2023 brought about many surprises, with the ‘most anticipated recession’ – at least for the U.S. – not happening. The outcome, at least for last year, was an exceptionally strong economy, and the stock market performance reflected that. Here we uncover the surprises, and what lays ahead in 2024.

2023

It (was) the economy, stupid

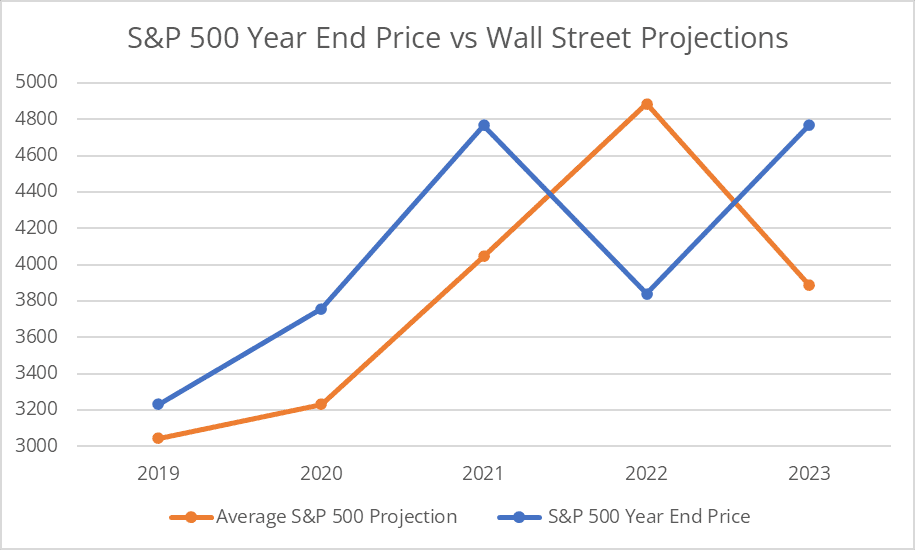

Economies generally held up better in 2023 than expected, with the U.S. in particular performing much stronger than projected. In Q3 2023, the U.S. economy delivered an annualized 4.9% in GDP growth. This was helped by debt-fuelled government spending, and the still supportive U.S. consumer. Compare this to end 2022, where nearly every economist was touting a recession. Either way, the gloomsters were wrong, on both the economy and the markets. The average 2023 year-end S&P 500 projections by Wall Street made in 2022 was 3,885 points – an 18.5% difference from the actual close of 4,769.

Inflation fell

It should have been no surprise that inflation dropped, and that it dropped at a reasonably rapid pace. It’s all about the maths – high base figures from 2022 meant that the year-on-year comparisons of prices would gradually slow as prices stabilised. The U.S. Consumer Price Index peaked at 9.1% (year-on-year change) in June 2022, but ended 2023 down by two-thirds at 3.4%. Why markets and central banks seemed surprised by that was the surprise.

