After a decade in the making, Uber is finally debuting on the New York Stock Exchange in May this year at a valuation of up to US$100 billion. We are all clamouring to know if this will be an investment opportunity of a lifetime or a one-way drive in the wrong direction.

What makes Uber interesting is its role as a disrupter in the taxi industry. I’m sure we’re all familiar with Uber – it is a ride-sharing platform that connects users who are looking for a ride with a personal driver that will drive them to their destination.

Users gain the convenience of knowing the driver’s location and time it takes for them to reach their pickup point. The cost of the trip is stated upfront and the fare is automatically charged to the user’s credit card upon reaching the destination.

For drivers, Uber helps to increase their potential earnings by minimizing downtime between rides. While drivers are on-route, the app will send a new pick-up request if it’s within proximity of a drop-off location.

Essentially, Uber is a ‘logistics broker’. Leveraging on the same concept, the company has ventured into food delivery with Uber Eats and freight with Uber Freight – making money by getting people, food, and cargo from point A to point B.

Uber is an asset-light and highly scalable business. In a short span of 10 years, the company managed to expand into 63 countries with a base of 3.9 million drivers and over 91 million monthly active platform consumers (MAPCs).

But does Uber’s scale and ambition for global domination mean its IPO will be a success?

Here are four things you need to know before you invest in the Uber IPO:

1. Uber remains unprofitable

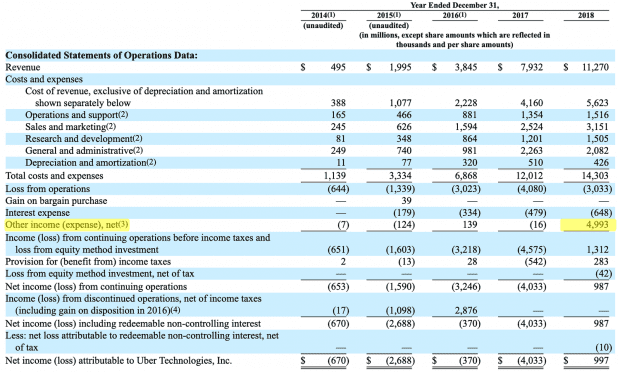

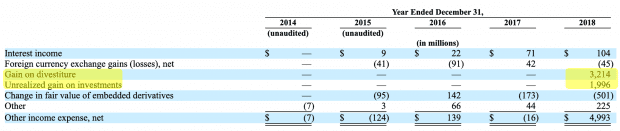

Although Uber’s ability to scale and grow their revenue is impressive (five-year CAGR of 86.6%), it remains persistently unprofitable to this day. Its net profit of US$997 million in 2018 was mainly due to a one-off contribution of US$5.0 billion from other income.

Looking at the footnotes, you can see that US$3.2 billion came from the gain on divestiture of their Russia/CIS operations to Yandex and Southeast Asian operations to Grab. Another US$2 billion in unrealized gains came from the appreciation of their 15.4% stake in China’s ride-hailing giant, Didi Chuxing.

2. Uber is in a highly competitive industry

The ride-sharing industry faces cut-throat competition. Except for price, there’s little to differentiate one platform from another. Competitors could join the price war if they have billions of dollars to burn. Whoever can withstand short-term losses and — through customer discounts and driver incentives — grow their user/driver base to a tipping point will be rewarded handsomely. It’s a winner-takes-all market.

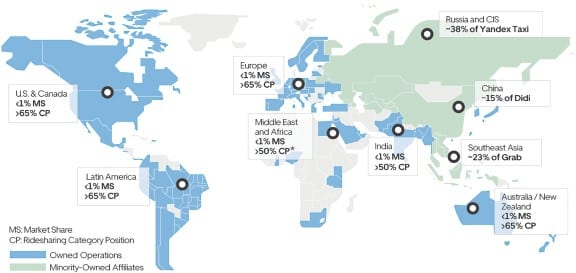

But Uber recognises that if it were to go all out, it would be a pyrrhic victory. In my opinion, it’s wise of them to exit their business in China and Southeast Asia in exchange for stakes in Didi Chuxing and Grab respectively, and to do a joint venture with Yandex in Russia.

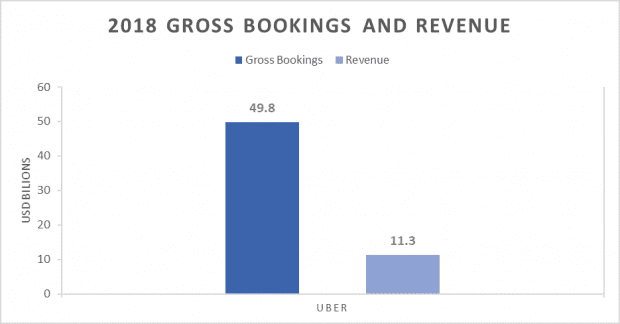

To keep drivers and customers happy, Uber paid out 77.3% of gross bookings in 2018. That includes driver fees, restaurant fees, driver incentives, refunds, and discounts. What was left over made up Uber’s 2018 revenue of US$11.3 billion.

Uber eventually plans to reduce driver-related fees through autonomous vehicles. That’s why it partnered up with big names in the automotive industry, Toyota, Volvo, and Daimler to develop and operate a fleet of driverless vehicles.

Imagine this, instead of spending US$38.5 billion to pay drivers fees and incentives, it can be used to purchase 1.1 million automated (in the near future) Tesla Model 3s at US$35,000 each. These vehicles can operate round the clock and last for the next 10-15 years. It’s still some way off, but it’s one of the ways Uber can increase its revenue and lower its operating costs.

3. Uber’s future is unpredictable

One thing is for sure, Uber is no Amazon. The e-commerce giant made a record US$10.1 billion in net profit in 2018, but it was still making sporadic losses as recently as 2014. However, Amazon was able to sustain its low profitability for a long time because of its phenomenal revenue growth. Over the last 10 years, Amazon grew its revenue 12-fold from US$19.2 billion in 2008 to US$232.9 billion in 2018.

For Uber, however, the company is already losing steam before it becomes profitable. Year-over-year revenue growth was cut in half, down from 106% in 2017 to 42% in 2018. If this continues, Uber may not become profitable anytime soon.

It’s natural for the founders of Uber to be ambitious and strive after lofty goals – the IPO prospectus highlights the US$12.3 trillion combined market – ridesharing, meal delivery, and freight – that Uber could potentially address. But for us, as investors, it’s important to be realistic what a business can or cannot achieve.

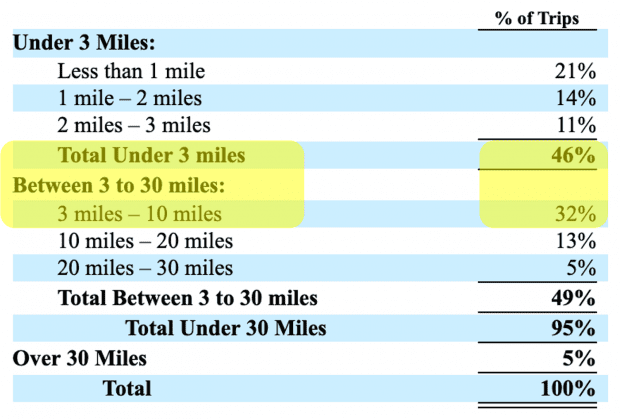

Unless everyone decides to eliminate car ownership, Uber’s scale is limited to cities. 78% of trips undertaken are under 10 miles. It makes more financial sense to own a car if you travel long distances daily. It’s also a challenge to get a ride in a rural area. Drivers don’t want to serve a small population that wouldn’t be able to generate enough income for them.

Overall, it’s hard to see that Uber has any long-term, sustainable competitive advantages. The competitive landscape could change in an instant. In the past two years, Uber has slowly lost its ridesharing market share in the U.S. to Lyft, falling from 78% in 2016 to 67% in 2018.

4. Uber is too pricey for my taste

The question is, would you pay US$100 billion for a business like Uber? My short answer is no.

Let’s again compare Uber with Amazon. In 2006, Amazon generated revenues of $10.7 billion, roughly equivalent to Uber today. However, Amazon had a market capitalisation of around US$27 billion then compared to Uber’s potential US$100-billion valuation at IPO. Uber is asking for nearly four times what Amazon was trading at in 2006.

Not only that, in 2006, Amazon was making a small net profit of US$190 million and had operating cash flows of US$700 million. Excluding other income, Uber lost US$4 billion in 2018.

| Amazon (2006) | Uber (2018) | |

|---|---|---|

| Revenue | US$10.7 billion | US$11.3 billion |

| Net Profit or (Loss) | US$190 million | (US$4.0 billion)* |

| Operating Cash Flow | US$700 million | (US$1.5 billion) |

| Market Capitalization | US$27.8 billion^ | Up to US$100.0 billion |

*excluding other income. ^2017 average.

So why would you pay almost four times more for a business that’s massively unprofitable and looks far less likely to dominate its industry like how Amazon has done? My thoughts exactly.

The fifth perspective

But does this mean that I won’t make money investing in Uber? Well, it’s anyone’s guess.

A company’s stock price can still fly skyward with enough optimism and investors with pockets full of cash. Take a look at Tesla. The automaker has lost more money every year since it listed in 2006. Yet, its share price has increased from US$17 at IPO to US$255 today — an increase of 1,500%.

Don’t underestimate the power of dreams. It can put a man on the moon, put a billionaire in the White House, and make an unprofitable business sexy. However, as an investor, I prefer to anchor the value of a company based on its fundamentals instead of its far potential.

It’s very hard for me to tell where a business will be in the next five to 10 years. So I’d cancel my Uber ride for now and pay the cancellation fee (i.e. miss out on any gains) than get myself lost in unfamiliar territory.

Thank you for a nice report on Uber. As an investor, I will share the same sentiment of not investing Uber for now–a company which has so much uncertainty in the future. The timing is also not right. One reason to explain Telsa today share price was because people were ridding on the rising US equity market in recent years. The US market had came to a peak and I believe it will soon entering into a bearish market. So, I do not think it is a wise to invest for Uber. I rather adopt a wait and see approach.

Superb article,THANK-YOU !!!

Yes. As investors, we invest in companies with proven business models.

In Uber’s case, the company is still in the start-up phase – in the process of becoming a commercially viable business. It’s very difficult to tell when they’ll get there or whether they’ll ever get there. So don’t be surprised if Uber starts to raise capital again a couple years down the road.

Let’s leave it to the venture capitalists to figure out. Don’t let the glitter of the unicorns blind us.

Very balanced analysis. Example is awesome, let investor decide final action.