The past year has been challenging for equities. Markets started the year on a positive footing as the US economic recovery continued to strengthen and it appeared likely that China’s central bank would be able to engineer a soft landing for its economy. But a surprise devaluation of the renminbi, followed by a broad selloff in China equities, quickly changed things. The third quarter of the year was marked by falling asset prices and a souring of investor sentiment as concerns about China, weakness in other emerging markets and uncertainty over when the US Federal Reserve would raise rates began to bite. Economic projections got progressively weaker over the course of the year. In late 2014, the US economy was projected to grow 3% in 2015. It is now expected to grow just 2.4%. Projections for this year were slashed from 2.9% to 2.5%. In Singapore, too, the growth forecast for 2015 was cut from 3.7% to 2.1%. Growth expectations for 2016 were slashed from 3.7% to 2.5%.

Against this backdrop, analysts polled by The Edge Singapore unanimously agree that the outlook is lacklustre for local equities. UBS analyst Cheryl Lee expects the Fed to raise the federal funds rate progressively to between 1.25% and 1.5% by end-2016 from close to zero at present. As investors await a decision at each Federal Open Market Committee meeting, however, equity markets are expected to be volatile.

The plunge in oil prices to below US$50 a barrel is positive for economic growth. Companies in the transport, manufacturing and heavy industry sectors should experience an improvement in margins on the back of lower energy costs. But CIMB Research’s head of equity research Kenneth Ng points out that quite a few locally listed stocks will be casualties. He says, “There have been many oil rig orders from Brazil, which [now] face the increased likelihood of deferment or cancellation. Who will bear the losses on these cancellations, especially when current day rates are substantially lower than when the orders were made?”

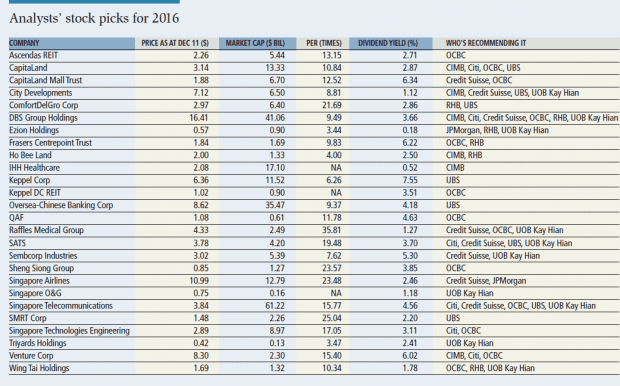

The obvious winners in an environment of rising interest rates are the banks. The top pick at the moment appears to be DBS Group Holdings, with at least six brokerage houses recommending it as a stock to own in 2016. RHB Research Institute Singapore says, among the local banks, DBS has the least exposure to the Asean region, which is vulnerable to the economic slowdown in China. Patrick Yau, Citi’s director and head of research for Singapore and Malaysia, also prefers DBS to the two other local banks. But he warns of a turning credit cycle and increased risks to asset quality through its exposure to China.

UBS’ Lee is likewise cautious on the banking sector. Among the three local banks, she reckons that the headwinds look better priced in for Oversea-Chinese Banking Corp. “Among the three banks, OCBC has the highest share of non-interest income, which should support earnings better than its peers in an environment of weak net interest income growth. The group’s less capital-intensive wealth management businesses also continue to make steady progress,” she says.

Offshore and marine picks

The oil and gas sector is likely to remain volatile until oil prices stabilise. Until then, investors should focus on stocks that have strong fundamentals and will be able to withstand a slump. Aditya Srinath, head of equity strategy for Asean at JPMorgan, likes oil and gas service provider Ezion Holdings and expects the company to see continued demand for its liftboats. “Ezion’s liftboat fleet is backed by bareboat charters,” says Srinath. Bareboat charters are charters that Ezion does not operate but instead leases out to clients. They offer a more predictable and stable cash-flow stream.

“Among asset owners in Singapore, Ezion stands out as one of the cheapest stocks, in our view, at three times Ft2016 earnings,” he adds.

UOB Kay Hian likes offshore fabricator Triyards Holdings as the company has successfully diversified into non-offshore-related fabrication work to mitigate the slump in offshore orders. In October, for instance, it announced USSIOO million ($141.4 million) worth of fresh contract wins comprising three chemical tankers for Swiss-Canadian Maritime, two aluminium vessels for undisclosed clients and one fabrication contract. The chemical tanker orders come with options, which are likely to be exercised in FY2016. This was followed by a US$12.8 million order for four escort tugs for Greenbay Marine in November. UOB Kay Hian says the order wins have given the stock earnings visibility for the next two years.

Lee of UBS says investors should not write off Keppel Corp just yet. The research house has included this stock in its preferred picks despite a very challenging earnings outlook, as it believes the weak earnings trend is no surprise to the market. “A key point in its favour is that the capex allocated to shipyards over the last five years has not been high, at about 4% of sales, or $380 million a year. Asset sales could also help manage its gearing. While strong share price catalysts may be lacking for now, we do not expect Keppel to record losses,” she says.

