How to use ROE to spot potentially high-growth investments

When you look at Berkshire Hathaway’s annual reports you will often see a page that lists Berkshire Hathaway‘s acquisition criteria. Under criteria number three, it states that a company must generate a good return on equity (ROE) while employing little or no debt.

So why is ROE and low debt so important to Warren Buffett?

ROE reflects the management’s ability to allocate capital efficiently and effectively. It measures how much return is generated for every dollar of shareholder equity. A company with high ROE (>15%) means it is able effectively generate growth without need for external financing.

(Apart from ROE, here are some other crucial factors we use when analyzing a stock and the formula we use to turn a -$400,000 fund into one with over $2,200,000 in profits.)

Why little or no debt?

However looking at ROE alone can be misleading; you need to compare with the debt levels of the company. If a company is highly leveraged, this will artificially boost its ROE.

Let me explain using the ROE formula:

ROE = Net Profit / Shareholders’ Equity x 100%

A company pays for the stuff it owns (assets) either by borrowing money (liabilities) or by getting it from shareholders (shareholders’ equity). When a company chooses to borrow a lot of money over using shareholders’ money, liabilities increase while shareholders’ equity decreases in tandem.

When shareholders’ equity is reduced, ROE is increased as now the same amount of net profit is generated using less shareholders’ equity. Even though the company can achieve a high ROE this way, it is is now exposed to more risk; banks can increase interest rates or call back the loan at any time.

And once the company decides to stop using debt to finance its business, it is unable to sustain its artificially high ROE. This is why we insist that a company can generate at least 15% ROE with little or no debt. It shows that the company is able to achieve this figure on its own without artificially boosting it by borrowing a lot of money.

How to calculate sustainable growth rate using ROE

ROE can be used to measure the sustainable growth rate of a company as well.

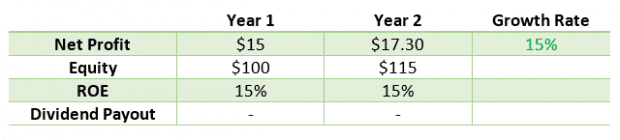

For example, if a company can achieve 15% ROE, this means it can generate $15 in net profit for every $100 of shareholders’ equity. If the company doesn’t pay any dividends, then this $15 in net profit is retained and added to the shareholder’s equity: $100 + $15 = $115.

The following year, if the company maintains its 15% ROE, it will generate $17.30 in net profit on the new $115 of shareholders’ equity. As net profit has grown from $15 to $17.30, its annual growth rate is also 15%; the same as its ROE.

In other words, without having to borrow more money, a company’s maximum sustainable growth rate is the same as its ROE.

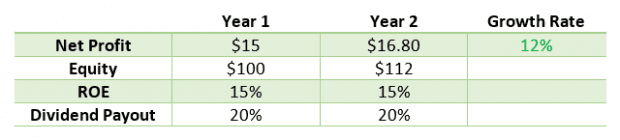

But if the company pays out a dividend, then its sustainable growth rate is decreased.

Using the same example, the company makes a net profit of $15 but this time has a dividend payout ratio of 20%. This means that the company pays out 20% of its net profit to shareholders as dividends: $15 x 20% = $3. Once the dividend of $3 is paid, the company now only has $12 in retained earnings. Once again, this is added to the shareholder’s equity: $100 + $12 = $112.

The following year, if the company maintains its 15% ROE, this time it will generate $16.80 in net profit on the new $112 of shareholders’ equity. As net profit has only grown from $15 to $16.80, its annual growth rate is now only 12% (which is 20% lower than its ROE of 15%).

In other words, when a company pays dividends, its maximum sustainable growth rate will be its ROE reduced in proportion by its dividend payout ratio.

Why you should expect more dividends when a company has low ROE

In my opinion, companies with an ROE below 10% should always pay all its earnings back to shareholders as dividends. As we’ve seen above, a company’s sustainable growth rate is equal to its ROE or lower. If the company can only generate 10% ROE then its maximum growth rate is also 10% p.a. (or lower). At this rate of growth, Investors are better off receiving dividends and investing the money for better returns elsewhere.

Compare ROE with competitors in the same industry

Now I’ve mentioned so far that an ROE above 15% is great, but you must always compare this with the industry average. If most companies in the industry are achieving 20% ROE, then 15% doesn’t look so good after all.

On the flip side, if the industry norm is only 10%, then an ROE of 15% suddenly looks really good. When that happens, you might want to do more research on a company that can generate such a high relative ROE and whether it is sustainable.

High ROE is a great way to filter companies for further research and analysis, but it is only one factor out of so many you need to explore before you decide if a company is a worthwhile investment or not.

[Here are some other Crucial Factors we use when we are analyzing a stock to see if it is a viable buy – The formula we use to turn a -$400,000 fund into one with over $2,000,000 in profits]