5 reasons why you should invest in foreign stock markets

Every investor’s goal is to make as much money as possible by taking the least amount of risk in the stock market. Some investors have avoided investing in foreign stocks altogether because it is commonly perceived as a risky operation.

While we may agree that there are risks associated with investing in foreign stocks, it may not be that risky after all if you weigh the pros and cons. In this article, I will list my reasons and you decide if it is about time for you to invest abroad (if you have not already done so).

1. Currency volatility does not mean you lose money

One Singapore dollar gave us 2.5 Malaysia ringgit two years ago. Today, the same dollar is worth 3.1 Malaysia ringgit. On currency exchange alone, Singaporeans who invested in Malaysian stocks saw their investment value drop by 19%. On the flip side, Malaysians who invested in Singaporean stocks saw their investments appreciate by 24%.

It is a fact that investors have to face currency volatility when investing overseas (or, technically, in foreign currency denominated stocks) but the point here is: currency volatility does not always equal to losing money.

Volatility works both ways and you enjoy higher returns if the foreign currency appreciates against your home currency. For example, Singaporeans who invested in U.S. stocks five years ago would be sitting on some nice forex gains now.

However, if the uncertainty of future foreign exchange rates keeps you awake every night, then it is better to stick to your home market. As a small retail investor, it is not practical nor cost-effective to hedge against currency movements and we believe that investors should never stray too far from one’s risk tolerance anyway.

2. There are cheaper ways to invest overseas

We are no longer living in the 80s or 90s; the Internet has opened whole new possibilities of what we can do around the world easily and efficiently. Being able to trade online at your fingertips, at low cost, is one of them.

A local broker charges relatively higher brokerage fees for trading foreign stocks. In Singapore, you will also be slapped with additional custodian fees; the monthly custodian fee is S$2 per foreign stock.

As I increased my exposure in the Hong Kong market over the years, I decided to set up a brokerage account in Hong Kong to lower costs — while I still live in Singapore. I use my Hong Kong brokerage account to buy Hong Kong shares. The brokerage fees are much cheaper than what my two local brokers offer me and, thankfully, there is no custodian fee.

| Broker | Country | Fees | Min. Fees |

|---|---|---|---|

| Chief Securities | Hong Kong | 0.0675% | HK$40 |

| Singapore Broker A | Singapore | 0.18% | HK$100 |

| Singapore Broker B | Singapore | 0.25% | HK$125 |

Likewise, if you are a Malaysian who plans to invest in the Singapore stock market, you may do the same (as a few of my Malaysian friends have done) by opening a Singaporean bank account and then proceeding to set up a Singaporean brokerage account. The good news is you don’t have to be a local resident to open a bank/brokerage account in Singapore or Hong Kong. So the next time you visit either city for business or leisure, consider opening a local brokerage account for your foreign investments.

For a list of brokers, check out this site (Singapore) and this site (Hong Kong). For commission rates, check directly with the respective broking houses as some of them may have revised their rates. Some brokers may even offer value-added services or offer you a discounted rate if your trading quantum is substantial. Remember to request a dongle for ease of banking and broking transactions.

If you do not plan to travel anytime, Interactive Brokers (IBKR) is a great alternative for foreign stock investments. IBKR is the top broker of choice among many investors and traders I know personally. IBKR offers extremely competitive rates and we certainly think so after looking at their fees:

| Tier | Fixed | Minimum Per Order |

|---|---|---|

| HK Stocks | 0.08% of trade value | HKD 18 |

| SGX Stocks | 0.08% of trade value | SGD 2.50 |

| Japan Stocks | 0.08% of trade value | JPY 80 |

| Australia | 0.08% of trade value | AUG 6.00 |

| Switzerland | 0.1% of trade value | CHF 10.00 |

| United States | USD 0.005 per share* | USD 1.00 |

| Canada | CAD 0.001 per share* | CAD 1.00 |

*Max commission is 0.5% of trade value

Do note that there might be other costs for foreign stocks such as taxes on capital gains and dividends. Withholding tax may also apply if the money is repatriated back to your home country. For example, there are no taxes on capital gains or dividends in Singapore and Hong Kong but Malaysia has a 10% withholding tax on dividends. Likewise, the U.S. has a 30% withholding tax on dividends for foreign investors. Taxes vary from country to country, so check with your professional tax advisor if need be.

3. Diversify your geopolitical risks

Political decisions made by governments in any country can result in share price volatility. Investors may cheer when a country opens its economy up for foreign investments and the reverse is also true if the government shuts the door. Geopolitical risk can also come in other forms like political unrest in Thailand or the threat of nuclear war from North Korea and can be highly unpredictable.

Investors from all over the world were startled when the Chinese government banned stock sales by major shareholders for six months after share prices in the Chinese stock market took a sudden plunge in 2015. I’m sure some Singaporeans remember (not too fondly) the CLOB saga in 1998 when 172,000 Singaporean investors lost their money after their investments in Malaysian companies were frozen by the Malaysian government in an attempt to control capital flight out of the country.

Again, politics are usually complicated and unpredictable. We like to think that no country or business can escape from political risk. Even if you put all your wealth in your home country, you still face risk arising from political upheaval in there. Conventional wisdom suggests that it is hard to go wrong if one were to invest in a politically stable country (see the Politically Stability Index) but even so, no one can guarantee that it is 100% foolproof when you concentrate all your assets in one country.

4. Foreign stocks give you more opportunity for growth

Portfolio diversification is often commonly used as a way to reduce risk, preserve our wealth, and, hopefully, improve our risk-adjusted returns. But besides reducing volatility in a well-diversified portfolio, investing overseas also gives you the opportunity to gain exposure in growth markets around the world – especially when your home market/currency is facing downward pressure.

For instance, the U.S. stock market has been an eight-year bull run since the Global Financial Crisis. In comparison, the Singapore and Hong Kong markets have a hard time matching the performance seen in the U.S.

5. Investing abroad gives you more high-quality choices

If there is only one reason why I choose to invest overseas, it is the freedom to pick quality companies across the globe. In 2015, there were 49,830 public-listed companies in the world; they were collectively worth US$67 trillion. In comparison, there are only 700+ companies listed in Singapore; you can say that the chances of finding a good company (or potentially great one) are better outside of Singapore than in.

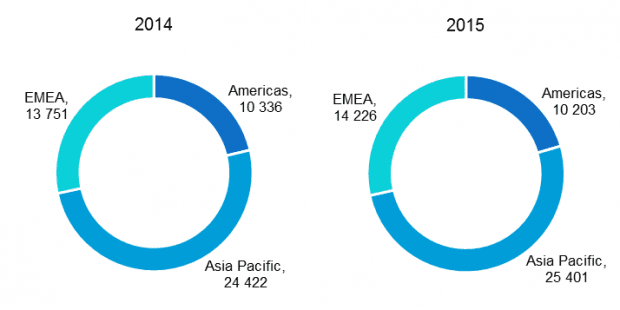

Number of listed companies (Source: World Federation of Exchanges)

We have to admit that Singapore has (so far) only produced a handful of great entrepreneurs who have built long-lasting quality companies that are able to compound shareholder value over decades. Even then, because of their success, many of these great companies have been taken private. As you can see from the table below, we have seen a number of quality companies taken private over the years. Lately, Global Logistic Properties and ARA Asset Management also face the possibility of privatization.

| Company | Year Delisted |

|---|---|

| Hsu Fu Chi | 2011 |

| Thomson Medical Centre | 2011 |

| Cerebos Pacific | 2012 |

| LMA International | 2012 |

| SHC Capital | 2012 |

| Asia Pacific Breweries | 2013 |

| Armstrong Industrial | 2014 |

| GoodPack Limited | 2014 |

Unearthing good companies takes time and if you think investing in your home country is tough, finding quality stocks in foreign markets can be even tougher. Foreign companies usually have different ways of presenting and reporting their financial results.

Just like a fund manager who has to hire a room of analysts to do the legwork, we, The Fifth Person, also invest a lot our resources into identifying high-quality companies in Asia and the U.S. that can compound our wealth over the long term. Many companies fail our criteria but the ones that pass them are great companies that we share with our members in Alpha Lab. A quality company may not always come cheap but when you expand your horizons and invest across multiple markets, the chances of finding one trading at an undervalued price is much higher.

The fifth perspective

Volatility is part and parcel of investing — and we certainly do not see currency volatility as a reason why we should only stick to our home market. We believe that the growth of quality stocks bought at fair or undervalued prices will offset any potential currency losses (if any) over the mid to long term.

If you’re a long-term investor, you shouldn’t let brokerage fees stop you from investing overseas – especially when you find a foreign stock with limited downside and potentially great investment returns. Unlike traders, long-term investors like us make fewer trades and fees shouldn’t eat too much of our total returns.

At the same time, we wouldn’t diversify into foreign markets if a portfolio is below US$10,000. Above that, we can allocate a small percentage (10%) of the portfolio for foreign stocks before gradually increasing the percentage as we become more familiar with a foreign market.

In conclusion, we view that the benefits of investing in foreign markets far outweigh the risks and, as a matter of fact, we have been investing in Malaysia, Hong Kong, Thailand and Indonesia, and the United States for many years and will likely continue to do so in the years to come.

This advice is more applicable to those with excess funds where the amounts are in millions. It is they who need to diversify not only within the country but also among several countries.

Small and Mid level investors may not find it practical whereas those with hundreds of millions and above may already be aware of several investment strategies.

Best wishes to those with millions in excess funds to invest.

LET 2017 BE A PROFITABLE YEAR BUT DO BE PREPARED FOR POSSIBLE LOSSES DUE TO UNCERTAINTIES. BEST OPTION: DO NOT OVER INVEST AND RISK YOUR NEEDS & SOME LUXURIES.

Good article preaching the benefits of foreign markets. Personally, with regards to the 3rd para in 5th perspective, I would say that it would be wise for all investors to start with the US market and then diversify into Singapore, rather than the other way round. Let me put it this way, it is all about PERSPECTIVE. If you were born into the US, would your first choice market to invest in be the SGX? Really? SGX? I would think any sane person would choose the US market. I’m sure many great investors would not be that rich if they started with the SGX and put only a small proportion into the US. Currency risks aside, the growth potential in US companies are massive, due to the global outreach. 3B in market cap over there is considered almost a penny stock. In sg, many companies are between 50-500m in Mkt Cap and restricted to doing business in this small economy. The number of 10+ baggers in the US is also a lot more than over here, not to mention the level of corporate governance that exists in the US companies. Many of the “public” companies here are ultimately family owned businesses who go public to artificially increase their net worth.

In conclusion, we should invest in US companies by default, unless a Singaporean company is really so attractive.

I have recently looked into investing in Hong Kong stocks and try to set up a Hong Kong based brokerage account as it Is cheaper in the trade fees in the long run like you mentioned . Anyone has experience setting this up before using a Singapore bank account? At the moment, I am checking Chief Group website but it mentions that a Hong Kong designated bank account is needed. Just wondering anyone had managed to open an account can share some insights here.

Hi Joseph, you need a HK bank account in order to open a HK brokerage account. I managed to get mine up with HSBC bank in HK before going over to Chief to open one. You can try it out 🙂