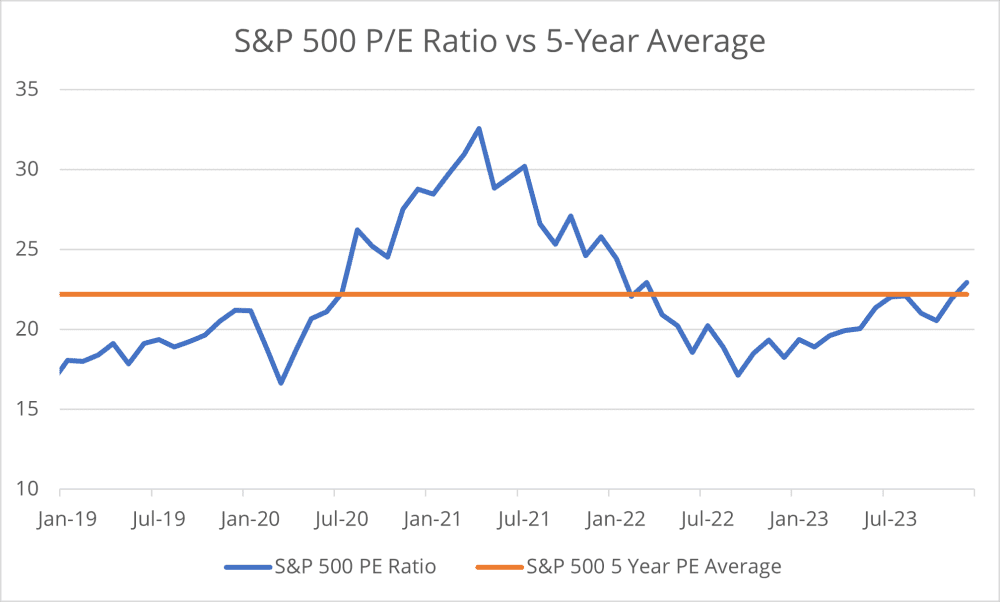

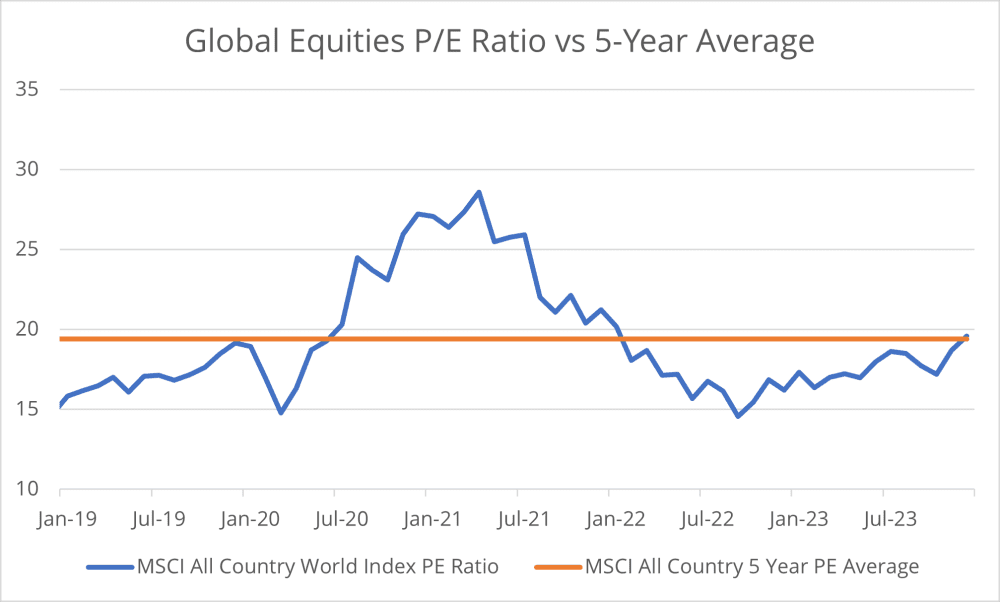

The market went up, but it’s neither cheap nor expensive

Fuelled by expectations that the more benign inflation environment would lead to interest rates stabilizing (or even falling), markets charged ahead in the final two months of the year. That year-end rally meant they just got even more expensive. However, on a longer-term basis, the U.S. Market (represented by the S&P 500) and global equities’ (represented by MSCI All Country World Index) price-to-earnings (P/E) ratio are just slightly above their five-year valuation averages.

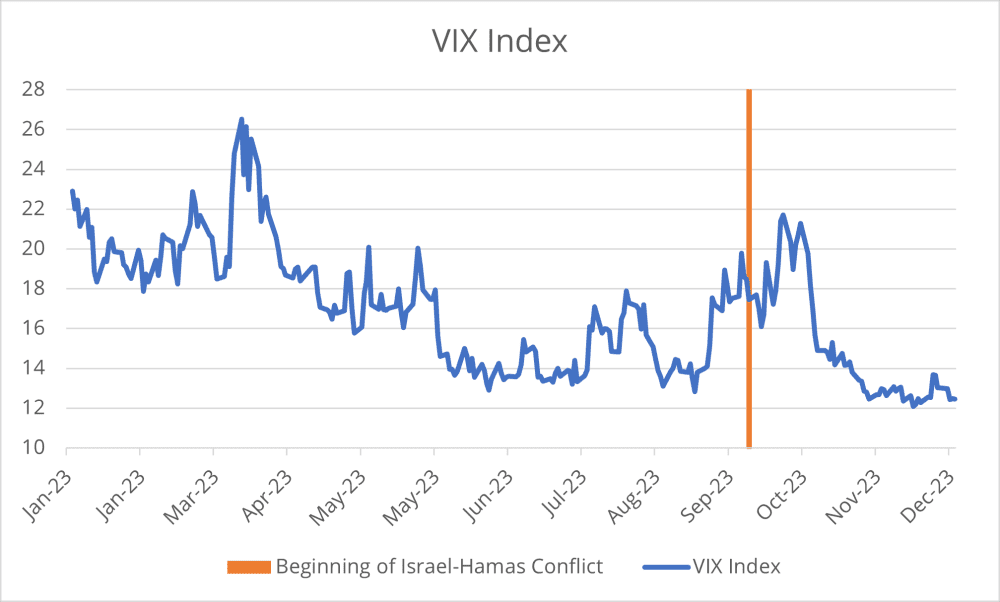

Wars take a backseat

Despite a new war breaking out in the Middle East, and the continuing stalemate in Ukraine, stock markets did what they always do. They ignored them. Despite the ongoing distressing images and news flow.

Take for example, the VIX Index, which measures the volatility in the U.S. stock market. It can also be seen as a proxy for fear in the market. When there’s more fear (i.e. news flow on war and conflict), the VIX tends to rise. But we’ve seen the opposite in 2023. Not only did the VIX stay below 20 — which indicates a perceived low-risk environment, it dropped to a multi-year low. The temporary spike in the VIX after the Hamas attack on October 7th and the subsequent Israeli response, seemed more to do with fears of long-term bond yields remaining higher, but subsequently faded away toward the year end.

2024

Has the Fed done enough or too much?

It’s all about the data. The strong rally in late 2023 has meant that markets are priced for perfection. The assumption is that central banks have pulled off the almost impossible feat of keeping inflation in check, without having to sacrifice the economy to get that done. This argument is less easy to make in Europe and the UK than in the U.S. both regions are facing a growth slowdown, which might cause the Bank of England and European Central Bank to start to cut rates sooner, should they hit a recession.

Froth versus the alternatives

Markets are expensive. Some stocks are stratospherically so. For example, Eli Lilly, an American pharmaceutical company that is the darling of investors for its new obesity drugs, now trades at an astronomical P/E ratio of 116! It’s also now the 10th largest company in the S&P 500 index. By comparison, the ‘Magnificent 7’, consisting of dominant tech companies: Apple, Alphabet, Microsoft, Amazon, Meta, Tesla and Nvidia trade at an average P/E ratio of 37, compared to S&P 500’s average of 23 (21 if you exclude those seven stocks).

At that valuation, the U.S. equity market has an earnings yield of 4.3% (inverse of the P/E ratio) which is in line with historic averages. This is a bit higher than the yields of 4% plus offered by bonds, which are lower risk, and would imply that fixed income looks rather more attractive at these levels.

Can China get back on track?

