DKSH Holdings Berhad (Bursa: 5908) has a long history in Malaysia. Part of the DKSH Group from Switzerland, DKSH Holdings Berhad has its history dating back to 1867 in Singapore. The company was previously listed on Bursa Malaysia as Diethelm Holdings back in 1994. After a merger in 2002, the company was renamed as DKSH Holdings Berhad.

Today, DKSH Holdings is one of the largest supply chain distributors in Malaysia. It serves many major brands in the sourcing, marketing, sales, logistics, distribution, fulfilment and after-sales services for their businesses in Malaysia.

Here are nine things you would need to know about DKSH Holdings Berhad.

1. Service range

DSKH Holdings prides itself as a market expansion specialist. This means that for a brand or company who wants to grow its market in Malaysia, they can hire DSKH Holdings to help them expand the reach of their products in the country. DKSH Holdings can help with the sourcing, market research, sales and marketing, distribution and logistics and even after-sales services for its clients.

2. Economic moat in Malaysia

Due to its long history in Malaysia, some of the largest brands in the country have been working with DKSH Holdings for a long time. Today, the company has more than 30 business locations in Malaysia and 12 distribution centres in the country. They serve more than 180 clients and produced net sales of about RM5.3 billion in 2016.

3. Clients it serves

DKSH Holdings serves a wide range of customers. It helps FMCG companies like Mead Johnson, Heinz, Cadbury and Hershey to distribute their products throughout Malaysia. This means the company works very closely with retailers like Tesco, Giant and Aeon, some of the largest retailers in the country.

It also serves customers in the healthcare products industry such as Roche, GSK and Pfizer to distribute their products. On top of that, DKSH Holdings is helping telcos like Umobile to distribute its prepaid telephone cards and also manages retail chains for Famous Amos, the chocolate chip cookie retailer.

4. Challenges faced

Unfortunately, DKSH Holdings is in a very tough business. It operates with very thin margins and constantly needs to scale all its business units to a certain size before they can be profitable. In 2016, its net margin was only 0.96%. This means that for every RM100 of sales, the company is only making about 96 sen in profit. In 2016, only its marketing and distribution & logistics segments are making a profit for the company. It may be a challenge for the company going forward.

5. Debt-free

However, it is not all negative for the company. Due to its long operating history in Malaysia, it has built its business to a level that it can be sustained without taking on any debt. In fact, in the past few years, the company has been operating at a net-cash position.

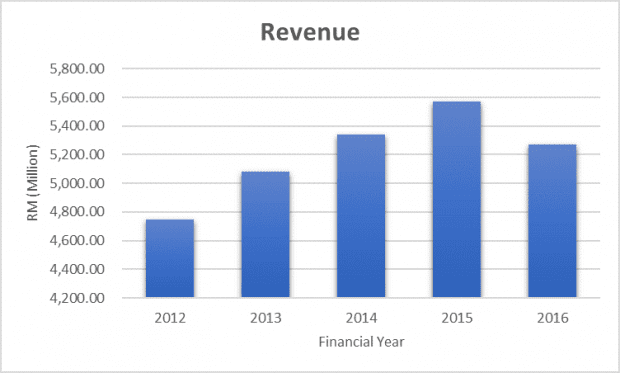

6. Revenue trend

Source: Annual Reports

The company is not a growth company. Its revenue has only been growing about 2.7% per annum from 2012 to 2016. Moreover, the company does not have a strong presence in the online distribution space at the moment. This means that as e-commerce in Malaysia grows, DKSH Holdings might not be able to capture that growth with it current business model.

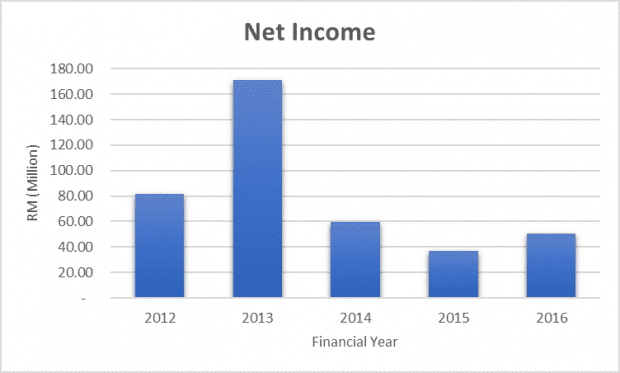

7. Earnings trend

Source: Annual Reports

Similarly, its net income has been declining over the past four years despite its revenue growing (albeit slowly). This means that its profit margin has diminished rapidly over the same period. In 2012, it has a net income margin of 1.7%. That was reduced to just 0.96% in 2016.

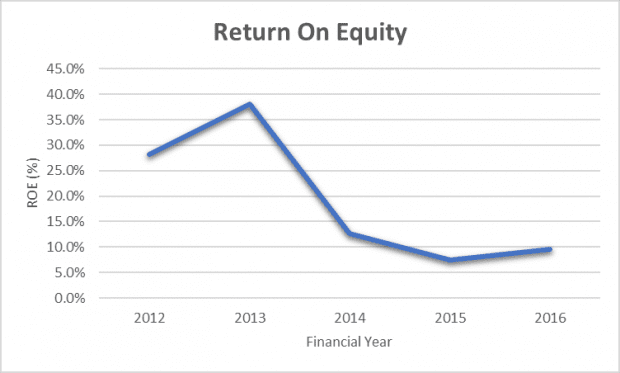

8. Return on equity

Source: Annual Reports

Although DKSH Holdings has a very low margin business, it is traditionally a high return on equity (ROE) business. This is because it is mostly a trading company which does not require a huge capital investment in the business for reinvestment once you reach a critical mass. This means it can serve more and more customers, distribute more products without huge additional investments to scale the business.

Unfortunately, over the past few years, the company has hit a sharp reduction in its return on equity. Its ROE fell from close to 30% in 2012 to less than 10% in 2016. This was partly due to the sharp drop in its profit margin, which has a magnifying effect on its ROE.

However, if the company works out some of the challenges it is facing now, there is potential for DKSH Holdings to return its business back to its previous ROE levels.

9. Signs of growth?

In 2015, the company invested a 20% stake in aCommerce, a regional e-commerce service provider and online distributor. This means that the company understands the challenges it is facing in the current market conditions and planning accordingly.

The investment marks two possible growth areas for the company. The company can grow by taking a share of the growing e-commerce market and focusing more on expanding its business outside of Malaysia. It is still too early for us to know if DKSH Holdings would be successful in both areas.

The fifth perspective

DKSH Holdings has stood the test of time. It is a company that is profitable and has a stellar balance sheet. It serves many of the world’s famous brands and has a wide distribution network in Malaysia. Yet, it is facing huge challenges in its business such as declining margins, the threat from e-commerce, and a lack of growth potential. If the company can find a way to restart its growth engine, maybe it would be worth a look for investors. Even though its future might seem gloomy at the moment, the company has weathered worse storms in the past and has thrived once the clouds cleared. Maybe it can do the same again.

and 10. They ignore communication. Never reply to emails.