Ever since its inception in the 1990s, exchange-traded funds (ETFs) have gained huge popularity among the investing community. Whether you’re a novice investor or a seasoned one, ETFs remain a compelling investment option.

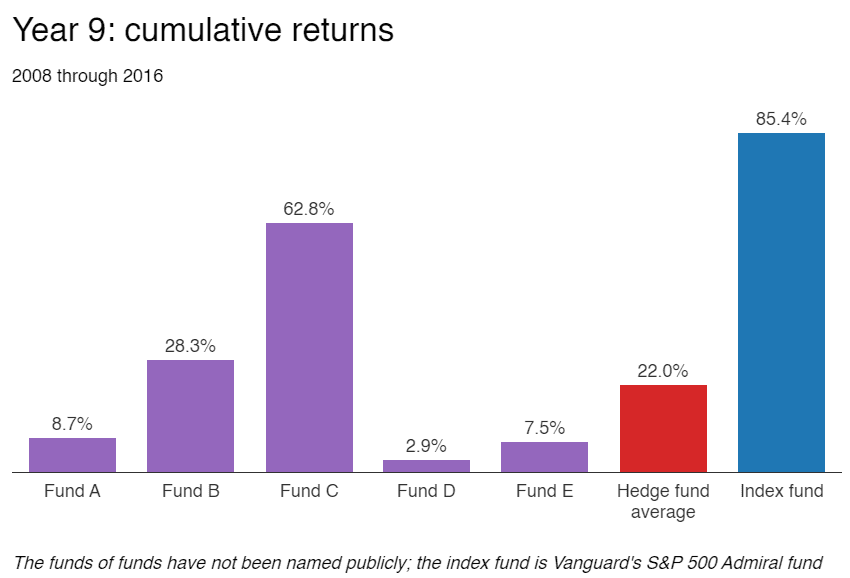

Warren Buffet, arguably the greatest investor of all time, is a huge advocate of ETFs and believes that most people are better off with index funds as opposed to stock picking. In fact, he believed it in so much that he even made a million-dollar bet in 2008 with Protege Partners, a hedge fund, that an index fund could beat an active manager, and Buffett won by a landslide. Here are the results for the first nine years of the bet:

An ETF is essentially designed to track the performance of a specific index, sector, commodity, or asset class. It offers a diversified portfolio of assets (similar to mutual funds) that provides investors with an efficient way to gain exposure to a wide range of investments, without having to buy each individual security separately. In simple terms, ETFs are a basket of securities.

For investors that do not have the time to conduct in-depth research on individual assets or just have different priorities in life but still want exposure to the markets, ETFs are a great option.

Examples of popular ETFs

There are many ETFs tracking different asset classes be it stocks, bonds, commodities, and industries. Globally, the most popular stock ETFs include:

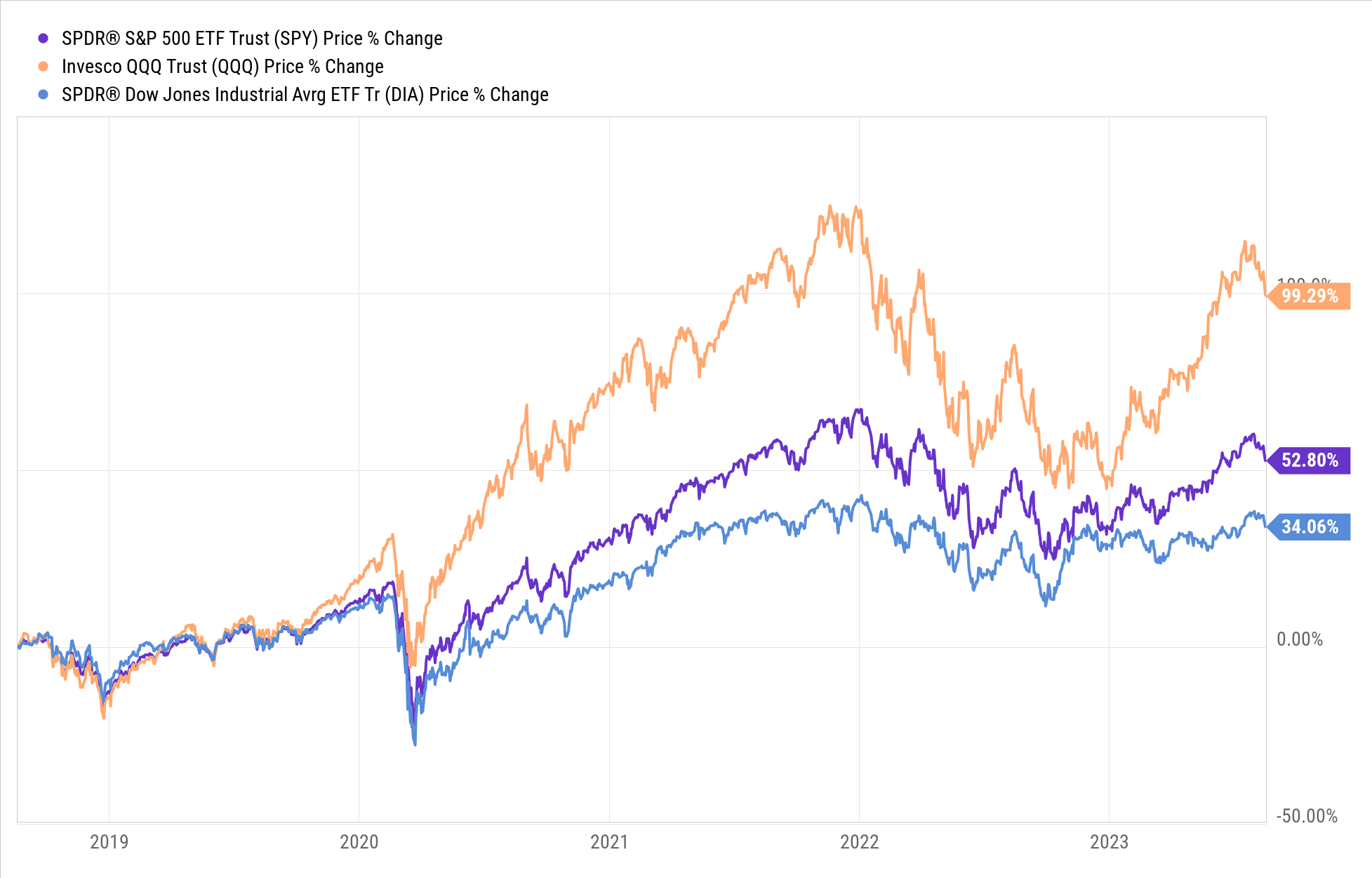

- SPDR S&P 500 ETF (SPY): This ETF, tracking the S&P 500 index, is one of the largest and most widely traded ETFs globally. It provides exposure to the 500 largest publicly traded companies in the United States.

- Invesco QQQ Trust (QQQ): The QQQ ETF, tracking the NASDAQ-100 index, is known for its focus on technology and growth-oriented stocks. It includes major tech companies such as Apple, Microsoft, Amazon, and Google.

- SPDR Dow Jones Industrial Average (DIA): This ETF, tracking the Dow Jones Industrial Average, consists of 30 large-cap, blue-chip stocks from various sectors.

For an in-depth comparison between the SPY and QQQ, you can watch our discussion here.

Given the America’s position as the world’s largest economy, its global economic influence, and the presence of the largest companies by market capitalization, these three U.S. ETFs are highly popular. The following chart illustrates the five-year returns of these ETFs:

That being said, while investing in ETFs that track the U.S. stock market is often the go-to choice for many investors, some argue that this approach can lead to geographical concentration. By relying heavily on a single market, investors essentially place a bet on the U.S. economy. It’s a matter of personal preference and confidence whether investors are comfortable with this level of exposure. Alternatively, for those seeking a broader global exposure and holding a positive outlook on the growth potential of emerging markets, VWRA presents a suitable option.

Introducing VWRA

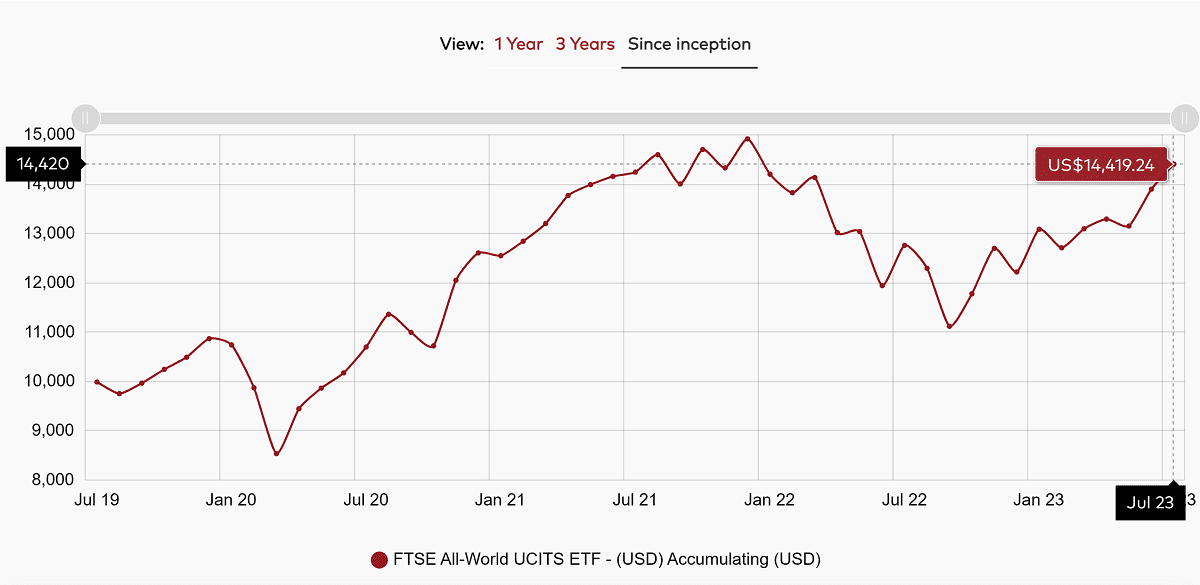

Introduced on 23 July 2019, the Vanguard FTSE All-World UCITS ETF (USD) Accumulating (VWRA) is an ETF designed to track the FTSE All-World index. This international equity index tracks stocks of large and mid-sized companies from both developed and emerging markets which covers 90-95% of global investable market capitalisation. VWRA operates as an accumulating ETF, meaning that any dividends generated by the fund are automatically reinvested, allowing for higher potential compound growth over time.

As of 31 July 2023, VWRA manages assets worth US$19.1 billion and has 3,688 holdings in its portfolio. This ETF is domiciled in Ireland, making it a more tax-efficient ETF choice for non-U.S. residents. Since its inception, this ETF has returned 42.67% cumulatively, or a compound annual growth rate of 9.24%.

At the same time, the SPY and QQQ have gone up 52.6% and 98.0% over the same period respectively. While VWRA may have underperformed up to date when compared to the performance of the U.S. ETFs, investors could potentially reap higher returns if returns from emerging markets outperform in the future.

VWRA composition

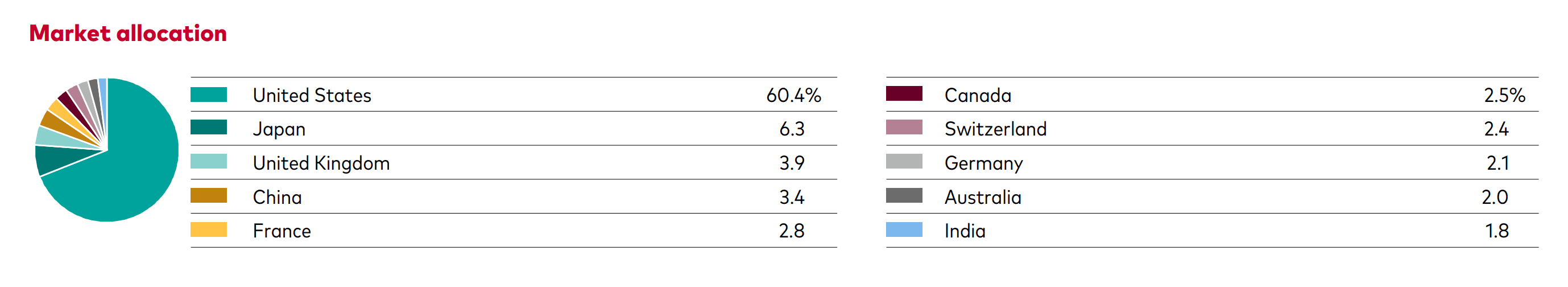

In terms of market exposure, VWRA mainly holds U.S. companies with a 60.4% allocation, followed by Japan (6.3%), United Kingdom (3.9%), and China (3.4%). VWRA’s global exposure can help provide some degree of stability in an investment portfolio during different market cycles, as it isn’t reliant on the performance of a single country, market, or sector. Investors can also potentially benefit from broader global economic trends and developments.

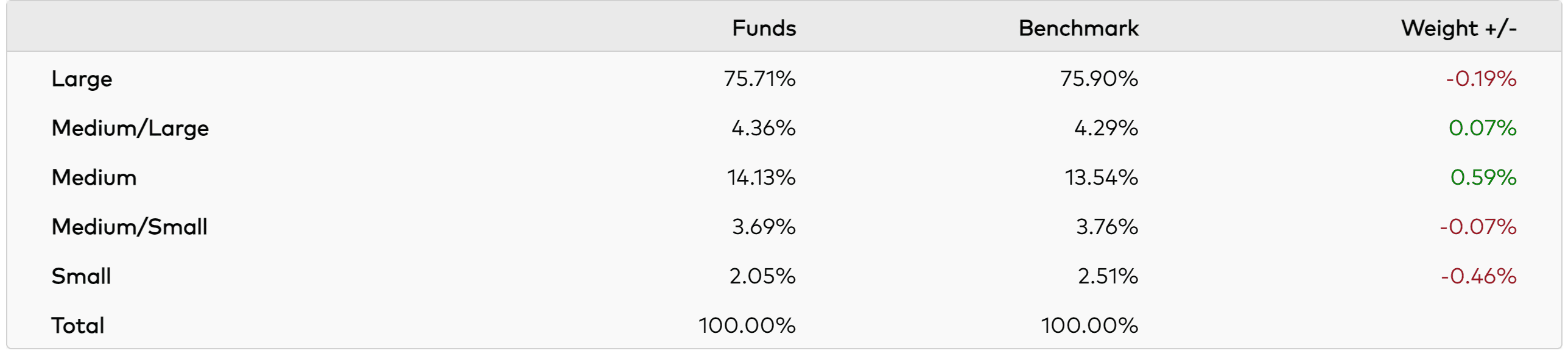

VWRA concentrates its holdings in large cap stocks at a current allocation of 75.71%, giving investors adequate exposure to medium and small-cap stocks that typically have higher volatility but higher potential for growth.

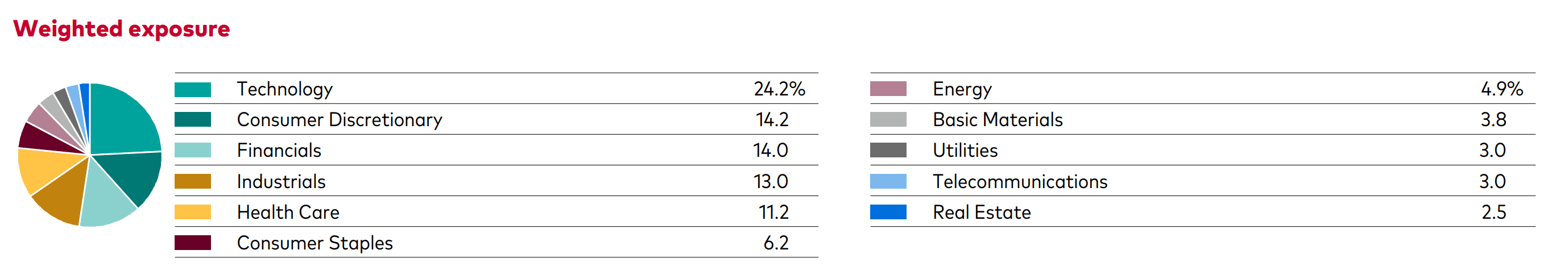

In terms of sector allocation, VWRA has its largest exposure in technology stocks followed by consumer discretionary, financials and industrials.

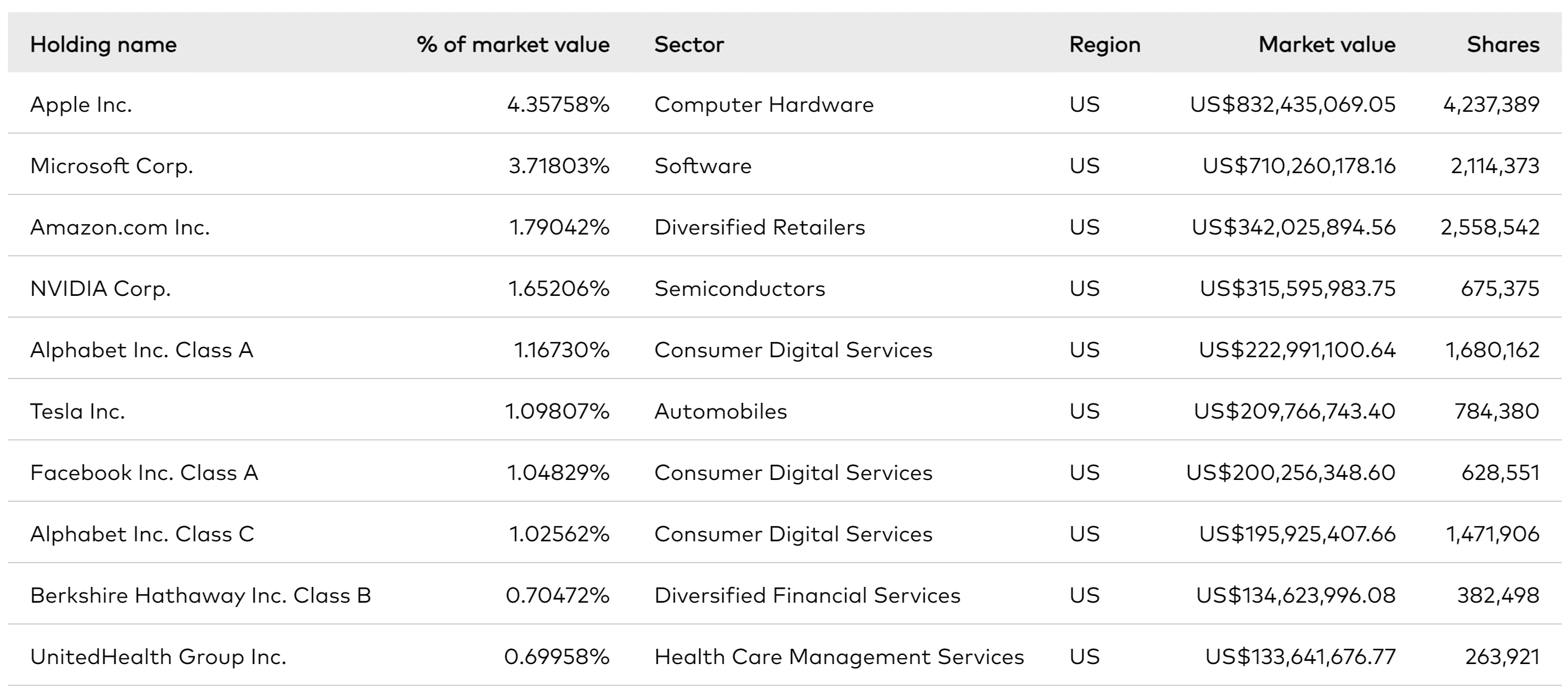

As for the top 10 holdings of VWRA, it is evident that there is a degree of similarity with the S&P 500, albeit with a lower allocation. This allocation strategy enables investors to capitalise on the growth potential of the U.S. market while also gaining exposure to emerging markets, which can provide the opportunity to benefit from higher growth rates in these economies.

VWRA fees

As for the fees, VWRA comes at a slightly higher expense ratio of 0.22% p.a. which is still low cost. To illustrate, the fees work out to $22 annually for every $10,000 invested.

| SPY | QQQ | VWRA | |

|---|---|---|---|

| Exchange | NYSE | Nasdaq | LSE |

| Expense Ratio | 0.09% | 0.20% | 0.22% |

| Domicile | U.S. | U.S. | Ireland |

| Dividend Withholding Tax (for non-U.S. residents with no tax treaties) | 30% | 30% | 15% |

| Distribution Policy | Distributing | Distributing | Accumulating |

The fifth perspective

Diversification lies at the heart of investing since risk appetites and goals vary among individuals. For investors who believe in the growth trajectory of emerging markets or simply want greater diversified exposure beyond the United States, VWRA provides a viable global ETF option. Personally, I find it fitting to concentrate on U.S. ETFs that primarily focus on American companies. Nevertheless, it could be prudent to allocate a small portion of the portfolio to VWRA, as it could offer potential upside from the growth and development of emerging markets.