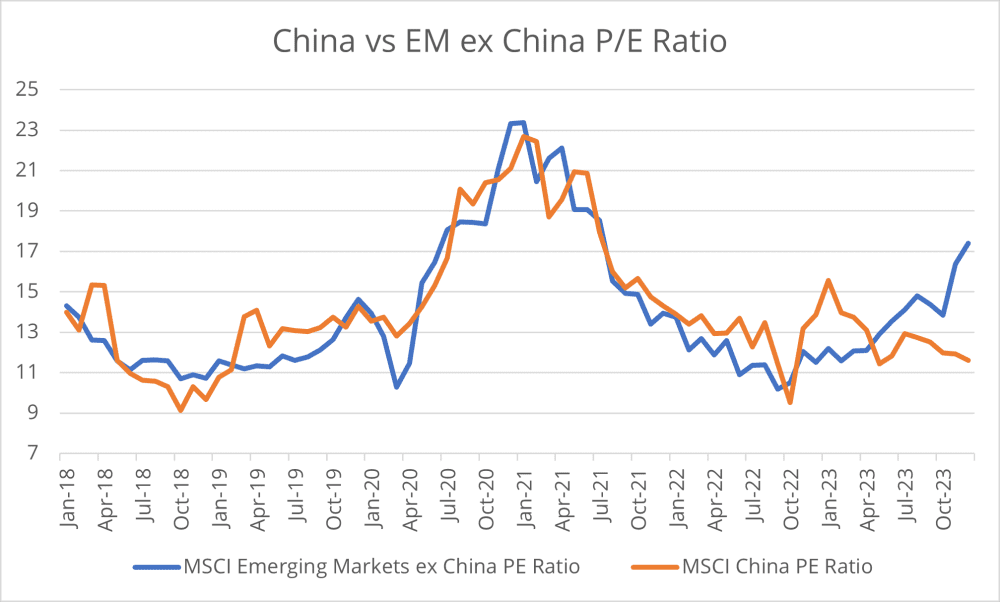

Could this be the trade of the year? Some analysts have highlighted the cheap valuations in China – the MSCI China Index trades at a P/E ratio of 11.6 (half that of the U.S.). However, it is cheap for a reason. Virtually all foreign investors have put China in the ‘too hard’ basket due to unpredictable government and regulatory policies, and the key property market being flat on its back. If the government were to finally find a way of convincing investors that the worst is over, then there could be a big rebound. The key word in that sentence though is ‘if’.

U.S. politics

If the same two deeply divisive figures end up slugging it out (again) for the top job in the U.S. Presidential Election as they did in 2020, markets will sit up and start taking notice from mid-year. Particularly when one is on record as saying that he’ll impose 10% tariffs on all imports on Day One. Cue retaliatory measures worldwide and a jump in inflation at the same time.

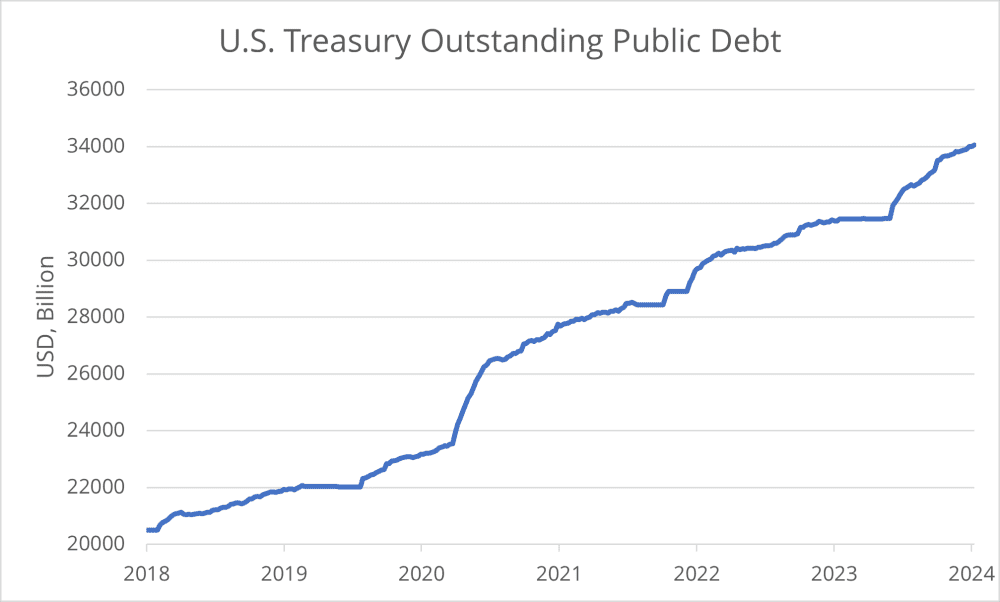

Tipping point of debt

At what point will investors start looking at the size of the government debt pile around the world and start saying that they need a higher return to justify the risks involved in holding it?

At that point, it’ll not be about interest rates being raised to head off inflation, interest rates will be rising because of lack of demand for that debt against excess supply. Prices will drop (and yields will rise) because investors will want to be paid more to reflect the higher risk that the government will run out of money to pay them back (not for nothing did James Carville, Bill Clinton’s political strategist, say in 1993 that he wanted to be reincarnated as the bond market, because ‘then you can intimidate everybody.’). Central banks will be pushed out of the driving seat, and bond investors will take over. As of 2024, U.S. public debt crossed the record US$34 trillion mark (equivalent to 123% of GDP).

What should you do?

With so many worries both foreseen and unforeseen, it’s easy to get lost in the noise and gyrations of the market. However, the two learning points in 2023 (and in pretty much every year before that) are that that most of the pundits on Wall Street failed to predict the rally, and that the best thing to do would have been to ignore them and to stay invested.

If you missed the jump in markets at the end of 2023, you would not have recouped some of the losses if you were invested in 2022. Not for the first time, the base point remains that investing is a long-term game, so sticking to your long-term strategic plan is a must.