Established in 1974, Temasek Holdings is a global investment company wholly owned by the Singapore government. As a generational investor, Temasek aims to deliver sustainable value over the long term, guided by its view of long-term structural trends.

Temasek Review is an annual event where Temasek provides an overview of its financial performance, investment activities, and strategic initiatives for the past financial year (as of 31st March). It also serves as an opportunity for the media to seek clarifications and ask hard-hitting questions surrounding Temasek’s operations and activity. For example, in the past financial year, Temasek had written down a loss of S$377 million due to its failed investment in FTX. This was one of the hot topics at Temasek Review 2023’s panel discussion. Here are 10 things I learned from Temasek Review 2023.

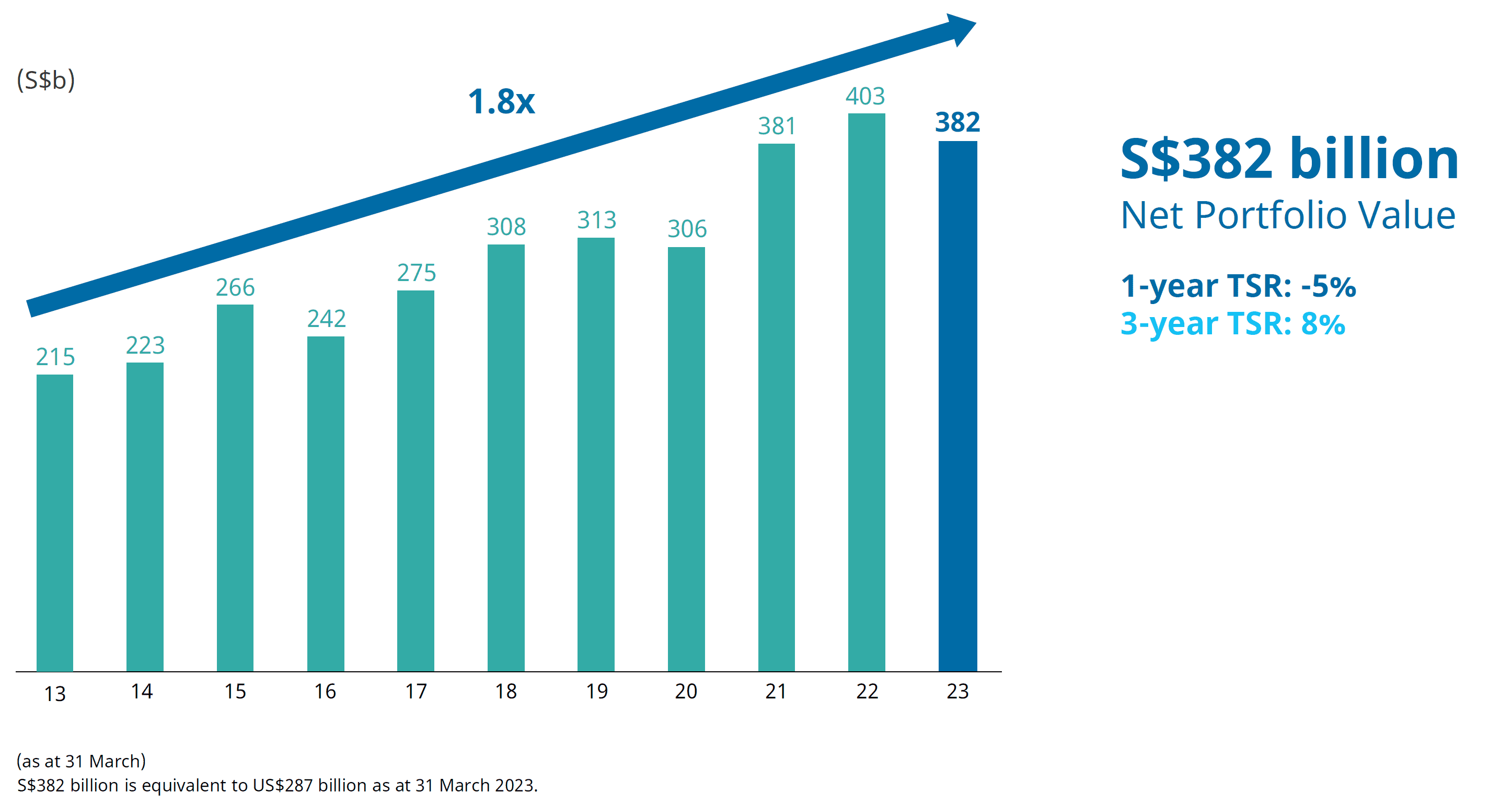

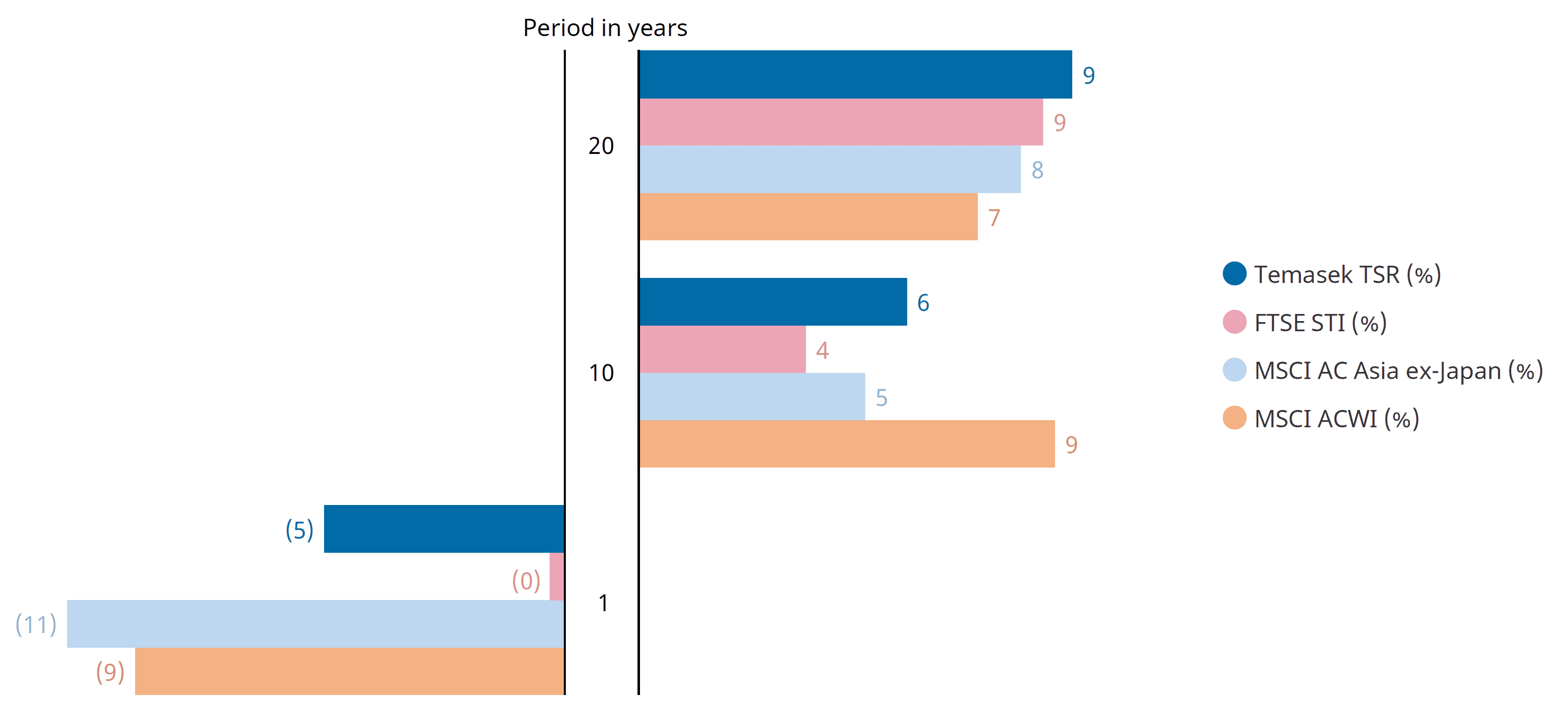

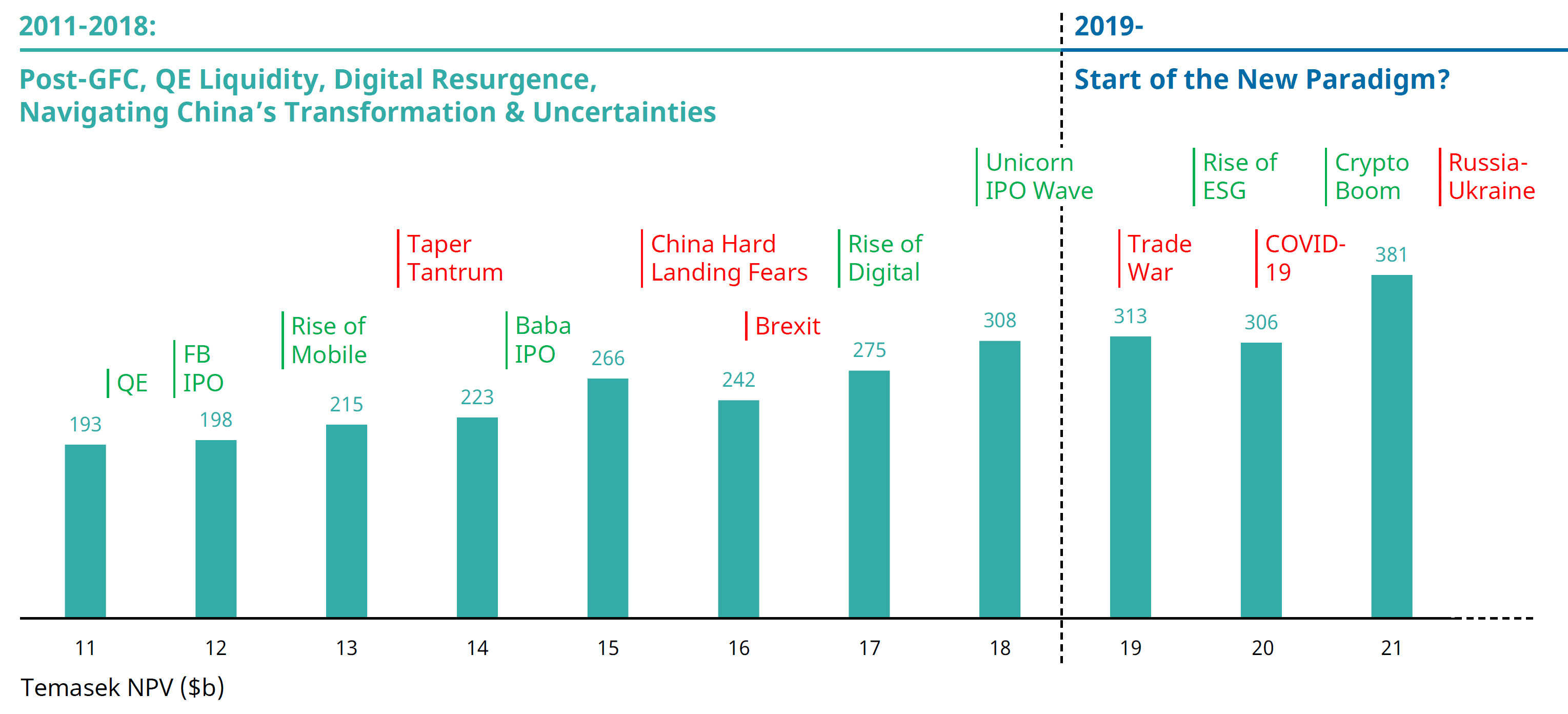

1. Temasek’s net portfolio value shrank from S$403 billion in 2022 to S$382 billion in 2023. The 5% drop in one-year total shareholder return (TSR) can be attributed to the current volatility in the stock market. This is also reflected in Temasek’s S$4 billion net investment for 2023, a reduced amount for the company, when compared to 2022’s net investment of S$24 billion.

Many market indices have recorded drops this year as well. Temasek’s 5% decline in portfolio value is relatively small compared to the 11% and 9% drop experienced by the MSCI AC Asia ex-Japan and MSCI ACWI respectively. Over the long term, Temasek still succeeds in maintaining a 20-year TSR of 9%, a higher return when compared to other market indices.