Winning with transportation

Meanwhile, transport companies are beneficiaries of lower fuel costs. Preferred plays are land transport operators ComfortDelGro corp and SMRT corp. The Land Transport Authority is gradually moving bus routes onto a government contracting model, under which the government assumes revenue risk. RHB analyst Ong Kian Lin expects ComfortDelGro to earn 7% to 8% operating margins on its core bus business once the transition is complete. Another expected positive next year, he adds, is the potential regulation of private car hire apps such as Uber and GrabCar. LTA could impose new regulatory requirements on the app providers or relax existing regulations for taxi companies. Both moves would level the playing field for the taxi business and benefit ComfortDelGro, the largest local taxi fleet operator.

UBS’ Lee expects impending overhauls of the public transport sector to significantly improve SMRTs earnings outlook and free cash now. Recent comments by Khaw Boon Wan, the newly appointed transport minister, of the need for an integrated land transport operating model have been taken as signs that a restructuring of the rail sector is closer than before. Lee estimates that SMRTs net capex burden could fall from $400 million to $l10 million annually by 2017, should LTA decide on a contracting model for the rail sector that is similar to the one for buses.

Srinath of JPMorgan likes Singapore Airlines, as he expects the demand-supply equation for the company and the industry to improve. This will drive the sector’s and SIA’s earnings recovery. He also points out that SIA holds net cash amounting to 27% of its market capitalisation, and he estimates SIA’s “liquidation value” at $14 a share. “If SLA paid out one-third of its current net cash balance, the yield would be 9%.”

Citi’s Yau has picked SATS following its offer to purchase a 49% stake in Kuala Lumpur-based Brahim’s Airline Catering Holdings. BACH currently serves 37 airlines at the Kuala Lumpur International Airport and Penang Airport. With the acquisition, Yau sees potential for SATS to increase its presence in Southeast Asia.

Property plays

The local property market is currently being weighed down by a slew of cooling measures. Data from URA shows that private residential property prices declined 1.3% in 3QFY2015. This was the eighth consecutive quarter of falling prices and an acceleration from the 0.9% decline in 2QFY2015. Analysts are therefore recommending that investors focus on developers that are heading out of Singapore to look for investment opportunities.

Property and hotel conglomerate City Developments is a top pick for its network spanning 25 countries. It has a hotel business with properties in London, Paris and New York. The company owns close to 7.2 million sq ft of lettable area in office, industrial, retail, residential and hotel space globally, in addition to a landbank of nearly 2.7 million sq ft. Management has also said it would look at transactions across major UK centres, particularly London, to leverage its knowledge of the UK market.

Carmen Lee, head of research at OCBC Investment Research, reckons that CapitaLand‘s serviced residence business should also do well. The Ascott, as the serviced residence unit is called, continues to build scale at an impressive speed, she says. It has achieved its target of 40,000 units by 2015 ahead of time and remains on track to double its inventory to 80,000 units by 2020.

CIMB’s Ng likes Ho Bee Land for its recurring income. In the past two years, Ho Bee acquired five prime office properties in London for about ESOO million ($1.1 bilion). These, coupled with the fully-leased 1.1 million sq ft integrated development The Metropolis in Singapore, are expected to generate rental revenue of some $ 130 million a year. When the high-end residential market eventually bounces back, Ho Bee will also be able to sell its remaining inventory on Sentosa Island. Properties in Sentosa are not subject to penalties imposed by the Qualifying Certificate rules, which require developers that are not 100% Singapore-owned to complete and sell a project within seven years of buying the land for the project.

While Wing Tai Holdings has been saddled with unsold inventory, RHB likes the stock for its diversified earnings base and solid asset backing. Wing Tai’s remaining unsold projects include luxury developments Le Nouvel Ardmore and Nouvel 18, where sales have been slow because of punitive stamp duties imposed on foreign buyers. Owing to its low cost for these projects and its strong balance sheet, RHWs Ong expects limited impact on the group in a worst-case scenario, in which no more units are sold. Meanwhile, its investment property portfolio, with contributions from markets such as Hong Kong, China and Malaysia, comprising commercial developments and serviced apartments, remained resilient and contributed recurring revenue of $38 million a year.

Among the trusts, Credit Suisse likes CapitaLand Mall Trust, as its suburban mall exposure and network of malls will provide stability. CMT owns malls such as Raffles City, Bugis+ and Westgate. About 76% of its portfolio is exposed to the “necessity shopping” segment—consumer spending that is necessary rather than discretionary. The largest portion, or 27%, of its portfolio is leased to the F&B sector, which has seen sales grow 3% y-o-y in 9M2015 versus a 2.4% decline islandwide.

RHB’s Ong has Frasers Centrepoint Trust as his top buy among the locally listed real estate investment trusts. He likes FCT for its portfolio of suburban malls, which are more resilient to weakness in consumer sentiment, and thinks they also have strong growth potential in the short and long term. “Given its strong retail dominance in northern Singapore, we expect the REIT to register positive rental revision for both Causeway Point and Northpoint, which constitute more than half of the total renewals in FY2016,” he adds.

Lee of OCBC is positive on both Keppel DC REIT and Ascendas REIT. Keppel DC REIT owns data centres and Lee says the trust offers investors pure-play exposure to a fast-growing industry. It should be a beneficiary of the big data and cloud computing trends. It also has a solid financial position, having hedged 90% of its total borrowings and 100% of its forecast foreign-sourced distributions until IHFY2017.

Meanwhile, Ascendas REIT recently marked its maiden entry into Australia with the acquisition of a portfolio of 26 logistics properties located in Melbourne, Sydney, Brisbane and Perth for a purchase consideration of A$1 billion ($1 billion). “The acquisition makes A-REIT the eighth-largest industrial landlord in Australia, giving it the scale to benefit from the long-term growth prospects of the e-commerce industry” Lee says.

Hope in healthcare

The local healthcare sector seems to have really come into its own this year— the SGX Health Care Index, which has 29 members, is up 7.2% this year and valued at 34.8 times earnings. Yet, analysts seem to think there is room for some of these stocks to run. Ng of CIMB says long-term trends such as the ageing population should continue to drive healthcare stocks. He favours IHH Healthcare, as he sees longer-term catalysts from acquisitions and organic growth in China and India.

Credit Suisse, OCBC and U0B Kay Hian like Raffles Medical Group, which should see attractive inorganic growth opportunities in Singapore and China. It has key expansion projects lined up for completion through 2018. Its Holland Village specialist centre is on track to open in IQ2016; and the expansion of Raffles Hospital is expected to be completed by early 2017. Meanwhile, its hospital in Shanghai is likely to be operational by early 2018.

For investors who are looking for niche opportunities, UOB Kay Hian recommends Singapore O&G. The company owns clinics specialising in women’s healthcare. It also recently acquired the businesses and practice of Dr Joyce Lim, one of Singapore’s best-known aesthetic professionals. The research house believes the group will continue to source for accretive mergers and acquisitions.

Stable yield

Among domestic growth proxies with stable growth and yield, analysts like QAF, Sembcorp Industries, Sheng Siong Group, Singapore Telecommunications, Singapore Technologies Engineering and Venture Corp.

For OCBC’s Lee, is attractive for its consistent distribution of five cents a share since 2011, giving it a decent yield of 5%. QAF has two core businesses — bakery and primary pork production. The bakery and pork production businesses contributed 49% and 38%, respectively, to overall sales in FY2014. Looking ahead, Lee sees the creation of new products as well as continued production capacity expansion in the Philippines as likely to support growth.

Shares of conglomerate Sembcorp Industries have tumbled in the face of fewer orders for its offshore unit SembCorp Marine, which has even experienced some cancellations. A deterioration in power spreads has also weighed on Sembcorp Industries’ domestic power business. But analysts now think these headwinds have been priced in, and the stock does not reflect the company’s prospects for higher revenue from its power assets in India as well as its growing utilities business.

Supermarket operator Sheng Siong has done well this year, up 22.5% year-to-date. But OCBC’s Lee expects the stock will continue to perform well as refurbishments of its older stores boost sales. Sheng Siong also pays good dividends and Lee expects it to pay out 90% of its FY2015 and FY2016 earnings, which would work out to a yield of 4%.

In the telecommunications sector, Citi’s Yau prefers Singtel, given its diverse income stream. On top of its Singapore business, the company also owns mobile operator Optus in Australia as well as stakes in telcos in India, Indonesia, Thailand and the Philippines.

Next year, a fourth mobile network operator is likely to enter the market. In the face of competition, Yau believes Singtel will be more insulated than its domestically oriented peers Ml and StarHub.

Yau also likes ST Engineering because a substantial proportion of its revenue is denominated in US dollars. ST Engineering provides maintenance, repair and overhaul services to airlines; sells armoured trucks to the military; installs electronics and communications systems; and builds and repairs ships. Last month, reporting its results for FY2015, ST Engineering highlighted “prolonged softness” in its business activities but also said the appreciation of the US dollar would help cushion the impact of this weakness on its performance.

Finally, analysts like Venture, as it has been showing solid performance for seven consecutive quarters now. The company provides electronics manufacturing services and design manufacturing services. On top of steady revenue growth, they point to sustained net margins of at least 5% since IQFY2010.

“This is possible only with its strategy of focusing on creating value for customers, rather than being just another electronics manufacturing services player,” says OCBC’s Lee.

This article first appeared in The Edge Singapore‘s year-end bumper issue 709.