 0.08% | 0.08% |

| Moomoo | 0.99* | 0.03%* | 0.03%* | 0.03%* |

| OCBC Securities | 25 | 0.275% | 0.22% | 0.18% |

| Phillip Securities | 25 | 0.28% | 0.22% | 0.18% |

| Saxo Markets | 5 | 0.08% | 0.08% | 0.08% |

| Tiger Brokers | 1.99 | 0.06% | 0.06% | 0.06% |

| UOB Kay Hian | 25 | 0.275% | 0.22% | 0.20% |

*1-year commission free; S$0.99 and 0.03% platform fee. Selected brokerage fees for comparison.

When you successfully register for your Moomoo SG universal account via the moomoo app, you also gain free access to Level 2 market data for the U.S. stock market; Level 1 market data for the Singapore stock market; Level 1 market data for China A Shares.

Investment products available through the moomoo app are offered by Moomoo Financial Singapore Pte. Ltd (Moomoo SG), a capital markets services licence holder regulated by the Monetary Authority of Singapore. Moomoo SG’s parent company, Futu Holdings Limited, is backed by world-class investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Open your Moomoo SG universal account today with the moomoo app here. *Terms and conditions apply. Platform and other fees apply.

All views expressed in the article are the independent opinions of The Fifth Person. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.