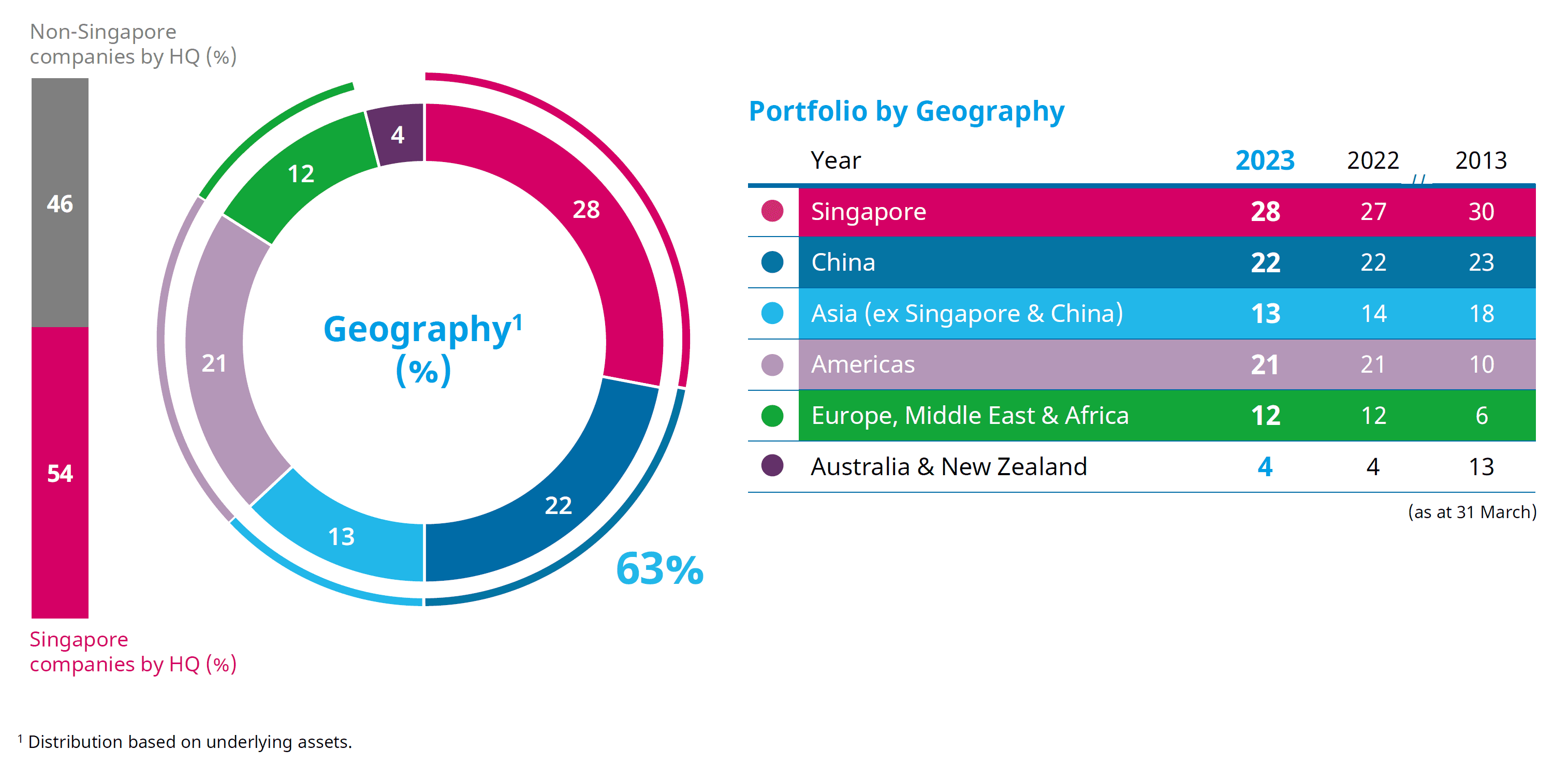

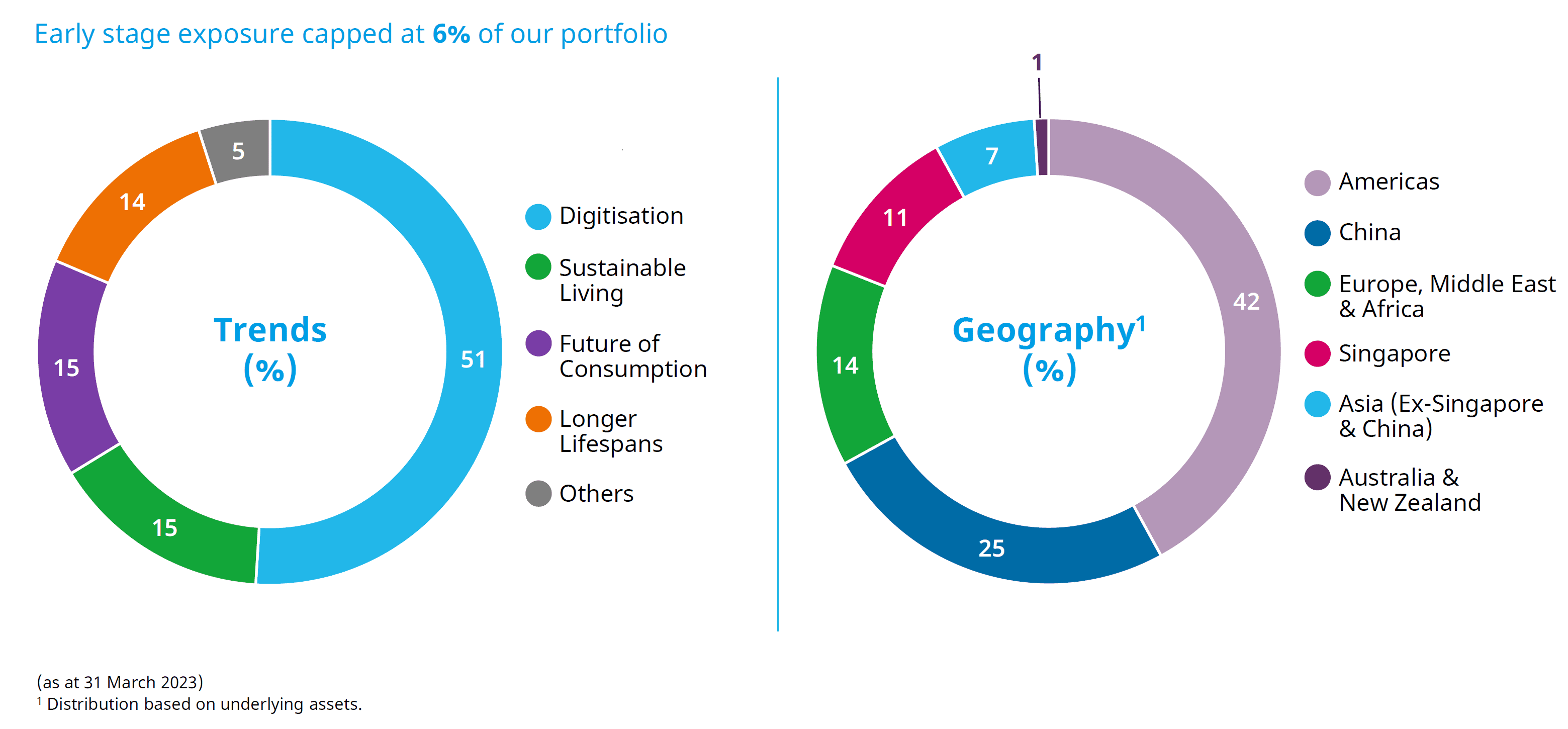

2. Temasek’s investments in the Americas now make up a significantly higher proportion of their portfolio. As of FY2023, the size of Temasek’s Americas investments has grown to 21% from 10% in 2013. The Americas also constitute the biggest proportion of global direct investments and early-stage portfolio investments.

