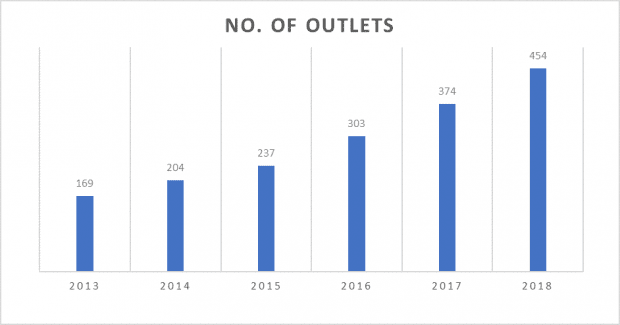

Mynews Holdings Berhad is a home-grown press and retail convenience outlet chain with 454 outlets throughout Malaysia. Its outlets are located across shopping malls, mixed development buildings, transportation hubs, and high-street shoplots. It opened its very first print media outlet, MAGBIT in 1996 in 1 Utama Shopping Centre. Ten years later, it was listed as Bison Consolidated Berhad and subsequently adopted its current name in line with the group’s branding activity.

I was curious how the recently-launched F&B concept, Maru Kafe, would give Mynews a competitive edge over its peer, FamilyMart. With this mind, I attended its recent 2019 annual general meeting.

Here are seven things I learned from the 2019 Mynews AGM:

1. As at 31 October 2018, Mynews owned 454 outlets throughout Malaysia. It aims to increase its presence in urban and suburban locations with heavy foot traffic primarily on the west cost of Peninsular Malaysia. Approximately 80% of its outlets are located in the Klang Valley. In 2018, Mynews opened 85 new outlets — a record high since 1996 — although the achievement was slightly below its target of 90. CEO Dang Tai Luk addressed Minority Shareholder Watch Group’s (MSWG) question and stated that Mynews will maintain its momentum in opening new outlets and total number of outlets will reach around 500 or 600 in 2019.

2. Revenue increased 20.1% from RM327.6 million in 2017 to RM393.4 million in 2018 and net profit rose 11.0% from RM22.7 million in 2017 to RM25.2 million in 2018. Gross and net profit margins have been relatively flat at about 36.9% and 6.4% on average respectively over the last three years. A number of external factors — the removal of goods and services tax, bottomed-out print media sales, clampdown on illegal tobacco products by the local authorities — all contributed positively to Mynews’ revenue. Same-store sales growth was 0.8% in 2018.

3. Mynews has partnered with two Japanese food industry players to set up a food processing facility (FPC) at its new headquarters in Kota Damansara, Selangor to roll out ready-to-eat (RTE) food and bakery products. The FPC is targeted to be completed by the second quarter of 2019 and expected to supply 150 outlets initially. The new RTE food and beverages offerings will be a potential growth driver for Mynews but the extent was not highlighted. The F&B plan has been incubated since they acquired Otaru Fine Food Sdn Bhd in 2016. Dang only mentioned that F&B usually makes up at least 70% of a modern convenience store’s product. In comparison, as of March 2019, F&B accounted for approximately 12% of Mynews’ revenue.

4. Maru Kafe was launched in October 2018. RTE F&B ranging from hot snacks and soft-serve ice cream are now available in 60 outlets as of March 2019. The offerings will be further complemented by FPC productions. When MSWG asked if the management would explore different outlet formats including premium outlets that target a different segment, Dang replied that Mynews would explore different outlet sizes and the introduction of Maru Kafe is a way to make Mynews even more recognisable to customers.

5. A shareholder talked about his recent communication barrier with Mynews’ foreign employees. Dang explained that labour shortage is a prevalent issue in Malaysia’s service industry and Mynews hires foreigners when there is a shortage of labour. However, Mynews goes the extra mile to hire and train as many locals as possible. As at 31 October 2018, 33.5% of Mynews employees are foreigners.

6. A shareholder asked if the company opens a fixed number of outlets within a certain distance. Dang replied instead that he views convenience stores as infrastructure and the purpose of a convenience store is to serve customers where there is density, traffic, and business.

7. A shareholder enquired about the return on investment of ‘Other investments’ that totaled RM45.1 million on the balance sheet in 2018. CFO Chong Siew Hoong explained that the investments are tax-free Islamic unit trust funds which provide higher returns than the bank interest rates. The funds comprise cash that was raised from the private placement in 2017 that was partly used for the acquisition of new headquarters.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »