Sunway REIT is the second largest REIT in Malaysia with a property portfolio of retail malls, hotels, office blocks, a medical facility, an industrial building and a university campus. As of 30 June 2019, the portfolio was valued at valued at RM8.05 billion.

In this article, I’ll give an update on the REIT’s segment developments in 2019, its latest annual results, and stock valuation. Here are 11 things to know about Sunway REIT before you invest:

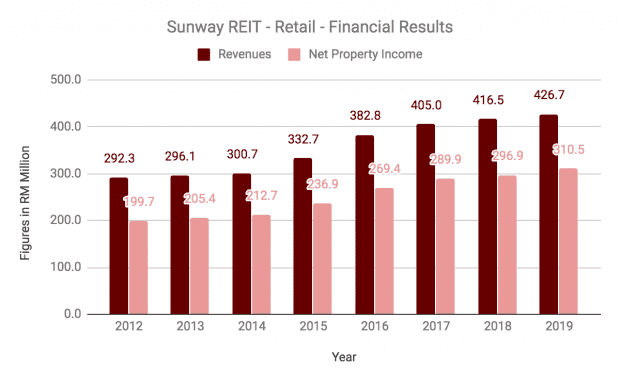

1. Retail revenue grew 2.5% year-on-year to RM426.7 million, and net property income (NPI) grew 4.5% y-o-y to RM310.5 million in FY2019. This growth was contributed largely by Sunway Pyramid which offset lower NPI at Sunway Carnival and Sunway Putra Mall.

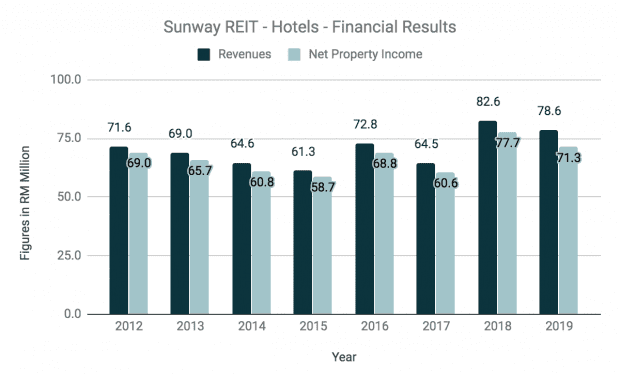

2. Hotel revenue fell 4.9% y-o-y to RM78.6 million, and NPI fell 8.2% y-o-y to RM71.3 million in FY2019. The drop was due to a weaker hospitality market during the year. Sunway Resort Hotel & Spa recorded the biggest fall as it was impacted by a loss of income from the refurbishment of its grand ballroom and meeting rooms over a four-month period from July to November 2018. This was partially offset by Sunway Clio which delivered its first full-year income contribution in 2019.

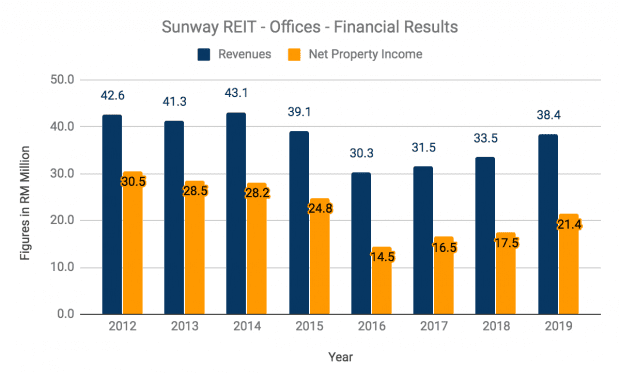

3. Office revenue grew 14.8% y-o-y to RM38.4 million and NPI grew 22.3% y-o-y to RM21.4 million. This was attributed to the REIT’s success in securing new tenants for Sunway Putra Tower and the expansion of existing tenants at Wisma Sunway.

4. In April 2019, Sunway REIT completed its acquisition of Sunway University for RM550 million. This property is currently leased to Sunway Education Group Sdn Bhd on a triple-net lease basis for a period of 30 years with a fixed rental uplift of 2.3% per annum. The acquisition contributed RM7.2 million in NPI for the year. As a result, NPI for the Services segment grew 35.4% to RM30.6 million in FY 2019. In the Industrial segment, NPI grew 14.6% on the back of positive rental reversions.

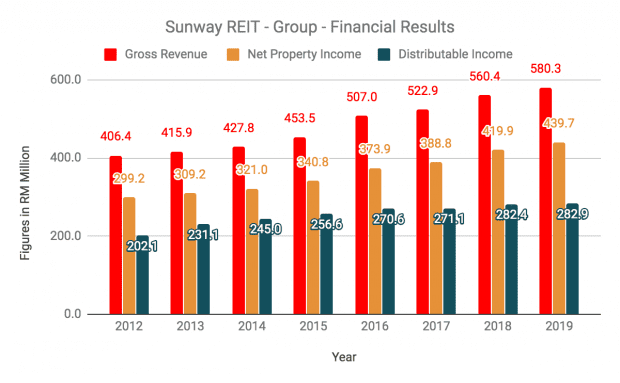

5. Total revenue grew 3.5% y-o-y to RM580.3 million, and total NPI grew 4.7% y-o-y to RM439.7 million in FY2019. This was mainly due to growth in the Retail, Office, Services, and Industrial segments highlighted above. Distributable income remained stable at RM282.9 million.

6. As of 30 June 2019, Sunway REIT has a gearing ratio of 37.9%. Average cost of debt is 4.02% and 45% of borrowings are at fixed interest rates. The weighted average debt maturity is 0.4 years with 48% of its debt rolled on a monthly basis supported by underwriting commitment from a financial institution.

7. As of 30 June 2019, Sunway REIT has a tenant base of 1,247 tenants, and eight master lease agreements. The portfolio occupancy rate was 95.5% and the top 10 tenants accounted for 13.1% of total revenue in FY2019:

| Tenant | Percentage of Total Revenue |

|---|---|

| Padini Dot Com Sdn Bhd | 2.3% |

| Parkson Corporation Sdn Bhd | 1.9% |

| TGV Cinemas Sdn Bhd | 1.5% |

| Aeon Co. (M) Bhd | 1.4% |

| GCH Retail (M) Sdn Bhd | 1.2% |

| JD Sports Fashion Sdn Bhd | 1.2% |

| Uniqlo (Malaysia) Sdn Bhd | 1.0% |

| Jabatan Kerja Raya | 0.9% |

| Beauty in Motion Sdn Bhd | 0.9% |

| Sunway Resort Hotel Sdn Bhd | 0.8% |

8. Sunway REIT is redeveloping Sunway Carnival for a total projected cost of RM353.0 million. The expansion will add 350,000 square feet of new space for the retail mall. The project is expected to be completed by Q2 2021.

9. Sunway Tower has suffered from low occupancy rates since 2014 when it was vacated by its two former anchor tenants. In 2019, it recorded an occupancy rate of just 20.1%. In a bid to change things up, the management has allocated RM22 million in refurbishment cost to convert five levels of Sunway Tower into co-working spaces with newer, trendier offerings. The project is expected to be completed by FY2020-2021.

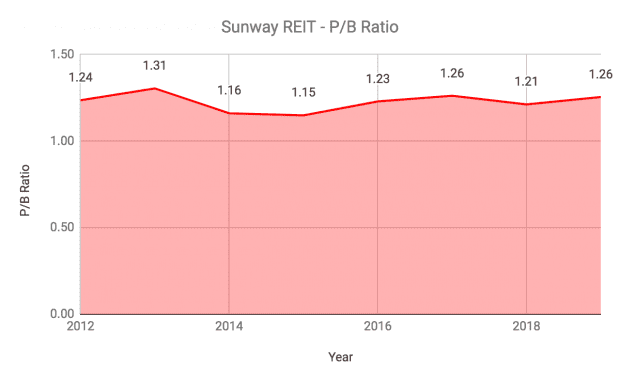

10. P/B ratio: As of 30 June 2019, Sunway REIT had a net asset value of RM1.49 per unit. Based on its closing unit price of RM1.81 (as of 31 Oct 2019), Sunway REIT has a P/B ratio of 1.21.

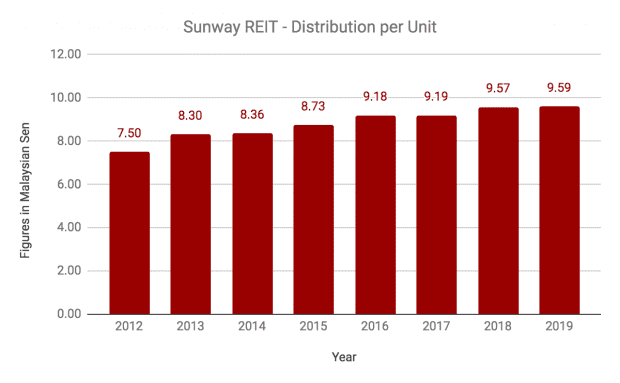

11. Distribution yield: Sunway REIT paid a distribution per unit (DPU) of 9.59 in FY2019. The REIT has a track record of paying a growing dividend over the years:

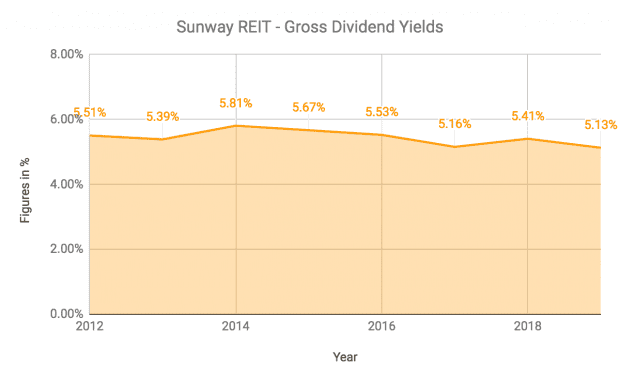

Based on its closing share price of RM1.81, Sunway REIT’s gross distribution yield is 5.30%.

The fifth perspective

Sunway REIT has maintained steady growth in revenue and NPI over the years, and rewarded unitholders with a growing dividend. Sunway REIT’s unit price hit a record high of RM1.95 recently in early October this year. However, the price has since come down and investors having a look at Sunway REIT would find it fairly valued at this point in time.