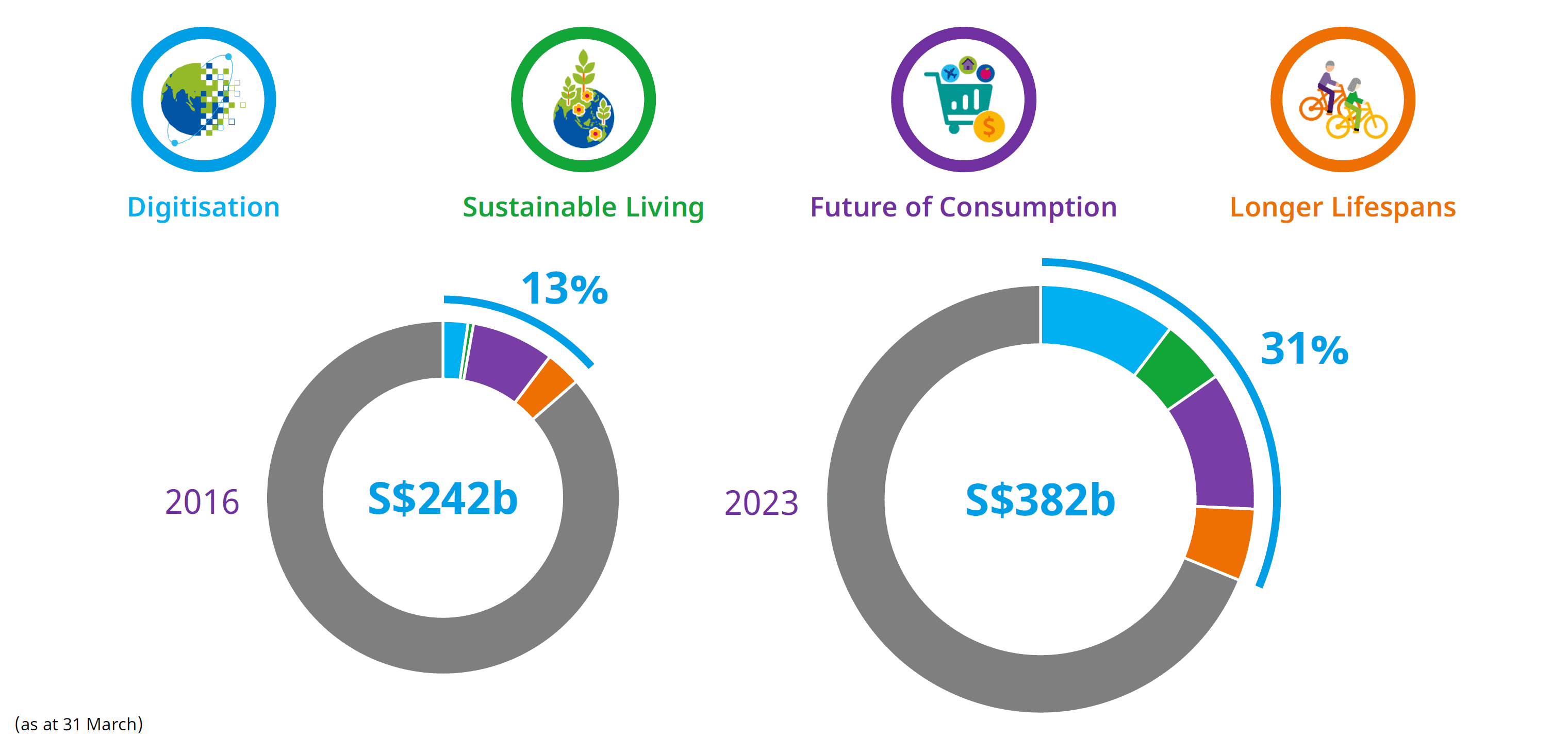

Temasek’s Americas portfolio has grown due to the investment opportunities present in the U.S. market that align with the structural trends of digitization, sustainable living, future consumption, and lifespan enhancement. Temasek believes these four trends show promising and sustainable long-term growth for the future. Resultantly, the company has gradually increased its exposure to these areas, from 13% of its S$242 billion portfolio in 2016 to 31% of its S$382 billion portfolio in 2023.

3. China comprised 22% of Temasek’s portfolio, down from 29% in 2020. A question was asked about Temasek’s apparent shift in investments from China to the Americas. Temasek’s Deputy CEO, Chia Song Hwee, explained that when Temasek was first established, its primary focus was on investing in Asia, notably China, to leverage the region’s growth potential. As the company progressed, emerging trends in technology and life sciences were identified, leading to a strategic decision to explore opportunities in the U.S. This resulted in the establishment of an office in the U.S. and the allocation of additional capital over the past seven to eight years to support portfolio growth. Temasek’s approach was not driven by specific targets but rather by a bottom-up analysis of trends, allowing the portfolio to evolve organically over time.

Initially, Temasek’s exposure to China was primarily through portfolio companies which participated in China’s early industrialization phase. In the early 2000s, the company began direct investments in China, marking the beginning of three distinct waves. The first wave involved investments in the banking and financial services sector, coinciding with China’s opening up and accession to the WTO. Subsequently, the focus shifted to the second wave, capitalizing on the growth of consumption; investments were made in e-commerce, gaming, retail, and other related industries. Currently, the company finds itself in the third wave, with a focus on the green energy transition, enterprise software, and healthcare life sciences. Temasek’s objective is to build a portfolio that remains relevant and aligned with the evolving landscape moving forward.

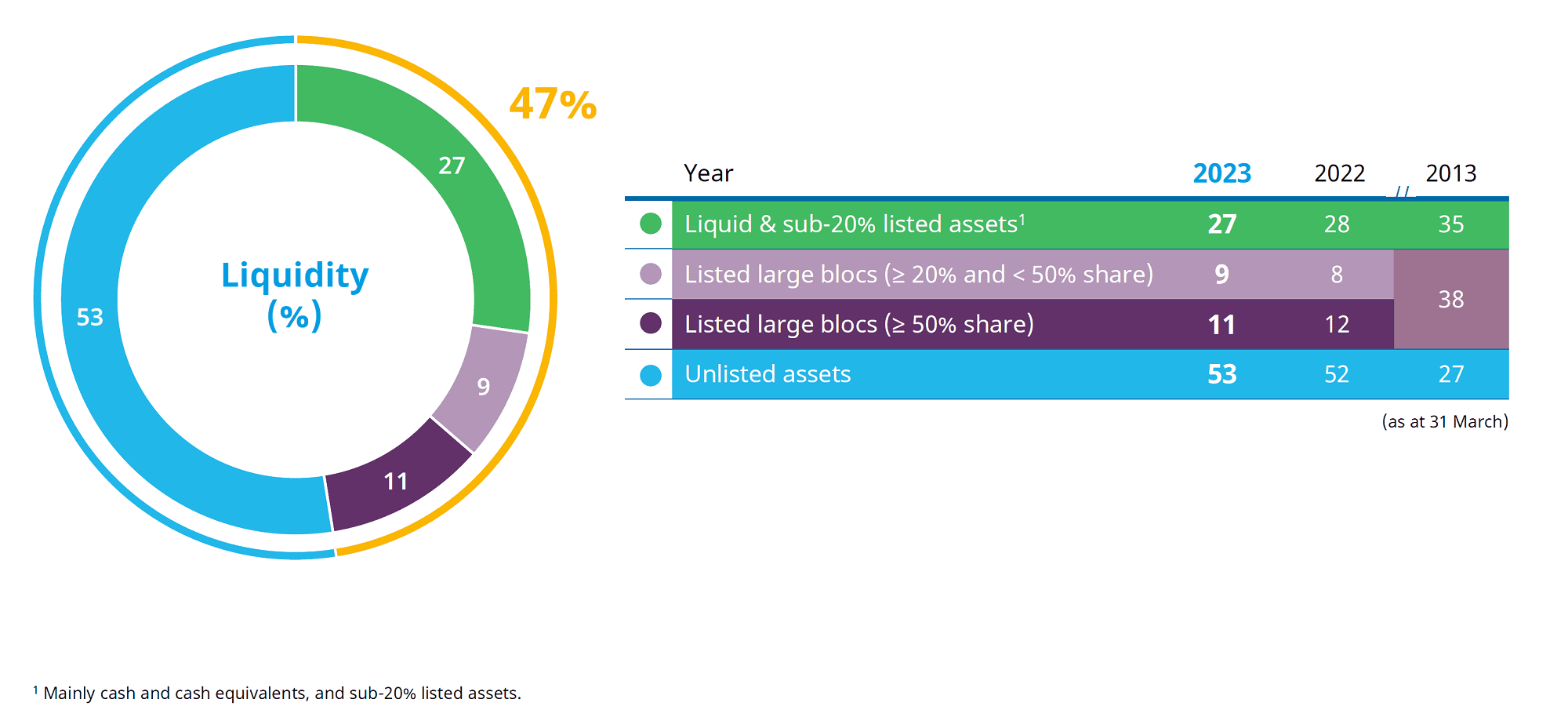

4. Temasek’s investment in unlisted assets continues to grow and now comprises 53% of its portfolio. Over the past 20 years, Temasek has seen also higher returns from its unlisted assets (14.4%) compared to its listed assets (8.0%).

The growth of Temasek’s unlisted assets can be attributed to two key factors. Firstly, early-stage portfolio investments, which are commonly unlisted, contributed to this growth. Despite a maximum allocation of 6% for early-stage exposure in Temasek’s portfolio, sustained investments in this sector have resulted in an increase in unlisted assets. Temasek’s early-stage portfolio offers valuable insights into emerging technologies and the four structural trends mentioned earlier.

Notably, early-stage investments have demonstrated strong performance, outperforming the overall portfolio with a notable 10.9% return over a seven-year period. This performance reflects the potential for significant appreciation in asset value through early growth opportunities.

The growth in Temasek’s unlisted assets can also be attributed to the relatively lower valuations associated with such investments. During a panel discussion, Temasek’s Chief Investment Officer, Rohit Sipahimalani, noted that valuations in the U.S. public market remain high, while unlisted companies in the private market are more open to accepting lower prices. This creates an opportunity for Temasek to invest in these unlisted companies at more favourable valuations. Furthermore, Sipahimalani mentioned that recent sales of unlisted companies by private equity firms seeking to provide liquidity to their shareholders have presented additional opportunities for Temasek. These sales have facilitated the acquisition of unlisted companies at lower valuations, further contributing to the growth of Temasek’s unlisted assets.

5. Key markets appear to be on the brink of recession as China, the U.S., and Europe show signs of weaker growth. A recession would place downward pressure on inflation. However, negative effects such as an outflow of economic activity and reduced profitability within these markets will be experienced as well. Here are Temasek’s outlook on its key markets:

- U.S. consumption remains resilient and low unemployment rates have kept inflationary pressures high. The rise of generative AI and the green transition have promoted increased investments which could delay the onset of a recession.

- Europe is in a technical recession with core inflation at 5% which has forced the European Central Bank to hike rates. Despite this, valuations remain fairly reasonable. Within Europe, Temasek will focus on quality investments that are capable of withstanding economic downturns.

- China is currently in its recovery phase following the pandemic. The country’s strong reliance on domestic consumption to drive growth has been impacted by job uncertainties. The softer growth outlook is reflected in its market valuations. Despite this, China appears to be on target to achieve its goal of 5% GDP growth for 2023.

- Singapore’s growth is slowing but inflation is expected to ease. However, monetary policies are likely to remain tight to hedge against inflation risks.

Temasek’s investment pace will be moderated, but they are ready to take advantage of any market dislocations. Investments will be influenced by the four structural trends with a greater focus on companies with strong pricing power and cash flows to increase portfolio resilience.

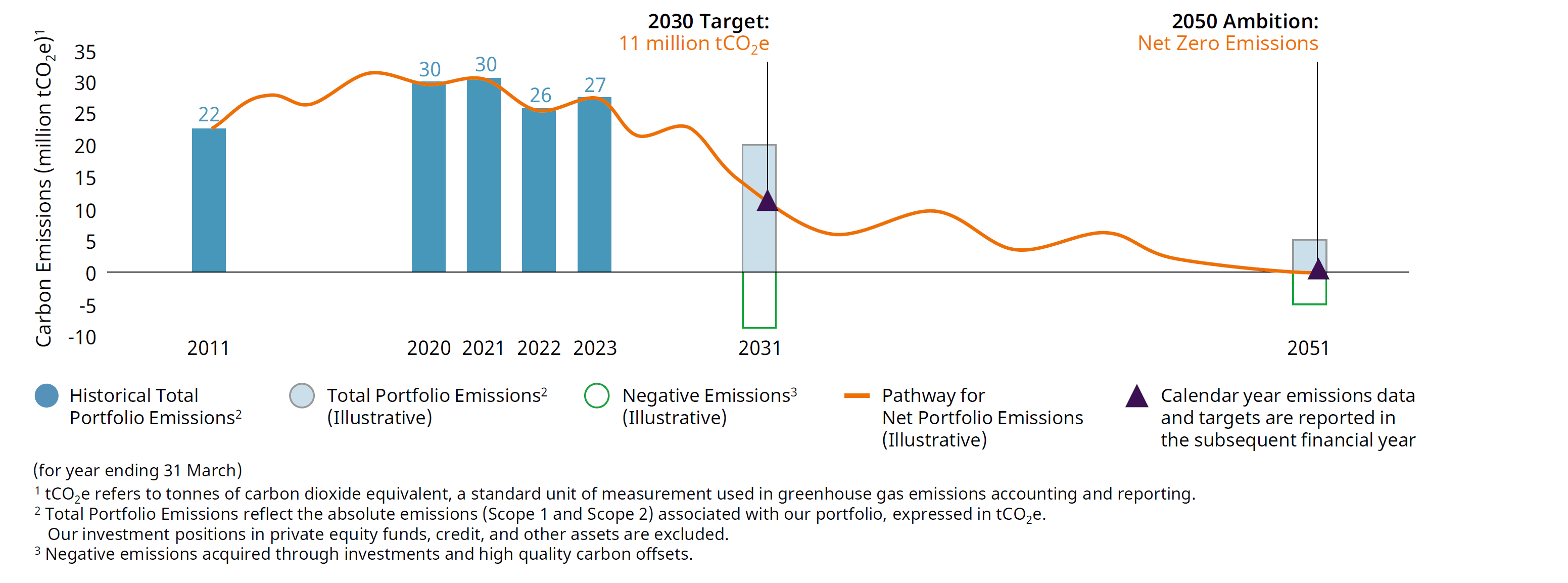

6. Temasek aims to achieve net zero carbon emission by 2050. Temasek’s portfolio emissions increased slightly from last year due to the return in business activity and operations of their subsidiary companies to pre-pandemic levels. The company reassures that they are still on track to halve 2010 carbon emission levels by 2030 and achieve net zero by 2050.

Temasek’s CEO, Dilhan Pillay, mentioned that Temasek subsidiary, Singapore Airlines, is aiming to reduce carbon emissions by operating a newer fleet of more fuel-efficient planes and researching sources of lower emission fuels.

7. Market volatility is inevitable. Investing in the stock market involves risk and market volatility is simply part of that risk. Recently, the COVID-19 pandemic, Russia-Ukraine conflict, and U.S.-China rivalry have impacted the behaviour of market participants. While stock market volatility can be unsettling for investors, it also presents opportunities. Consequently, Temasek aims to invest in businesses that can weather future market shocks and capitalise on the cheaper valuations of fundamentally good companies that these shocks present.

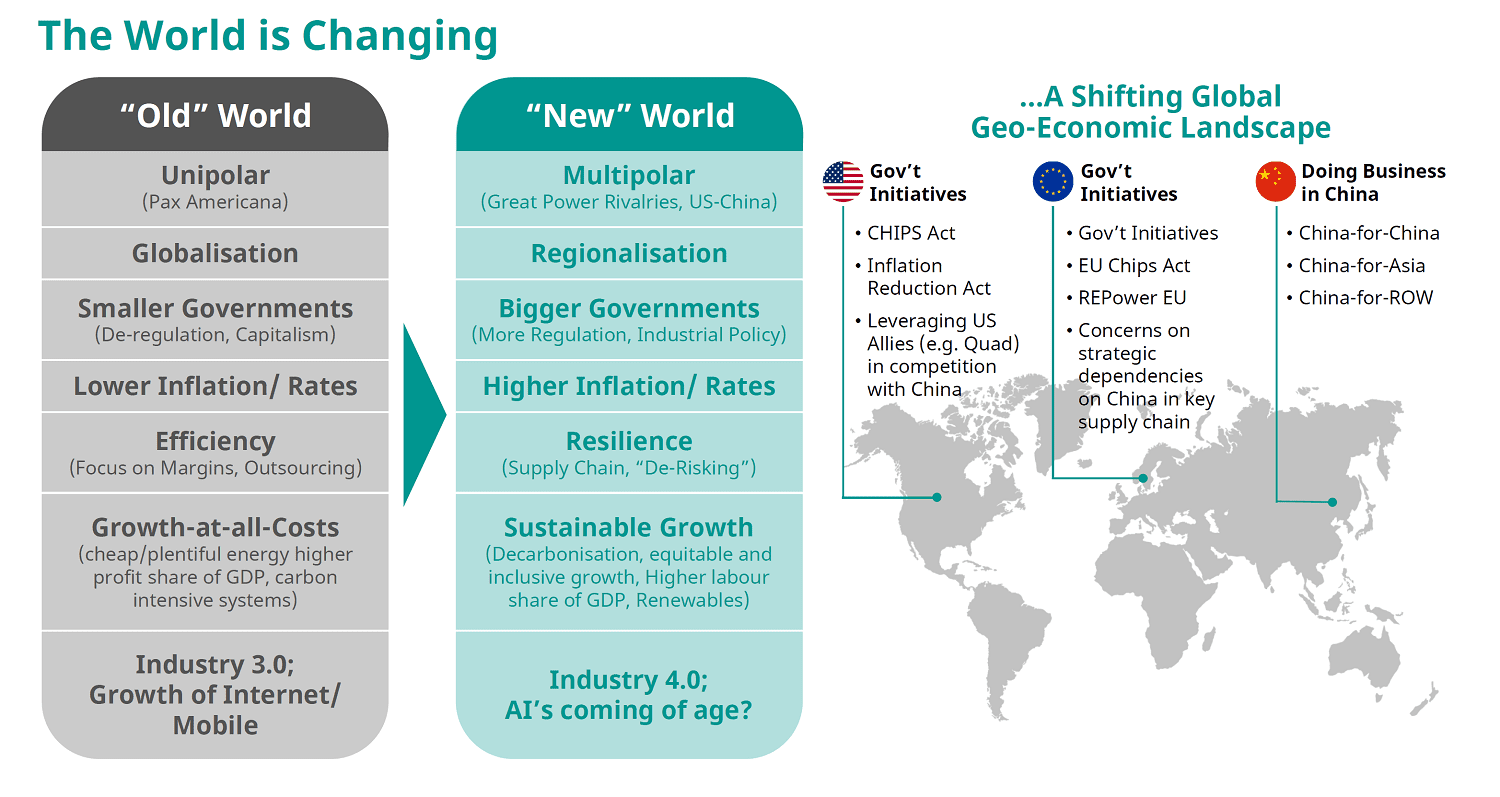

8. There has been a clear shift in the world following the pandemic. The world is currently experiencing a shift towards a more multipolar order, with notable power rivalries emerging, such as the ongoing rivalry between the U.S. and China. This transition signifies a departure from a highly globalised world to one that is becoming more regionalised. The growing emphasis on supply chain resilience over efficiency has led to the increasing adoption of nearshoring practices.

In the context of Temasek, Chia highlighted that their investments in China are primarily driven by domestic consumption and are not directly exposed to the global decoupling of supply chains from China. However, indirect effects, such as higher costs and inflationary pressures, are expected to arise as a result of this global shift in supply chains.

9. Temasek’s development engine, comprising 4% of their portfolio, is focused on identifying and building capabilities within future growth sectors. These capabilities can be utilised by Temasek’s portfolio businesses to improve efficiency and resilience. During the panel discussion, Chia emphasized the significant role played by Temasek’s cybersecurity companies, Ensign and ISTARI, in significantly reducing the resolution time for a cyberattack experienced by another portfolio company. Without these capabilities, the prolonged resolution time could have resulted in more substantial costs due to operational disruptions. Therefore, while these capabilities may not always yield the highest financial returns, they bring intangible value to Temasek by enhancing the resilience of the businesses within its portfolio.

10. The panel discussion invariably faced some questions surrounding Temasek’s failed investment in FTX. Pillay explained that in early stage investments, some may yield significant success while others may perform poorly. Fortunately, the majority of the Temasek’s investments have yielded positive results, with only a few turning out exceptionally poorly. Ultimately, the success of an investment depends on the values and actions of the individuals being backed. If these values change over time or do not align with expectations, issues may arise. Preventing such issues from arising is extremely difficult as it is nearly impossible to predict the outcome with certainty from the beginning. In the specific case of FTX, the decision to write down the investment was a response to the way in which the company experienced a significant collapse.

Chia also explained that given Temasek’s stake in FTX was marginally above 1%, their capacity to wield influence was limited. Nevertheless, Temasek provided suggestions to FTX to enhance specific areas of the business. They advised measures to ensure compliance, as they identified regulatory adherence as a significant risk. Despite offering these recommendations, Temasek recognized that their influence was restricted due to their relatively small ownership stake. Consequently, they did not possess substantial control over decision-making procedures in FTX.

The fifth perspective

Temasek has consistently displayed its dedication to promoting sustainable growth and generating lasting value through its diversified portfolio and strategic investments in diverse sectors. While the FTX scandal may have raised concerns, Pillay assured that it was an isolated incident. This event has not altered Temasek’s long-term perspective and commitment. With a prudent investment strategy, global collaborations, and robust governance practices, Temasek remains steadfast in its mission to contribute to Singapore’s prominence as a leading global financial and economic centre.