Listed in December 2011, Pavilion REIT owns four malls — Pavilion Kuala Lumpur Mall, Intermark Mall, Da Men Mall, and Elite Pavilion Mall — as well as an office tower known as Pavilion Tower. As of 2018, its portfolio has a combined net lettable area (NLA) of 2.4 million square feet.

I was keen to learn more about Pavilion REIT as it owns Pavilion Kuala Lumpur Mall, a popular, award-winning mall located right in the heart of Bukit Bintang — Kuala Lumpur’s prime shopping belt.

Here are seven things I learned from the 2019 Pavilion REIT AGM:

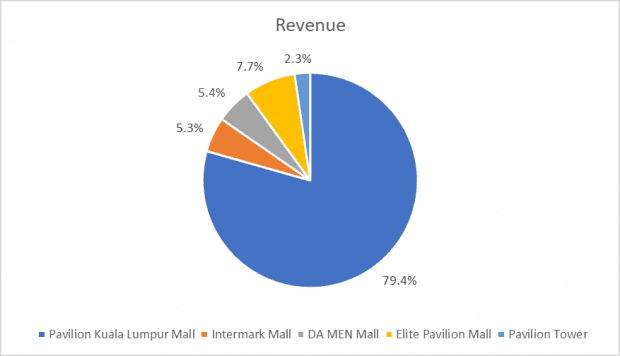

1. Revenue improved 13.2% from RM490.0 million in 2017 to RM554.9 million in 2018. The hike in revenue is due to contributions from the recently acquired Elite Pavilion Mall in April 2018, higher rental income from Pavilion Kuala Lumpur Mall after a repositioning exercise, and higher occupancy at Intermark Mall. The retail segment contributed 97.7% of Pavilion REIT’s revenue. Pavilion Kuala Lumpur Mall alone contributed to 79.4% of total revenue.

2. Pavilion REIT has a small tenant concentration risk as its ten largest tenants make up 12.0% of its 2018 gross rental income. It has a total of 867 retail and office leases. In the retail segment, tenants in the food & beverage and fashion sectors took up 27% and 24% of its total NLA. In the office segment, tenants in the property and consultancy services sectors occupied 58% and 12% of NLA respectively. As at 31 December 2018, Pavilion REIT’s weighted average lease expiry for retail and office stood at 1.15 and 1.21 years respectively.

3. Pavilion REIT financed its acquisition of Elite Pavilion Mall using debt. As a result, its borrowings surged from RM1.5 billion in 2017 to RM2.1 billion in 2018, which led to an increased gearing ratio from 25.9% to 33.8%. Average cost of debt was 4.8% and 53.5% of total borrowings (RM1.2 billion) are on floating interest rates. Current liabilities of RM900.9 million consisted mainly of RM716.0 million in term loans which was successfully renewed.

4. In 2018, Pavilion Kuala Lumpur Mall achieved a 4.4% positive rental reversion. A unitholder pointed out that leases comprising 65% NLA and 60% revenue of the mall would expire in 2019. Non-independent executive director Lee Tuck Fook said that getting new tenants is not a major issue as the mall was 98.7% occupied in 2018 and he expects a single-digit positive rental reversion in 2019. In general, 70% of the mall’s shoppers are Malaysians while the rest are tourists who come from China, Indonesia, Australia, and the Middle East. In contrast, Da Men Mall is a neighbourhood mall in the suburbs and Intermark Mall mainly attracts the office crowd.

5. CEO Philip Ho Yew Hong expressed the directors’ concern over the year-on-year decline in the value of Da Men Mall by RM106.0 million. The mall had a 74.4% occupancy rate in 2018. The mall depends very much on events to draw crowds. The management is currently looking to reposition Da Men Mall as a community-friendly and family-driven mall by updating its tenant mix. In 2018, asset enhancement initiatives –including a route layout change and upgrading of the 500-metre pedestrian walkway to the train station – were undertaken to save shoppers’ time and improve customer experience. By mid-2019, an insurance agency with around 600 staff will relocate its office to a commercial shop in front of Da Mem Mall. The CEO is hopeful that the daily traffic to the mall will be boosted as a result. Despite the lacklustre performance, Lee reminded that Da Men Mall only contributes slightly above 5% of the REIT’s revenue.

6. Pavilion REIT reserves the right of first refusal for fahrenheit88 mall and Pavilion Hotel Kuala Lumpur. Other shopping malls such as Pavilion Damansara Heights and Pavilion Bukit Jalil are also owned by its sponsor. The management will evaluate opportunities offered to them and only acquire properties that are yield-accretive and create long-term value to Pavilion REIT. The management had previously decided not to participate in the development of Pavilion Bukit Jalil but the CEO recently expressed his interest in the mall post-construction.

7. A unitholder asked about Parkson’s tenancy status at Pavilion Kuala Lumpur Mall as it recently closed its outlet at Suria KLCC mall. Lee reassured unitholders that Parkson is spending to upgrade its store at Pavilion Kuala Lumpur as the remaining stores are important to its business income. From what I personally observed, renovation was ongoing at Parkson within the mall and fashion brand, MSGM, is also scheduled to open its store in Parkson in April 2019.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »