GD Express (GDEX) is an express delivery and logistics service provider. Established in 1997, GDEX today has over 150 stations in Malaysia and Singapore that provide domestic and international express delivery services. The company also provides customised logistics and warehouse services for clients who require specialised solutions. GDEX listed in 2005 and trades on Bursa Malaysia under the ticker symbol 0078.

We attended GDEX’s most recent annual general meeting to find out about its past year’s performance and its outlook for the year ahead. Here are 10 things we learned from the 2017 GD Express AGM.

1. Revenue increased 13.99% year-on-year from RM219.8 million in 2016 to RM250.5 million in 2017. 68% of total revenue is contributed by the B2B segment and the rest from the B2C segment. The increase of revenue was mainly due to the strong growth in business volume from the B2C segment because of the growing trend in e-commerce.

2. Earnings before interest, tax, depreciation and amortisation (EBITDA) increased 12.03% from RM51.1 million to RM57.3 million. GDEX is in expansion mode and has been adding more manpower and delivery trucks along with investing in its network and IT infrastructure. For example, GDEX increased the number of its delivery trucks from 654 to 831 vehicles, increasing the total carrying capacity from 1,682.5 to 2,289.6 tonnes to meet the growing demand in express delivery services. Staff costs increased 50% in 2017 as manpower rose from 2,984 to 3,513 staff. The management explained that logistics is a labour-intensive industry and they need to hire more staff as the company expands.

3. The management estimated that RM30 million will be used for 2018 CAPEX, with 20% budgeted for IT infrastructure. GDEX has also invested heavily in the hardware and software of its automated systems and processes. Its automated conveyor belt system now sorts 120,000 parcels daily from 90,000 parcels previously. However due to the nature of the business, the management stressed that they are unable to automate certain processes such as delivery.

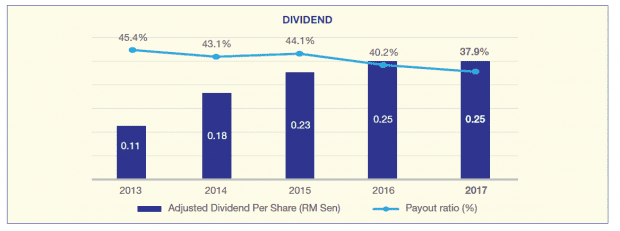

4. GDEX’s dividend payout ratio has been falling from 44.1% in 2015 to 37.9% in 2017. The most reason is that the management wants to conserve cash for the company’s expansion. GDEX declared a dividend of RM0.25 per share for FY2017.

Source: GDEX Annual Report 2017

5. The management pointed out that even though e-commerce industry is experiencing high growth, it is also very competitive with many start-ups and mergers:

- Alibaba recently led a US$1.1 billion investment in Tokopedia, one of Indonesia’s largest online marketplaces

- J&T Express, an Indonesian logistics company, teamed up with Alibaba to form J&T Alibaba to help Indonesian companies tap the Chinese market

- South Korean logistics firm, CJ Express, acquired a 31.4% stake in Malaysian firm, Century Logistics, for RM174.78 million, and is targeting other local last-mile delivery companies

“An upsurge of interest in e-commerce made competition in the express delivery service industry even more intense during the year under review. Many existing players as well as the emergence of newcomers with new technology have poured huge amount of funds into the industry in their efforts to compete and take market share. This has resulted in an increasingly crowded and highly challenging marketplace.” – Teong Teck Lean, CEO

6. According to the management, the logistics industry is entering its maturity stage and is now going through a shakeout. To remain competitive, the management plans to expand aggressively and be the dominant player in Malaysia, invest overseas (Indonesia), and continually scale up GDEX’s capabilities in operations, automation, and digitization.

7. GDEX invested RM10.4 million in five-year convertible bonds in PT Satria Antaran Prima (SAP) — a fast-growing express delivery carrier in Indonesia with 56 branches and more than 1,500 employees. Upon conversion of the bonds, GDEX will own a 40.0% stake in the company and gain a stronger foothold in the Indonesian express delivery market. The CEO said that SAP shares many similar characteristics with GDEX during its early stages of growth and believes that SAP has great potential to grow like GDEX in the years to come. So far, the management is happy and satisfied with SAP’s financial performance.

8. A shareholder asked if GDEX planned to leverage on the Digital Free Trade Zone introduced by the Malaysian government. The management shared that GDEX recently acquired a 30% stake in Web Bytes, a business software solutions company, to leverage on their capabilities to build new innovative solutions to enhance GDEX’s customer experience.

9. Another shareholder expressed her concerns about rising fuel prices and the weakening ringgit and asked if these would impact GDEX’s margins. The management said that the company does not have any plans to increase its current courier charges for the time being as they are still profitable. At the same time, they can reduce the impact of the two issues by passing down costs in the form of handling and fuel surcharges.

10. A shareholder wanted to understand the management’s rationale for acquiring a property company in Ipoh. The management explained that they intend to buy more properties in the future as they need permanent bases like warehouses to store their client’s goods, especially for overseas clients. The management plans to organise a professional team to oversee this business segment.

With additional article contributions by Mitra Chen.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »