I made an 80.7% return in seven months investing in Neo Group when I chanced upon the company when reading the newspaper. This is a classic example of being observant and being able to spot potential investment ideas as you go through the activities in your daily life.

Neo Group caught my eye because they posted a 293.6% gain in net profit for 1H2014. I have a habit of being curious when a company suddenly posts a huge gain in their quarterly report. I wanted to find out what caused the jump in profits and, more importantly, whether it was sustainable and could be repeated in the second half of the year.

Before I share my research and the business catalyst that spiked Neo Group’s profit, let’s have a brief understanding of Neo Group’s business model.

Neo Group’s Business Model

Neo Group is the largest catering company in Singapore in terms of market share. The company has three business segments mainly food catering, food retail and food supplies.

The food catering segment comprises three brands — Neo Garden, Deli Hub, and Orange Clove. In total, this segment commands 10% market share of the $360 million food catering industry in Singapore in 2015. The food retail segment owns a takeaway budget sushi store called Umisushi which has 25 outlets in Singapore. Their food supplies segment is their sourcing point where the company purchases their food ingredients to distribute to their food catering and food retail units.

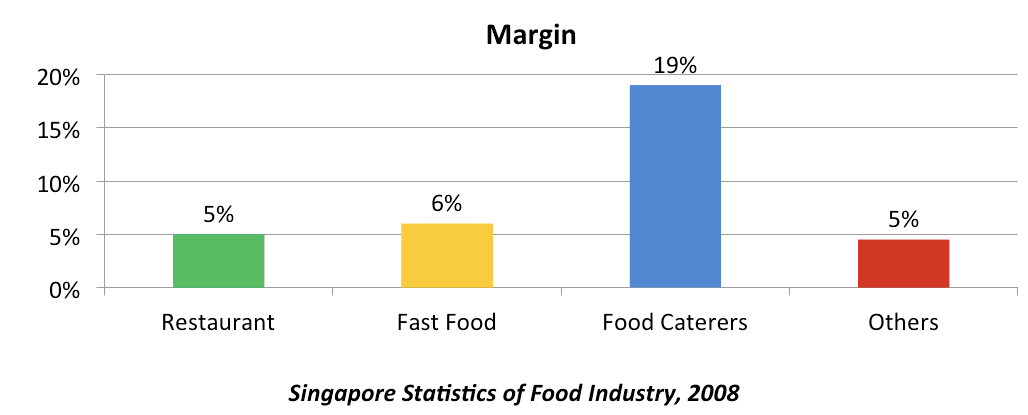

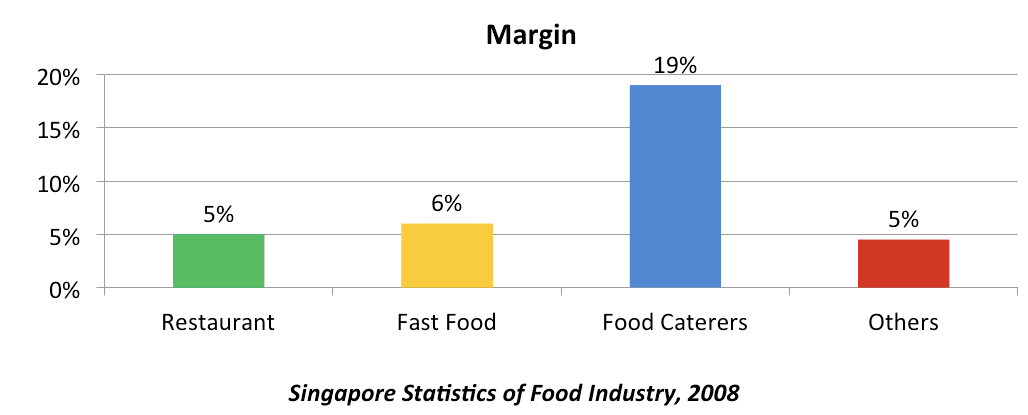

The merit of investing in a food catering company is that it usually has better margins compared to a regular F&B business. Food caterers enjoy a 19% profit margin while the rest only command 5-6% margins. The depressed margins are mainly due to the high cost of rent for retail spaces.

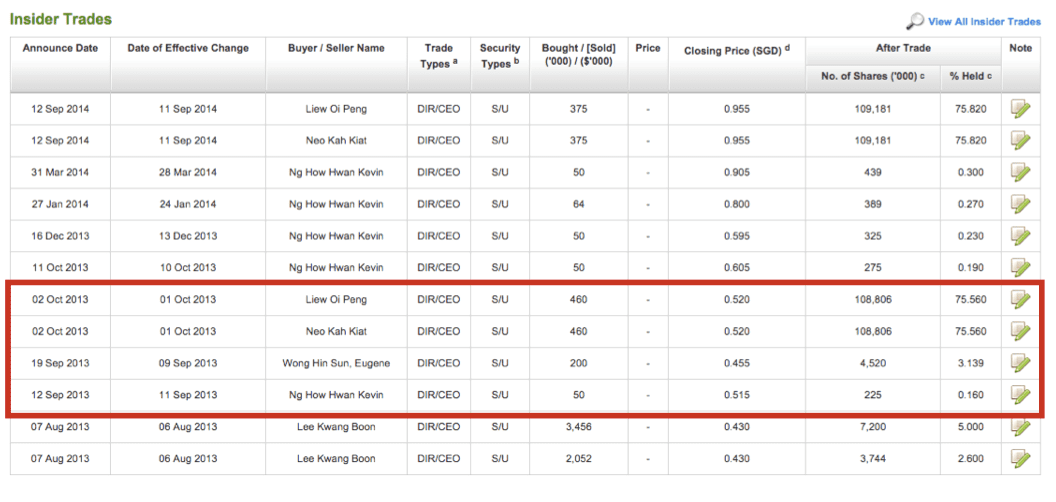

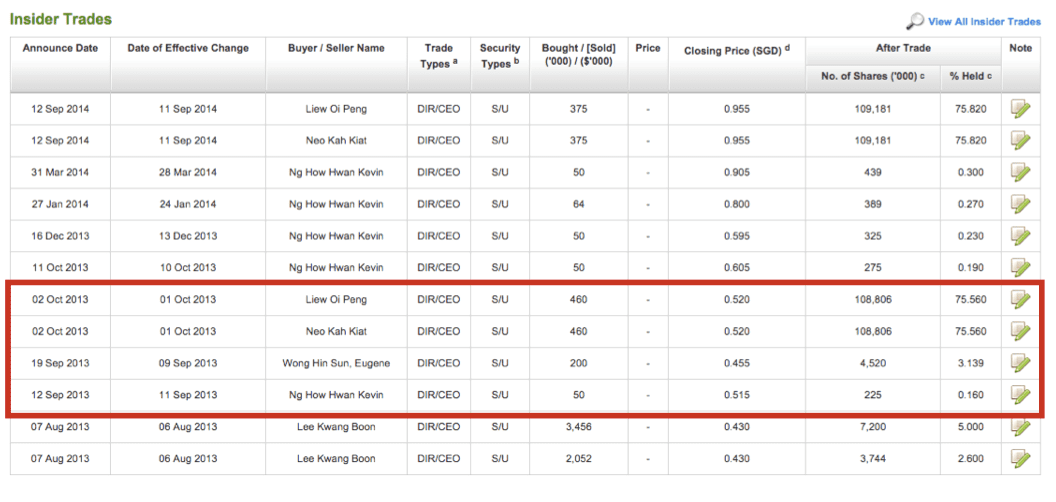

Insider Trades

Source: ShareInvestor

At the time when I was researching Neo Group, insiders had recently purchased their company shares. To quote Peter Lynch:

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

So this was a plus point for me.

The Catalyst

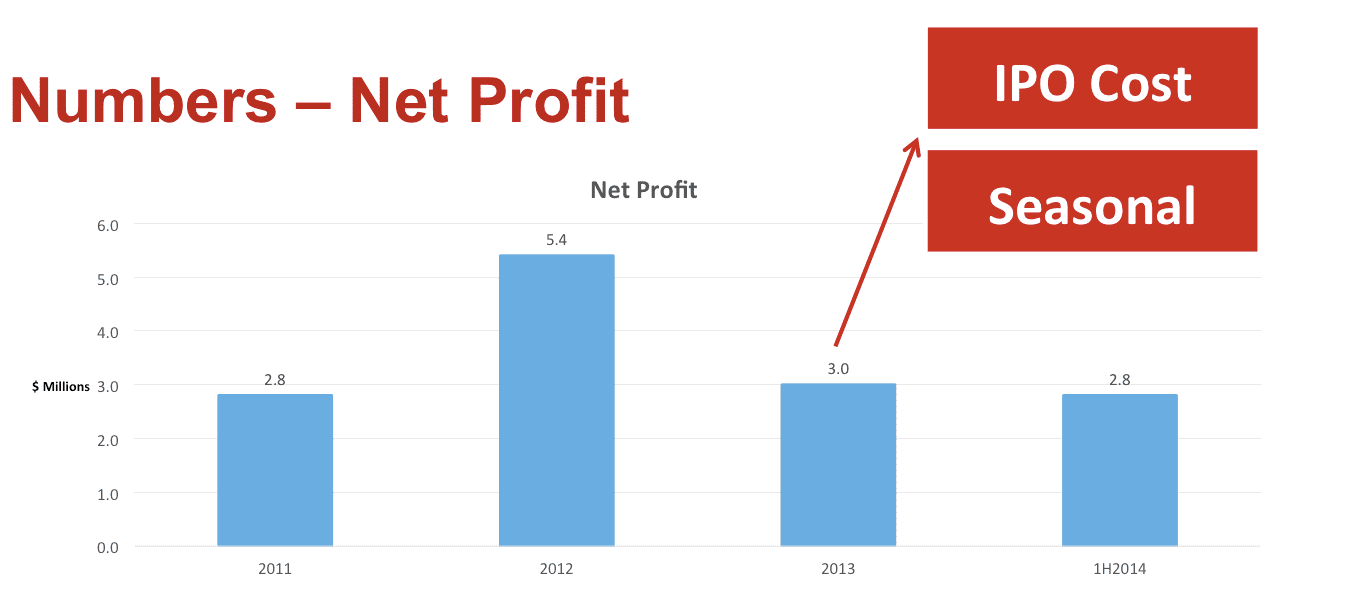

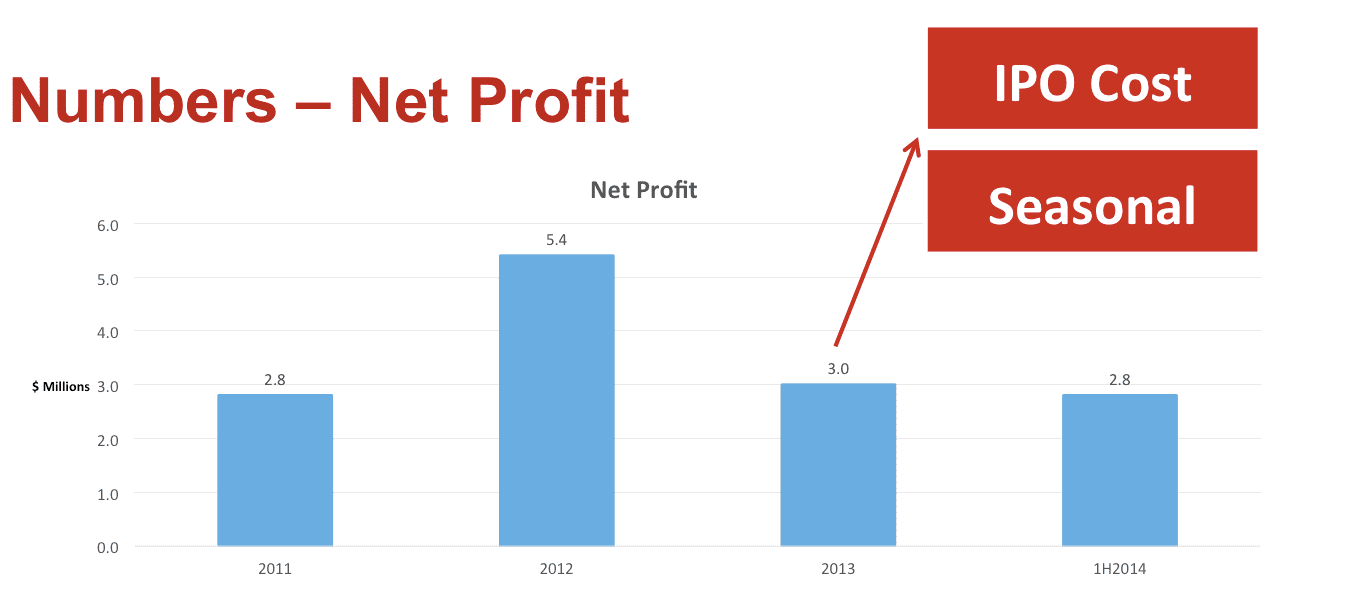

Referring to the chart above, you can see that Neo Group’s net profit for 1H2014 was already equal to FY2013’s full year results. Upon further research, I discovered there were two reasons why FY2013’s profit figures were so low.

The first reason was the cost of Neo Group’s IPO listing that year. This is a one-off expense.

The second reason is due to the fact that Neo Group’s financial year ends in January and Chinese New Year in FY2013 fell in February. This meant that earnings from Chinese New Year was not reflected in Neo Group’s FY2013 results but instead reflected in 1H2014 – which explained the huge jump in profits.

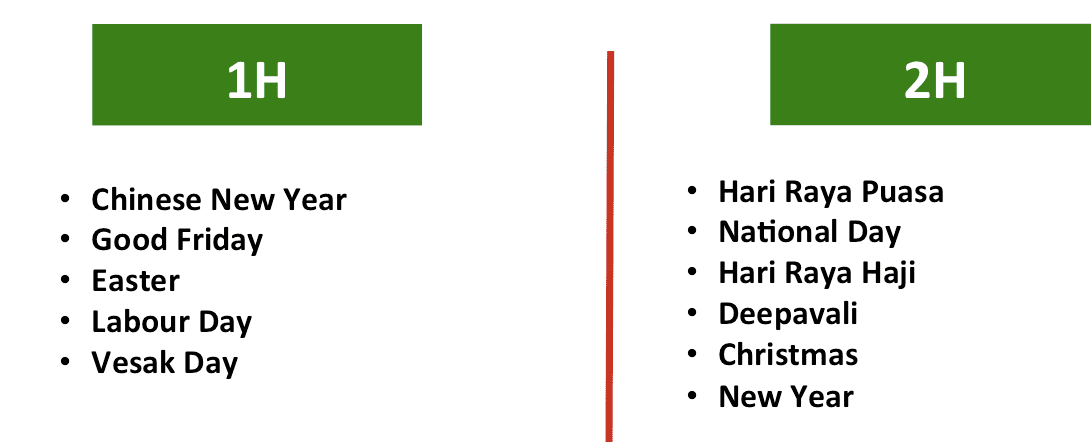

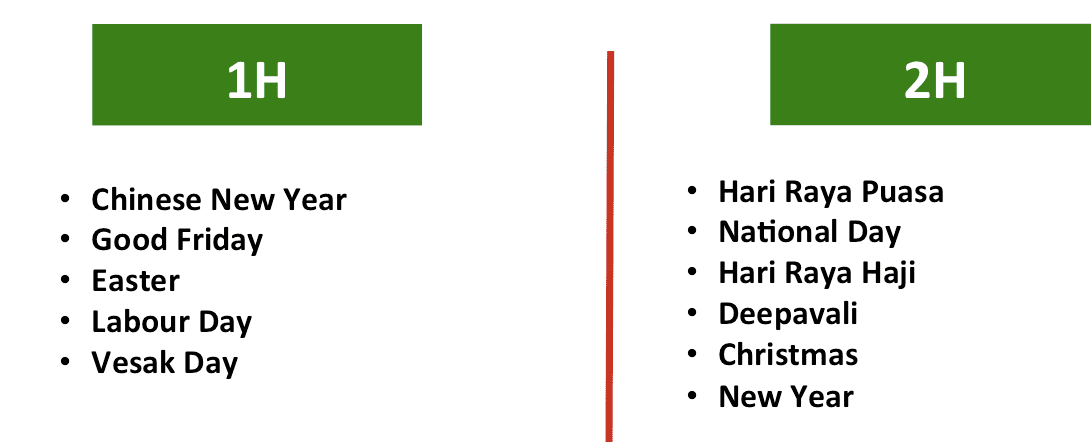

Neo Group’s business is also seasonal in nature; customers cater food and throw more parties during holidays. Looking at the calendar, I noticed that there were more holidays in the second half of the year in Singapore – which meant even higher potential earnings for Neo Group in 2H2014.

So in a nutshell, with profits for 1H2014 already equal to the whole of FY2013’s earnings and more holidays in line for 2H2014, I expected Neo Group’s profit to significantly grow year-on-year for FY2014.

Valuation

At the time, Neo Group’s trailing PE was 14, which I thought was fair value. So with their market leadership, good margins, and large potential upside for 2H2014, I decided to purchase Neo Group at 49 cents and waited for the company to announce their year-end results. True enough, Neo Group announced full year earnings gains of 111.9%. Its share price shot up to 90 cents and I sold my position for a tidy 80.7% gain in seven months.

The Fifth’s Perspective

I wanted to share this case study to illustrate that investing can be as straightforward as spotting a temporary opportunity like this.

At that point in time, it was clear that Neo Group’s full-year profit figures had a high potential upside. If the company posted a huge gain, there was a good chance that its share price might jump in tandem (which it did). And even if my hypothesis was wrong, I was, in my opinion, already buying the stock at a fair price and my downside was reasonably protected. Barring unforeseen events, Neo Group’s stock price was unlikely to fall 10-20% when the company was performing so well. At worst, the stock might have stayed flat if investors felt the higher profits didn’t deserve a higher stock price.

So while there are no guarantees when it comes to investing, putting the two together — a high potential upside and a limited downside — it was a calculated risk I was willing to take and one that paid off pretty nicely for me!

(Photo credit: Neo Group)

Sensationalising title much?

Only if you think so 🙂

The point of the article is to share a successful example of how you can spot a potential investment idea, the research that goes on behind it, and how we made our gains.

Thanks for reading by the way! 😉

hopefully only I think so.

I do like certain portions of your articles and certainly rusmin’s. I also like the effort of some of your other contributors.

If possible, please do some like what ak71 used to do, an article after your finish your shares purchase but before you profit take and then after you profit take.

you’re welcome and thank you, I find the brevity of most of your team’s informational posts easier to digest. keep up the good work!

Thanks SMK!

We’ll take your suggestion onboard. We’re just very careful with articles like that because there are people who simply buy a stock just because someone else is doing so — without doing their own due diligence.

It’s important because everyone’s financial goals, risk appetite and time horizon are all different; a stock that might be a great investment for someone might be terrible for someone else.

On the other hand, we do our best to share some really good investment ideas and analysis (ETFs, AGMs, business model analysis, financial highlights, etc), so our readers are better informed and can make more profitable investment decisions for themselves 🙂

While I detest attention-grabbing titles (esp those with “how to make a million …” & “… millionaire this-&-that”), this article, however, is a case study, which I appreciate learning from. So, keep an open mind and go beyond the title. Instead, focus on the gist of the article and decide whether there’s substance over form in the article.

By the way, this article’s title is not sensational. It’s merely factual if one had indeed made a 80.7% return in 7 months. Nothing ambiguous in the title. It’d have been a sensational piece of writing had it been just a generic big-picture fluff stating the obvious and explaining nothing, and not the article it really is … one that articulates the meticulous analysis & thought process leading to the decision to buy the shares.

Victor, keep up the good work. I always enjoy reading and learning from your case studies.

I like case studies. but have not found a case study where one 1) makes a case study after buying but before the peak and 2) then do a post mortem after profit taking.

ak71 used to have those.

Is the title a fact? without any way of verification, generously saying yes.

Is the case study the only occurrence in your entire portfolio? I don’t know, you tell me.

Do you have other situations whereby similar circumstances result in the prices dropping off terribly instead of rising? I don’t know but if you do, these are the ones I feel I am more interested because it would help me to identify how to lose less money.

Hi SMK,

That’s a great suggestion. We’ll look into sharing some of our losses as well because like any other investor, we too make mistakes at times!

The difference is getting out early when you discover you’ve made a mistake and not continue holding on to a basket of eggs when the eggs have already gone bad. Easier said than done though.

Thanks anon! Yes, of course, the 80.7% return in seven months is factual. Glad you like the article and case study!

Hi Victor,

Thanks for sharing.

Neo group has fallen from ~90c to ~60c.

The free float is ~9.2%…I thought if free float is <10%, the stock need to be privatized..

But PE still a bit high, ~16.

David

Thanks David!

I don’t monitor Neo Group at the moment, but yes, under SGX rules a company must have at least 10% free float to remain listed. There is a 3-month grace period to increase the free float to the required amount.

Interesting, but, readers do be alert that this should not be a buy or sell call…. do your own due diligence – Neo is on its way down at the moment.

A good case study though, and if you had taken profit at the high point, good for you.

Yes, please always do your own due diligence. This a case study from Neo Group’s FY2014 and its current situation is most probably very different right now.

Based on your reasoning, if Neo Group dropped to around $0.50, and conditions are similar, e.g., PE at 15 instead of 14, will you still buy?

Hi CKH,

This scenario will almost never repeat itself because it is extremely unlikely Neo Group will shift its financial calendar again.

Thanks ya Victor Chng, I am truly newbie in investment stock. Would you teach me? I am Indonesian, live at Liberia as expatriate, and want to invest in Singapore SGX, kindly need your suggest personally.

Hi Sariadi,

You can start off by reading this. It will definitely help you get started in the Singapore market:

https://fifthperson.com/how-to-start-investing-in-singapore-a-practical-guide-for-beginners/

Hi Victor,

Neo Garden is 44c now. Div yield ~2.25% & P/E ~14.

Will monitor it:-)

David

The sad part about this? all this effort and analysis, and anyone with 10mil can put it in an FD, go to sleep, and wake up richer than you 😛

This is why people always say “I made 80%!” instead of “I made $500!” – it’s more sensational to use percentages.

1% of 10mil is a much larger sum than 80% of 1000, or even 10,000 for that matter.

Kind of sad. All that work and still can’t make more than someone doing nothing.

Damn, wish we all had 10 million! 🙂

Hi Sir.

I am new to stock investing.

I understand from my friend that buying REITs and keep it for dividend is better than ,keeping in the saving account.

Recently ,i Apply for lend-lease Global REIT. i was allotted l000 units.

The last traded price is 93.5 cents.My question is, is it good to buy at these price.or should i waits for the stock price to fall further.

Please advise.

thankyou